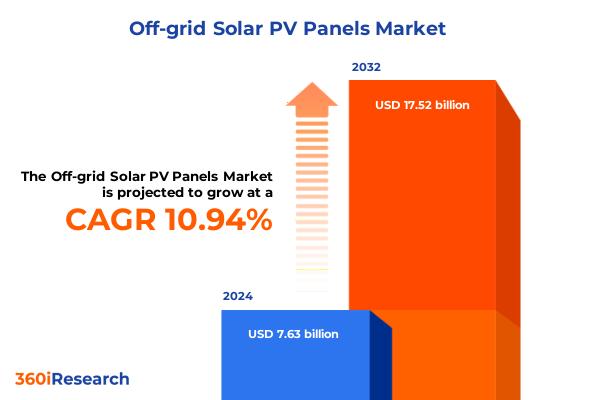

The Off-grid Solar PV Panels Market size was estimated at USD 8.45 billion in 2025 and expected to reach USD 9.27 billion in 2026, at a CAGR of 10.97% to reach USD 17.52 billion by 2032.

Pioneering Off-Grid Solar Revolution Through Innovative Photovoltaic Solutions That Empower Remote Communities And Accelerate Sustainable Energy Independence

The off-grid solar photovoltaic landscape has evolved from a nascent solution to a cornerstone of decentralized energy access, driven by plummeting costs, rising environmental imperatives, and a global push toward equitable electrification. In remote regions and island communities, where grid extension proves prohibitively expensive or logistically unfeasible, off-grid solar systems now deliver reliable and clean electricity for lighting, communication, water pumping, and refrigeration. This technological empowerment not only transforms livelihoods but also fosters resilience against climate-induced disruptions, underscoring the strategic importance of off-grid solar PV in national energy portfolios.

Moreover, the convergence of advanced solar cell technologies with energy storage and digital monitoring platforms has unlocked new performance thresholds. Integrated battery storage ensures consistent power supply through diurnal and seasonal variability, while real-time monitoring enhances system uptime and predictive maintenance. As multi-stakeholder coalitions-including development agencies, private investors, and local cooperatives-scale deployment models, the resulting economies of scale reinforce the narrative that decentralized solar PV is both an economically viable and socially transformative pathway toward universal electrification.

Unveiling The Technological And Market Disruptions Redefining Off-Grid Photovoltaic Systems Through Advances In Storage Integration And Cost Reductions

Landmark advancements in photovoltaic cell architecture and energy storage chemistries are reshaping the off-grid market, ushering in a new era of performance and affordability. High-efficiency monocrystalline modules, once the province of utility-scale projects, are being tailored for decentralized applications, delivering greater wattage per square meter and reducing the footprint required for remote installations. Concurrently, the introduction of bifacial modules captures reflected irradiance, boosting yield in reflective environments such as snowfields and white-roofed structures, thus broadening the geographic viability of off-grid solar solutions.

Beyond hardware innovations, financing mechanisms and business models have undergone parallel transformation. Pay-as-you-go financing platforms leverage mobile money networks to lower entry barriers, empowering off-grid consumers to adopt photovoltaic systems without significant upfront capital. These digital enrollment systems also enable remote diagnostics and credit scoring, which streamline operations for service providers. Consequently, the off-grid solar value chain is witnessing horizontal integration, with technology providers, local distributors, and fintech partners coalescing into agile ecosystems capable of rapid market penetration.

Assessing The Long-Term Market And Supply Chain Implications Of Recent United States Solar Module Tariffs On Off-Grid Photovoltaic Adoption And Competitiveness

In early 2025, the United States government implemented a set of tariffs targeting module imports from key global suppliers, citing concerns over unfair trade practices and national energy security. These measures raised import duties by up to 20 percent on select solar cells and modules, triggering immediate cost adjustments throughout the off-grid sector. Small-scale developers and end users faced higher procurement expenses, compelling many to reassess project economics and financing structures. In response, several integrators accelerated shift toward vertically integrated supply chains, investing in domestic assembly facilities to mitigate exposure to tariff volatility.

However, the cumulative impact of these tariffs has been far from uniformly constraining. Encouragingly, parallel incentive programs-including production tax credits for domestically assembled modules and grants for distributed storage deployment-have balanced the import levies. This policy coupling has fostered localized manufacturing clusters in the southern United States and has stimulated R&D into alternative module substrates less dependent on foreign raw materials. As a result, the off-grid segment is adapting through a dynamic interplay of trade policy and targeted subsidies, ultimately reshaping the competitive contours of the industry.

Illuminating Market Dynamics Across Module Types Components And Application Verticals To Reveal Nuanced Off-Grid Photovoltaic Adoption Patterns

The market exhibits distinct performance characteristics when analyzed by module type. Monocrystalline panels lead in efficiency, commanding premium applications where rooftop or canopy space is constrained, while polycrystalline variants maintain appeal for cost-sensitive installations that prioritize upfront affordability over maximum watts-per-unit area. Thin film modules, though less efficient, find niche deployments in flexible or semi-transparent applications, such as portable chargers and solar-integrated building facades, where form factor and installation versatility outweigh absolute yield.

Component-level segmentation further refines strategic priorities. Battery systems have shifted decisively toward lithium-ion chemistries, which offer superior energy density and lifecycle cost benefits; nonetheless, lead acid batteries remain entrenched in budget-driven off-grid kits, and emerging flow battery prototypes are capturing interest for multi-day storage resilience. Charge controllers, whether maximum power point tracking or pulse width modulation, optimize PV output under variable irradiance, but MPPT controllers are rapidly displacing legacy PWM units in mid- and high-power assemblies. Inverter architecture also delineates market approaches: string inverters underpin larger microgrid installations, microinverters facilitate modular scaling in remote residential setups, and hybrid inverters integrate storage and AC generation into unified balance-of-system assemblies.

Application-driven adoption underscores differentiated use cases. Residential off-grid systems, from rural homesteads to vacation cabins, prioritize ease of use, minimal maintenance and aesthetic integration. Commercial deployments, typified by telecom towers and agricultural pumping stations, demand robust reliability and remote monitoring capabilities. On the industrial front, mining camps, oil and gas wellheads, and disaster relief operations leverage scalable off-grid PV to decarbonize energy supplies in the most logistically challenging environments.

This comprehensive research report categorizes the Off-grid Solar PV Panels market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Module Type

- Component

- Application

- Sales Channel

Exploring Regional Off-Grid Solar Trajectories In The Americas Europe Middle East Africa And Asia Pacific To Highlight Strategic Growth Opportunities

Across the Americas, an amalgam of federal incentives and state-level programs is catalyzing decentralized solar growth. In the United States, enhanced tax credits for energy storage systems and rural electrification grants are unlocking private investment in off-grid installations, while in Latin America, public–private partnerships are pioneering solar mini-grids to extend power to unserved communities. Canadian initiatives, particularly for remote indigenous settlements, blend utility-backed procurement with community ownership models, setting replicable precedents for collaborative infrastructure financing.

The Europe, Middle East & Africa region presents diverse opportunities shaped by regulatory landscapes and development imperatives. In Europe, island territories in the Mediterranean are deploying hybrid solar–storage systems to reduce diesel dependence, whereas North African markets harness abundant insolation to support remote telecom sites and water-pumping applications. Sub-Saharan Africa remains a focal point for humanitarian and social impact ventures, with NGOs and multilateral agencies underwriting the rollout of modular off-grid kits to overcome the limitations of centralized grid expansion.

Asia-Pacific continues to drive global off-grid solar adoption rates, propelled by expansive rural electrification goals and digital financing platforms. In India, the convergence of public subsidies and pay-as-you-go models has electrified millions of off-grid households, while Southeast Asian archipelagos leverage microgrid projects to bridge connectivity gaps. In Oceania, mining and tourism operators in Australia have integrated high-capacity battery banks with PV arrays to power remote sites, showcasing the versatility of off-grid architectures in extreme environments.

This comprehensive research report examines key regions that drive the evolution of the Off-grid Solar PV Panels market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators And Strategic Players Driving Disruption And Collaboration In The Off-Grid Solar Photovoltaic Ecosystem

Leading technology providers and integrators are redefining competitive dynamics through product innovation, strategic alliances, and capacity expansions. Solar module manufacturers have prioritized high-efficiency cell formats and bifacial technologies, while storage firms are racing to commercialize second- generation lithium chemistries and scalable flow battery systems. Meanwhile, inverter specialists are embedding advanced grid-forming capabilities and inverter-based microgrid controls into compact packages tailored for off-grid applications.

Ecosystem cohesion is evident in cross-sector partnerships that span energy, telecommunications, and digital finance. Solar developers collaborate with mobile network operators to deploy energy solutions for tower sites, reducing diesel logistics and unlocking OPEX savings. Fintech platforms integrate usage analytics from off-grid kits into credit-scoring algorithms, enabling microfinance institutions to underwrite consumer loans for system acquisition. This convergence creates value loops that drive down total cost of ownership and strengthen customer retention across geographies.

Emerging entrants are also reshaping the landscape. Modular solar-as-a-service models, which bundle equipment financing, software monitoring, and maintenance under a subscription fee, are gaining traction among off-grid communities and industrial operators alike. These novel business structures, underpinned by robust data analytics, underscore a transition from product-centric to outcome-driven market strategies.

This comprehensive research report delivers an in-depth overview of the principal market players in the Off-grid Solar PV Panels market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canadian Solar Inc.

- Emmvee Photovoltaic Power Private Limited

- First Solar, Inc.

- Hanwha Q CELLS Co., Ltd.

- JA Solar Technology Co., Ltd.

- Jinko Solar Co., Ltd.

- LG Electronics Inc.

- LONGi Green Energy Technology Co., Ltd.

- Panasonic Holdings Corporation

- REC Solar Holdings AS

- Risen Energy Co., Ltd.

- Sharp Corporation

- SunPower Corporation

- Talesun Energy

- Trina Solar Co., Ltd.

- Vikram Solar Ltd.

- Waaree Energies Ltd.

Empowering Industry Leaders With Strategic Roadmaps To Navigate Evolving Technologies Regulations And Competitive Landscapes In Off-Grid Solar

Industry leaders must recalibrate supply chain strategies to mitigate geopolitical and trade uncertainties. Diversifying procurement across emerging manufacturing hubs in Southeast Asia, Central America, and Eastern Europe can buffer against tariff-induced cost fluctuations and logistical bottlenecks. At the same time, forging long-term supply agreements with key module and battery vendors secures preferential pricing and fosters joint R&D into next-generation PV and storage components.

Furthermore, embedding digital platform capabilities within off-grid offerings will unlock service-oriented revenue streams. Remote performance monitoring, predictive maintenance algorithms, and user engagement portals can enhance asset uptime and bolster customer loyalty. Equally critical is the expansion of innovative financing mechanisms-ranging from micro-leasing to green bonds-that democratize access to solar assets for underserved households and enterprises.

Finally, proactive engagement with policy makers and development agencies will ensure that regulatory frameworks evolve in tandem with technological advancements. Advocating for streamlined permitting processes, targeted subsidies for high-efficiency modules, and standards for energy storage safety can accelerate deployment rates and foster a level competitive landscape that benefits both incumbents and newcomers.

Detailing Robust Research Approaches And Analytical Techniques That Underpin Comprehensive Insights Into Off-Grid Solar Photovoltaic Market Dynamics

The insights presented herein are derived through a rigorous blend of qualitative and quantitative research methodologies. Secondary intelligence was gathered from specialized energy journals, policy white papers, and technical standards publications to establish a comprehensive understanding of current off-grid solar innovations and regulatory frameworks. Concurrently, primary research encompassed in-depth interviews with senior executives across module manufacturing, energy storage, system integration, and rural electrification initiatives.

Data triangulation techniques were employed to reconcile disparate information streams, ensuring that market segmentation, supply chain analyses, and competitive assessments rest on verified evidence. The study further integrates case studies of exemplar off-grid deployments, financial model simulations for pay-as-you-go frameworks, and product benchmarking across multiple geographies. This systematic approach guarantees both the validity and reliability of strategic recommendations, enabling stakeholders to make well-informed decisions in a rapidly evolving market context.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Off-grid Solar PV Panels market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Off-grid Solar PV Panels Market, by Module Type

- Off-grid Solar PV Panels Market, by Component

- Off-grid Solar PV Panels Market, by Application

- Off-grid Solar PV Panels Market, by Sales Channel

- Off-grid Solar PV Panels Market, by Region

- Off-grid Solar PV Panels Market, by Group

- Off-grid Solar PV Panels Market, by Country

- United States Off-grid Solar PV Panels Market

- China Off-grid Solar PV Panels Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Core Findings And Strategic Imperatives To Illuminate Future Pathways For Sustainable Off-Grid Solar Photovoltaic Adoption Worldwide

In synthesizing the core findings, it is evident that the off-grid solar photovoltaic sector stands at an inflection point defined by converging technological breakthroughs, adaptive policy landscapes, and evolving commercial models. Efficiency gains in module design and energy storage have compressed system-level costs, while digital financing and microgrid management tools have lowered barriers to adoption. Moreover, regional programs and public–private partnerships continue to extend the reach of off-grid PV into previously unserved or underserved markets.

Looking ahead, the trajectory toward scalable, sustainable off-grid energy ecosystems will hinge on continued innovation and cross-industry collaboration. Developing circular economy practices-such as module recycling and second-life battery applications-will enhance environmental stewardship and valorize end-of-life assets. Simultaneously, advancing interoperability standards for hardware and software components will streamline integration, accelerate deployment timelines, and foster global best-practice exchange.

Ultimately, decision-makers who prioritize supply chain resilience, customer-centric service delivery, and proactive policy engagement will be best positioned to capture the transformative potential of off-grid solar photovoltaic systems, ensuring lasting impact for communities, enterprises, and the planet alike.

Unlock Exclusive Insights And Partner With Ketan Rohom To Secure Your Comprehensive Off-Grid Solar Market Research Report Today

Interested stakeholders seeking to unlock unparalleled insights into off-grid solar market dynamics can connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the comprehensive report that will catalyze strategic decision-making and accelerate business growth in remote electrification deployments

- How big is the Off-grid Solar PV Panels Market?

- What is the Off-grid Solar PV Panels Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?