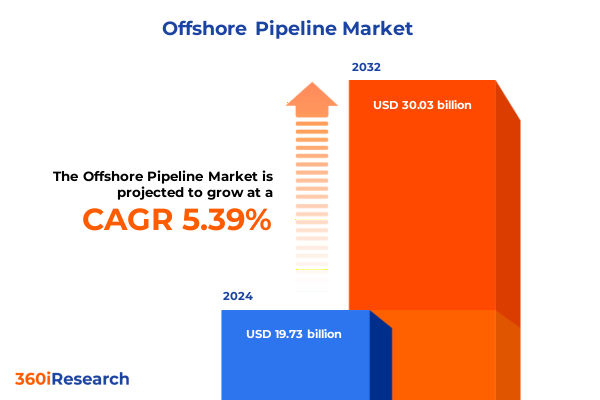

The Offshore Pipeline Market size was estimated at USD 20.79 billion in 2025 and expected to reach USD 21.69 billion in 2026, at a CAGR of 5.38% to reach USD 30.03 billion by 2032.

Navigating the Complex Dynamics of the Offshore Pipeline Market Amid Technological Advancements, Regulatory Pressures, and Sustainability Imperatives

The offshore pipeline industry is undergoing a period of unprecedented complexity and opportunity, driven by converging technological advances, shifting regulatory environments, and evolving energy demand patterns. As deepwater exploration and production move into increasingly remote and challenging environments, the demand for robust pipeline solutions that can withstand extreme pressures, corrosive media, and harsh weather conditions has never been higher. At the same time, project economics are being reshaped by fluctuating commodity prices, regional supply chain constraints, and intensified scrutiny around sustainability and carbon management.

Against this backdrop, stakeholders require a clear understanding of how emerging trends such as digital asset management, advanced materials science, and innovative installation methods are altering the competitive landscape. Moreover, evolving governmental policies-ranging from tightened safety standards to regional content requirements and tariff regimes-are influencing procurement strategies and capital allocation. This introduction frames the broader context within which offshore pipeline operators, EPC contractors, material suppliers, and investors must navigate to achieve both resilience and profitability.

In exploring technological breakthroughs alongside shifting market and policy dynamics, this executive summary provides decision-makers with a concise yet comprehensive overview of the forces shaping the offshore pipeline sector today. It sets the stage for deeper analysis of the transformative trends, segmentation nuances, regional variations, and actionable recommendations that follow.

Uncovering How Energy Transition, Digitalization, and Sustainability Collaborations Are Redefining Offshore Pipeline Development and Lifecycle Management

The offshore pipeline ecosystem is being reinvented by multiple converging forces that extend far beyond traditional project execution models. Leading the charge is the global energy transition, which has galvanized investment in infrastructure capable of transporting biogenic gases, hydrogen blends, and carbon capture and storage streams. Conventional oil transportation pipelines are now coexisting with experimental CO₂ injection conduits equipped with real-time monitoring systems to ensure safety and integrity under new operating parameters.

Simultaneously, digitalization is revolutionizing lifecycle management through asset performance analytics, predictive maintenance platforms, and digital twins. By integrating sensors along pipeline runs and employing machine learning algorithms, operators can anticipate corrosion, stress concentrations, and potential leak scenarios, thereby reducing downtime and mitigating environmental risk. This shift toward data-driven operations not only enhances safety and efficiency but also attracts capital from stakeholders prioritizing ESG outcomes.

Rising emphasis on sustainability has prompted innovation in materials and coatings, such as low-impact thermal insulation systems and concrete weight coatings designed to minimize ecological disturbance during anchoring. Collaborative R&D alliances between EPC firms, specialized coating manufacturers, and research institutions are accelerating the adoption of greener solutions. Taken together, these transformative shifts are redefining project value chains from concept through decommissioning, compelling industry participants to adapt or risk falling behind.

Assessing the Far-Reaching Implications of 2025 United States Tariffs on Steel Imports and Their Ripple Effects Across Offshore Pipeline Procurement and Project Economics

In early 2025, the United States implemented revised tariff measures on steel imports, targeting specific grades of pipe still predominantly sourced from international markets. These measures have elevated landed costs for carbon steel, duplex steel, and stainless steel pipe variants used in offshore applications. As a result, procurement teams must reassess sourcing strategies, balancing the need for premium materials against looming budget pressures.

The immediate effect has been a shift toward regional supply options, with operators in the Gulf of Mexico increasingly turning to domestic mills and exploring alternative alloys to mitigate tariff exposure. While this transition supports local manufacturing, it has introduced new challenges around capacity constraints, lead-time variability, and qualification testing for nontraditional suppliers. In parallel, extended duty drawback processes have prompted firms to optimize import-export volumes to reclaim tariffs, thereby adding administrative overhead.

In the medium term, these tariffs are reshaping competitive dynamics, incentivizing alliances between offshore operators and domestic steel producers. Some engineering and procurement contractors are renegotiating long-term supply contracts to secure preferential pricing, while others are investing in advanced material research to develop composite pipelines that bypass tariff classifications. Ultimately, the cumulative impact of the 2025 tariff regime underscores the growing importance of agile supply chain planning and strategic material innovation in safeguarding project feasibility.

Delving into Product Type, Application, Material Composition, Installation Method, Diameter Range, Coating Technology, and Pressure Band Segmentation to Reveal Offshore Pipeline Market Nuances

A nuanced understanding of market segmentation is essential for illuminating the varied demands and investment priorities across the offshore pipeline landscape. When considering pipeline design by product type, operators are evaluating the trade-off between flexible conduits-favored for dynamic riser applications subject to platform motion-and rigid steel lines that offer unmatched pressure ratings for long-distance subsea transmission. Each choice engenders different engineering requirements, installation approaches, and maintenance protocols.

Application-based segmentation further highlights the distinct performance criteria for gas lift lines, which must maintain minimal thermal loss, versus water injection networks optimized for corrosion control. Similarly, oil transportation pipelines demand high-strength steel and advanced coatings to withstand abrasive crude blends, whereas gas transportation pipelines prioritize leak detection and safety instrumentation. At the material level, carbon steel remains the workhorse for low-pressure services, while duplex and nickel alloys are gaining traction in high-pressure, high-corrosion environments. Stainless steel finds selective use in chemically aggressive streams and in tiebacks to aging platforms.

Method of installation is another critical axis: the choice between J-Lay, pull-tight, reel-lay, or S-Lay dictates vessel selection, operational risk profiles, and schedule implications. Diameter segmentation reveals that pipelines less than 12 inches are common in flowlines, 12 to 24 inches are the mainstay for trunk lines, and greater than 24 inches are deployed for strategic interfield or export services. Coating technologies-from concrete weight coatings for stability to three-layer polyethylene for corrosion protection-must be matched to water depths and soil conditions. Finally, pressure range segmentation differentiates systems operating under low, medium, or high pressure, which in turn drives wall thickness, welding standards, and inspection regimes. Integrating these segmentation insights enables stakeholders to tailor solutions that optimize performance, cost, and safety across the offshore pipeline value chain.

This comprehensive research report categorizes the Offshore Pipeline market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Installation Method

- Diameter

- Coating

- Pressure Range

- Application

Highlighting Distinct Offshore Pipeline Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Regions to Illustrate Diverse Project Dynamics

Regional dynamics shape offshore pipeline strategies in ways that reflect both project maturity and local regulatory environments. In the Americas, the Gulf of Mexico continues to be a cornerstone market driven by decommissioning campaigns, brownfield tie-backs, and the gradual reopening of frontier basins off Brazil’s coast. Operators here are focusing on fatigue-resistant designs and accelerated hook-up schedules to capitalize on rising oil and gas prices while meeting stringent U.S. offshore safety regulations.

Moving eastward into Europe, the Middle East, and Africa, the North Sea remains a high-cost, high-regulation zone where mature fields demand innovative rehabilitation pipelines and CO₂ injection networks to extend field life. Simultaneously, the Middle Eastern offshore landscape is witnessing a surge in megaprojects under national energy diversification drives, while West Africa’s deepwater basins are attracting investments in robust flexible pipe systems engineered for complex subsea topographies.

In the Asia-Pacific region, South China Sea developments are marked by geopolitical sensitivities and joint-venture models, prompting emphasis on modular pipeline assembly and local content compliance. Australia’s offshore sector is characterized by ultra-deepwater projects requiring thermal insulation coatings and specialized J-Lay campaigns to manage long tieback distances. Across all regions, stakeholders must reconcile divergent legislative regimes, labor markets, and environmental standards to ensure seamless global execution.

This comprehensive research report examines key regions that drive the evolution of the Offshore Pipeline market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading EPC Contractors, Specialty Material Suppliers, and Digital Innovators Shaping the Offshore Pipeline Industry Through Strategic Alliances

The competitive landscape in offshore pipelines is shaped by a cadre of global engineering, procurement, and construction firms alongside specialist material suppliers. Major EPC organizations have bolstered their subsea capabilities through strategic M&A, acquiring niche coating providers and digital service platforms to deliver end-to-end solutions. These firms are increasingly positioning themselves as partners that can offer integrated design, installation, and lifecycle services, rather than merely commodity pipe installers.

On the material and fabrication side, steel producers are differentiating through proprietary alloy formulations and lean manufacturing processes that accelerate qualification timelines. Some have also invested in near-net-shape forging technologies to produce large-diameter seamless pipe more efficiently. Equipment suppliers are enhancing value propositions by embedding sensors into spool-piece assemblies and developing autonomous inspection tools that minimize diver intervention.

Emerging players in the flexible pipeline segment are leveraging polymer science breakthroughs to reduce weight and enhance bend performance, enabling faster reel-lay operations. Meanwhile, digital solution providers are capturing market share by offering subscription-based analytics platforms for integrity management and remote monitoring. Together, these various actors are forging a dynamic marketplace where collaborative ecosystems often trump standalone capabilities in driving project success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Offshore Pipeline market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allseas Group S.A.

- Enppi

- Fugro N.V.

- Heerema Marine Contractors

- Larsen & Toubro Limited

- McDermott International, Ltd.

- National Petroleum Construction Company

- Oceaneering International, Inc.

- Penspen Limited

- Petrofac Limited

- Royal Boskalis Westminster N.V.

- Saipem S.p.A.

- Saipem SA

- Subsea 7 S.A.

- TechnipFMC plc

- Van Oord Offshore B.V.

- Worley Limited

Strategic Imperatives for Offshore Pipeline Leaders Including Supply Chain Resilience, Digital Integration, and Tariff Mitigation Protocols

To maintain momentum amid rising costs and technological complexity, industry leaders should prioritize building resilient and diversified supply chains by establishing framework agreements with multiple steel and coating vendors, including domestic and specialty alloy producers. Embracing modular construction techniques and hybrid installation methods can reduce vessel dependency and optimize project schedules, ultimately enhancing operational agility.

Digital transformation must be accelerated by implementing integrated asset management platforms that marry real-time sensor data with predictive analytics. Organizations should invest in workforce upskilling to ensure personnel can leverage these digital tools effectively, thereby reducing unplanned downtime and extending pipeline service life. Collaborative R&D partnerships, particularly around low-carbon material development and carbon capture pipeline systems, will position firms at the forefront of next-generation offshore infrastructure.

In navigating tariff uncertainties, decision-makers should conduct scenario planning exercises to assess the financial and logistical implications of potential policy shifts. Establishing tariff mitigation protocols-including duty drawback optimization and tariff reclassification assessments-will safeguard project viability. Finally, engaging proactively with regulatory bodies to shape pragmatic standards and local content requirements can unlock strategic advantages in key regions.

Explaining the Comprehensive Multi-Stage Research Methodology Incorporating Secondary Data Review, Primary Expert Interviews, and Advanced Analytical Frameworks

This research report was developed through a rigorous multi-stage methodology designed to ensure accuracy, relevance, and actionable insights. The process began with an exhaustive review of secondary data, including public regulatory filings, industry white papers, technical journals, and pipeline codes of practice from leading standards organizations. This established a foundational understanding of market drivers, material specifications, and regulatory frameworks.

Next, we conducted in-depth primary interviews with a cross-section of stakeholders: senior engineers at major EPC firms, procurement executives at operator companies, R&D scientists specializing in subsea materials, and regulatory authorities overseeing offshore pipeline safety. These interviews provided on-the-ground perspectives and validated emerging technology trends.

Our analytical framework then triangulated quantitative data from project databases with qualitative insights from expert interviews, ensuring consistency and identifying any anomalies. Advanced analytical techniques-including SWOT analysis, Porter’s Five Forces, and scenario modeling-were employed to benchmark competitive positioning and forecast potential market trajectories under varying economic and policy scenarios.

Throughout the study, an expert advisory panel of offshore engineers, materials scientists, and market analysts reviewed draft findings to refine assumptions and enhance interpretive rigor. The final report synthesizes these elements into a coherent narrative designed to guide strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Offshore Pipeline market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Offshore Pipeline Market, by Product Type

- Offshore Pipeline Market, by Material

- Offshore Pipeline Market, by Installation Method

- Offshore Pipeline Market, by Diameter

- Offshore Pipeline Market, by Coating

- Offshore Pipeline Market, by Pressure Range

- Offshore Pipeline Market, by Application

- Offshore Pipeline Market, by Region

- Offshore Pipeline Market, by Group

- Offshore Pipeline Market, by Country

- United States Offshore Pipeline Market

- China Offshore Pipeline Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Summarizing Key Trends, Segmentation Insights, and Regional Nuances to Empower Strategic Decision-Making Across the Offshore Pipeline Value Chain

This executive summary has distilled the pivotal trends and dynamics reshaping the offshore pipeline industry. From the accelerating integration of digital twins and advanced materials to the strategic realignments prompted by 2025 U.S. steel tariffs, stakeholders are operating in an environment where agility and innovation are paramount. Detailed segmentation insights underscore the importance of tailoring solutions across product types, applications, materials, installation methods, diameters, coatings, and pressure bands to meet diverse project requirements.

Regional analysis highlights how the Americas, EMEA, and Asia-Pacific regions present unique challenges and opportunities-whether through decommissioning operations in mature basins or ambitious deepwater developments under evolving regulatory regimes. Leading corporations and specialized vendors are forging collaborative ecosystems, blending EPC expertise with material science breakthroughs and digital platforms to deliver integrated lifecycle solutions.

As the industry advances, those who align supply chain resilience, digital transformation, and sustainability imperatives will achieve a competitive edge. The methodology underpinning this research ensures that findings are grounded in empirical evidence and subject-matter expertise, providing a reliable foundation for strategic planning. This conclusion serves as a call to action for decision-makers to leverage these insights in driving operational excellence and long-term growth.

Unlock Exclusive Offshore Pipeline Market Intelligence by Connecting with Associate Director Ketan Rohom for Tailored Strategic Insights

To access the comprehensive offshore pipeline market research report and secure exclusive insights tailored to your strategic objectives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. His expertise in translating complex market data into actionable intelligence will ensure you receive a customized briefing that aligns with your organization’s growth plans. Engage with Ketan to discuss bespoke licensing options, enterprise-wide access, and add-on consulting services that can sharpen your competitive positioning. Let this report empower your decision-making, mitigate project risks, and uncover untapped opportunities within the global offshore pipeline sector.

- How big is the Offshore Pipeline Market?

- What is the Offshore Pipeline Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?