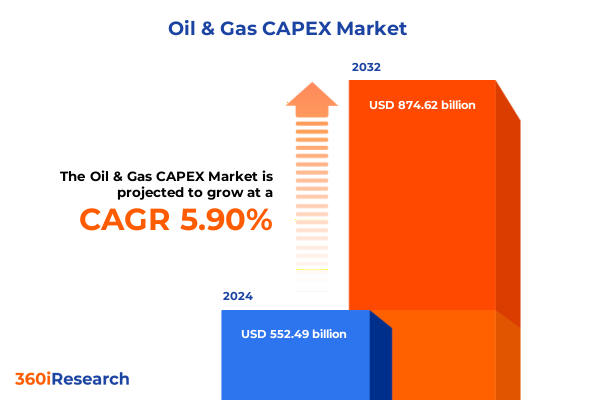

The Oil & Gas CAPEX Market size was estimated at USD 583.10 billion in 2025 and expected to reach USD 616.28 billion in 2026, at a CAGR of 5.96% to reach USD 874.62 billion by 2032.

A comprehensive overview of capital expenditure dynamics reshaping the oil and gas industry amid shifting energy demands and regulatory landscapes

The oil and gas industry today stands at a pivotal crossroads where capital expenditure decisions determine not only operational continuity but also long-term competitiveness. As energy demand patterns shift in response to global decarbonization goals, companies are compelled to reassess traditional spending priorities and embrace more dynamic investment frameworks. Infrastructure integrity and reliability remain non-negotiable, yet the need for agile responsiveness to regulatory, environmental, and technological disruptions has never been greater.

In this context, capital allocation extends beyond conventional project execution; it encompasses a holistic view of asset lifecycles, supply chain robustness, and digital transformation imperatives. Senior executives must evaluate trade-offs between sustaining legacy systems and pioneering next-generation solutions, all while navigating cost pressures and stakeholder mandates for sustainability. Maintaining clear visibility into expenditure drivers and aligning them with corporate strategic objectives is essential to foster resilience and drive value creation across fluctuating market conditions.

By establishing transparent governance structures, integrating real-time data analytics, and prioritizing cross-functional coordination, organizations can fortify their investment rationale and swiftly pivot in response to external shocks. This introduction lays the groundwork for understanding how evolving industry forces are reshaping the contours of capital deployment in oil and gas, setting the stage for a deeper exploration of the transformative shifts, tariff impacts, segmentation insights, and regional nuances that follow.

Exploring transformative technological environmental and geopolitical shifts redefining capital investments in oil and gas operations by 2025

The capital expenditure landscape in oil and gas is undergoing a seismic transformation driven by a convergence of technological breakthroughs, policy realignments, and evolving stakeholder expectations. First, the acceleration of digitalization-including artificial intelligence enables predictive maintenance, reduces unscheduled downtime, and improves decision-making through advanced analytics. Simultaneously, automation technologies from robotics to remote monitoring are optimizing field operations, minimizing personnel risks, and enhancing resource efficiency. As a result, traditional capex allocations toward brute asset expansion are increasingly balanced by investments in smart infrastructure and data-driven capabilities.

Second, sustainability mandates and net-zero commitments are catalyzing a shift toward low-carbon projects. Renewable integrations, carbon capture retrofits, and electrification of on-site equipment are now fundamental components of capital planning. This paradigm shift requires companies to embed environmental performance metrics within their financial appraisal processes, ensuring that every dollar invested contributes to both operational goals and decarbonization targets.

Third, geopolitical volatility and supply chain disruptions have elevated the importance of strategic resilience. Trade restrictions, tariffs, and regional conflicts can impede equipment imports, delay project timelines, and inflate costs. Consequently, executives are diversifying supplier portfolios, establishing local fabrication hubs, and reevaluating long-term sourcing contracts to safeguard against interruptions.

Finally, changing market structures-driven by fluctuating commodity prices, new entrants, and evolving consumption patterns-are prompting organizational agility. Flexible contracting models, phased development approaches, and integrated asset management strategies are now critical to absorb market shocks and safeguard investment returns. These transformative shifts collectively redefine how capital is prioritized, governed, and optimized for the future of oil and gas.

Assessing the cumulative repercussions of United States tariffs implemented in 2025 on global oil and gas investment strategies and supply chain resilience

In 2025, a suite of U.S. tariffs targeting steel, aluminum, and select energy-related equipment has introduced significant headwinds for global capital investment strategies. The tariff regime, expanding beyond its 2018 origins, now encompasses specialty alloys and high-precision components used in drilling systems, pipeline fabrication, and refining infrastructure. These measures have driven up procurement costs, prompting companies to reassess tender specifications and explore alternative sourcing corridors.

The cumulative effect has been twofold: procurement budgets have tightened as material surcharges escalate, and project schedules face heightened uncertainty due to extended lead times. Fabricators and equipment vendors, grappling with elevated input costs, are renegotiating contracts and seeking exemptions or tariff engineering strategies to mitigate financial burdens. Midstream operators and EPC contractors have responded by increasing local content thresholds, investing in regional manufacturing partnerships, and accelerating domestic fabrication capacity expansions.

Moreover, the ripple effects on global supply chains have underscored the need for portfolio diversification. Firms referencing U.S. tariff classifications are layering contingency buffers into their capex projections, reconfiguring logistics routes, and bolstering inventory management protocols to reduce exposure to unpredictable policy shifts. While some costs can be recouped through long-term service agreements and optimized procurement models, the immediate reality is that project economics require recalibration to maintain viability under the new tariff landscape.

Looking ahead, companies that proactively engage with policy stakeholders, leverage trade-compliance expertise, and integrate adaptive procurement strategies will be better positioned to navigate the evolving tariff environment without compromising their strategic growth ambitions.

Unveiling critical segmentation insights across capex types products streams technologies and end uses driving strategic allocation decisions

The diverse spectrum of investment needs across the oil and gas value chain underscores the importance of nuanced segmentation insights for effective resource allocation. When scrutinizing spending patterns based on capex type-including Brownfield Modification, Decommissioning, Maintenance & Turnaround, and New Field Development-it becomes apparent that maintenance activities dominate short-term budgets to ensure reliability of aging assets, while strategic allocations toward new field development signal a focus on long-term growth potential.

A parallel examination based on product differentiation between Crude Oil and Natural Gas reveals shifting emphasis: gas-oriented projects are attracting more investment due to their favorable emissions profiles and growing role in power generation and industrial feedstocks. Within this framework, natural gas infrastructure expansions often secure higher priority funding, reflecting broader energy transition goals.

Disaggregating by stream type shows that downstream investments in Distribution, Petrochemicals, and Refining are tailored to meet evolving consumer and industrial demand, driving upgrades to enhance product quality and environmental performance. Midstream capital, spanning Processing, Storage, and Transportation, prioritizes capacity optimization and digital integration to improve throughput efficiency. In the upstream domain, Drilling and Exploration budgets are progressively allocated toward high-complexity, deepwater, and unconventional plays, where technology innovations can unlock incremental reserves with lower break-even costs.

Technology-based segmentation-focused on Drilling, Processing, and Production-highlights the need for advanced equipment and process controls, particularly in high-pressure, high-temperature environments. Investment in next-generation drill bits, subsea processing units, and modular production systems is reshaping field development strategies.

Assessing capex through the lens of end-user industry shows that Industrial applications, such as Manufacturing and Power Generation, drive substantial upstream and midstream investments, whereas Transportation uses-Automotive, Aviation, and Maritime-fuel long-term demand expectations, influencing downstream and logistical capital priorities. Finally, the dichotomy between Offshore and Onshore projects shapes cost structures, regulatory requirements, and risk profiles. Offshore developments demand larger initial outlays and extended lead times but often offer access to high-quality reserves, while onshore ventures provide faster returns and lower logistical complexity. Together, these segmentation dimensions guide decision-makers in channeling resources where they best align with operational objectives and strategic aspirations.

This comprehensive research report categorizes the Oil & Gas CAPEX market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Capex Type

- Product

- Stream Type

- Technolog

- End-User Industry

- Location

Illuminating contrasting regional investment priorities across the Americas Europe Middle East Africa and Asia Pacific energy infrastructure landscapes

Regional investment strategies in oil and gas CAPEX reflect distinct economic imperatives, regulatory frameworks, and resource endowments across the Americas, Europe Middle East & Africa, and Asia Pacific. In the Americas, shale plays and tight oil formations continue to attract robust capital allocations, buoyed by established midstream networks and supportive fiscal regimes. Investment emphasis here is on enhancing recovery through well optimization, high-precision drilling, and digital field management tools that maximize production efficiency and cost control.

Conversely, Europe Middle East & Africa investments are bifurcated between mature basin revitalization and new exploration frontiers. In Western Europe, retrofit projects aimed at reducing environmental footprints and complying with stringent emissions regulations lead spending activities, whereas in the Middle East and Africa, emphasis shifts to large-scale integrated developments, subsea expansions, and cross-border pipeline initiatives. These diverse priorities require flexible financing structures and strategic alliances between national oil companies and international operators.

Asia Pacific’s capital landscape is equally varied. Established LNG import markets in Japan and South Korea focus spend on regasification and storage capacity, while emerging economies in Southeast Asia prioritize offshore field expansions and upstream joint ventures to meet burgeoning energy demand. Additionally, China’s drive for energy security has triggered investments in both conventional upstream projects and midstream connectivity, reinforcing the strategic significance of regional supply corridors.

These regional insights underscore the necessity for tailored capital frameworks that account for local regulatory climates, resource characteristics, and end-user requirements. By aligning investment strategies with regional priorities, companies can optimize resource allocation, enhance project returns, and foster resilient growth across geographies.

This comprehensive research report examines key regions that drive the evolution of the Oil & Gas CAPEX market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining leading industry participants’ strategic positioning innovation partnerships and operational excellence in oil and gas capital programs

A deep dive into industry participants’ activities illustrates how leading companies are positioning their capital agendas for maximum impact. Integrated supermajors are leveraging their scale to invest in multi-segment portfolios that balance upstream resource acquisitions with downstream processing expansions. These entities prioritize high-margin assets and strategic partnerships to spread risk and accelerate access to emerging resource plays.

National oil companies continue to dominate resource control in key producing regions, channeling funds toward national development goals and local content programs. Their CAPEX strategies often prioritize infrastructure self-sufficiency and capacity building, reinforcing energy security objectives while stimulating domestic industries.

Independent operators and E&P specialists have adopted leaner models, focusing on high-return unconventional projects and deepwater opportunities. By embracing digital field optimization and precision drilling techniques, these players extract value from complex reservoirs with more capital discipline, delivering attractive cash flows even under volatile price environments.

Service providers and equipment manufacturers are also reshaping the capex landscape through solution-based offerings. They create end-to-end project delivery platforms that integrate engineering, procurement, and construction expertise, supplemented by digital asset management services. Such partnerships allow operators to offload execution risk and secure performance guarantees, aligning incentives across the supply chain.

Collectively, these strategic moves illustrate a broader industry trend toward collaboration, technological integration, and portfolio diversification, as leading companies refine their capital deployment strategies to thrive in an increasingly complex and decarbonizing sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Gas CAPEX market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adani Green Energy Limited

- Air Liquide S.A.

- Air Products and Chemicals, Inc.

- Apple Inc.

- Aramco Group

- AT&T Inc.

- Barrick Gold Corp

- BERKSHIRE HATHAWAY INC.

- BP PLC

- Chevron Corporation

- China Petroleum and Chemical Corporation

- ConocoPhillips Company

- ENEOS Group

- Exxon Mobil Corporation

- Indian Oil Corporation Limited

- Intel Corp.

- Laurus Labs Limited

- Maire Tecnimont S.p.A.

- META PLATFORMS, INC

- Microsoft Corporation

- Neste Corporation

- Norsk e-Fuel AS

- Nvidia Corporation

- Osaka Gas Co., Ltd.

- PetroChina Company Limited

- PetroSA

- Petróleo Brasileiro S.A.

- QatarEnergy

- Reliance Industries Limited

- Repsol S.A.

- Royal Dutch Shell plc

- Samsung Electronics Co., Ltd.

- Sasol Limited

- Saudi Arabian Oil Company

- Shell PLC

- Teck Resources Ltd.

- TotalEnergies SE

- Toyota Motor Corporation

- Uniper SE

- Verizon Communications Inc.

- Volkswagen Aktiengesellschaft

Actionable recommendations empowering industry leaders to optimize capital deployment mitigate risks and accelerate sustainable growth trajectories

To navigate the evolving capital expenditure environment effectively, industry leaders should adopt a suite of pragmatic actions designed to enhance agility and resilience. First, embedding digital twin and predictive analytics across critical assets will enable real-time performance monitoring and proactive maintenance planning, significantly reducing unplanned downtime and total lifecycle costs.

Second, establishing flexible contracting models with suppliers and EPC partners can insulate projects from price volatility and supply chain disruptions. By negotiating performance-based clauses and dynamic pricing adjustments, companies can align incentives to drive on-time delivery and cost containment.

Third, championing strategic alliances with technology innovators and academic institutions can accelerate the development of low-carbon solutions, such as advanced CO₂ capture systems and electrification modules. These collaborations foster knowledge exchange, de-risk pilot deployments, and position companies at the forefront of decarbonization efforts.

Fourth, enhancing procurement resilience through regional supplier diversification and localized manufacturing capacity reduces dependence on single-source imports and mitigates exposure to tariff changes. A robust supplier qualification program that emphasizes financial health, compliance history, and technological capabilities further strengthens supply chain security.

Finally, augmenting capital planning frameworks with scenario-based stress testing allows executives to evaluate investment portfolios under varying commodity price paths, regulatory shifts, and technological adoption rates. This forward-looking approach ensures that capital deployment remains aligned with corporate strategy, regulatory obligations, and stakeholder expectations, ultimately driving sustainable value creation.

Detailing the rigorous research methodology combining primary expert engagement secondary data analysis and robust validation processes

This analysis leverages a rigorous research methodology, integrating structured primary engagements with industry veterans and subject-matter experts alongside extensive secondary data review. Expert interviews included senior executives from operators, service providers, and regulatory bodies, providing first-hand perspectives on capital allocation trends and decision-making criteria.

Secondary research encompassed public disclosures, technical papers, trade journals, and policy documents to ensure comprehensive coverage of technological advancements, tariff developments, and regional investment drivers. Proprietary databases and process benchmarking studies were consulted to identify emerging patterns in spending allocations and supplier performance metrics.

Data triangulation techniques were applied to reconcile insights from diverse sources, strengthening the validity of findings. Quantitative inputs were cross-verified through back-testing against historical project outcomes, while qualitative observations were refined through iterative stakeholder workshops.

A validation process, including peer review by independent experts, ensured that conclusions reflect both operational realities and strategic imperatives. This robust methodological approach underpins the credibility of the insights and recommendations presented throughout the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Gas CAPEX market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Gas CAPEX Market, by Capex Type

- Oil & Gas CAPEX Market, by Product

- Oil & Gas CAPEX Market, by Stream Type

- Oil & Gas CAPEX Market, by Technolog

- Oil & Gas CAPEX Market, by End-User Industry

- Oil & Gas CAPEX Market, by Location

- Oil & Gas CAPEX Market, by Region

- Oil & Gas CAPEX Market, by Group

- Oil & Gas CAPEX Market, by Country

- United States Oil & Gas CAPEX Market

- China Oil & Gas CAPEX Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1908 ]

Concluding perspectives synthesizing key findings implications and future directions for capital expenditure in the evolving oil and gas sector

The evolving oil and gas capital expenditure landscape demands a delicate balance between sustaining legacy operations and investing in future-proof technologies. As digitalization, sustainability mandates, and geopolitical dynamics continue to reshape investment priorities, organizations must cultivate adaptive frameworks that reconcile cost efficiency with resilience.

Segmentation insights reveal that tailoring capex strategies to specific project types, product lines, operational streams, technological levers, end-use applications, and geographic contexts is critical for maximizing returns. Likewise, regional nuances-from shale optimization in the Americas to low-carbon retrofits in Europe Middle East & Africa and upstream expansions in Asia Pacific-underscore the importance of localized decision criteria.

The impact of U.S. tariffs in 2025 serves as a reminder that policy shifts can rapidly alter cost structures and supply chain configurations, necessitating agile procurement and scenario planning. Leading companies that deploy innovative contracting models, forge strategic partnerships, and prioritize digital and sustainability investments are best positioned to thrive amid uncertainty.

Looking forward, the integration of advanced analytics, low-carbon technologies, and resilient sourcing strategies will define the next phase of capital deployment. Organizations that embrace these imperatives can unlock new value avenues, manage risk proactively, and secure competitive advantage in a dynamic energy ecosystem.

Engage with Associate Director of Sales Marketing Ketan Rohom to access the full in-depth report and unlock strategic capital investment intelligence

To gain immediate access to the comprehensive report that unpacks the latest capital investment trends, strategic insights, and risk mitigation frameworks, reach out directly to Associate Director of Sales & Marketing Ketan Rohom. With a deep understanding of evolving energy sector priorities and a proven track record of guiding industry leaders to informed decisions, Ketan can arrange a personalized briefing or provide a detailed proposal tailored to your organization’s specific needs. Don’t miss the opportunity to leverage this authoritative analysis to refine your CAPEX strategies and secure a competitive edge in tomorrow’s oil and gas landscape.

- How big is the Oil & Gas CAPEX Market?

- What is the Oil & Gas CAPEX Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?