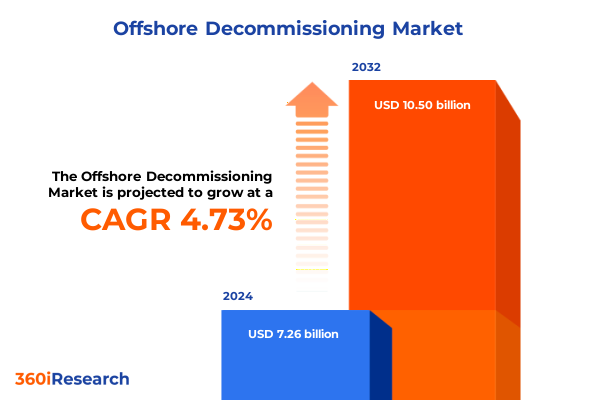

The Offshore Decommissioning Market size was estimated at USD 7.57 billion in 2025 and expected to reach USD 7.90 billion in 2026, at a CAGR of 4.78% to reach USD 10.50 billion by 2032.

Exploring the Foundational Drivers and Strategic Imperatives That Are Redefining Offshore Decommissioning as a Pillar of Global Sustainable Energy Infrastructure Management and Resilience

Initially, offshore decommissioning has emerged as a critical component of the global energy transition, driven by the retirement of aging platforms and structures that no longer meet performance or environmental benchmarks. As mature fields reach the end of their economic life cycles, operators are increasingly focused on responsibly removing wells, topsides, and subsea infrastructure to mitigate environmental liabilities and comply with stringent regulatory frameworks. This paradigm shift has elevated decommissioning from a routine operational task to a strategic priority within the broader context of sustainable energy management.

Furthermore, the convergence of regulatory mandates and stakeholder expectations is intensifying pressure on operators to adopt best practices in asset retirement planning. Financial assurance requirements, risk management protocols, and environmental remediation standards are compelling industry participants to seek innovative and efficient approaches. Consequently, the market is witnessing heightened collaboration among engineering firms, consultancy specialists, and technology providers to deliver end-to-end solutions that optimize cost, safety, and environmental outcomes. In this evolving ecosystem, strategic alignment across service providers and end users is paramount.

Identifying the Pivotal Technological Innovations and Regulatory Shifts Reshaping Offshore Decommissioning Operations and Environmental Commercial Practices and Setting New Standards for Industry Evolution

In recent years, technological breakthroughs have transformed the offshore decommissioning landscape, enabling more precise and cost-effective removal methodologies. Advanced robotics and remotely operated vehicles now carry out intricate subsea cutting and lifting tasks with minimal human intervention, significantly reducing safety risks and operational downtime. Simultaneously, digital twins and data analytics platforms have emerged as powerful tools for scenario modeling and risk assessment, allowing stakeholders to simulate decommissioning sequences and optimize resource allocation before mobilizing equipment.

Moreover, regulatory bodies and policymakers are aligning to foster consistent frameworks that balance environmental stewardship with economic feasibility. Collaborative initiatives between governments and industry forums are establishing standardized protocols for financial assurance and environmental monitoring, thereby enhancing transparency and reducing the risk of project delays. These transformative shifts underscore a broader trend toward integrated, technology-enabled solutions that streamline decommissioning workflows and support sustainable legacy management.

Analyzing the Far-Reaching Economic Consequences of United States Tariffs Imposed in 2025 on Offshore Decommissioning Costs Competitive Financial Supply Chain Dynamics

Analyzing the tariff landscape reveals significant headwinds for offshore decommissioning in the United States following policy actions in 2025. A recent impairment announcement by Equinor attributed approximately $300 million of incremental cost impacts to new tariffs on imported steel, which drove the company to record a $955 million writedown on its U.S. offshore wind assets. These measures, introduced alongside the suspension of offshore wind leases, have underscored the vulnerability of supply chains to sudden regulatory shifts and have added pressure on service providers that rely on imported materials for decommissioning projects.

Furthermore, the broader ripple effects of these tariffs extend beyond direct material costs. Increased lead times and elevated logistics expenses have disrupted project schedules, compelling operators to reevaluate procurement strategies and inventory buffers. As a result, many decommissioning contractors are exploring alternative sourcing arrangements and forging closer partnerships with domestic steel mills to mitigate exposure. This cumulative impact of U.S. tariffs highlights the critical importance of supply chain resilience and proactive risk management when estimating project viability and budgeting.

Unlocking Strategic Opportunities Through In-Depth Segmentation Analysis That Illuminates Service Structure and End User Trends Driving Growth Patterns in the Offshore Decommissioning Market

Segmentation analysis reveals nuanced pathways for capturing value across distinct service offerings and customer profiles. Engineering and consultancy services have become indispensable during the early planning phases, as operators rely on experts to navigate complex regulatory requirements and design tailored decommissioning strategies. As projects progress to the execution stage, onshore disposal and recycling facilities play a pivotal role in transforming recovered materials into reusable commodities, while specialized plug and abandonment services-categorized into pipeline and well abandonment-focus on sealing legacy infrastructure to prevent environmental contamination.

Delving deeper, subsea structure removal specialists leverage advanced lifting methodologies to detach and transport submerged assemblies, whereas topsides removal contractors manage the safe deconstruction of surface facilities. In parallel, site remediation teams address residual contamination in both onshore staging areas and adjacent marine environments. Additionally, the structure type segmentation-spanning floating production systems, oil rigs, subsea infrastructure, support platforms, and wellheads-illuminates the technical diversity and equipment requirements inherent to each asset class. By aligning service capabilities with specific end user needs, including decommissioning contractors, operators, and vessel owners, stakeholders can capitalize on targeted opportunities and drive operational excellence across the entire value chain.

This comprehensive research report categorizes the Offshore Decommissioning market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Structure Type

- End User

Illuminating Regional Dynamics and Market Drivers Across the Americas Europe Middle East Africa and Asia-Pacific That Define Offshore Decommissioning Prospects Long-Term Resilience

Regional dynamics exert a profound influence on decommissioning strategies, reflecting variations in regulatory regimes, environmental sensitivities, and local supply chain capacity. In the Americas, a mature regulatory framework in the Gulf of Mexico and North Atlantic has established clear financial assurance guidelines, but rising tariff pressures and aging platform inventories are driving operators to innovate in cost control and environmental compliance. Brazil’s deepwater plays, conversely, present opportunities for collaboration between global contractors and domestic service providers amid evolving decommissioning legislation.

Turning to Europe, the Middle East, and Africa, stringent European Union directives and North Sea legacy issues have catalyzed investments in advanced removal technologies and circular economy practices. In contrast, the Middle East region is beginning to formulate decommissioning roadmaps for early-generation assets, while offshore fields in West Africa see growing interest from specialist providers adept at navigating complex logistical challenges. Across Asia-Pacific, Australia’s regulatory overhaul has accelerated removal schedules for aging platforms, and Southeast Asian markets are witnessing pilot projects that test modular decommissioning units. These regional insights underscore the necessity of adapting commercial models and technological approaches to local market characteristics and regulatory imperatives.

This comprehensive research report examines key regions that drive the evolution of the Offshore Decommissioning market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Participants and Their Strategic Initiatives Shaping Technological Advancements Operational Excellence and Collaborative Sustainability in Offshore Decommissioning Competitive Landscape

Leading industry participants continue to refine their service portfolios and forge strategic alliances to strengthen market positioning. Major subsea contractors have expanded their fleets of heavy-lift vessels and invested in bespoke cutting solutions to address increasingly complex removal tasks. Oilfield services giants are integrating digital platforms and leveraging existing well abandonment expertise to offer plug and abandonment packages that optimize wellbore integrity and minimize environmental risk.

In parallel, emerging players specializing in onshore disposal are developing recycling infrastructures that comply with stringent waste management standards while capturing the residual value of recovered metals. Meanwhile, vessel owners are retrofitting assets to meet dual roles in decommissioning and offshore renewable support, reflecting a shift toward diversified service models. Collectively, these advancements highlight a competitive landscape where differentiation hinges on technological capability, collaborative networks, and the ability to anticipate evolving regulatory demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Offshore Decommissioning market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AF Gruppen ASA

- Aker Solutions ASA

- Allseas Group S.A.

- Baker Hughes Company

- DeepOcean Group Holding BV

- Halliburton Company

- Heerema Marine Contractors N.V.

- Jan De Nul Group NV

- John Wood Group PLC

- Koninklijke Boskalis Westminster N.V.

- McDermott International, Ltd.

- Oceaneering International, Inc.

- Petrofac Limited

- Ramboll Group

- Royal Boskalis Westminster N.V.

- Saipem S.p.A.

- Schlumberger Limited

- Subsea 7 S.A.

- TechnipFMC plc

- Van Oord Dredging and Marine Contractors B.V.

Formulating Targeted Strategic Recommendations That Enable Industry Leaders to Enhance Efficiency Manage Risks and Capitalize on Emerging Sustainable Opportunities in Offshore Decommissioning

To enhance operational efficiency, industry leaders should prioritize holistic project planning that integrates digital simulations with onshore recycling logistics. By leveraging predictive analytics and digital twins, stakeholders can streamline resource allocation and optimize vessel itineraries, thereby reducing idle time and limiting cost overruns. Furthermore, establishing long-term partnerships with domestic material suppliers can mitigate tariff exposure and reinforce supply chain resilience.

Moreover, companies are advised to engage proactively with regulators and local communities to secure social license to operate and pre-empt potential delays. Transparent communication regarding environmental safeguards and financial assurances fosters stakeholder confidence and facilitates smoother project execution. Finally, investing in workforce upskilling-particularly in robotics operation, subsea welding, and environmental monitoring-will ensure that organizations maintain a competitive edge and can respond swiftly to the evolving technical complexities of offshore decommissioning.

Detailing a Robust Research Methodology Integrating Qualitative Interviews Quantitative Data Analysis and Rigorous Validation Through Stakeholder Engagement to Deliver Comprehensive Offshore Decommissioning Insights

Our research methodology combines qualitative and quantitative approaches to ensure robustness and veracity. Primary data collection involved in-depth interviews with senior executives from operators, contractors, and regulatory bodies, complemented by technical consultations with engineering and environmental specialists. Secondary research drew upon industry journals, government publications, and financial filings to triangulate market dynamics and validate emerging trends.

Additionally, we applied rigorous data analytics to assess project costs, service uptake rates, and technological adoption curves. This quantitative analysis was further supported by stakeholder engagement workshops that refined key assumptions and provided real-world feedback on strategic implications. By integrating these elements, our methodology delivers a comprehensive view of offshore decommissioning that is both empirically grounded and strategically actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Offshore Decommissioning market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Offshore Decommissioning Market, by Service Type

- Offshore Decommissioning Market, by Structure Type

- Offshore Decommissioning Market, by End User

- Offshore Decommissioning Market, by Region

- Offshore Decommissioning Market, by Group

- Offshore Decommissioning Market, by Country

- United States Offshore Decommissioning Market

- China Offshore Decommissioning Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 795 ]

Synthesizing Key Insights and Strategic Imperatives to Drive Informed Decision-Making and Chart a Sustainable Future Through Collaborative Innovation in the Offshore Decommissioning Sector

In synthesizing our findings, it is evident that offshore decommissioning is transitioning from a niche operational concern to a cornerstone of sustainable energy infrastructure management. The interplay of technological innovation, regulatory evolution, and market segmentation is creating diverse pathways for value creation, while regional dynamics underscore the importance of tailored approaches. As tariff pressures and supply chain disruptions persist, stakeholders must remain agile and collaborative to safeguard project viability.

Ultimately, informed decision-making-grounded in robust research and strategic foresight-will distinguish market leaders from laggards. By embracing integrated digital platforms, fortifying domestic supply chains, and fostering transparent stakeholder relationships, organizations can navigate the complexities of decommissioning and contribute to a cleaner, safer energy future. These strategic imperatives should guide investment priorities and partnership models for the years ahead.

Driving Engagement with Ketan Rohom to Access In-Depth Offshore Decommissioning Market Intelligence and Tailored Strategic Solutions Through Exclusive Consultation and Report Acquisition

If you are ready to deepen your understanding of offshore decommissioning dynamics and implement strategies that deliver measurable impact, Ketan Rohom stands ready to guide your next steps. Leveraging years of expertise in market analysis and client advisory, Ketan offers an exclusive consultation to explore tailored solutions aligned with your organizational objectives. This engagement ensures that you gain immediate access to the most current market intelligence and practical frameworks needed to navigate complex regulatory environments and evolving supply chain considerations. Reach out now to secure your copy of the comprehensive market research report and position your team at the forefront of strategic decision-making in offshore decommissioning.

- How big is the Offshore Decommissioning Market?

- What is the Offshore Decommissioning Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?