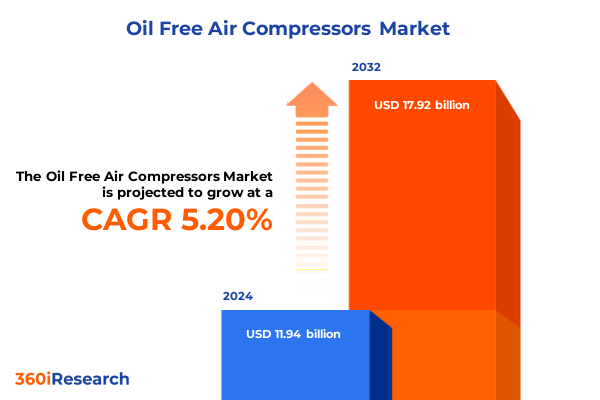

The Oil Free Air Compressors Market size was estimated at USD 12.49 billion in 2025 and expected to reach USD 13.10 billion in 2026, at a CAGR of 5.28% to reach USD 17.92 billion by 2032.

Setting the Stage for the Oil-Free Air Compressor Market with Critical Industry Drivers Sustainability Imperatives and Innovation Trajectories

The oil-free air compressor sector has experienced robust growth in recent years, reaching a global valuation of USD 15.7 billion in 2024 as industries contend with stringent particulate contamination standards and environmental regulations. This growth has been propelled by the expanding presence of sectors like pharmaceuticals, food processing, and electronics manufacturing, where air purity is non-negotiable. Moreover, energy efficiency initiatives and sustainability mandates are further elevating the demand for oil-free systems over traditional oil-lubricated counterparts.

Advances in compressor design-including dry screw, scroll, and centrifugal technologies-have driven oil-free systems to deliver higher power density and reduced maintenance requirements. The integration of variable speed drive (VSD) systems and magnetic bearing motors is delivering energy savings of up to 50%, while IoT-enabled sensors provide real-time performance monitoring and predictive analytics to optimize uptime.

Given the confluence of regulatory pressures, environmental objectives, and industrial modernization, purchasing cycles now emphasize life-cycle cost over capital outlay alone. End users increasingly seek turnkey solutions that include installation, remote diagnostics, and performance guarantees, reflecting a shift toward service-oriented business models.

Examining How Technological Disruptions and Environmental Regulations Are Reshaping Oil-Free Air Compressors Landscape in 2025 and Beyond

The oil-free air compressor market is being reshaped by a wave of technological innovations that prioritize energy efficiency and digitalization. Variable speed drive (VSD) technology has evolved to incorporate advanced motor control algorithms, magnetic bearing systems, and integrated IoT sensors, achieving energy savings of up to 50% compared to fixed-speed units and payback periods under 18 months.

Simultaneously, the integration of IoT and AI-driven predictive maintenance platforms is transitioning maintenance strategies from reactive to proactive. Real-time monitoring of performance metrics such as pressure, temperature, and vibration enables operators to anticipate failures before they occur, minimizing downtime and extending equipment life. This shift not only enhances reliability but also aligns with broader industry 4.0 initiatives aimed at unlocking operational efficiencies.

Beyond technology, sustainability mandates and environmental regulations are elevating the strategic importance of oil-free compressors. As global energy costs rise and emissions targets tighten, manufacturers are investing in heat recovery systems and water-cooled configurations that reduce energy consumption and carbon footprints. The result is a new generation of oil-free systems that deliver both environmental stewardship and economic value.

Assessing the Cumulative Impact of 2025 United States Tariff Adjustments on Oil-Free Air Compressor Supply Chains and Cost Structures

The 2025 expansion of U.S. tariffs on imported steel, aluminum, and specialized compressor components has introduced significant cost pressures across the oil-free air compressor supply chain. Tariffs on stainless steel sinks, air conditioner coils, and other key inputs have risen to as high as 50% under recently announced measures aimed at bolstering domestic production. These levies have driven up procurement costs for original equipment manufacturers (OEMs) and distributors, compressing margins and triggering price adjustments for end users.

In response, leading manufacturers are restructuring supply chains to localize production and qualify alternative suppliers. A recent case in point is Husqvarna’s decision to shift assembly from China to European plants while rerouting Canada-bound shipments to avoid U.S. tariff entanglements. Companies are also negotiating strategic partnerships with non-tariff-exposed vendors and investing in modular, locally assembled compressor platforms to mitigate ongoing trade volatility.

End users in industries such as food & beverage, pharmaceuticals, and chemicals are confronting longer lead times and elevated capex budgets as a direct consequence of these tariff measures. In a CIPS survey, procurement specialists warned of potential 20% price increases on critical machinery and components in 2025, underscoring the need for agile sourcing strategies and extended service agreements that can absorb short-term cost shocks.

Uncovering Critical Segmentation Insights Across Product Types Usability Stages Power Ratings Cooling Methods End Users and Sales Channels

Analysis of the oil-free air compressor market reveals nuanced performance across multiple dimensions of segmentation. By product type, rotary screw compressors dominate in heavy-duty industrial applications due to their ability to deliver continuous flow and high efficiency, while scroll compressors are preferred in laboratory and medical environments for their compact form factor and ultra-low contamination risk. Centrifugal compressors serve high-capacity facilities such as water treatment and large chemical plants, leveraging high airflow rates at low operating pressures. Reciprocating and axial compressors retain niches in specialized processes demanding precise pressure control or extremely high pressure ratios.

When evaluating usability, stationary oil-free compressors account for the bulk of installed base in fixed manufacturing and processing plants, whereas portable units are capturing share in construction, field service, and mobile medical applications due to their flexibility and ease of deployment. Single-stage machines dominate small to medium power ratings, while two-stage systems are increasingly adopted for high-pressure requirements in heavy industry. Power ratings between 15-50 HP are most prevalent in SMEs across food & beverage and textiles, whereas Above 250 HP units are installed in large chemical, petrochemical, and energy facilities where continuous, high-capacity air supply is essential.

Cooling method analysis shows air-cooled compressors leading in general manufacturing contexts for their lower installation costs, while water-cooled systems are favored in hot-climate regions and process industries with stringent thermal management needs. End-user segmentation highlights manufacturing-especially automotive, electronics, and metal fabrication-as the single largest demand generator, closely followed by chemical & petrochemical and oil & gas sectors. The food & beverage and healthcare industries are prioritizing contamination-free air through scroll and rotary screw technologies. Sales channel scrutiny reveals a strong preference for offline procurement complemented by growing digital sales platforms that streamline quote generation and remote diagnostics.

This comprehensive research report categorizes the Oil Free Air Compressors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Stage

- Usability

- Cooling Method

- Power Source

- Speed Type

- Power Rating

- Pressure Range

- End User

- Sales Channel

Delineating Key Regional Dynamics Across the Americas Europe Middle East Africa and Asia Pacific Oil-Free Air Compressor Markets

Regional dynamics in the oil-free air compressor market underscore distinct drivers and adoption patterns across the Americas, EMEA, and Asia-Pacific. In the Americas, the United States commands over 21% of global demand, buoyed by strong growth in pharmaceuticals and healthcare applications as well as federal incentives for energy-efficient equipment that favor VSD-equipped compressors. Canada and Mexico contribute meaningful share through expanding food processing and clean energy projects, reinforcing North America’s position as a mature yet evolving market.

Europe, the Middle East & Africa region accounts for roughly 32% of worldwide consumption, with Germany, France, and the U.K. leading the transition to oil-free systems under strict EU emissions and air quality regulations. The Middle East’s petrochemical facilities and desalination plants are driving demand for high-capacity centrifugal compressors, while Africa’s burgeoning industrial corridors in Nigeria, Kenya, and South Africa report year-on-year double-digit growth as energy infrastructure and healthcare projects accelerate.

Asia-Pacific is the fastest-growing regional market, representing over 35% of global revenue with China alone contributing more than 38% of regional demand. Rapid industrialization in India, rising pharmaceutical capacity in Southeast Asia, and Japan’s technology-driven manufacturing base fuel a CAGR of nearly 6% through 2030. Adoption of portable units in construction and aftermarket services, alongside integration with Industry 4.0 frameworks, cements the region’s leadership in both volume and innovation.

This comprehensive research report examines key regions that drive the evolution of the Oil Free Air Compressors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Oil-Free Air Compressor Manufacturers and Their Strategic Initiatives in Innovation Partnerships and Market Expansion

The competitive landscape of the oil-free air compressor market is anchored by a combination of global conglomerates and specialized regional players. Atlas Copco maintains leadership through its ISO Class 0 certified portfolio and ongoing investment in variable speed technology, while Ingersoll Rand leverages strategic acquisitions-such as the Tuthill pump and compressor business-to broaden its oil-free offerings and enhance service capabilities. Kaeser Kompressoren and Sullair (part of Hitachi Group) continue to push R&D in advanced materials and high-efficiency air-end designs, focusing on lower life-cycle costs and reduced environmental impact. ELGi Equipments and Hanwha Power Systems have carved niche positions in emerging markets by delivering cost-effective scroll and rotary screw solutions tailored to local end-user requirements.

Several entrants and mid-tier players-such as Bauer Compressor and FS Elliot-are expanding through partnerships with automation and service providers to bundle compressors with turnkey performance guarantees and digital monitoring platforms. Recent developments include Atlas Copco’s launch of the ZR 90-160 VSD+ rotary screw series, delivering integrated IoT connectivity and enhanced part-load efficiency, and Kaishan USA’s introduction of two-stage rotary screw compressors featuring advanced intercooling architecture. These strategic moves underscore a market-wide pivot toward solutions that blend hardware innovation with predictive service models to maximize uptime and energy savings.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil Free Air Compressors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerzener Maschinenfabrik GmbH

- Air Squared, LLC

- Airpol Sp. z o.o.

- Anest Iwata Motherson Pvt. Ltd

- Atlas Copco AB

- BOGE Anlagenbau GmbH & Co. KG

- Busch Vacuum Solutions

- Dalgakiran Compressor

- Denair Energy Saving Technology (Shanghai) PLC

- Elgi Equipments Limited

- Frank Technologies Private Limited

- Fusheng Co., Ltd.

- Hanwha Power Systems Co., Ltd.

- Hitachi Ltd.

- Hubei Teweite Power Technology Co.,Ltd.

- Ingersoll Rand Inc.

- Kaeser Compressors, Inc.

- Kaishan Machinery Co., Ltd.

- KOBELCO COMPRESSORS CORPORATION

- Mehrer Compression GmbH

- Neuman & Esser Group

- Rolair Systems

- Shanghai Screw Compressor Co., Ltd.(SCR)

- Sullivan-Palatek Inc.

- Sundyne, LLC

- Venus Compressors Private Limited

- Werther International Inc.

- Zen Air Tech Pvt. Ltd.

Actionable Recommendations for Industry Leaders to Navigate Disruptions Leverage Emerging Technologies and Strengthen Competitive Positions

To thrive amid evolving regulations, tariff pressures, and technological disruptions, industry leaders should accelerate investment in localized manufacturing footprints. Establishing assembly or fabrication hubs in tariff-exempt regions such as within USMCA or ASEAN will reduce exposure to import duties and shorten lead times, enabling more competitive pricing and resilient supply chains. This strategy should be complemented by long-term supply agreements with regional steel and alloy producers to hedge against raw material cost volatility.

Simultaneously, companies must double down on R&D for energy-optimized oil-free technologies, including advanced VSD control algorithms, magnetic bearing integration, and next-gen composite air-end materials. Partnering with IoT and AI specialists will facilitate the rollout of predictive maintenance platforms that extend service intervals and offer value-added diagnostics. By packaging equipment sales with tiered service-as-a-subscription models, manufacturers and distributors can secure recurring revenue while delivering performance guarantees that resonate with end-user capex and sustainability mandates.

Outlining a Robust Research Methodology Integrating Primary Interviews Secondary Data Analysis and Rigorous Validation Techniques

Our research framework was built on a multi-layered approach integrating primary and secondary data sources to ensure depth and rigor. Primary research comprised in-depth interviews with over 25 senior executives across OEMs, distributors, and end users in key industries such as pharmaceuticals, food & beverage, and energy. These discussions provided qualitative context on procurement strategies, technology adoption timelines, and service expectations that shaped our analysis.

Secondary research involved comprehensive review of annual reports, regulatory filings, technical white papers, and industry association data to quantify historical trends, segmentation performance, and regional dynamics. Trade journals, patent databases, and technical standards documentation informed the evaluation of emerging technologies and product roadmaps.

Rigorous triangulation and validation steps were applied throughout, cross-referencing primary insights with secondary evidence and third-party publications. A Delphi panel of subject-matter experts further reviewed preliminary findings to refine assumptions and ensure analytical accuracy. This methodology delivers a balanced, fact-based view of the oil-free air compressor market, supporting informed decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil Free Air Compressors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil Free Air Compressors Market, by Product Type

- Oil Free Air Compressors Market, by Stage

- Oil Free Air Compressors Market, by Usability

- Oil Free Air Compressors Market, by Cooling Method

- Oil Free Air Compressors Market, by Power Source

- Oil Free Air Compressors Market, by Speed Type

- Oil Free Air Compressors Market, by Power Rating

- Oil Free Air Compressors Market, by Pressure Range

- Oil Free Air Compressors Market, by End User

- Oil Free Air Compressors Market, by Sales Channel

- Oil Free Air Compressors Market, by Region

- Oil Free Air Compressors Market, by Group

- Oil Free Air Compressors Market, by Country

- United States Oil Free Air Compressors Market

- China Oil Free Air Compressors Market

- Competitive Landscape

- List of Figures [Total: 22]

- List of Tables [Total: 2385 ]

Drawing Key Conclusions on Market Evolution Strategic Imperatives and Future Outlook for Oil-Free Air Compressors Across Industries

The oil-free air compressor market is poised for continued expansion, driven by ongoing digitalization, stringent purity standards, and sustainability imperatives. Technological advances in VSD controls, IoT-enabled monitoring, and advanced compression materials are converging to deliver systems that combine high performance with low environmental impact. Regional dynamics will remain differentiated, with Asia-Pacific leading on volume growth, EMEA focusing on regulatory compliance and emissions reduction, and the Americas balancing energy efficiency incentives with tariff-induced cost management. �Success in this market will hinge on a dual focus: localizing manufacturing and supply chains to mitigate trade risks, while layering in digital service offerings to capture life-cycle value and foster deeper end-user partnerships. Integrated strategies that blend hardware innovation, predictive maintenance, and strategic alliances will define the leading players of tomorrow.

Take the Next Step in Optimizing Your Operations by Securing Comprehensive Insights from Our Executive-Level Oil-Free Air Compressor Report

If you’re ready to leverage deep insights into market dynamics, competitive landscapes, and strategic imperatives within the oil-free air compressor industry, please reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Ketan can guide you through the full suite of research deliverables, answer detailed questions about the report’s methodologies and findings, and discuss tailored licensing options to suit your organization’s needs. Secure your copy today and arm your team with the actionable intelligence required to drive growth, optimize procurement strategies, and outpace the competition in a market defined by performance, purity, and sustainability.

- How big is the Oil Free Air Compressors Market?

- What is the Oil Free Air Compressors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?