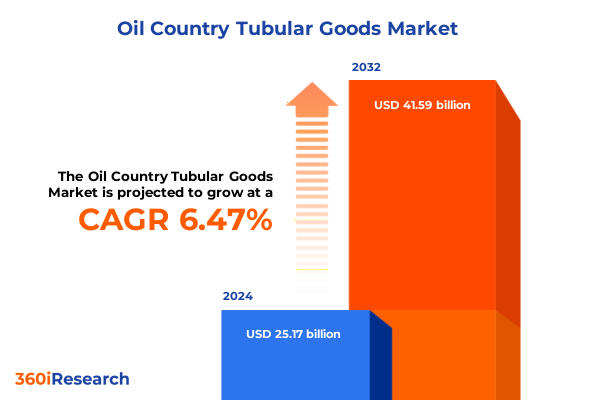

The Oil Country Tubular Goods Market size was estimated at USD 26.71 billion in 2025 and expected to reach USD 28.38 billion in 2026, at a CAGR of 6.52% to reach USD 41.59 billion by 2032.

Harnessing the Evolving Dynamics of Oil Country Tubular Goods Market in Response to Global Energy Demand Shifts and Tech Innovations

The oil country tubular goods sector stands at the confluence of evolving energy paradigms and accelerating technological innovation. As upstream oil and gas operators pursue greater efficiency in unconventional shale plays and deepwater fields, tubular products such as casing, drill pipe, and production tubing have become fundamental enablers of wellbore integrity and operational performance. The resilience of the global energy complex, influenced by shifting production economics and geopolitical factors, underscores the critical role of robust supply chains for these high-value components. Meanwhile, downstream refiners and service providers continue to demand advanced material grades and manufacturing processes that enhance corrosion resistance and fatigue life, driving continuous evolution of product specifications.

Historically, seamless fabrication processes dominated the market due to strict dimensional tolerances and metallurgical uniformity. However, welded production techniques have gained traction for certain size ranges, leveraging cost efficiency and yield improvements. In parallel, premium grades have emerged alongside industry-standard API grades, addressing more challenging well environments and higher pressure regimes. Finally, offshore applications, characterized by stringent integrity requirements and regulatory scrutiny, have spurred the adoption of next-generation material chemistries and qualifying test protocols, while onshore operators prioritize rapid delivery and modular well designs. Against this backdrop, understanding the multifaceted landscape of oil country tubular goods is essential for decision-makers seeking to optimize capital spending, manage risk, and navigate a market shaped by both tradition and transformation.

Mapping the Transformative Shifts Reshaping Oil Country Tubular Goods Industry Through Technological Integration and Sustainability Imperatives

Recent years have witnessed transformative shifts in the oil country tubular goods industry as sustainability mandates and digitalization converge to redefine operational paradigms. The advent of real-time downhole monitoring and predictive analytics has enabled operators to optimize drilling trajectories and proppant placement, directly impacting the load profiles experienced by tubular strings. In response, manufacturers are integrating sensor‐embedded couplings and high‐strength, corrosion-resistant alloys to reinforce well integrity and extend run life. Such advancements reflect a broader move toward lifecycle performance assessment, where total cost of ownership analysis incorporates both procurement and in-service maintenance economics.

Moreover, environmental, social, and governance considerations have amplified the focus on manufacturing footprint reduction. Producers of seamless and welded tubing alike are investing in green energy sources for their mills, waste-heat recovery systems, and low-emission forging technologies. These initiatives not only align with net-zero commitments but also anticipate tightening regulatory requirements across major production hubs. In tandem, digital twins of tubular assets are gaining adoption, enabling scenario testing for buckling, collapse, and tensile loading under complex wellbore conditions. Such computational tools inform material grade selection and quality assurance protocols, bridging the gap between metallurgical research and field deployment.

As the industry moves forward, the intersection of data-driven engineering and sustainable manufacturing continues to drive differentiation among suppliers. Operators, in turn, are leveraging these innovations to secure more predictable drilling outcomes, reduce non-productive time, and enhance environmental stewardship. This ongoing transformation signals a pivotal moment for stakeholders poised to embrace the next era of tubular goods excellence.

Evaluating the Cumulative Impact of 2025 United States Tariffs on Oil Country Tubular Goods Supply Chains and Competitive Dynamics

Since early 2025, United States trade policy has exerted significant influence on the oil country tubular goods supply chain, particularly through the reinstatement and subsequent adjustment of Section 232 tariffs on steel and aluminum. In February, the presidential proclamation closed existing exemptions and restored a full 25% levy on imported steel, followed by an elevation to 50% on both steel and aluminum in June to shield domestic producers against global excess capacity and unfair trade practices. These measures have reverberated throughout the tubular goods market, as steel billets and aluminum fittings represent critical raw materials for seamless and welded fabrication processes.

While the heightened duties were designed to bolster national security and revitalize metallurgical capacity in the United States, they have introduced cost pressures for OCTG manufacturers reliant on imported feedstock. Many domestic mills have responded by ramping up output of API-certified steel, yet capacity constraints and lead-time extensions persist. Concurrently, a landmark judicial decision clarified that certain tariffs imposed under the International Emergency Economic Powers Act exceeded executive authority, though it explicitly preserved Section 232 measures. This jurisprudence provided partial relief on ad hoc IEEPA-derived levies, yet steel and aluminum duties remain intact as they derive from national security mandates.

Adding complexity, the U.S. Department of Commerce’s final results of the 2022 countervailing duty review on OCTG imports from South Korea confirmed zero subsidy rates, effectively maintaining tariff–neutral status for Korean suppliers since February 2025. Simultaneously, the rescission of the antidumping duty review on Chinese tubular goods eliminated a potential layer of import duties, leaving Section 232 as the predominant trade barrier. As a result, U.S. purchasers have had to adapt contracting strategies, source diversification plans, and cost pass-through mechanisms to mitigate the cumulative impact of these trade measures on production budgets and project economics.

Unearthing Key Segmentation Insights Across Product Types, Manufacturing Processes, Material Grades, and Application Environments

Segmenting the oil country tubular goods landscape reveals differentiated dynamics across product types, manufacturing methodologies, material classifications, and deployment contexts. When viewed through the lens of product offerings, casing, drill pipe, and tubing each respond to unique mechanical demands. Within casing applications, conductor, intermediate, production, and surface casing perform sequential functions that uphold well integrity and zonal isolation under gradually increasing pressure regimes. Drill pipe, by contrast, endures cyclic fatigue during drilling operations, driving the adoption of premium grades for extended lateral sections. Production tubing must accommodate corrosive fluids and elevated temperatures, prompting material enhancements that improve yield strength and resistance to hydrogen sulfide.

The contrast between seamless and welded production processes further underscores market plurality. Seamless fabrication remains the benchmark for stringent dimensional control and defect avoidance, particularly in deepwater and high-pressure environments. However, welded options have achieved cost competitiveness for larger diameters and intermediate strength classifications, supported by automated inspection systems that detect weld discontinuities in real time. Turning to material considerations, API grades continue to meet baseline industry requirements, while premium grades address more aggressive downhole chemistries and unconventional completions, where high-chromium alloys and micro-alloyed steel variants extend service life.

Ultimately, the onshore versus offshore debate drives divergent procurement priorities. Onshore operations emphasize rapid turnaround, logistics optimization, and tiered standards that balance price with performance. Offshore operators, facing stringent regulatory oversight and remote logistics constraints, place a premium on rigorous qualification protocols, full-length ultrasonic testing, and application-specific thread compounds. Recognizing these layered segmentation insights empowers stakeholders to tailor product portfolios, optimize inventory strategies, and align value propositions with evolving field requirements.

This comprehensive research report categorizes the Oil Country Tubular Goods market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Manufacturing Process

- Treatment Method

- Material Type

- Outside Diameter

- Application

Highlighting Key Regional Insights Spanning the Americas, Europe Middle East and Africa, and Asia Pacific Energy Markets

Regional trends in the oil country tubular goods market are shaped by diverse energy portfolios, regulatory frameworks, and infrastructure development cycles. In the Americas, the shale revolution continues to drive demand for durable casing and drill pipe solutions designed for unconventional reservoirs. Producers in the Permian, Bakken, and Eagle Ford plays prioritize seamless tubulars with premium-grade metallurgy to withstand high-pressure fracturing and extended laterals. Meanwhile, on the West Coast, regulatory emphasis on emissions reduction has led to closer collaboration between tubular suppliers and service companies to validate low-emission manufacturing techniques and optimize logistics to remote basins.

Across Europe, the Middle East and Africa, the landscape is divided between mature markets and emerging deepwater frontiers. North Sea operators maintain reliance on vetted seamless casing strings and high-yield drill pipe, underpinned by stringent health, safety, and environmental standards. In the Middle East, ongoing investment in offshore oilfields fosters demand for high-specification alloys and automated inspection regimes, as wells exceed depths of 10,000 feet subsea. African projects, often greenfield in scope, are forging new supply agreements to balance cost competitiveness with risk mitigation, leveraging flexible welded tubulars where logistic constraints and local content rules prevail.

Asia Pacific presents an equally complex tableau. Australia’s offshore developments hinge on high-pressure, high-temperature casing designs, while Southeast Asian markets blend onshore and shallow marine requirements for drill pipe durability and corrosion resistance. In China and India, robust refining expansions are paralleled by growing attention to domestic manufacturing standards for API-certified tubes, supported by initiatives to localize feedstock production and reduce reliance on imported steel billets. Understanding these regional nuances enables suppliers and operators to synchronize production planning, enhance service models, and foster strategic partnerships tailored to each market’s regulatory and operational imperatives.

This comprehensive research report examines key regions that drive the evolution of the Oil Country Tubular Goods market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring Competitive Landscapes and Strategic Moves of Leading Oil Country Tubular Goods Manufacturers and Service Providers

Leading players in the oil country tubular goods arena continue to innovate and consolidate to maintain competitive advantage amid evolving market conditions. Tenaris has leveraged its global manufacturing network to optimize seamless and welded product lines, supporting digital threading solutions and integrated supply chain tracking. Vallourec focuses on premium-grade tubulars for extreme well environments, investing in proprietary alloy development and automated heat-treatment facilities to reduce microstructural variability. TMK, with its strategic footprint in North America and Eurasia, differentiates through tailored thread designs and on-site technical support for joint integrity verification.

Across the competitive landscape, National Oilwell Varco has expanded its offerings by integrating tubulars with services such as inventory management, threading equipment, and make-up torque analytics. This move mirrors an industry shift toward comprehensive solutions that encompass both products and lifecycle support. Smaller specialists and regional mill operators are carving niches by aligning with local content requirements and delivering rapid-turnaround welded tubing for mid-market projects. Strategic partnerships between service contractors and tubular manufacturers have intensified, focusing on downhole performance guarantees and joint warranty frameworks.

Recent mergers and joint ventures also reflect a drive for scale and geographic diversification. Collaborations targeting emerging deepwater plays in West Africa and the Asia Pacific illustrate a shared commitment to R&D investments in alloy chemistry and advanced non-destructive testing. As the competitive field evolves, successful participants will be those that harness their engineering expertise, adaptive manufacturing models, and collaborative service offerings to secure long-term contracts and navigate an increasingly complex global supply chain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil Country Tubular Goods market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alleima AB

- ArcelorMittal S.A.

- Arvedi Group

- AUTOBLOK S.P.A.

- BENTELER International Aktiengesellschaft

- Continental Steel and Tube Company

- EVRAZ North America, Inc.

- Hunting PLC

- ILJIN STEEL CO., LTD.

- JD Rush Company, Inc.

- JFE Holdings, Inc.

- Jindal Pipes Ltd

- Nippon Steel Corporation

- NOV Inc.

- Sandvik AB

- Sanjack Group Co.,Ltd.

- SB International, Inc.

- Shandong Saigao Group Corporation

- Shengji Group

- Sumitomo Corporation

- Tata Steel Limited

- Techint Group

- Tenergy Equipment & Service Ltd.

- Threeway Steel Co.,Ltd.

- Tianjin Pipe Corporation

- TMK Group

- TPS-Technitube Röhrenwerke GmbH

- Tubos India.

- United States Steel Corporation

- Vallourec Group

- voestalpine Tubulars GmbH & Co KG

Formulating Actionable Recommendations to Optimize Supply Chain Resilience, Drive Innovation, and Enhance Competitiveness in Tubular Goods Sector

Industry leaders must adopt a multifaceted approach to stay ahead in a market characterized by volatile raw-material pricing, evolving regulatory environments, and technological disruption. First, securing diversified supply sources for seamless steel billets and aluminum fittings will mitigate tariff-related cost escalations. Establishing conditional contracts with domestic and trusted international mills can balance capacity requirements and cost predictability. Concurrently, operators should engage tubular goods suppliers in collaborative innovation programs to co-develop premium grades optimized for site-specific downhole conditions, leveraging advanced metallurgical simulation tools.

Investing in digital supply chain platforms that track lot-level data from mill certification through on-site deployment will enhance transparency, reduce quality disputes, and improve turnaround times. Integrating predictive maintenance analytics with downhole sensor data can preempt failure modes, extend run life, and provide empirical justification for material upgrades. Furthermore, aligning procurement strategies with sustainability objectives-such as sourcing low-carbon steel and implementing cradle-to-gate emissions reporting-will resonate with increasingly ESG-minded investors and regulators.

Finally, forging strategic alliances with service companies, fracturing contractors, and engineering consultancies will create bundled offerings that differentiate on value rather than price alone. By developing outcome-based contracts that tie compensation to performance metrics like non-productive time reduction and well integrity benchmarks, stakeholders can share risk and reward more equitably. This collaborative ecosystem will accelerate the adoption of next-generation tubular technologies, secure long-term commercial commitments, and reinforce resilience in the face of market uncertainties.

Detailing a Rigorous Research Methodology Incorporating Primary Interviews, Secondary Data Triangulation, and Analytical Frameworks

This research integrates a rigorous methodology combining in-depth primary interviews with industry executives, engineers, and procurement specialists alongside exhaustive secondary data analysis. Primary engagements were conducted through structured, scenario-based dialogues that probed technical challenges, procurement frameworks, and future investment priorities. Insights gleaned from these interviews were systematically coded to identify recurring themes in material preferences, manufacturing constraints, and service integration.

Secondary research encompassed review of trade publications, regulatory filings, and corporate disclosures to map historical trends in production capacity, tariff developments, and technological adoption. Government databases and international trade registries were analyzed to quantify countervailing and anti-dumping duty actions, as well as tariff modifications under Section 232 and related statutory authorities. Analytical frameworks, including SWOT analysis and Porter’s Five Forces, were employed to assess competitive dynamics and potential entry barriers.

Triangulation of primary and secondary findings ensured robust validation of market narratives, while iterative feedback loops with subject-matter experts refined our understanding of deployment segmentation and regional nuances. Quality control processes, such as data consistency checks and peer review by senior analysts, were applied throughout. This comprehensive approach provides a high-confidence foundation for the strategic insights and recommendations presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil Country Tubular Goods market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil Country Tubular Goods Market, by Product Type

- Oil Country Tubular Goods Market, by Manufacturing Process

- Oil Country Tubular Goods Market, by Treatment Method

- Oil Country Tubular Goods Market, by Material Type

- Oil Country Tubular Goods Market, by Outside Diameter

- Oil Country Tubular Goods Market, by Application

- Oil Country Tubular Goods Market, by Region

- Oil Country Tubular Goods Market, by Group

- Oil Country Tubular Goods Market, by Country

- United States Oil Country Tubular Goods Market

- China Oil Country Tubular Goods Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Strategic Takeaways to Navigate Opportunities and Challenges in the Evolving Oil Country Tubular Goods Market

As the oil country tubular goods sector navigates an era of technological acceleration, policy shifts, and sustainability imperatives, the synthesis of insights underscores several strategic priorities. Differentiation through advanced material grades and digitalized supply chains will separate industry leaders from cost-focused competitors. Supply chain resilience, underpinned by diversified sourcing, domestic capacity utilization, and flexible contracting mechanisms, will be critical to absorb ongoing tariff fluctuations and raw-material volatility.

Furthermore, the integration of lifecycle performance analysis-from downhole sensor data to metallurgy advancements-will unlock new opportunities for outcome-based service models. Aligning such innovations with ESG commitments and transparent reporting standards will reinforce stakeholder confidence and support capital allocation. Regional market complexities-from the mature deepwater realms of EMEA to the dynamic shale corridors of the Americas and evolving offshore agenda in Asia Pacific-require localized strategies that marry global best practices with tailored solutions.

Ultimately, stakeholders who leverage collaborative ecosystems-uniting operators, manufacturers, and service providers-will be positioned to deliver comprehensive value propositions that drive operational excellence. By embracing the research findings and recommendations outlined herein, decision-makers can chart a resilient path forward, capitalize on emerging opportunities, and secure a sustainable competitive edge in the ever-evolving oil country tubular goods landscape.

Empower Your Strategic Decisions with Expert Insights and Secure the Comprehensive Tubular Goods Market Report by Partnering with Ketan Rohom Today

To access comprehensive, actionable intelligence on the oil country tubular goods market and secure a competitive edge, reach out to Ketan Rohom, Associate Director of Sales & Marketing, without delay. Ketan Rohom brings deep subject-matter expertise and client-focused guidance to facilitate your purchase of the full market research report. Engage directly with Ketan to customize your research package, clarify analytical frameworks, and ensure that your strategic priorities are fully addressed. Don’t miss this opportunity to empower your decision-making with the latest insights, data-driven analysis, and forward-looking perspectives tailored to your business objectives. Contact Ketan today to acquire the definitive resource that will inform supply chain optimization, investment planning, and long-term growth strategies in the dynamic oil country tubular goods sector.

- How big is the Oil Country Tubular Goods Market?

- What is the Oil Country Tubular Goods Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?