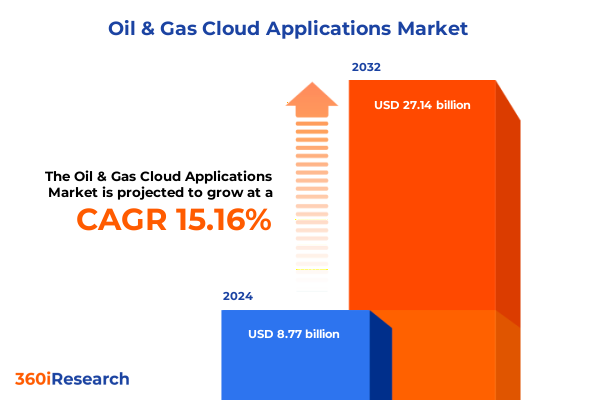

The Oil & Gas Cloud Applications Market size was estimated at USD 10.12 billion in 2025 and expected to reach USD 11.67 billion in 2026, at a CAGR of 15.13% to reach USD 27.14 billion by 2032.

How Industry Leaders Are Embracing Cloud Technologies to Drive Operational Resilience, Efficiency, and Sustainable Growth

The oil and gas industry is undergoing an unprecedented wave of digital transformation as companies pivot from traditional on-premises systems to cloud-based solutions. Over the past two years, energy executives have accelerated cloud adoption, recognizing that rapid scalability and advanced analytics are critical to optimizing production and reducing operational risk. Data modernization initiatives, once focused primarily on cost reduction, now serve as a catalyst for innovation, enabling remote monitoring of wells and pipelines, real-time decision-making, and integration of emerging technologies such as artificial intelligence and digital twins. Furthermore, the imperative to address workforce skill gaps has elevated continuous learning as an enterprise priority, with companies investing heavily in cloud-based training platforms to foster the agility needed to harness new capabilities. Building upon this, industry stakeholders are discerning about which cloud technologies to integrate, balancing core infrastructure upgrades with pilot deployments of AI-driven tools. As a result, oil and gas organizations are recalibrating their digital roadmaps to emphasize resilience and sustainability alongside efficiency, laying the groundwork for transformative gains in the years ahead.

Exploring the Paradigm Shifts in Hybrid Cloud Adoption, IoT Integration, AI-Driven Analytics, and Cybersecurity Safeguards

The oil and gas landscape has been reshaped by several transformative shifts, each accelerating the industry’s digital journey. First, hybrid cloud adoption has emerged as a cornerstone strategy, enabling companies to combine the security of private clouds for sensitive well logs and compliance data with the elastic compute power of public clouds for analytics and big data projects. This flexible approach has reduced capital expenditures while maintaining stringent data governance. Second, the integration of industrial IoT devices has created a live feedback loop between field assets and central operations centers, allowing for predictive maintenance that minimizes unplanned downtime and maximizes asset performance. Third, the rise of AI and machine learning in cloud environments is revolutionizing reservoir modeling and drilling optimization; machine-driven algorithms sift through massive geological data sets to forecast well productivity and optimize fracking parameters in near real time. Fourth, digital twins hosted in the cloud are now rendering virtual replicas of offshore platforms and pipeline networks, granting engineers the ability to simulate scenarios and improve safety measures without risking personnel or equipment. Finally, security frameworks embedded within cloud platforms are evolving to counter sophisticated cyber threats, leveraging advanced encryption, identity-based access controls, and continuous monitoring to safeguard critical infrastructure. Together, these shifts represent a holistic evolution in how oil and gas companies harness the cloud to unlock new levels of performance and reliability.

Analyzing the Multifaceted Impact of 2025 U.S. Tariff Adjustments on Cloud Infrastructure Costs, Supply Chain Resilience, and Procurement Timelines

In 2025, U.S. tariffs on imported hardware components have introduced a new dimension of cost and supply chain complexity for cloud service providers and enterprise consumers alike. Tariffs on servers, storage arrays, and networking equipment have elevated hardware acquisition expenses by 10 to 20 percent, compelling providers to either absorb the costs or pass them onto customers through adjustments to service pricing models. Simultaneously, potential levies on semiconductor wafers and assembled chips threaten to further disrupt the procurement of GPUs and specialized AI accelerators, central to the high-performance workloads that underpin predictive maintenance and advanced analytics. These increased outlays have led to project timelines stretching by an average of 20 to 30 percent, as procurement teams grapple with extended lead times and the need to qualify alternative suppliers in regions such as Southeast Asia and Mexico. Cloud operators are responding by exploring inventory buffer strategies, investing in domestic manufacturing partnerships, and re-evaluating refresh cycles to extend the lifespan of existing infrastructure. The net effect is a more resilient, albeit costlier, ecosystem that demands agile sourcing strategies and transparent cost management to safeguard digital transformation roadmaps.

Integrating Diverse Cloud Application Segments Across Asset Management, Service Models, and End-User Operational Domains

The cloud applications landscape in oil and gas is delineated by several key segments that each address distinct operational needs. In field operations, solutions range from comprehensive asset management platforms-encompassing inventory control and predictive maintenance-to field force management tools that optimize workforce deployment. Monitoring and analysis applications leverage real-time data streams to support safety and security protocols, while supply chain management systems orchestrate logistics and procurement. From a service model perspective, infrastructure as a service underpins compute and storage needs, platform as a service accelerates application development, and software as a service delivers pre-configured, scalable applications-either general purpose or tailored to industry-specific workflows. These layered delivery models allow organizations to select the optimal balance of control and simplicity. Meanwhile, end users across upstream exploration, midstream transportation, and downstream refining increasingly rely on cloud-native capabilities to unify data silos, ensure regulatory compliance, and enhance collaboration among cross-functional teams. This convergence of application types, service models, and user profiles drives the evolution of holistic cloud ecosystems tailored to the complexities of oil and gas operations.

This comprehensive research report categorizes the Oil & Gas Cloud Applications market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Model

- Application

- End User

Dissecting Regional Nuances in Cloud Strategy Driven by Infrastructure Maturity, Regulatory Imperatives, and Market Expansion Dynamics

Regional dynamics play a defining role in the adoption and application of cloud technologies across the oil and gas value chain. The Americas continue to lead the charge, with advanced IT infrastructure and deep integration of digital oilfield initiatives fostering a mature ecosystem of scalable cloud solutions. In contrast, Europe, Middle East & Africa have seen their cloud deployments shaped by stringent regulatory environments and a growing emphasis on sustainability, driving demand for platforms that facilitate emissions monitoring and environmental reporting. Asia-Pacific stands out for its rapid expansion of exploration and production activities, underpinned by government incentives and significant investment in emerging markets, which together have accelerated cloud platform rollouts for real-time monitoring and risk mitigation. These regional nuances illustrate how localized policy frameworks, economic priorities, and infrastructure maturity converge to inform cloud strategies, enabling operators to tailor their technology roadmaps for maximum impact in diverse operating contexts.

This comprehensive research report examines key regions that drive the evolution of the Oil & Gas Cloud Applications market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Alliances and Innovative Cloud Solutions Delivering AI-Driven Optimization, Serverless Architectures, and High-Performance Computing

Leading technology providers have forged strategic partnerships and developed specialized offerings to meet the unique requirements of oil and gas operators. Amazon Web Services powers ExxonMobil’s DPH collaboration platform, enabling serverless architectures and multiregion databases that support thousands of global users in capital project workflows, all while ensuring enterprise-grade security and compliance. Microsoft Azure has teamed with Ambyint to deliver AI-driven artificial lift optimization, leveraging IoT Hub, Kubernetes services, and real-time analytics to increase production efficiency and reduce operating expenses across North American basins. Google Cloud’s collaboration with Schlumberger to host its DELFI cognitive E&P environment exemplifies cloud-native innovation, providing high-performance computing and scalable data lakes for seismic processing, reservoir modeling, and field development planning. Meanwhile, IBM’s suite of AI and analytics solutions is accelerating predictive maintenance, supply chain optimization, and sustainability reporting through its integrated consulting services and cloud-native platforms, achieving measurable uptime and asset utilization improvements in upstream, midstream, and downstream operations. These strategic alliances underscore how cloud service providers and system integrators are co-creating value by embedding industry expertise into robust, secure, and scalable platforms.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Gas Cloud Applications market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- Alibaba Group Holding Limited

- Amazon Web Services, Inc.

- Aspen Technology, Inc.

- Baker Hughes Company

- Bentley Systems, Inc.

- Capgemini S.A.

- Dassault Systèmes SE

- Google LLC

- HCL Technologies Limited

- Hewlett Packard Enterprise

- Honeywell International Inc.

- IFS AB

- Infor, Inc.

- International Business Machines Corporation

- Microsoft Corporation

- Oracle Corporation

- Palantir Technologies Inc.

- PetroCloud LLC

- PetroDE

- Quorum Software

- RiskEdge Solutions

- Sage Software Solutions

- Salesforce Inc.

- SAP SE

- Schneider Electric SE

- TIBCO Software Inc.

- WellEz Information Management LLC

- Workday, Inc.

Strategic Imperatives for Executives to Foster Talent, Fortify Supply Chains, and Strengthen Governance in Cloud-First Operations

To capitalize on the full potential of cloud applications, industry leaders should prioritize strategic talent development, supply chain diversification, and robust governance frameworks. First, establishing a continuous learning culture will equip technical and operational teams with the capabilities to deploy, secure, and optimize cloud platforms; targeted training programs and cloud-native certifications should be integrated into performance plans. Second, proactive vendor diversification and localized sourcing strategies will mitigate tariff-related disruptions; organizations must cultivate partnerships across multiple manufacturing hubs and explore domestic production initiatives to maintain equipment availability. Third, adopting a cloud-first architecture principle will standardize infrastructure and accelerate the migration of legacy systems, while enabling better interoperability and scalable consumption models. Fourth, embedding comprehensive cybersecurity and compliance guardrails-such as zero-trust network segmentation and immutable logging-will safeguard critical operations against evolving threats and ever-stricter regulatory requirements. Finally, leveraging cross-industry consortiums and data-sharing alliances can foster collective resilience, enabling refined best practices and streamlined compliance approaches that benefit the broader oil and gas community.

Robust Research Framework Leveraging Secondary Data Analysis, Executive Interviews, Quantitative Surveys, and Industry Case Studies

This research integrates both secondary and primary methodologies to ensure comprehensive and accurate insights. Secondary research involved an exhaustive review of industry publications, regulatory filings, technology whitepapers, and cloud service provider documentation to capture current trends, best practices, and vendor offerings. Primary research consisted of in-depth interviews with C-level executives, IT leaders, and field operations managers across upstream, midstream, and downstream segments to validate findings and uncover nuanced use cases. Quantitative data points were triangulated through global survey responses and historical project data, while qualitative inputs from expert panels provided contextual clarity on strategic priorities and implementation challenges. Additionally, case studies of leading oil and gas companies were analyzed to benchmark performance metrics and technology adoption roadmaps. The combination of these methodologies ensures that the conclusions and recommendations presented herein are grounded in both empirical evidence and industry expertise.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Gas Cloud Applications market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Gas Cloud Applications Market, by Service Model

- Oil & Gas Cloud Applications Market, by Application

- Oil & Gas Cloud Applications Market, by End User

- Oil & Gas Cloud Applications Market, by Region

- Oil & Gas Cloud Applications Market, by Group

- Oil & Gas Cloud Applications Market, by Country

- United States Oil & Gas Cloud Applications Market

- China Oil & Gas Cloud Applications Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Unifying Strategic Insights to Drive Measurable Gains in Efficiency, Resilience, and Sustainability Through Cloud Adoption

In summary, the oil and gas sector’s cloud journey is entering a phase of strategic maturity characterized by hybrid deployment models, AI-driven analytics, and a renewed focus on operational resilience. While the growth of cloud applications offers unparalleled opportunities for efficiency, safety, and sustainability, it also introduces complexities around cost management, supply chain resilience, and regulatory compliance. Navigating these challenges requires a holistic approach that aligns technology investments with talent development, governance frameworks, and regional market dynamics. By learning from pioneering implementations-such as serverless collaboration platforms and AI-powered optimization services-organizations can chart a clear roadmap toward digital agility. Ultimately, those who balance innovation with robust risk management will unlock sustainable competitive advantage in an increasingly data-driven energy landscape.

Secure Your Definitive Market Intelligence Directly From Our Expert and Propel Your Cloud Strategy to New Heights

Ready to equip your organization with the insights and strategic direction needed to lead in the rapidly evolving oil and gas cloud applications arena? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain your comprehensive market research report and unlock the full potential of cloud transformation for enhanced operational efficiency and competitive advantage.

- How big is the Oil & Gas Cloud Applications Market?

- What is the Oil & Gas Cloud Applications Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?