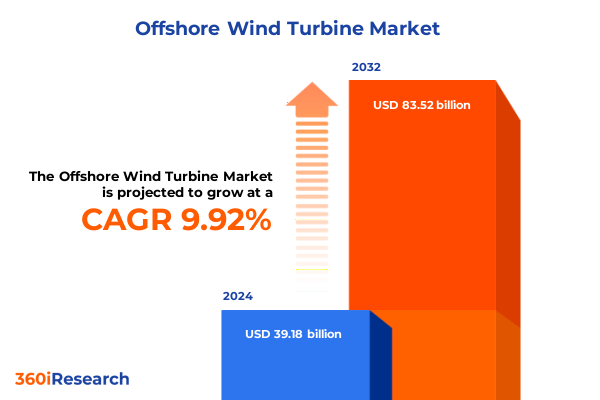

The Offshore Wind Turbine Market size was estimated at USD 43.15 billion in 2025 and expected to reach USD 46.78 billion in 2026, at a CAGR of 9.89% to reach USD 83.52 billion by 2032.

Setting the Stage for Offshore Wind Innovation and Strategic Growth Amidst Evolving Renewable Energy Priorities and Nationwide Decarbonization Goals

Offshore wind energy has emerged as a cornerstone of global decarbonization efforts, offering substantial potential to meet renewable energy targets while strengthening energy security. Over the past decade, technological advancements have unlocked larger turbine capacities and more efficient foundations, enabling projects in deeper waters and harsher marine environments. As governments and corporations commit to aggressive net-zero goals, investment in offshore wind is accelerating, fueled by supportive policy frameworks, favorable financing, and growing stakeholder demand for sustainable energy solutions. This executive summary synthesizes critical insights into the evolving offshore wind landscape, focusing on transformative shifts, regulatory impacts, segmentation analysis, regional dynamics, and leading market participants. Furthermore, qualitative findings drawn from expert interviews and industry publications underscore the nuanced challenges and opportunities shaping project development and supply chain optimization. By articulating key segmentation trends across turbine capacity, foundation design, component supply, and water depth considerations, readers will gain a comprehensive understanding of the variables influencing project economics and technical feasibility. In addition to addressing current market drivers, this summary anticipates how emerging technologies such as digital twin simulations and advanced materials may reshape cost dynamics and operational performance in upcoming years. Emphasis is placed on the interplay between regulatory frameworks and supply chain resilience as critical determinants of project viability in a rapidly evolving competitive environment.

Navigating Transformative Shifts Shaping Offshore Wind Projects through CuttingEdge Technological Advances Supply Chain Innovations and Emerging Partnerships

Technological innovation has become a defining force in offshore wind, propelling the industry into a new era marked by greater scale, efficiency, and adaptability. Turbine designs exceeding six megawatts are increasingly the standard, leveraging advanced blade aerodynamics and high-capacity generators to maximize energy capture while minimizing levelized cost of energy. Simultaneously, digital solutions such as predictive maintenance platforms and real-time monitoring enable operators to optimize performance and extend asset lifecycles. Furthermore, these technological leaps are complemented by breakthroughs in foundation engineering, with floating systems like semi-submersible and tension leg platforms opening access to deepwater sites previously deemed uneconomical. Such flexibility promises to unlock vast resource potential in regions where seabed conditions challenge traditional monopile and jacket designs.

In addition, evolving supply chain configurations are reshaping procurement and logistics strategies. Modular manufacturing hubs located proximal to port infrastructure streamline turbine assembly, reducing onshore transportation complexity and mitigating weather-related delays. Collaborative ventures between turbine OEMs, maritime contractors, and specialized fabricators are forming integrated value chains that emphasize efficiency and risk sharing. Moreover, public and private financing models are adapting to these shifts, with green bonds and merchant power purchase agreements providing novel funding pathways. As a result, project timelines are accelerating, and competitive dynamics are intensifying. Ultimately, these transformative shifts converge to create a more dynamic industry landscape characterized by innovation-driven growth and resilient operational frameworks.

Evaluating the Cumulative Impact of 2025 United States Tariff Policies on Offshore Wind Supply Chains Strategic Investment Dynamics and Cost Structures

United States tariff policies enacted in early 2025 have introduced significant considerations for offshore wind stakeholders, influencing sourcing decisions and cost structures across the value chain. Higher import duties on key components, notably blades, nacelles, and specialized steels, have prompted developers and suppliers to reassess procurement strategies. In response, many operators are exploring nearshoring options and domestic manufacturing partnerships to mitigate tariff exposure and maintain competitiveness. This shift is fostering investment in local fabrication facilities and enhancing supply chain resilience against geopolitical fluctuations.

Moreover, the cumulative impact extends beyond immediate cost implications. Tariff-induced price adjustments have accelerated efforts among component manufacturers to optimize designs, adopt alternative material technologies, and streamline production processes. Such innovation-driven efficiencies are mitigating upward pressure on capital expenditures. Transitioning to a more domestically oriented supply chain also carries secondary benefits, including reduced transportation emissions and stronger alignment with federal content requirements under prevailing energy legislation. Nevertheless, developers must navigate potential capacity constraints as U.S. fabrication lines scale up to meet growing demand.

Additionally, financial institutions and investors are recalibrating risk assessments, factoring in tariff volatility and policy uncertainty. Scenario planning exercises are increasingly integral to project due diligence, with contingency measures such as price hedging and contract structures designed to accommodate fluctuating input costs. Consequently, the industry landscape is witnessing a gradual realignment, where long-term competitiveness hinges on the ability to balance cost efficiency with regulatory compliance and sustainability goals. As the tariff environment evolves, continuous dialogue between policymakers and industry leaders will be vital to ensure that the United States remains an attractive market for offshore wind investment.

Unveiling Key Market Segmentation Insights to Illustrate Offshore Wind Dynamics across Capacity Ranges Foundation Types Component Categories and Water Depth

Within the context of offshore wind deployment, turbine capacity emerges as a foundational segmentation dimension, spanning smaller installations below three megawatts, midscale assets in the three-to-six-megawatt bracket, and increasingly, large-scale turbines with capacities above six megawatts. Machines exceeding six megawatts unlock superior energy capture per unit and improved economies of scale, rendering them particularly attractive for high-demand projects in deepwater environments albeit with heightened engineering complexities and specialized logistics. In contrast, the three-to-six-megawatt class strikes a balance between manageable installation requirements and robust performance, often favored in nearshore sites. Meanwhile, units under three megawatts maintain relevance in nascent markets or constrained grid scenarios, where deployment agility and modularity are paramount.

Turning to foundation type, market activity encompasses traditional monopiles designed for shallow seabeds alongside gravity-base and jacket solutions that address transitional to moderate depths. Gravity-base foundations leverage mass and ballast to secure structures on relatively stable seabeds, while jacket frameworks distribute loads through multi-legged steel lattices suited to variable conditions. Additionally, floating platforms-exemplified by semi-submersible, spar buoy, and tension leg designs-are revolutionizing access to deepwater resource zones by decoupling structure stability from seabed constraints.

Component segmentation further clarifies supply chain dynamics, with blades, nacelles, and towers each representing critical cost and performance drivers. Blade innovations focus on extending aerodynamic profiles and integrating advanced composite materials, while nacelle development emphasizes power conversion efficiency and modular assembly. Tower design evolution prioritizes increased hub heights to harness stronger wind velocities.

Lastly, water depth segmentation differentiates sites into shallow, transitional, and deepwater categories. Shallow zones benefit from simplified installation and lower logistical complexity, transitional depths demand hybrid foundation engineering, and deepwater locations predominantly rely on floating concepts and robust mooring systems to ensure structural integrity and operational resilience.

This comprehensive research report categorizes the Offshore Wind Turbine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Turbine Capacity

- Foundation Type

- Component

- Water Depth

Deciphering Regional Offshore Wind Trends to Highlight Market Opportunities Challenges and Policy Drivers in the Americas EMEA and AsiaPacific Energy Landscapes

Regional dynamics in the Americas are shaped by a growing alignment of federal and state policies with ambitious decarbonization agendas, catalyzing offshore wind project pipelines along both the Atlantic coast and Gulf of Mexico. In the United States, intermediary leasing rounds and targeted grants have stimulated early-stage development, while supply chain localization efforts are strengthening domestic manufacturing capacity. Latin American interest is rising, with exploratory studies and pilot installations underway in Brazil and Chile, driven by coastal wind resource potential and supportive regulatory frameworks. This regional momentum is underpinned by strategic port infrastructure investments that streamline assembly and logistics, reinforcing North and South America as burgeoning offshore wind hubs.

In Europe, the Middle East, and Africa landscape, longstanding commitment to offshore wind is reflected in mature markets within the North Sea and Baltic regions. Policy stability and long-term offtake agreements have fostered record-setting auction results and rapid commissioning of utility-scale farms. Meanwhile, Mediterranean countries are evaluating transitional opportunities, leveraging floating pilot projects to test platform designs suited to deeper basins. In select Middle Eastern markets, diversification strategies are prompting feasibility assessments for offshore wind to complement existing solar portfolios. Across Africa, nascent interest is concentrated on hybrid renewable initiatives in coastal zones, with international partnerships facilitating knowledge transfer and financing.

The AsiaPacific region is experiencing dynamic growth, spearheaded by major initiatives in China, Taiwan, South Korea, and Japan. Government-led targets and streamlined permitting are accelerating capacity additions, while local content regulations are fostering robust manufacturing ecosystems. Southeast Asian nations are conducting resource mapping to inform competitive bids, and Australia’s supportive market mechanisms are bridging the gap between pioneering pilot farms and commercial-scale arrays. Collectively, these varied regional trajectories underscore the imperative for stakeholders to tailor strategies according to local policy drivers, infrastructure maturity, and resource characteristics.

This comprehensive research report examines key regions that drive the evolution of the Offshore Wind Turbine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Leadership and Competitive Dynamics among Leading Offshore Wind Companies Driving Innovation Collaborative Ventures and Global Expansion

Leading industry participants have intensified collaborative efforts to secure competitive advantages across offshore wind markets. Companies are differentiating through next-generation turbine platforms designed to deliver greater output and reduced installation costs. For instance, manufacturers have prioritized R&D investment in blade technologies featuring longer spans and adaptive pitch controls to optimize performance in varied wind regimes. Meanwhile, strategic alliances between turbine OEMs and maritime contractors are forming end-to-end service offerings, encompassing project design, logistics planning, and lifecycle maintenance.

Furthermore, energy developers are forging joint ventures to diversify project portfolios and streamline capital allocation. Partnerships that integrate utility-scale operators with infrastructure specialists are facilitating access to innovative financing structures and risk-sharing mechanisms. Technology suppliers are also enhancing modular solution suites, offering integrated nacelle-tower-blade packages that accelerate deployment timelines. In parallel, digital solution providers are embedding advanced condition monitoring systems and predictive analytics into the service mix, driving operational excellence and cost predictability.

In addition, competitive dynamics are evolving as new entrants and utilities transition from onshore to offshore ventures, leveraging existing brand recognition and stakeholder networks to expedite market entry. This competitive reshaping has prompted established participants to refine their value propositions, emphasizing sustainability credentials and local economic impact to differentiate in auction and permitting processes. As a result, the ecosystem is characterized by a fluid interplay between incumbent strengths and emergent models, highlighting the importance of strategic agility and continual innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Offshore Wind Turbine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Bob's Red Mill Natural Foods

- Borges Agricultural & Industrial Nuts

- Cargill Incorporated

- Diamond Foods LLC

- Hain Celestial Group Inc

- Hormel Foods Corporation

- John B Sanfilippo & Son Inc

- Ludlow Nut Company Ltd

- Mariani Nut Company

- Nestlé S.A.

- NOW Health Group Inc

- Nuts.com

- Olam International Limited

- PepsiCo Inc

- Royal Nut Company

- Select Harvests Limited

- Sun Organic Farm

- The J.M. Smucker Company

- The Kraft Heinz Company

- The Wonderful Company LLC

- Tierra Farm

- Treehouse Private Brands Inc

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Offshore Wind Opportunities through Strategic Partnerships and Sustainable Practices

To capitalize on the expanding offshore wind landscape, industry leaders should prioritize strategic alignment between project development and supply chain resilience. It is essential to cultivate relationships with domestic fabricators and component suppliers to navigate evolving tariff frameworks and ensure timely delivery of critical assets. Moreover, engaging early with regulatory authorities and community stakeholders can streamline permitting processes and foster social license, reducing potential project delays.

In addition, executives should integrate digital technologies throughout the lifecycle of offshore wind assets. By adopting predictive maintenance platforms and real-time performance analytics, operators can minimize downtime, extend equipment lifespans, and enhance return on investment. Collaboration with technology partners to pilot digital twin simulations can further optimize design parameters and preemptively address installation challenges.

Furthermore, diversifying foundation strategies by blending fixed and floating configurations enables entry into a wider array of seabed conditions, underscoring the need for flexible engineering solutions. Firms must also explore cross-sector partnerships, aligning with ports, logistics providers, and offshore service vessel operators to coordinate complex marine operations efficiently.

Finally, embedding sustainability and environmental stewardship into strategic decision-making is vital. Tracking carbon intensity across the value chain and committing to circular economy principles in component fabrication will reinforce project credibility and align with evolving stakeholder expectations. By adopting these measures, industry leaders can strengthen competitive positioning and accelerate the transition toward a resilient, cost-effective offshore wind portfolio.

Outlining a Robust Research Methodology Integrating Multisource Data Evaluation Qualitative Expert Interviews and Rigorous Analytical Frameworks

Drawing on a comprehensive research framework, this study integrates quantitative data analysis with qualitative expert insights to deliver robust market intelligence. Primary research involved structured interviews with senior executives, project developers, technical consultants, and policy advisors to capture nuanced perspectives on emerging trends, tariff implications, and operational challenges. In parallel, secondary sources including academic journals, industry white papers, regulatory filings, and specialized technical publications were systematically reviewed to corroborate and enrich primary findings.

The analytical approach encompassed thematic coding of expert responses to identify recurring patterns in technology adoption, supply chain adjustments, and regional policy impacts. Data triangulation was employed to cross-validate insights, ensuring consistency between interview feedback and documented industry developments. Additionally, segmentation analysis was conducted to examine variables such as turbine capacity, foundation type, component categorization, and water depth profiles, offering a structured lens through which to evaluate project feasibility and investment drivers.

Rigorous quality assurance measures, including peer reviews and iterative validation sessions with subject matter experts, were implemented to refine key findings and eliminate potential biases. This methodological rigour underpins the strategic recommendations provided herein and ensures that the conclusions reflect a balanced interpretation of the most reliable and up-to-date information. Transparency in research processes enables stakeholders to assess the relevance and applicability of the insights to their unique operational contexts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Offshore Wind Turbine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Offshore Wind Turbine Market, by Turbine Capacity

- Offshore Wind Turbine Market, by Foundation Type

- Offshore Wind Turbine Market, by Component

- Offshore Wind Turbine Market, by Water Depth

- Offshore Wind Turbine Market, by Region

- Offshore Wind Turbine Market, by Group

- Offshore Wind Turbine Market, by Country

- United States Offshore Wind Turbine Market

- China Offshore Wind Turbine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Summarizing Critical Conclusions on Offshore Wind Industry Trajectories Sustainability Imperatives and Strategic Priorities to Guide Future Investments

As global imperatives for decarbonization intensify, offshore wind stands out as a vital contributor to sustainable energy portfolios. The industry is in the midst of transformative evolution, characterized by technological breakthroughs, strategic supply chain realignments, and regionally tailored growth trajectories. While the introduction of United States tariffs in 2025 has reshaped component sourcing and cost considerations, it has also galvanized domestic manufacturing and innovation efforts, ultimately fostering a more resilient ecosystem. Segmentation analysis across turbine capacity, foundation type, component categories, and water depth underscores the multifaceted nature of project planning and execution, highlighting the importance of customized solutions.

Regional insights reveal a mosaic of opportunities, from the acceleration of nascent markets in the Americas to the entrenched offshore clusters of Europe and the dynamic expansion unfolding across the AsiaPacific corridor. Competitive dynamics among leading companies emphasize the strategic interplay between technological differentiation, collaborative ventures, and sustainable practices. To navigate this complex landscape, industry leaders must embrace agility, invest in digital and engineering innovations, and engage proactively with policy and community stakeholders.

In summary, the offshore wind sector is poised for robust growth, driven by converging factors that favor cleaner energy adoption. Stakeholders equipped with comprehensive market intelligence, methodological transparency, and action-oriented strategies will be positioned to lead in delivering cost-effective, sustainable offshore wind solutions that align with global decarbonization goals.

Empowering DecisionMakers with Trusted Insights and Direct Access to Advanced Offshore Wind Research via Ketan Rohom’s Specialized Support

To further strengthen your strategic planning and unlock a deeper understanding of these critical offshore wind trends, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing, for personalized insights and direct access to the full market research report. Ketan brings extensive experience engaging with energy sector leaders and can tailor discussions around precise areas of interest, whether it be tariff impact analysis, segmentation deep dives, regional benchmarking, or bespoke competitive intelligence. Reach out to Ketan to request a comprehensive briefing, explore subscription options, or arrange a detailed demonstration of interactive data dashboards. Empower your organization with the actionable intelligence required to drive efficient project development, enhance supply chain resilience, and capitalize on the transformative opportunities within the offshore wind industry today.

- How big is the Offshore Wind Turbine Market?

- What is the Offshore Wind Turbine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?