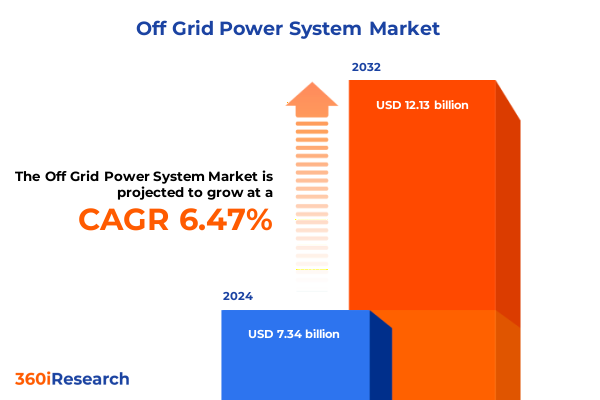

The Off Grid Power System Market size was estimated at USD 7.69 billion in 2025 and expected to reach USD 8.06 billion in 2026, at a CAGR of 6.71% to reach USD 12.13 billion by 2032.

Charting a resilient sustainable energy future through autonomous power architectures driven by innovation and demand growth

The off-grid power system sector stands at the forefront of energy innovation, addressing the dual imperatives of sustainability and energy equity. As global energy demands intensify and grid vulnerabilities become more apparent, decentralized power architectures offer resilient solutions for communities, industries, and remote installations. These systems leverage a combination of solar photovoltaics, energy storage, and power electronics to create autonomous energy networks that can operate independently of centralized infrastructure.

Driven by advancing battery chemistries and cost declines in photovoltaic modules, off-grid installations now provide reliable, cost-effective electricity access to regions where grid extension is impractical or prohibitively expensive. This trend has prompted stakeholders ranging from humanitarian organizations to remote industrial operators to reevaluate traditional supply models. In this context, off-grid power systems are not merely stopgap measures but are emerging as preferred architectures for sustainable, long-term electrification strategies. The imperative for energy security, environmental stewardship, and economic resilience underpins the accelerating deployment of these systems across diverse applications worldwide.

Looking ahead, the off-grid market is poised for further transformation as digital monitoring and predictive maintenance technologies enhance operational efficiency, while novel hybrid configurations integrate wind, diesel, and hydrogen options. Together, these innovations will redefine the possibilities of decentralized power, empowering decision-makers to deliver reliable energy solutions that meet the distinct needs of their end users and environments.

Navigating the convergence of advanced storage innovations policy incentives and evolving user expectations reshaping off-grid energy deployments

The landscape of off-grid power systems is undergoing profound transformation as emerging technologies, shifting policy frameworks, and changing consumer expectations converge. Innovations in advanced lithium-ion and next-generation solid-state batteries are dramatically extending storage lifetimes and energy densities, thereby reducing the total cost of ownership. Meanwhile, power electronics such as maximum power point tracking (MPPT) charge controllers and smart inverters are enabling finer control over energy flows and seamless integration with microgrids and intelligent energy management systems.

Regulatory shifts are reshaping market dynamics as governments introduce incentives for decentralized renewable energy solutions and tighten emissions standards for backup diesel generators. Carbon pricing mechanisms and green finance instruments are directing more capital toward off-grid solar and storage projects, catalyzing investment in both established and emerging markets. At the same time, heightened focus on energy resilience in the face of extreme weather events and cybersecurity threats is driving organizations to adopt microgrid architectures that can island during grid disturbances.

Concurrently, user preferences are evolving as residential and commercial customers seek environmentally responsible, cost-efficient energy solutions that decouple them from rising electricity tariffs. This confluence of technological breakthroughs, regulatory momentum, and consumer priorities is forging a new paradigm in which off-grid systems play a central role in achieving both localized energy autonomy and broader climate goals. As these transformative shifts gather pace, stakeholders must align their strategies to harness the full potential of decentralized power.

Assessing how 2025 tariff measures catalyze domestic supply chain realignment and innovation in off-grid system manufacturing

The implementation of new United States tariffs in early 2025 has introduced both challenges and adaptive responses within the off-grid power system industry. By imposing higher duties on imported solar modules and critical battery components, these tariffs have driven a strategic pivot among system integrators and original equipment manufacturers toward domestic supply chains. Suppliers have accelerated investments in local manufacturing capabilities, leveraging federal grants and tax credits to offset increased input costs.

In response to tariff-induced cost pressures, developers are increasingly exploring alternative materials and streamlined designs to maintain project viability. This has led to a resurgence of interest in thin-film photovoltaic technologies, which can be produced domestically with lower capital expenditure, as well as intensified efforts to optimize charge controller and inverter topologies for performance efficiency. Additionally, partnerships between American universities and private enterprises are fast-tracking research into advanced battery chemistries that minimize reliance on tariff-affected imports.

Furthermore, the tariffs have spurred a geographical recalibration of project deployment. States with robust manufacturing incentives and strong renewable energy mandates have emerged as attractive hubs for vertically integrated off-grid solutions. At the same time, stakeholders are advocating for tariff waivers on specialized components to safeguard critical electrification efforts in remote communities. Ultimately, the 2025 tariff measures have catalyzed a reconfiguration of supply networks and innovation priorities, reinforcing the sector’s emphasis on domestic resilience and technological self-reliance.

Revealing how component choice end-user requirements and application specifics define differentiated value propositions in decentralization

Analyzing market dynamics through the lens of component diversification reveals the pivotal roles of batteries, charge controllers, inverters, and solar PV modules in shaping competitive landscapes. Within the battery segment, the contrast between traditional lead-acid and cutting-edge lithium-ion technologies underscores a broader industry transition toward higher energy density and longer cycle lives. Innovations in MPPT and PWM charge control systems are enhancing energy harvest from renewable sources, while inverter architectures-spanning central, microinverter, and string options-offer varying balances of scalability, reliability, and cost efficiency. Similarly, monocrystalline, polycrystalline, and thin-film solar PV modules provide end users with tailored trade-offs between efficiency, manufacturing footprint, and price.

End-user segmentation demonstrates that each customer category possesses distinct requirements. Commercial operators prioritize system durability and predictable performance for continuous operations, whereas industrial entities demand large-scale modularity and integration with existing infrastructure. Residential consumers, seeking autonomy and reduced utility expenses, favor plug-and-play systems with user-friendly interfaces.

Application-based analysis further refines these insights. In healthcare, off-grid systems guarantee uninterrupted power for critical medical equipment, whereas lighting applications benefit from distributed network architectures that minimize downtime. Telecommunication towers leverage hybrid configurations to ensure network reliability in remote areas, and water pumping installations utilize energy storage buffering to manage variable solar input. By understanding the nuanced needs across these segments, stakeholders can craft differentiated offerings that align product portfolios and services to evolving market demands.

This comprehensive research report categorizes the Off Grid Power System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- End User

- Application

Understanding region-specific drivers adaptive strategies and investment hotspots shaping off-grid power adoption globally

Regional trends are instrumental in charting the trajectory of the off-grid power market across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, a combination of regulatory support for renewable microgrids and private sector investment is accelerating adoption in off-grid regions, particularly in Latin America and remote areas of North America. Here, the convergence of ample solar irradiance and focused infrastructure programs is fostering an environment where standalone systems are becoming increasingly cost-competitive.

Across Europe, the Middle East, and Africa, disparate energy landscapes require tailored approaches. European nations prioritize integration with smart grid initiatives and emphasize zero-emission targets, driving the deployment of sophisticated hybrid microgrids. In the Middle East, where solar potential is vast, large-scale off-grid installations serve industrial and agricultural needs, while African governments and NGOs partner to extend basic electrification to rural communities through solar-storage kits.

Asia-Pacific stands as a growth engine, bolstered by government-led rural electrification drives and burgeoning industrial demand in Southeast Asia. India’s ambitious off-grid solar schemes and Australia’s remote area power supply programs exemplify the region’s diverse strategies. Together, these distinct regional dynamics underscore the importance of context-aware strategies, enabling providers to align technology portfolios with regulatory frameworks and resource endowments across these global markets.

This comprehensive research report examines key regions that drive the evolution of the Off Grid Power System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining how integrated R&D investments partnerships and ecosystem-driven distribution models define market leadership

Leading players in the off-grid power system arena are distinguished by their integrated approach to research and development, strategic partnerships, and global distribution networks. Industry frontrunners have invested heavily in next-generation battery chemistries, securing intellectual property that enhances performance while lowering lifetime costs. Concurrently, top suppliers of charge controllers and inverters have established collaborative R&D centers with academic institutions to pioneer artificial intelligence-driven energy management solutions.

Moreover, vertically integrated firms that control module fabrication, storage cell assembly, and system integration are gaining market share by delivering turnkey solutions with predictable delivery timelines and standardized quality benchmarks. Meanwhile, emerging challengers are leveraging digital platforms to offer customizable system configurations, remote monitoring services, and performance guarantees, thereby redefining customer expectations.

Strategic alliances between technology developers and local installers are also reshaping distribution models. By fostering ecosystem partnerships, leading companies are accelerating market entry in underserved territories and co-creating financing schemes that reduce upfront costs for end users. This collaborative mindset, combined with robust product portfolios and value-added services, is setting a new benchmark for industry excellence and ensuring that market leaders remain at the vanguard of off-grid innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Off Grid Power System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Enphase Energy, Inc.

- Huawei Digital Power Technologies Co., Ltd.

- Morningstar Corporation

- OutBack Power Technologies, Inc.

- Schneider Electric SE

- SMA Solar Technology AG

- Sun Power Corporation

- Sungrow Power Supply Co., Ltd.

- Tesla, Inc.

- Victron Energy B.V.

Leveraging integration digital innovation and strategic financing partnerships to secure competitive advantage and drive sustainable growth

To thrive amid evolving regulatory environments and intensifying competition, industry leaders should first prioritize vertical integration of manufacturing capabilities to mitigate supply chain risks and preserve margin resilience. Concurrently, investment in advanced analytics and digital twins can enhance system reliability while optimizing operational expenditures through predictive maintenance.

Next, forging strategic partnerships with financial institutions and development agencies will unlock innovative funding mechanisms, enabling broader adoption in emerging markets and supporting social impact objectives. Leveraging such collaborations to design pay-as-you-go and performance-based financing models can reduce capital barriers for end users and accelerate deployment timelines.

Finally, companies must embrace modular and scalable system architectures that permit seamless upgrades as technology evolves. By standardizing interfaces and adopting open communication protocols, solution providers can future-proof their offerings and cultivate customer loyalty. This comprehensive approach-spanning manufacturing, financing, and product design-will empower industry players to lead the charge in delivering resilient, accessible, and sustainable off-grid power solutions.

Detailing a rigorous multi-stage research framework integrating stakeholder interviews secondary analysis and patent landscape evaluation

This research employs a multi-stage methodology combining primary interviews with key industry stakeholders and secondary analysis of policy frameworks, patent filings, and technical publications. Initial data collection involved in-depth discussions with system integrators, component manufacturers, and end users to capture current challenges and emerging requirements. Simultaneously, regulatory databases and government reports provided insights into tariff regulations, incentive structures, and electrification targets across major markets.

Secondary research incorporated a comprehensive review of academic journals, white papers, and proprietary technical databases to evaluate advancements in battery chemistries, inverter topologies, and photovoltaic materials. Patent landscape analysis was conducted to identify innovation trajectories and assess competitive positioning. Quantitative data were triangulated using project case studies and financial disclosures to validate qualitative findings.

Throughout the process, rigorous data validation protocols ensured consistency and accuracy. Cross-verification with independent experts and iterative feedback cycles refined the analysis, resulting in a robust, actionable framework tailored to the needs of decision-makers seeking high-confidence insights into the off-grid power system market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Off Grid Power System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Off Grid Power System Market, by Component

- Off Grid Power System Market, by End User

- Off Grid Power System Market, by Application

- Off Grid Power System Market, by Region

- Off Grid Power System Market, by Group

- Off Grid Power System Market, by Country

- United States Off Grid Power System Market

- China Off Grid Power System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1272 ]

Synthesizing how innovation policy segmentation and strategic positioning converge to shape the future of decentralized energy solutions

In summary, the off-grid power system market is being redefined by a confluence of technological innovation, regulatory evolution, and shifting user demands. Advanced storage technologies and intelligent power electronics are enhancing system performance and cost metrics, while policy incentives and tariff measures are driving localization of supply chains.

Segmentation analysis underscores the importance of component diversity, end-user customization, and application-specific design in capturing value across the market. Regional insights reveal varied growth trajectories, with the Americas, EMEA, and Asia-Pacific each presenting unique opportunities shaped by resource endowments and policy agendas.

Market leaders are distinguished by their integrated R&D investments, ecosystem partnerships, and customer-centric service models. By adopting the recommendations outlined here-vertical integration, digital innovation, strategic financing, and modular architecture-industry players can navigate uncertainties and position themselves for long-term success. As decentralized power solutions continue to gain traction, those who anticipate trends and adapt proactively will harness the transformative potential of off-grid energy.

Unlock strategic off-grid power market intelligence and future-proof your business by partnering with an expert guide to secure the definitive research report

To gain unparalleled insights and strategic foresight into the evolving off-grid power system market, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report and capitalize on emerging growth opportunities worldwide

- How big is the Off Grid Power System Market?

- What is the Off Grid Power System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?