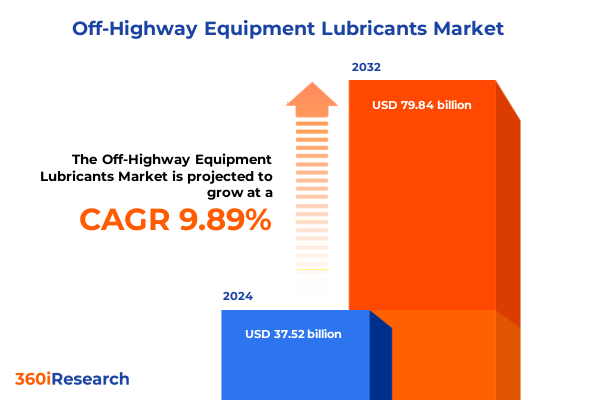

The Off-Highway Equipment Lubricants Market size was estimated at USD 41.20 billion in 2025 and expected to reach USD 45.25 billion in 2026, at a CAGR of 9.90% to reach USD 79.84 billion by 2032.

Pioneering Performance in Off-Highway Lubricants Navigating Evolving Demands and Technological Innovations Driving Industry Transformation

Off-highway equipment lubricants play an indispensable role in ensuring the reliability and operational efficiency of heavy machinery used across agriculture, construction, forestry, and mining sectors. These specialized fluids must not only meet stringent performance specifications dictated by original equipment manufacturers but also adapt to heightened demands for energy efficiency, extended drain intervals, and reduced emissions. As such, industry stakeholders are embracing advanced additive technologies and novel base oil formulations to balance the dual imperatives of machine protection and environmental stewardship. Additionally, the increasing adoption of sensor-based condition monitoring has created new opportunities for lubricant providers to offer data-driven service models that complement traditional product offerings.

Within this dynamic landscape, lubricant developers are navigating complex regulatory frameworks that govern biodegradability, toxicity, and sustainability. Simultaneously, end-users are under pressure to lower total cost of ownership by maximizing equipment uptime and minimizing maintenance interventions. Consequently, the industry is witnessing a strategic shift from one-size-fits-all solutions toward bespoke fluid recipes tailored to specific equipment architectures and operational profiles. By understanding these interrelated forces, decision-makers can better position their portfolios to address emergent challenges and accelerate the transition toward next-generation formulations.

Assessing Dramatic Technological and Sustainability-Driven Transformations Redefining Standards and Capabilities Across Off-Highway Lubricants

Recent years have witnessed sweeping transformations in off-highway equipment lubricants, fueled by relentless pursuit of lower carbon footprints and heightened machine performance. In particular, the convergence of advanced synthetic base oils with proprietary additive chemistries has unlocked unprecedented levels of thermal stability and oxidation resistance, thereby enabling longer change intervals and reduced fluid waste. Meanwhile, accelerated research into bio-based and biodegradable fluids is redefining sustainability benchmarks, as manufacturers seek to align product portfolios with circular economy principles. Furthermore, digital integration through IoT-enabled sensors and predictive analytics has transitioned lubricants from a passive consumable to a value-added service component that informs proactive maintenance strategies.

At the same time, original equipment manufacturers have significantly tightened specification requirements, driving collaboration across the value chain to engineer formulations that deliver optimal performance under diverse operating conditions. With electrification and hybrid powertrains gradually entering off-highway markets, lubricants must also accommodate novel thermal and electrical conductivity requirements. These converging trends underscore a broader industry pivot toward chemistry-driven differentiation and service-oriented business models.

Evaluating the Cascading Effects of Recent United States Tariffs on Supply Dynamics Cost Structures and Strategic Sourcing Decisions

The introduction of new United States tariffs on chemical intermediates and finished lubricant components in 2025 has reverberated across global supply chains, compelling stakeholders to reassess sourcing strategies and cost structures. Heightened import duties on specialty base oils and additive packages have triggered a recalibration of inventory holdings, as distributors and end-users seek to mitigate near-term price volatility. In response, many suppliers have accelerated qualification of alternative feedstock streams and diversified logistics partnerships to circumvent tariff-exposed routes. Concurrently, domestic production capacities have been scaled up, supported by targeted capital investments aimed at reducing reliance on import-sensitive materials.

Moreover, tariff-driven supply chain adjustments have elevated lead times for critical components, prompting equipment operators to adopt more flexible maintenance schedules and safety-stock policies. While cost pass-through to end-users remains a sensitive issue, forward-looking companies are leveraging long-term agreements and collaborative procurement frameworks to stabilize pricing and ensure uninterrupted fluid availability. Overall, the cumulative impact of these trade measures underscores the importance of agile sourcing strategies and robust supplier relationships to navigate an increasingly complex policy environment.

Deciphering Comprehensive Segmentation Patterns to Uncover Distinct Demand Drivers Across Products Base Oils Equipment Applications and Channels

In dissecting the off-highway lubricants market, it is essential to recognize the interplay between product formulations, feedstock origins, equipment applications, end-use industries, functional roles within machinery, and distribution pathways. Products such as compressor fluids and hydraulic oils deliver critical performance across farm tractors, construction machinery, forestry harvesters, and mining haul trucks, with compressor lubricants subdivided into reciprocating and rotary types to address distinct operational stresses. Moreover, engine oils, gear oils, and greases custom-blended with aluminum complex, calcium, or lithium thickening agents cater to requirements ranging from high-temperature resilience to load-bearing capacity.

Simultaneously, base oil selection - whether mineral group I, mineral group II, semi-synthetic blends, or fully synthetic chemistries comprising esters and polyalphaolefins - dictates the lubricant’s oxidative stability, thermal tolerance, and biodegradability profile. Meanwhile, specific equipment segments, encompassing agricultural, construction, forestry, and mining platforms, each impose unique viscosity, anti-wear, and corrosion-protection parameters. When considering the industries that utilize this equipment, from broadacre farming to open-pit mining, it becomes clear that fluid competencies must be finely tuned to the harshest environments. Furthermore, each lubricant must fulfill its role in drivetrain systems, internal combustion engines, hydraulic circuits, or transmission components, with performance expectations differing accordingly. Finally, the choice of direct manufacturer sales, regional distributors, or e-commerce channels influences service levels, technical support, and delivery lead times across the value chain.

This comprehensive research report categorizes the Off-Highway Equipment Lubricants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Base Oil Type

- Equipment Type

- End Use Industry

- Application

- Sales Channel

Regional Dynamics Shaping Off-Highway Lubricant Demand and Innovation Trajectories Across Americas Europe Middle East Africa and Asia-Pacific

Geographic dynamics significantly shape the trajectory of off-highway lubricant demand and innovation adoption. In the Americas, mature markets are defined by rigorous environmental regulations in North America and an ongoing upgrade cycle of agricultural and construction fleets in South America, where remote operations underscore the necessity for extended-life fluids and comprehensive service agreements. As a result, providers in this region are intensifying investments in laboratory testing facilities and field demonstration programs to validate performance under extreme conditions.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes and climate variability drive fluid development priorities from cold-start performance in northern latitudes to thermal degradation resistance under desert conditions. Regional OEM alliances have fostered the co-development of multifunctional lubricants capable of addressing both European emissions mandates and Middle Eastern heavy-duty mining requirements. Meanwhile, rapid infrastructure expansion in Africa has spurred demand for versatile lubricants that can serve both mechanized agriculture and extractive industries.

The Asia-Pacific region exhibits some of the highest growth rates, fueled by ambitious industrialization initiatives and large-scale infrastructure projects. In China, India, Australia, and Southeast Asia, the proliferation of construction and mining equipment necessitates cost-effective yet high-performance lubricants that withstand abrasive dust, extreme temperatures, and long cycle times. Consequently, regional blending and packaging hubs have emerged to enable agile product customization and responsive distribution models.

This comprehensive research report examines key regions that drive the evolution of the Off-Highway Equipment Lubricants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Pioneering Product Diversification Strategic Partnerships and Sustainable Innovations in Off-Highway Lubricants

A constellation of leading industry participants is driving innovation, strategic partnerships, and portfolio diversification in the off-highway lubricants sector. Major integrated oil companies are leveraging their upstream feedstock capabilities to streamline supply chains, while specialty lubricant manufacturers concentrate on niche chemistries that meet increasingly stringent environmental and OEM performance standards. Cross-sector collaborations between additive companies, base oil refiners, and equipment OEMs have become commonplace, enabling co-creation of fluids that precisely align with machine specifications and sustainability goals.

In parallel, regional players are capitalizing on local raw material access and service networks to deliver competitively priced alternatives tailored to specific market needs. This dual approach - global scale combined with local customization - is reshaping competitive dynamics, as incumbents and new entrants alike vie for aftermarket share and original equipment contracts. Additionally, ramped-up investment in R&D centers and specialized testing rigs reflects a commitment to accelerating time-to-market for next-generation formulations that address electrification, hybrid drivetrains, and circular economy principles.

This comprehensive research report delivers an in-depth overview of the principal market players in the Off-Highway Equipment Lubricants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bharat Petroleum Corporation Limited

- BP p.l.c.

- Caltex Australia Group

- Chevron Corporation

- China Petroleum & Chemical Corporation

- Exxon Mobil Corporation

- Fuchs Petrolub SE

- Gazprom Neft Lubricants LLC

- Gulf Oil International

- Idemitsu Kosan Co., Ltd.

- Indian Oil Corporation Limited

- JXTG Nippon Oil & Energy Corporation

- Kuwait Petroleum Corporation

- Motul S.A.

- PetroChina Company Limited

- Petroliam Nasional Berhad

- Phillips 66 Company

- PJSC Lukoil

- Repsol S.A.

- Shell plc

- TotalEnergies SE

- TotalEnergies SE

- Valvoline Inc.

Strategic Imperatives and Practical Roadmaps for Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Operational Risks

Industry leaders should prioritize investment in advanced synthetic and bio-based fluid platforms that deliver superior protection and align with evolving environmental regulations. Concurrently, forging strategic alliances with OEMs and additive suppliers can expedite co-development of tailored formulations that enhance machine longevity and fuel efficiency. To counter tariff-induced cost pressures, executives are advised to establish multi-sourcing frameworks complemented by robust supplier performance metrics and collaborative forecasting tools.

Moreover, integrating digital service offerings - from condition-monitoring sensors to cloud-based analytics dashboards - can transform lubricants into value-added solutions that drive customer loyalty and open recurring revenue streams. In operational terms, regional market opportunities warrant localized blending capabilities and flexible distribution partnerships, ensuring rapid response to emergent demand fluctuations. Finally, leaders must embed sustainability into product roadmaps by adopting life cycle assessment methodologies and pursuing circular economy initiatives such as refillable packaging and recycling programs.

Integrative Research Approach Combining Primary Interviews Secondary Data Triangulation and Rigorous Quality Assurance to Ensure Insight Accuracy

This study is grounded in a rigorous research framework that combines primary interviews with senior executives from equipment OEMs, lubricant formulators, distributors, and end-users across key global markets. Complementing these insights, secondary data was systematically gathered from industry white papers, trade association publications, and customs and tariff databases to validate supply chain dynamics and regulatory impacts. To ensure analytical integrity, data points were cross-referenced through a triangulation process that reconciles divergent sources and identifies consensus trends.

Quality assurance protocols included peer review by subject-matter experts and methodical checks for data consistency, completeness, and relevance. The research team applied industry-standard classifications and segmentation schemas to maintain comparability, while advanced statistical techniques were used to analyze qualitative and quantitative information. This comprehensive methodology ensures that conclusions and recommendations reflect the most recent market realities and provide a reliable foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Off-Highway Equipment Lubricants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Off-Highway Equipment Lubricants Market, by Product Type

- Off-Highway Equipment Lubricants Market, by Base Oil Type

- Off-Highway Equipment Lubricants Market, by Equipment Type

- Off-Highway Equipment Lubricants Market, by End Use Industry

- Off-Highway Equipment Lubricants Market, by Application

- Off-Highway Equipment Lubricants Market, by Sales Channel

- Off-Highway Equipment Lubricants Market, by Region

- Off-Highway Equipment Lubricants Market, by Group

- Off-Highway Equipment Lubricants Market, by Country

- United States Off-Highway Equipment Lubricants Market

- China Off-Highway Equipment Lubricants Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Summarizing Key Takeaways to Empower Decision Makers with Clear Perspectives on Technological Shifts Tariffs Segmentation and Strategic Priorities

The off-highway equipment lubricants landscape is at a pivotal inflection point, shaped by the confluence of technological innovation, regulatory evolution, and shifting trade policies. Advanced synthetic and bio-based formulations are redefining performance expectations, while IoT-enabled monitoring is transforming lubricants into interactive service solutions. At the same time, the 2025 tariff measures have underscored the strategic importance of supply chain resilience and agile sourcing models. Segmentation analysis reveals a mosaic of demand drivers that varies by product type, base oil composition, equipment category, functional application, and sales channel, necessitating targeted commercial and technical strategies.

Regional disparities further complicate the competitive equation, with distinct requirements emerging across the Americas, EMEA, and Asia-Pacific markets. Against this backdrop, industry participants must calibrate their portfolios, partnerships, and go-to-market approaches to capture value in both mature and high-growth geographies. Ultimately, stakeholders who embrace collaborative innovation, digital transformation, and sustainability integration will be best positioned to thrive in this dynamic environment.

Engage Expert Insights for In-Depth Market Analysis and Strategic Guidance Reach Out to Ketan Rohom to Obtain the Comprehensive Off-Highway Lubricants Report Today

Unlock unparalleled clarity into off-highway equipment lubricants with a comprehensive market research report that delves into transformational shifts, tariff impacts, segmentation strategies, regional nuances, and competitive benchmarks. By securing this intelligence, you gain actionable insights that empower your organization to fine-tune product portfolios, optimize supply chains, and capitalize on emerging growth pockets. Engage directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to discuss customized data packages, pricing options, and exclusive consultancy services that can accelerate your strategic planning. Whether you require deep dives on base oil formulations, detailed tariff analysis, or granular region-wise performance matrices, this report offers the precision and depth needed to drive sustainable competitive advantage in today’s rapidly evolving off-highway lubricants landscape.

- How big is the Off-Highway Equipment Lubricants Market?

- What is the Off-Highway Equipment Lubricants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?