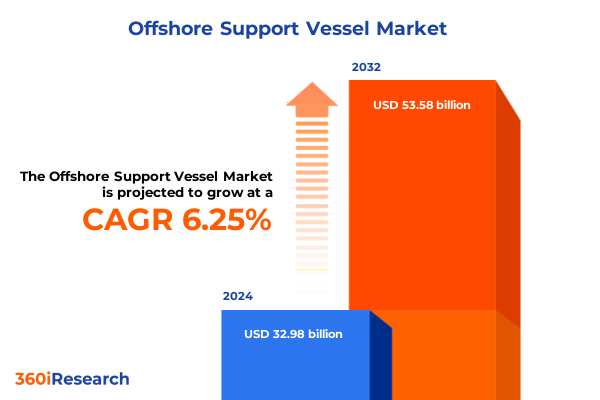

The Offshore Support Vessel Market size was estimated at USD 34.74 billion in 2025 and expected to reach USD 36.72 billion in 2026, at a CAGR of 6.38% to reach USD 53.58 billion by 2032.

Setting the Stage for the Offshore Support Vessel Sector’s Critical Role in Energizing Global Maritime Operations and Infrastructure Growth

The offshore support vessel segment plays a pivotal role in underpinning the logistics, maintenance, and operations that drive global maritime industries, particularly in energy and defense. As capital-intensive enterprises navigate an evolving energy transition, these specialized vessels have become indispensable facilitators of both hydrocarbon and renewable energy projects. Introducing the landscape and purpose of this report, this executive summary encapsulates the key market influences that shape fleet utilization, vessel design advances, and end-user requirements across diverse maritime missions.

By examining the market’s current contours, this section sets the foundation for understanding how macroeconomic shifts, regulatory frameworks, and technological breakthroughs are converging to redefine vessel deployment strategies. From platform supply and anchor handling tug operations to dive support and seismic survey missions, the offshore support vessel category emerges as a dynamic enabler of offshore exploration, construction, and security operations. This comprehensive introduction underscores the strategic importance of fleet adaptability, operational efficiency, and environmental compliance as the sector pursues resilient growth trajectories.

Unveiling the Technological and Environmental Revolution Redefining Offshore Support Vessel Operations Worldwide

In recent years, the offshore support vessel domain has experienced a paradigm shift driven by digital transformation, decarbonization imperatives, and an unwavering focus on operational resilience. Industry leaders are rapidly integrating advanced analytics, remote monitoring systems, and digital twins to optimize vessel uptime, reduce maintenance costs, and enhance safety protocols. Alongside these digital initiatives, propulsion innovations such as hybrid-electric drives and dual-fuel configurations are gaining traction, offering operators pathways to comply with stringent emissions standards while containing lifecycle expenditures.

Furthermore, the ascent of autonomous and remotely operated systems is recalibrating traditional crewing paradigms, enabling extended mission endurance and real-time decision-making from onshore control centers. Coupled with an increased emphasis on modular design, these transformative technologies are amplifying fleet versatility, permitting swift reconfiguration between roles such as platform supply, dive support, and emergency response. This section illuminates how these converging forces are reshaping cost structures, contracting processes, and competitive positioning across the global offshore support vessel landscape.

Assessing How 2025 U.S. Tariff Policies Are Reshaping Cost Structures and Capacity Planning in the Offshore Support Vessel Market

The introduction of new United States tariffs in early 2025 has generated significant ripple effects throughout the offshore support vessel ecosystem. Imposed on key imported components and certain foreign-flagged vessel charters, these measures have elevated procurement costs and prompted operators to reassess supply chain strategies. As steel, specialized equipment, and spare parts face higher import levies, shipowners and charterers are increasingly exploring domestic fabrication options, driving renewed interest in local yards and encouraging onshore manufacturing collaborations.

Moreover, the tariff landscape has reshaped strategic fleet planning, with several operators postponing foreign vessel charters in favor of existing assets or newly constructed domestically compliant vessels. The result has been a tightening of available vessel capacity offshore, compelling service providers to optimize scheduling and bolster asset utilization rates. In parallel, the looming prospect of further trade measures has heightened the sector’s emphasis on supply chain transparency and risk mitigation, underscoring the necessity for multi-sourcing strategies and strengthened partnerships with U.S.-based fabricators and equipment suppliers.

Discovering How Vessel Type, Fuel Selection, Water Depth, and Diverse End-User Requirements Drive Offshore Support Vessel Design and Utilization

A nuanced examination of vessel type reveals that platform supply vessels remain the workhorses of routine logistics and material transfer, while anchor handling tug and supply vessels assume critical roles in towing, mooring steel anchors, and supporting exploration campaigns. Dive support vessels are increasingly sought after for subsea inspection and maintenance tasks, particularly within complex offshore wind farm developments, whereas seismic survey ships are engaging in high-resolution subsurface data acquisition to underpin both hydrocarbon and renewable energy site assessments.

When viewed through the lens of fuel type, the market demonstrates a clear bifurcation between traditional fuel oil propulsion and the emerging adoption of liquified natural gas, the latter offering operators discernible emissions reductions. Meanwhile, the category segmentation into deepwater and shallow water operations highlights distinct technical requirements: vessels operating in deepwater theaters demand robust dynamic positioning systems and extended range capabilities, in contrast to shallow water units that prioritize maneuverability and cost-effective operation for nearshore tasks.

End-user segmentation further delineates demand dynamics, as defense applications-spanning maritime security operations and naval support-compete with oil and gas enterprises engaged in exploration and production activities, as well as renewable energy developers advancing offshore wind farms and wave and tidal projects. This layered end-user perspective underscores that vessel specifications, crewing protocols, and contractual structures must be precisely aligned with the unique demands of each operational milieu.

This comprehensive research report categorizes the Offshore Support Vessel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vessel Type

- Fuel Type

- Category

- End User

Gaining a Pan-Regional Perspective on How Market Forces and Policy Frameworks Shape Offshore Support Vessel Demand from the Americas to Asia-Pacific

In the Americas, the offshore support vessel sector benefits from established oil and gas fields in the Gulf of Mexico and a burgeoning offshore wind pipeline along the U.S. East Coast. The region’s strategic focus on domestic content has been amplified by tariff measures, incentivizing operators to leverage local construction and maintenance capabilities. Additionally, growing defense modernization programs in the Western Hemisphere are fuelling demand for multi-mission vessels capable of rapid deployment and coastal security patrols, further broadening the service landscape.

Across Europe, the Middle East, and Africa, the market is characterized by an intricate balance of legacy hydrocarbon operations in the North Sea, robust offshore wind installations spanning the U.K. and continental Europe, and emerging exploration initiatives off West Africa and the Eastern Mediterranean. Regulatory frameworks emphasizing carbon neutrality and green financing have accelerated the uptake of dual-fuel and fully electric support vessels. Concurrently, geopolitical dynamics in the Middle East underscore the need for versatile assets that can pivot between commercial support and naval supply duties in response to security contingencies.

The Asia-Pacific corridor exhibits a dual trajectory, with Southeast Asian production hubs and Australian liquefied natural gas terminals demanding conventional offshore support services, while China, Japan, and South Korea spearhead offshore wind development in deeper waters. These markets are rapidly investing in specialized heavy-lift construction vessels and advanced survey ships, reflecting an integrated strategy that aligns energy transition goals with maritime infrastructure expansion. Support vessel operators in this region are forging strategic alliances with local shipyards to ensure compliance with domestic content rules and capture government-backed project opportunities.

This comprehensive research report examines key regions that drive the evolution of the Offshore Support Vessel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Fleet Operators Are Leveraging Green Retrofits, Digital Integration, and Strategic Alliances to Strengthen Market Position

Leading global operators have diversified fleets to encompass hybrid propulsion technologies, leveraging retrofitting programs to convert existing vessels to dual-fuel or LNG systems and thus stay ahead of emissions mandates. Companies with strong balance sheets are investing in digital platforms that integrate vessel sensors, operational dashboards, and predictive analytics, enabling real-time performance optimization and remote troubleshooting. At the same time, specialist firms are forging consortiums with offshore wind developers to co-design purpose-built dive support and construction vessels tailored to turbine installation and maintenance schedules.

In the defense segment, market participants are securing long-term charters with naval authorities, offering vessel availability guarantees supported by rigorous maintenance frameworks. Meanwhile, service providers targeting oil and gas clients are extending offerings to include integrated survey-to-construction packages, providing seamless project continuity from geophysical data collection through platform installation. Across the board, strategic M&A activity is intensifying as companies seek to augment their geographic reach, pool technical expertise, and preserve economies of scale in an increasingly capital-intensive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Offshore Support Vessel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Møller - Mærsk A/S

- Bourbon Maritime

- BUREAU VERITAS MARINE & OFFSHORE

- CBO Holding S.A.

- Damen Shipyards Group

- DNV GL

- DOF ASA

- Edison Chouest Offshore Companies

- GAC Group

- GC Rieber AS

- Glomar Holding B.V.

- Harvey Gulf International Marine, LLC

- Havila Shipping ASA

- Kawasaki Kisen Kaisha, Ltd.

- MMA Offshore Limited

- Nam Cheong Limited

- Ostenjso Rederi

- PACC Offshore Services Holdings Ltd.

- SEACOR Marine Holdings Inc.

- Seaspan Corporation

- Siem Offshore Inc.

- Solstad Offshore ASA

- The VM Group

- Tidewater Inc.

- Ulstein Group

- Vroon Group B.V.

- Wärtsilä Corporation

Outlining Strategic Pathways for Fleet Modernization, Digital Transformation, and Collaborative Project Execution in a Volatile Trade Environment

Industry leaders should prioritize accelerating decarbonization initiatives by investing in LNG or hybrid-electric retrofits, leveraging available environmental grants and financing instruments. By proactively aligning vessel specifications with rapidly evolving emissions regulations, operators can secure blue-chip charters from energy majors and government agencies. In parallel, adopting integrated digital ecosystems that converge remote monitoring, predictive maintenance, and automated reporting will unlock operational efficiencies and reduce unplanned downtime.

Furthermore, forging collaborative partnerships with offshore wind developers and shipyards can yield co-created vessel designs that minimize project risks and optimize installation timelines. This approach not only enhances value propositions for renewable energy clients but also diversifies service portfolios. Finally, companies should implement robust supply chain risk management protocols in light of recent tariff volatility, ensuring multi-sourcing strategies and strategic buffer inventories to maintain uninterrupted operations.

Detailing a Rigorous Mixed-Method Research Approach Integrating Primary Interviews, Secondary Analysis, and Scenario-Based Validation

This research integrates extensive primary engagements with vessel operators, shipbuilders, and charterers, complemented by expert interviews with industry analysts and maritime regulators. A structured secondary review of technical publications, policy briefs, and industry association reports was undertaken to triangulate key market drivers and technology adoption rates. Data validation was reinforced through cross-referencing vessel registries, certification bodies, and operator performance disclosures.

Analytical rigor was upheld by employing scenario analysis to stress-test tariff impacts and technology roll-out timelines. Geographic segmentation was informed by regional project pipelines and regulatory frameworks, while end-user demand profiles were constructed using historical activity logs and contractual award announcements. This methodology ensures a robust, transparent foundation for the insights presented, facilitating confident decision-making for stakeholders across the offshore support vessel value chain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Offshore Support Vessel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Offshore Support Vessel Market, by Vessel Type

- Offshore Support Vessel Market, by Fuel Type

- Offshore Support Vessel Market, by Category

- Offshore Support Vessel Market, by End User

- Offshore Support Vessel Market, by Region

- Offshore Support Vessel Market, by Group

- Offshore Support Vessel Market, by Country

- United States Offshore Support Vessel Market

- China Offshore Support Vessel Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings to Chart a Proactive Course for Fleet Modernization and Strategic Risk Mitigation

The offshore support vessel sector is poised at a strategic inflection point, driven by accelerating energy transition imperatives, digital transformation, and evolving trade policies. Operators that successfully navigate this complex landscape will do so by embracing green propulsion technologies, harnessing digital tools for operational excellence, and establishing resilient supply chains. Concurrently, a clear alignment with end-user objectives-whether in defense, oil and gas, or renewable energy-will enable tailored fleet solutions that deliver superior project outcomes.

In conclusion, this executive summary underscores that sustained competitive advantage will hinge on proactive fleet modernization, collaborative partnerships, and agile risk management. As market participants contend with tariff-induced cost pressures and regulatory shifts, a holistic strategy that integrates technical innovation with strategic alliances will be essential. The insights outlined herein provide a comprehensive blueprint for stakeholders seeking to capitalize on emerging opportunities and mitigate the complexities inherent in the global offshore support vessel market.

Engage with Expert Sales Leadership to Acquire In-Depth Offshore Support Vessel Market Intelligence for Strategic Decision-Making

To explore tailored insights and secure a comprehensive understanding of the offshore support vessel market dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Engage in a strategic discussion that will illuminate how your organization can leverage this analysis to gain a competitive edge. Contact him today to purchase the full market research report and unlock actionable intelligence vital for guiding your next business decisions.

- How big is the Offshore Support Vessel Market?

- What is the Offshore Support Vessel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?