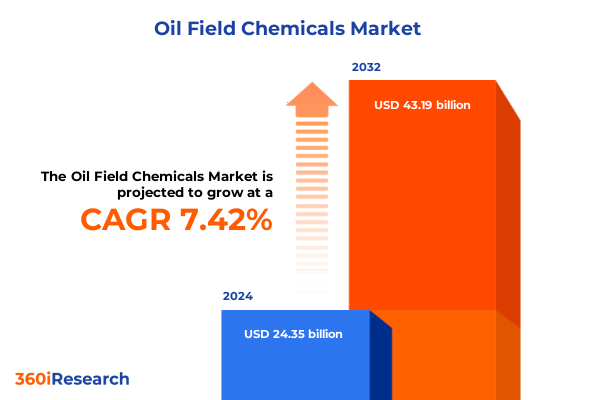

The Oil Field Chemicals Market size was estimated at USD 26.12 billion in 2025 and expected to reach USD 28.02 billion in 2026, at a CAGR of 7.44% to reach USD 43.19 billion by 2032.

Understanding the Transformative Power of Oil Field Chemicals in Boosting Drilling Performance and Operational Excellence Nationwide

Oil field chemicals have become instrumental in elevating operational performance and environmental stewardship across every segment of the hydrocarbon value chain. These specialized formulations are engineered to meet the rigorous demands of drilling, completion, production, and stimulation processes, ensuring that wells deliver optimal flow rates, maintain structural integrity, and comply with evolving regulatory standards. As exploration moves into more challenging formations-ranging from ultra-deepwater reservoirs to high-temperature unconventional plays-the role of tailored chemistries has never been more critical. By enhancing fluid rheology, controlling corrosion, and mitigating downhole risks, these products form the bedrock of modern upstream operations, driving both efficiency and safety.

Moreover, the strategic importance of oil field chemicals extends beyond performance optimization. In an era of heightened environmental awareness and stringent emissions regulations, chemical suppliers are under pressure to innovate sustainable solutions that minimize ecological footprints. Biodegradable additives, water-based mud alternatives, and low-toxicity corrosion inhibitors exemplify this paradigm shift. Consequently, stakeholders across the value chain-from operators to service providers-are placing greater emphasis on green credentials when selecting chemical portfolios. With ongoing advancements in material science and process automation, the introduction of smart formulations and digital monitoring capabilities is further transforming how these products are deployed in the field.

How Digitalization, Sustainability Mandates and Geopolitical Dynamics Are Reshaping the Oil Field Chemicals Industry Landscape

Recent years have witnessed a confluence of technological innovation and strategic realignment that is redefining the oil field chemicals landscape. Foremost among these is the integration of digitalization and data analytics into chemical management. Advanced sensors, machine learning algorithms, and cloud-based platforms enable real-time monitoring of fluid properties, predictive maintenance of equipment, and automated dosage control. These digital workflows not only enhance operational consistency across remote locations but also foster proactive decision-making by flagging anomalies before they escalate into costly downtime.

Simultaneously, sustainability mandates and evolving regulatory frameworks are exerting profound influence over product development priorities. Suppliers are accelerating R&D efforts to reformulate traditional chemistries with bio-derived feedstocks, recyclable carriers, and reduced hazard ratings. At the same time, geopolitical dynamics-including trade tensions and energy security concerns-have ushered in an era of supply chain diversification. Operators are reevaluating sourcing strategies to mitigate risks associated with single-origin dependence, while governments are implementing local content requirements to bolster domestic manufacturing capabilities. These multifaceted shifts underscore the necessity for agile, innovation-driven approaches that can adapt to both environmental imperatives and market uncertainties.

Evaluating the Compound Effects of Newly Enacted United States Tariffs on Oil Field Chemical Imports and Domestic Supply Chains in 2025

The cumulative impact of newly imposed United States tariffs on oil field chemical imports in 2025 has prompted significant strategic recalibrations across the supply chain. With additional duty rates enacted under Section 301 measures targeting select specialty chemicals and complementary raw materials, operators and service companies have encountered elevated procurement costs that permeate drilling and production budgets. This heightened cost environment has spurred both immediate tactical responses-such as renegotiating long-term supplier contracts-and more fundamental shifts, including the acceleration of local manufacturing investments to insulate operations from future tariff volatility.

Import restrictions have also induced supply chain bottlenecks, particularly for high-performance additives sourced predominantly from overseas facilities. The resulting scarcity of critical components has highlighted the imperative for strategic inventory management and alternative sourcing pathways. In response, industry participants are forging joint ventures with domestic chemical producers, thereby creating blended portfolios that balance imported and locally manufactured chemistries. Over time, this reshoring trend is poised to enhance supply security, though it may also reshape competitive dynamics by favoring players with robust domestic infrastructure.

Furthermore, the tariff-driven cost pressures have catalyzed intensified R&D efforts directed toward process intensification and raw material efficiency. Suppliers are prioritizing formula optimization to reduce dosages without compromising performance, while equipment manufacturers are designing dosing systems engineered for ultra-precise delivery. Through these innovations, the sector is striving to offset the financial burden of tariffs by unlocking incremental operational savings and delivering enhanced value to end users.

Unveiling Segmentation-Driven Strategies Through Detailed Analysis of Product Types, Well Formats, Chemical Forms and Applications

An in-depth segmentation analysis reveals how different product families address diverse well conditions and operational objectives. Cements and grouts are essential for zonal isolation and well integrity, bridging formation irregularities and preventing fluid communication; completion chemicals-comprising cement additives and lost circulation materials-ensure efficient sealing and control of downhole losses. Drilling chemicals extend across oil based muds, synthetic based muds, and water based muds, each tailored to specific lithology, environmental restrictions, and well depth. Production chemicals cover a spectrum including biocides to combat microbial threats, corrosion inhibitors for downhole tubular protection, demulsifiers that separate emulsified hydrocarbons and produced water, and scale inhibitors to prevent mineral deposition. For enhanced recovery efforts, stimulation chemicals such as acidizing agents and fracturing chemistries are employed to improve reservoir permeability and connect fracture networks to the wellbore.

Beyond product type, segmentation by well architecture highlights critical performance differentials. Directional wells demand rheologically optimized fluids that maintain borehole stability along complex trajectories; horizontal and multilateral wells require advanced completion fluids capable of ensuring zonal isolation across extended laterals; vertical wells, often used for appraisal, rely on versatile chemical packages that balance cost and functionality. Chemical form-emulsions, gels, liquids, powders-further influences logistics, shelf life and field handling practices, enabling operators to align supply chain efficiency with rig site constraints. Application-driven segmentation underscores the end-use focus of each solution: corrosion control preserves asset life; well completion processes including cementing, lost circulation control and zonal isolation secure bore integrity; well drilling additives and wellbore cleaning agents facilitate uninterrupted penetration rates; acidizing and fracturing in well stimulation unlock additional production from tight formations. This layered segmentation approach empowers stakeholders to pinpoint chemistries that align precisely with operational goals, geological contexts and environmental considerations.

This comprehensive research report categorizes the Oil Field Chemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Well Type

- Form

- Application

Uncovering Regional Nuances and Growth Drivers Across the Americas, Europe Middle East Africa and Asia-Pacific Oil Field Chemicals Markets

Across the Americas, oil field chemical demand is largely driven by robust unconventional exploration and production activities. The United States continues to lead with shale formations where innovative fracturing chemistries deliver enhanced hydrocarbon recovery, while Canada’s oil sands operations require specialized bitumen-compatible additives. Latin American markets are gradually expanding as regional operators leverage improved fiscal frameworks to invest in modernization of aging fields. Infrastructure enhancements and favorable fiscal incentives in these jurisdictions further bolster demand for advanced chemical formulations.

In Europe, Middle East and Africa, the landscape is shaped by contrasting drivers. Middle Eastern projects benefit from abundant resources, spurring investments in acidizing and stimulation solutions optimized for high-temperature carbonate reservoirs. European operators face stringent environmental regulations that emphasize the adoption of low-emission drilling fluids and green completion technologies. Across Africa, emerging offshore discoveries in deepwater basins are generating interest in robust corrosion control and well integrity chemistries capable of withstanding highly corrosive brine conditions. Meanwhile, Asia-Pacific markets exhibit a dual focus: Australia’s stringent import regulations and environmental oversight drive preferences for local manufacturing of water-based muds, while Southeast Asian operators prioritize cost-effective additives for mature fields and incremental recovery projects. These regional nuances reflect varying regulatory, geological and economic landscapes, underscoring the need for adaptable chemical strategies that respect local requirements.

This comprehensive research report examines key regions that drive the evolution of the Oil Field Chemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Driving Innovation Portfolio Diversification and Strategic Partnerships in the Oil Field Chemicals Arena

Leading players in the oil field chemicals sector have sharpened their competitive edge through strategic portfolio expansions, alliances and focused R&D programs. Established service companies are integrating digital monitoring platforms into their chemical offerings to provide real-time visibility into fluid performance and operational metrics. By forging partnerships with technology startups, these firms are accelerating the deployment of advanced sensor networks and AI-driven analytics that optimize chemical usage and reduce nonproductive time.

Chemical manufacturers are responding to market pressures by diversifying their feedstock sources, investing in sustainable raw materials, and expanding production capacity near key hydrocarbon basins. Collaborative research agreements with academic institutions and national laboratories are fueling innovations in nano-engineered inhibitors, self-healing cement systems and multi-functional stimulation blends. Furthermore, mergers and acquisitions are reshaping the competitive landscape, enabling nimble players to gain scale and established firms to augment niche capabilities. This dynamic interplay of strategy and innovation underscores a sector-wide commitment to delivering differentiated chemical solutions that meet evolving operational, environmental and economic imperatives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil Field Chemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Aquapharm Chemical Pvt. Ltd. by PCBL

- Ashland Inc.

- Baker Hughes Company

- BASF SE

- ChampionX Corporation

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- Clariant AG

- Dow Inc.

- Ecolab Inc.

- Evonik Industries AG by RAG-Stiftung

- ExxonMobil Corporation

- Halliburton Company

- Huntsman Corporation

- Innospec Inc.

- Kemira Oyj

- Krishna Antioxidants Pvt. Ltd

- LG Chem Ltd. by LG Corp.

- Lubrizol Corporation by Berkshire Hathaway

- Newpark Resources Inc.

- Nouryon Chemicals Holding B.V.

- Schlumberger Limited

- SNF Group

- Solvay S.A.

- Stepan Company

- Syensqo Group

- The Dow Chemical Company by DuPont, Dow Inc

- The Lubrizol Corporation

- Thermax Limited

- Veolia Environnement S.A.

- W. R. Grace and Co. by Standard Industries

Actionable Strategic Recommendations to Navigate Market Volatility Accelerate Innovation and Strengthen Competitive Positioning in Oil Field Chemicals

Industry leaders should prioritize the integration of digital platforms with chemical management systems to harness the full potential of data-driven performance optimization. By deploying connected dosing equipment and cloud-based analytics, operators can shift from reactive interventions to predictive maintenance, thereby unlocking significant cost efficiencies and mitigating downtime risks. Equally important is the pursuit of sustainable chemistry pathways; investing in bio-derived additives, recyclable carriers and low-toxicity compounds will not only satisfy regulatory requirements but also enhance corporate social responsibility credentials.

Diversifying supply chains through local content partnerships and regional manufacturing hubs will reduce exposure to geopolitical disruptions and tariff volatility. Strategic alliances with domestic chemical producers can facilitate co-development of tailored formulations that address unique reservoir conditions. Finally, leaders should allocate resources toward accelerated innovation in high-performance and multi-functional chemistries-balancing incremental R&D investments with targeted acquisitions in specialized segments. This holistic approach will fortify competitive positioning, drive operational excellence and ensure resilience amid evolving market dynamics.

Detailed Insights into the Rigorous Mixed-Method Research Methodology Underpinning This Comprehensive Oil Field Chemicals Study

This comprehensive study synthesizes quantitative data and qualitative insights drawn from a rigorous mixed-method research framework. Primary research involved in-depth interviews with upstream operators, service company executives, and regulatory authorities to capture firsthand perspectives on evolving challenges and innovation drivers. Secondary research encompassed detailed reviews of industry whitepapers, peer-reviewed journals and public filings to establish a robust contextual baseline and validate emerging trends.

A systematic data triangulation process was employed to reconcile diverse information sources, ensuring reliability and coherence in the analysis. The study’s segmentation matrices were refined through iterative validation rounds with subject matter experts, while regional insights were corroborated against macroeconomic indicators and energy policy developments. Throughout the methodology, stringent quality control measures-such as cross-verification of interview transcripts and independent peer reviews-ensured the integrity and accuracy of findings. This disciplined approach underpins the strategic recommendations and conclusions presented herein, offering stakeholders a dependable foundation for informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil Field Chemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil Field Chemicals Market, by Product Type

- Oil Field Chemicals Market, by Well Type

- Oil Field Chemicals Market, by Form

- Oil Field Chemicals Market, by Application

- Oil Field Chemicals Market, by Region

- Oil Field Chemicals Market, by Group

- Oil Field Chemicals Market, by Country

- United States Oil Field Chemicals Market

- China Oil Field Chemicals Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Perspectives on the Evolving Oil Field Chemicals Sector and Key Takeaways for Stakeholders in a Dynamic Energy Environment

Drawing together the key themes of technological innovation, regulatory evolution and strategic realignment, this analysis highlights the multifaceted nature of the oil field chemicals industry. The integration of digital capabilities into chemical management processes promises profound efficiency gains, while sustainability imperatives are reshaping R&D priorities toward greener, more environmentally benign solutions. Concurrently, geopolitical ripple effects-most notably tariff policies-have underscored the importance of supply chain resilience and the strategic value of localized manufacturing.

In synthesizing these insights, stakeholders are equipped with a holistic understanding of the forces driving change and the levers available to capture value. From tailored segmentation strategies that align chemical properties with geological contexts to actionable recommendations that bolster competitive advantage, this executive summary provides a clear roadmap for navigating a dynamic energy landscape. As the sector continues to adapt to emerging challenges and opportunities, the ability to translate insights into decisive action will distinguish the industry’s leaders from its followers.

Take the Next Step in Driving Operational Excellence and Market Intelligence with Ketan Rohom’s Exclusive Oil Field Chemicals Report Offering

To embark on a journey toward unparalleled operational excellence and deep market intelligence in oil field chemicals, reach out to Ketan Rohom, Associate Director, Sales & Marketing. Leverage his expertise in guiding industry decision-makers through the data-driven insights and actionable strategic frameworks articulated in this report

By partnering with Ketan, organizations gain priority access to in-depth analyses, bespoke consulting extensions, and early notifications of emerging trends that can shape procurement strategies, technology adoption roadmaps, and sustainable growth initiatives. His collaborative approach ensures that findings translate into tangible impact-from optimizing supply chains to accelerating high‐performance chemical deployments in complex well environments

Secure a competitive edge today by contacting Ketan Rohom to learn how this exclusive market research report can become a cornerstone of your strategic planning and investment choices

- How big is the Oil Field Chemicals Market?

- What is the Oil Field Chemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?