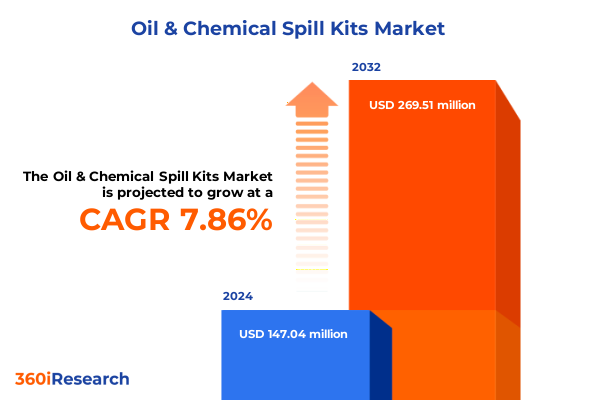

The Oil & Chemical Spill Kits Market size was estimated at USD 158.42 million in 2025 and expected to reach USD 169.21 million in 2026, at a CAGR of 7.88% to reach USD 269.51 million by 2032.

Understanding the Critical Importance of Oil and Chemical Spill Response Solutions for Ensuring Environmental Protection and Operational Continuity

Environmental stewardship and operational resilience are more crucial than ever in industries handling hazardous fluids. Uncontrolled spills of oil and chemicals can result in catastrophic environmental damage, costly cleanups, lost productivity, and severe regulatory penalties. As environmental regulations tighten and stakeholder expectations shift toward zero-tolerance for contamination, companies must adopt proactive measures to mitigate risks. Spill kits designed specifically for oil and chemical incidents have evolved from simple collections of absorbents to integrated solutions that enable rapid, compliant, and cost-effective response.

This executive summary provides an overview of the strategic drivers shaping the spill kit landscape. It highlights the market’s transformative shifts, the impact of evolving trade policies, nuanced segmentation insights, and the regional outlook. Through this lens, decision-makers and industry leaders can understand the key considerations for selecting the right spill response solutions, optimizing supply chains, and enhancing corporate environmental and safety performance. By synthesizing complex industry data into clear takeaways, this introduction sets the stage for a deeper exploration of the factors redefining spill kit markets and guiding best-in-class response strategies.

Exploring the Transformative Shifts Impacting Oil and Chemical Spill Kit Industry Dynamics Driven by Sustainability, Technology, and Evolving Regulatory Standards

In recent years, the spill kit industry has undergone a paradigm shift driven by three converging forces: sustainability mandates, rapid technological innovation, and increasingly stringent regulatory frameworks. Sustainability has become a cornerstone for procurement decisions, as end users seek bio-based and recyclable materials that minimize ecological footprints while maintaining high absorbency rates. Advances in materials science have yielded next-generation polymers and natural fiber blends that deliver superior performance without compromising biodegradability.

Simultaneously, digitalization is reshaping how spill response is managed across complex operations. Smart inventory management systems now enable real-time monitoring of kit levels, expiration dates, and deployment readiness, ensuring that response teams can act swiftly when incidents occur. Integration with IoT-enabled sensors and mobile applications facilitates remote oversight and data-driven decision-making, reducing response times and mitigating environmental impact.

Regulatory bodies have responded to high-profile spill incidents by tightening requirements for spill preparedness and reporting. New mandates emphasize preventive planning and transparent documentation, compelling companies to invest in comprehensive spill kits that align with compliance thresholds. As a result, organizations are seeking partners who can deliver turnkey spill readiness solutions, combining product innovation with training, auditing, and digital support. Together, these transformative shifts are redefining competitive dynamics and raising the bar for effective spill management.

Analyzing the Cumulative Impact of 2025 United States Tariff Measures on the Oil and Chemical Spill Kit Supply Chain, Costs, and Manufacturing Ecosystem

Trade tensions and shifting tariff policies in 2025 have introduced new complexities for manufacturers and distributors of spill containment products. United States tariffs on key raw materials-particularly polymers and specialty chemicals-have raised input costs, prompting supply chain reconfigurations. Many producers are exploring regional sourcing strategies to mitigate duty impacts, while others are passing incremental expenses onto end users, testing pricing elasticity.

These measures have also influenced domestic manufacturing decisions. Some firms are accelerating investments in local production facilities to capitalize on tariff exemptions and reduce logistic vulnerabilities. This reshoring trend provides greater control over quality and lead times, but requires careful capital planning and workforce development. For distributors, the tariffs have forced renegotiation of sourcing contracts and the exploration of alternative material blends that comply with regulatory thresholds while maintaining performance standards.

Furthermore, the cumulative effect of tariffs has underscored the importance of agile supply chain management. Companies that have implemented advanced planning systems and diversified their supplier base are better positioned to absorb cost fluctuations and maintain service levels. Ultimately, the 2025 tariff landscape has reinforced the necessity for integrated procurement strategies and dynamic risk mitigation plans, ensuring that spill preparedness remains uncompromised despite external economic pressures.

Uncovering Essential Segmentation Insights across Configuration End‐User Industry Material Sales Channel Spill Type and Kit Size Dimensions

A nuanced understanding of market segmentation reveals the diverse requirements and purchasing behaviors across different dimensions of spill response solutions. Configuration options range from absorbent pads designed for rapid deployment on flat surfaces to specialized booms, which include floating and inflatable variants engineered for containing surface spills on water. For confined spaces and drains, drain covers provide an immediate barrier, while loose absorbents and absorbent pillows offer flexibility for irregular spill areas. Rolls deliver high-volume coverage in large spill scenarios, ensuring continuous absorbent coverage over extended timeframes.

End user industry segmentation highlights distinct demand patterns. Automotive and food and beverage facilities prioritize kits with quick single-use deployment and simplified disposal protocols. In contrast, chemical manufacturing and pharmaceuticals require spill kits that meet stringent chemical compatibility standards and often integrate neutralizers for acids or bases. The oil and gas sector, spanning upstream exploration, midstream transport, and downstream refining, demands modular, rugged solutions capable of withstanding harsh environments and extreme weather. Marine and utility operators favor corrosion-resistant materials and portable kits that can be stowed in vessels or remote substations.

Material differentiation further refines purchaser preferences. Inorganic materials such as clay and silica are prized for their high absorbency of hydrocarbon-based fluids, while organic materials like biodegradable polymers and natural fibers appeal to environmentally conscious buyers seeking renewable solutions. Polypropylene options, including melt blown and needle punched variants, offer a balance of cost-effectiveness and chemical resistance, making them ubiquitous across diverse spill scenarios.

Sales channel dynamics shape distribution and customer engagement strategies. Direct sales efforts cater to large industrial accounts requiring customized spill kit configurations and long-term service agreements. Distributors enable broad geographic coverage and local inventory stocking, while online retailers meet the needs of smaller organizations and emergency responders seeking rapid replenishment with transparent pricing. Finally, spill type and kit size considerations-chemical versus oil applications and large, medium, or small kit footprints-determine packaging, labeling, and instructional content to ensure clarity and compliance during emergency response.

This comprehensive research report categorizes the Oil & Chemical Spill Kits market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Configuration

- Material

- Spill Type

- Kit Size

- End User Industry

- Sales Channel

Illuminating Regional Disparities and Growth Drivers for Oil and Chemical Spill Kits across Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics reflect the interplay of regulatory environments, infrastructure maturity, and environmental risk profiles across global markets. In the Americas, government incentives and stringent EPA regulations have driven widespread adoption of advanced spill kits, particularly within the oil and gas and manufacturing sectors. Infrastructure investments in remote production regions have created demand for ruggedized solutions capable of operating in extreme climates.

Europe, the Middle East, and Africa present a tapestry of regulatory frameworks. The European Union’s REACH and Seveso directives mandate rigorous spill preparedness, fostering high demand for specialized kits that integrate chemical neutralizers and comprehensive documentation. In the Middle East, rapid expansion of petrochemical complexes has spurred growth in both local manufacturing and imported spill response solutions, while in Africa, infrastructure constraints and emerging environmental regulations are catalyzing initiatives to improve spill management capacity, often with support from international development agencies.

Asia-Pacific markets exhibit heterogeneous growth trajectories. Developed economies like Japan and South Korea emphasize automation and integration of smart monitoring technologies, with spill kits linked to digital maintenance systems. In Southeast Asia and Australia, robust environmental standards and high marine traffic volumes underscore the importance of portable and versatile spill response kits. Meanwhile, China’s ongoing industrial modernization and infrastructure projects continue to drive demand for scalable solutions tailored to both inland and coastal spill scenarios.

This comprehensive research report examines key regions that drive the evolution of the Oil & Chemical Spill Kits market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Participants and Their Strategic Initiatives Shaping the Oil and Chemical Spill Kit Market’s Innovation and Competitive Landscape

Leading providers of spill kit solutions are differentiating through a combination of product innovation, strategic partnerships, and expanded service offerings. Several major players have announced acquisitions of specialized absorbent manufacturers to integrate proprietary formulations and accelerate product development. Others are collaborating with equipment suppliers and digital platform vendors to offer end-to-end spill management systems that encompass detection, containment, and reporting.

Strategic alliances with regulatory consultants and safety equipment distributors have enabled these companies to deliver turnkey compliance packages, offering on-site assessments, training programs, and audit support alongside their core spill kit products. Some forward-looking firms have launched subscription-based supply models, ensuring that clients receive automatic replenishment shipments and access to performance analytics. This service differentiation has proven particularly appealing to large enterprises prioritizing continuous readiness and transparent cost structures.

Product portfolios are also expanding to include specialized kits for emerging risk scenarios, such as rechargeable coolant containment systems for electric vehicle manufacturing and high-temperature resistant absorbents for industrial furnaces. By investing in research and development centers and forging relationships with materials science institutes, leading companies are positioning themselves at the forefront of sustainable spill response innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Chemical Spill Kits market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- American Textile & Supply, Inc.

- Brady Corporation

- Chemtex International Inc.

- Cortec Corporation

- Darcy Spillcare Manufacture Ltd.

- ESP US

- Fentex Limited

- Fiberweb plc

- Hygeco International Solutions

- Johnson Matthey PLC

- New Pig Corporation

- NPS Corporation

- Safeguard Technology Inc.

- Sorbent Products Company, Inc.

- Stockhausen GmbH & Co. KG

- UltraTech International, Inc.

Delivering Actionable Strategic Recommendations to Guide Industry Leaders in Optimizing Spill Response Readiness Supply Chain Resilience and Regulatory Compliance

To remain competitive and resilient in today’s volatile environment, industry leaders must adopt a proactive, holistic approach. First, they should evaluate their supply chains to identify potential exposure points related to tariff fluctuations and raw material availability, and then diversify suppliers across multiple regions to ensure continuity. Simultaneously, investing in local manufacturing capabilities or forging joint ventures can mitigate geopolitical risks and reduce lead times for critical spill response materials.

Second, companies should prioritize partnerships with technology providers to embed digital monitoring and inventory management within their spill response offerings. Real-time tracking of kit deployment readiness and usage patterns not only improves response speed but also provides actionable data for continuous improvement and compliance reporting. Training programs and simulation exercises should be integrated into service agreements, equipping frontline teams with the knowledge and confidence to deploy swiftly and effectively.

Finally, embracing sustainability as a strategic differentiator will resonate with environmentally conscious stakeholders and regulators alike. Incorporating biodegradable polymers, natural fibers, and recyclable packaging into product lines can enhance brand reputation and open new market segments. By coupling eco-friendly materials with circular economy initiatives-such as take-back programs for spent absorbents-organizations can demonstrate tangible environmental leadership while maintaining high performance standards.

Detailing a Robust Research Methodology Integrating Comprehensive Primary and Secondary Data Collection Market Intelligence and Analytical Frameworks

This analysis is underpinned by a multi-stage research methodology that integrates primary and secondary data sources to ensure rigor and reliability. Secondary research included an extensive review of industry publications, regulatory filings, patent databases, and company disclosures to map product innovations and market developments. Insights from environmental agencies, trade associations, and technical standards bodies provided critical context on evolving compliance requirements and best practices.

Primary research was conducted through in-depth interviews with supply chain managers, safety officers, regulatory consultants, and end-user procurement specialists across key industries. These qualitative engagements offered nuanced perspectives on decision-making criteria, emerging challenges, and regional variations. To supplement interviews, structured surveys gathered quantitative data on purchase drivers, mitigation priorities, and service expectations at both enterprise and facility levels.

Data triangulation was applied throughout to validate findings, cross-referencing primary feedback with third-party market intelligence and real-world case studies of spill incidents. Analytical frameworks, including SWOT and PESTEL assessments, were employed to synthesize internal and external factors shaping the market. The result is a comprehensive, multi-dimensional view of the oil and chemical spill kit landscape, designed to inform strategic decision-making and investment planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Chemical Spill Kits market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Chemical Spill Kits Market, by Configuration

- Oil & Chemical Spill Kits Market, by Material

- Oil & Chemical Spill Kits Market, by Spill Type

- Oil & Chemical Spill Kits Market, by Kit Size

- Oil & Chemical Spill Kits Market, by End User Industry

- Oil & Chemical Spill Kits Market, by Sales Channel

- Oil & Chemical Spill Kits Market, by Region

- Oil & Chemical Spill Kits Market, by Group

- Oil & Chemical Spill Kits Market, by Country

- United States Oil & Chemical Spill Kits Market

- China Oil & Chemical Spill Kits Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding Critical Takeaways That Emphasize the Strategic Importance and Future Directions for Effective Oil and Chemical Spill Response Solutions

Effective spill response solutions stand at the intersection of environmental responsibility, operational efficiency, and regulatory adherence. By examining the transformative shifts in materials science, digital integration, and policy enforcement, it becomes evident that organizations must adapt swiftly to maintain readiness. The 2025 tariff landscape further underscores the need for agile supply chain strategies, encouraging localized production and supplier diversification.

Segmentation analysis reveals the importance of tailoring configurations-whether absorbent pads, booms, or specialized pillows-to the unique demands of each industry and spill scenario. Regional insights highlight that while the Americas benefit from mature infrastructure and stringent regulations, EMEA and Asia-Pacific markets are evolving rapidly, driven by regulatory harmonization and technological adoption. Leading companies are capitalizing on these trends through strategic partnerships, service innovations, and sustainability-focused product development.

In synthesizing these findings, the common thread is clear: organizations that integrate advanced technologies, diversify sourcing, and embrace eco-friendly materials will be best positioned to navigate uncertainty and uphold the highest standards of environmental stewardship. This conclusion not only encapsulates the report’s core takeaways but also sets the stage for informed action to strengthen spill management capabilities and drive long-term resilience.

Reach Out to Ketan Rohom Associate Director Sales & Marketing to Secure the Comprehensive Oil and Chemical Spill Kit Market Research Report

If you’re ready to deepen your understanding of the oil and chemical spill kit market and gain access to unparalleled insights, reach out today to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). With his expertise in navigating complex industry dynamics and tailoring research solutions to organizational needs, Ketan can guide you through the report’s comprehensive analysis, ensuring you obtain the detailed intelligence necessary to inform critical business decisions. By contacting him, you’ll unlock actionable data on market drivers, regulatory impacts, segmentation nuances, regional variations, and competitive strategies. Don’t miss this opportunity to bolster your strategic planning, strengthen your spill response capabilities, and stay ahead of emerging trends. Engage with Ketan Rohom now to secure your copy and position your organization for success in the evolving world of oil and chemical spill solutions.

- How big is the Oil & Chemical Spill Kits Market?

- What is the Oil & Chemical Spill Kits Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?