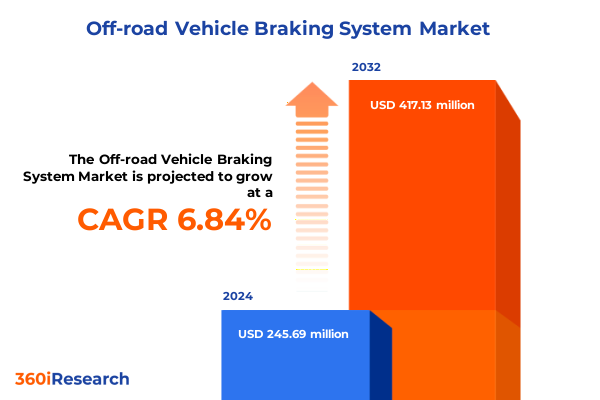

The Off-road Vehicle Braking System Market size was estimated at USD 262.37 million in 2025 and expected to reach USD 277.48 million in 2026, at a CAGR of 6.84% to reach USD 417.13 million by 2032.

Exploring the Evolutionary Advancements and Strategic Significance of Off-Road Vehicle Braking Systems Within the Modern Mobility Ecosystem

Off-road vehicle braking systems have undergone a remarkable evolution, emerging as critical enablers of safety and performance across diverse terrain applications. Contemporary demands for enhanced control and reliability have propelled the industry toward sophisticated solutions that integrate advanced materials, electronic control units, and system-level optimization. As manufacturers strive to meet rigorous safety regulations and address the specialized requirements of recreational, commercial, military, and racing segments, braking technologies have become a focal point for innovation. In particular, the convergence of mechanical durability with intelligent braking modulation has redefined expectations for rider confidence and operational efficiency.

Through the lens of recent technological breakthroughs, stakeholders are now better equipped to understand how modular designs, predictive maintenance algorithms, and regenerative braking integration are reshaping the market. With off-road vehicles increasingly tasked to operate in extreme environments-ranging from arid deserts to mountainous terrains-the design priorities extend beyond traditional stopping power to encompass heat management, corrosion resistance, and real-time diagnostic capabilities. This introduction lays the groundwork for examining transformative shifts, trade policy impacts, segmentation insights, and strategic recommendations that will enable decision-makers to navigate complexities and seize opportunities in this dynamic market.

Analyzing the Paradigm Shift Driven by Electrification, Digitalization, and Advanced Materials in Off-Road Vehicle Braking System Development

Recent years have witnessed profound shifts in the off-road braking landscape, driven by the electrification of utility vehicles, the digitalization of control systems, and the emergence of novel composite materials. Against this backdrop, manufacturers are transitioning from legacy drum and single-caliper disc technologies toward multi-piston calipers with adaptive electronic braking force distribution. Such transitions have been catalyzed by the rapid adoption of electric motors in side-by-side and utility vehicle platforms, necessitating integration with regenerative braking circuits to optimize energy recapture and thermal management.

Furthermore, the proliferation of connected vehicle architectures has introduced advanced driver-assistance functionalities, whereby real-time feedback from wheel speed sensors, temperature monitors, and inertial measurement units feed into centralized braking control modules. Material science innovations have likewise played a pivotal role, as semi-metallic and ceramic friction materials replace traditional organic compounds to enhance fade resistance and longevity under high-load conditions. By reconciling mechanical robustness with electronic intelligence, these transformative shifts underscore a broader industry mandate to deliver safer, lighter, and more sustainable off-road braking solutions.

Assessing the Cumulative Influence of United States 2025 Tariffs on Supply Chain Dynamics and Cost Structures in Off-Road Braking Systems

The cumulative impact of recent United States tariffs implemented in 2025 has reverberated throughout the off-road braking components ecosystem, reshaping sourcing strategies and cost frameworks. As levies on imported steel, aluminum, and electronic subassemblies took effect, original equipment manufacturers have embarked on vertical integration initiatives, either by forging domestic supply partnerships or by investing in end-to-end production capabilities. These strategic pivots aim to mitigate exposure to fluctuating tariff schedules while preserving critical lead times for core modules such as multi-piston calipers and electronic control units.

In parallel, suppliers have pursued localization of key raw materials and established alternative regional hubs to circumvent tariff-related bottlenecks. This dual-pronged approach has, on one hand, elevated near-term capital expenditures but, on the other hand, has fostered redundancy in manufacturing footprints and strengthened supply chain resilience. Ultimately, the landscape now rewards agile participants capable of recalibrating procurement practices, leveraging trade agreements, and capitalizing on domestic manufacturing incentives to sustain competitiveness in a tariff-intensive environment.

Unveiling Critical Segmentation Insights Across Vehicle Types, Brake Technologies, Sales Channels, Materials and Application Domains

In examining market segmentation, it becomes evident that distinct vehicle classes exert unique demands on braking architecture. All-terrain vehicles and dirt bikes prioritize lightweight construction and compact disc brake systems to optimize maneuverability, whereas side-by-side and utility vehicles rely on robust drum brake configurations and multi-piston disc assemblies to manage higher load capacities. Brake technology segmentation further reveals the rising prominence of electric brake modules that interface seamlessly with electronic stability programs, even as traditional disc and drum brakes continue to dominate core performance requirements with their respective single-piston, multi-piston, duo-servo, and leading-trailing shoe variants.

Sales channel diversity underscores the balance between original equipment manufacturing and aftermarket customization, where dealers and specialty fabricators offer tailored friction materials or replacement kits to enthusiasts seeking performance upgrades. Materials segmentation highlights an ongoing shift away from purely organic compounds toward semi-metallic and ceramic blends that deliver superior thermal tolerance without compromising pad life. In terms of application, stakeholders must address the nuanced requirements of commercial sectors-including agriculture, construction, and mining-alongside military and racing use cases that demand both precision stopping and rapid heat dissipation, all while catering to the recreational segment’s appetite for reliable and low-maintenance braking solutions.

This comprehensive research report categorizes the Off-road Vehicle Braking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vehicle Type

- Brake Type

- Material

- Sales Channel

- Application

Mapping Regional Dynamics and Growth Potential Across the Americas, Europe Middle East Africa, and Asia Pacific Markets for Braking Systems

Regional landscapes for off-road braking systems manifest distinct growth trajectories shaped by regulatory frameworks, infrastructure development, and consumer preferences. In the Americas, widespread adoption of recreational utility vehicles and robust aftermarket ecosystems fuel ongoing investments in advanced braking modules, with OEMs collaborating closely with specialty parts suppliers to roll out customization options and replacement components. Furthermore, supportive government grants for domestic manufacturing reinforce the region’s appeal as a strategic production hub.

Across Europe, the Middle East, and Africa, stringent safety standards and emissions regulations have accelerated the integration of electronic braking controls and regenerative solutions, particularly in nations with extensive agricultural and construction sectors. Partnerships between European braking specialists and emerging market assemblers are fostering technology transfer while optimizing cost efficiency. Meanwhile, in the Asia-Pacific region, rapid industrialization and rising disposable incomes have elevated demand for utility vehicles and all-terrain designs, prompting leading players to expand local manufacturing capacities and tailor friction material formulations to diverse climatic conditions, from arid deserts to tropical environments.

This comprehensive research report examines key regions that drive the evolution of the Off-road Vehicle Braking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Competitive Strategies and Innovation Trajectories Among Leading Global Manufacturers in Off-Road Braking Systems

Leading players in the off-road braking market are distinguished by their technological prowess and strategic alliances. Established braking component manufacturers have intensified R&D efforts to refine multi-piston caliper designs, integrating lightweight alloys and sensor arrays that deliver precise pressure modulation under variable terrain stresses. Simultaneously, electronic control unit suppliers are forming joint ventures with OEMs to ensure seamless integration of braking logic within vehicle-wide electrical architectures.

Collaborative ventures between material science innovators and automotive fabricators have yielded progressive friction composites, balancing thermal conductivity with wear resistance. Tier-one suppliers are also diversifying their portfolios through acquisitions of specialty foundries and spin-out ventures focused on additive manufacturing of brake components, thereby reducing lead times and enabling rapid prototyping. These strategic maneuvers underscore a broader competitive dynamic in which ecosystem partnerships and vertical integration play pivotal roles in defining market leadership and fostering next-generation braking solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Off-road Vehicle Braking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACDelco

- Akebono Brake Industry Co., Ltd.

- Allied Signal Inc.

- Apex Brakes

- Bendix Commercial Vehicle Systems LLC

- Brembo S.p.A.

- Carlisle Braking Systems

- EBC Brakes

- Haldex AB

- Knorr-Bremse AG

- Mando Corporation

- Meritor, Inc.

- Mobile Industrial Controls

- Parker Hannifin Corp

- Perfection Hy-Test

- TSE Brakes, Inc.

- WABCO Holdings Inc.

- Wilwood Engineering, Inc.

- ZF Friedrichshafen AG

Strategic Recommendations for Industry Leaders to Navigate Market Complexity and Capitalize on Emerging Opportunities in Off-Road Braking

To maintain a competitive edge, industry leaders should prioritize end-to-end supply chain transparency, leveraging digital twins and blockchain-enabled traceability to preempt disruptions and optimize inventory levels. Strategic investments in localized production centers-paired with modular platform design-will allow rapid configuration of braking systems across vehicle types, from dirt bikes to heavy-duty utility machines. Moreover, deploying predictive analytics for maintenance forecasting can enhance after-sales service offerings, reducing downtime for commercial and military clients.

Leaders must also cultivate symbiotic partnerships with material innovators to accelerate the adoption of advanced composite friction formulations, ensuring performance differentiation in heat-intensive racing and mining applications. Finally, integrating regenerative braking modules with energy storage systems presents a unique value proposition for electrified off-road platforms, reinforcing sustainability credentials and aligning with evolving regulatory mandates.

Comprehensive Overview of Research Methodology Incorporating Primary Interviews, Secondary Analysis, and Data Triangulation Techniques

This research combines comprehensive secondary analysis of industry publications, regulatory filings, and patent databases with primary interviews conducted across OEM engineering teams, Tier-one suppliers, and material science laboratories. Data triangulation was achieved by cross-referencing technical specifications from component datasheets with firsthand feedback obtained through structured interviews and on-site plant visits.

Quantitative validation of technological trends incorporated anonymized performance data from field trials and benchmarking studies, while qualitative insights were enriched by expert roundtables convened with vehicle integrators and aftermarket specialists. This mixed-method approach ensures a balanced perspective that accurately captures both the macro-level shifts and the nuanced operational challenges inherent to off-road braking system development.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Off-road Vehicle Braking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Off-road Vehicle Braking System Market, by Vehicle Type

- Off-road Vehicle Braking System Market, by Brake Type

- Off-road Vehicle Braking System Market, by Material

- Off-road Vehicle Braking System Market, by Sales Channel

- Off-road Vehicle Braking System Market, by Application

- Off-road Vehicle Braking System Market, by Region

- Off-road Vehicle Braking System Market, by Group

- Off-road Vehicle Braking System Market, by Country

- United States Off-road Vehicle Braking System Market

- China Off-road Vehicle Braking System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Core Insights and Strategic Imperatives to Guide Stakeholders in the Off-Road Vehicle Braking System Landscape

The synthesis of technological, regulatory, and geopolitical factors underscores a dynamic inflection point for off-road vehicle braking systems. As electrification trends accelerate and material innovations mature, braking performance will increasingly hinge on the seamless integration of mechanical robustness with electronic intelligence. Regional policy shifts and trade dynamics will continue to influence sourcing strategies and manufacturing footprints, highlighting the need for agile, data-driven decision-making.

Market participants that embrace modular designs, foster ecosystem partnerships, and implement predictive maintenance frameworks will be best positioned to capture value across commercial, military, racing, and recreational segments. The evolving landscape promises transformative opportunities for organizations prepared to invest in R&D, localize critical supply chains, and deliver high-performance braking solutions tailored to the unique demands of off-road applications.

Engage with Associate Director Ketan Rohom to Unlock In-Depth Insights and Transform Decision Making Through the Full Market Research Report

For a deeper dive into comprehensive analysis and strategic guidance, reach out to Associate Director Ketan Rohom at 360iResearch. By engaging directly, you will gain immediate access to exclusive insights that can streamline your decision-making process and uncover untapped opportunities in the off-road vehicle braking system market. Connect with Ketan to explore tailored data, personalized recommendations, and an investor-ready presentation that equips your leadership team with the clarity and confidence necessary to shape the future of your organization’s mobility initiatives. Secure your organization’s competitive advantage today by initiating a dialogue with Ketan Rohom and unlocking the full market research report.

- How big is the Off-road Vehicle Braking System Market?

- What is the Off-road Vehicle Braking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?