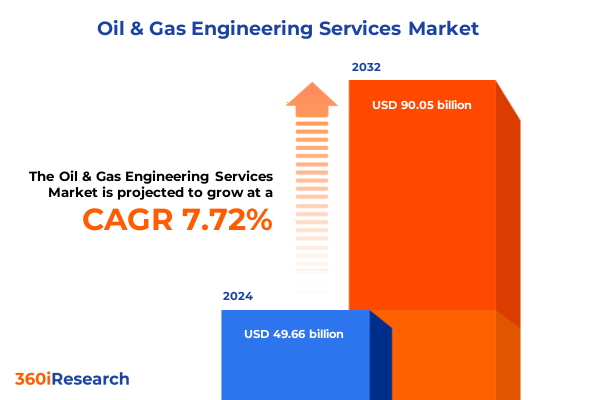

The Oil & Gas Engineering Services Market size was estimated at USD 53.32 billion in 2025 and expected to reach USD 57.29 billion in 2026, at a CAGR of 7.77% to reach USD 90.05 billion by 2032.

Understanding the Evolving Role of Engineering Services as the Backbone of Modern Oil & Gas Operations and Sustainable Energy Initiatives

The global imperative for reliable, efficient, and environmentally responsible energy supplies has elevated engineering services in oil and gas far beyond traditional design and construction roles. Today, this sector forms the backbone of exploration, production, transportation, and processing networks essential to meeting energy demand while navigating increasingly stringent environmental mandates. As operators and regulatory authorities intensify their focus on emissions reduction, safety enhancements, and cost containment, engineering firms are innovating at unprecedented speed to deliver integrated solutions that mitigate risk, optimize performance, and enable the energy transition.

Moreover, the convergence of digital technologies with conventional engineering disciplines has reshaped the expectations placed on service providers. Holistic design approaches that embed predictive maintenance, real-time monitoring, and advanced analytics are no longer optional add-ons; they have become fundamental to achieving project longevity and fiscal discipline. Consequently, organizations across the value chain are forging deeper partnerships with engineering specialists to co-develop solutions that address complex challenges ranging from reservoir management to carbon capture. As such, the introduction of this executive summary frames a landscape in which engineering services function as strategic enablers of both operational excellence and environmental stewardship.

Unprecedented Technological and Regulatory Shifts Redefining Oil & Gas Engineering Services from Digital Transformation to Decarbonization Strategies

The oil and gas engineering services landscape is undergoing a transformative realignment driven by four interrelated catalysts: digitalization, decarbonization, regulatory evolution, and capital discipline. Digitalization initiatives now permeate every phase of project life cycles, leveraging 3D modeling and simulation to eliminate design errors, employing automated drilling technologies to accelerate exploration, and integrating digital twin platforms coupled with AI-driven predictive maintenance to extend asset lifespans and reduce unplanned downtime. These technologies have proven instrumental in enhancing operational agility and reducing total cost of ownership.

Simultaneously, decarbonization has emerged as a strategic imperative, compelling service providers to integrate hydrogen and renewable energy capabilities with traditional hydrocarbon platforms. This shift is mirrored by heightened regulatory demands around greenhouse gas emissions and flaring, prompting the incorporation of specialized flare and emission systems design and the utilization of gas processing plant expertise to capture and valorize waste streams. Consequently, engineering firms are bundling carbon capture modules with conventional refining and petrochemical projects to deliver turnkey decarbonization solutions.

Amid these technological and environmental pressures, regulatory recalibrations-particularly in major markets-are reshaping compliance frameworks for offshore and onshore applications. Stringent safety regulations and evolving emissions standards necessitate continuous redesign of pipeline systems, storage facilities, and subsea interfaces. In response, the industry has witnessed a growing emphasis on modular, standardized engineering packages that facilitate regulatory approvals and expedite deployment across brownfield and greenfield sites. As pressure on capital intensifies, stakeholders are also demanding more flexible contracting models and transparent cost structures, reinforcing the trend toward lump-sum turnkey, cost-reimbursable, and time-and-material arrangements that align incentives and mitigate risk.

Assessing the Cumulative Impact of New United States Tariffs in 2025 on Equipment Costs Supply Chains and Project Viability Across Oil & Gas Engineering

In 2025, the United States enacted a suite of tariffs targeting imported steel, specialized drilling equipment, and critical instrumentation used throughout the oil and gas value chain. These measures have had a cumulative impact on project economics by elevating material costs, constraining supply chain flexibility, and prompting a strategic recalibration among both operators and engineering firms. The heightened duties on pipeline components and compressor station hardware have directly increased capital expenditure on new midstream infrastructure, while also complicating maintenance and upgrade projects in downstream facilities.

Beyond direct cost inflation, these tariffs have amplified lead times for imported goods, forcing project teams to explore domestic manufacturing partnerships or substitute alternative materials. As a result, engineering service providers have reengineered procurement strategies to secure supply chain resilience, often pre-qualifying multiple vendors and renegotiating contract terms to offset duty-induced price hikes. In parallel, the higher price of imported items has incentivized greater reliance on local content, which has driven increased collaboration with national oil companies and independent midstream operators seeking to reduce exposure to tariff volatility.

Furthermore, the ripple effects of tariffs extend to offshore platforms and subsea operations where key components-such as subsea well completion equipment and remote monitoring sensors-were traditionally sourced internationally. The necessity to adapt to higher domestic sourcing costs has accelerated investments in additive manufacturing and modular design, enabling rapid prototyping and localized production of bespoke parts. Collectively, these adaptations underscore how the 2025 tariff landscape has not only elevated cost pressures but also spurred innovative approaches to supply chain management and technology deployment within oil and gas engineering services.

Delving into Service Type Project Type Contractual Frameworks Technological Applications and End-User Demands for Comprehensive Segment-Level Insights

The oil and gas engineering services market can be further illuminated by analyzing the interplay of service type, project typology, contract structure, technological adoption, application environment, and end-user dynamics. Within downstream operations, specialized competencies such as flare and emission systems design, gas processing plant engineering, petrochemical plant engineering, and refinery design underscore the essential role of engineering disciplines in product quality optimization and regulatory compliance. Midstream projects demand expertise in compressor station design, pipeline engineering, storage facility design, terminal and port infrastructure engineering, as well as transportation systems engineering, reflecting the sector’s critical role in ensuring unbroken product flows and logistical efficiency.

Upstream activities, conversely, rely heavily on drilling and well engineering to unlock reserves, reservoir engineering and production engineering to maximize recovery, exploration support to identify new prospects, subsea engineering to facilitate deepwater operations, and well completion engineering to ensure safe production. Each of these service categories intersects with project types, whether brownfield expansions, greenfield developments, or decommissioning and abandonment initiatives, requiring tailored solutions for legacy asset optimization, new asset construction, or end-of-life dismantlement.

Contract types influence the risk and reward profiles across service engagements, with cost-reimbursable arrangements offering transparency in high-uncertainty contexts, lump-sum turnkey models providing budget certainty for greenfield expansions, and time-and-material contracts enabling rapid mobilization for maintenance and remediation tasks. Technology adoption, encompassing 3D modeling and simulation, automated drilling and robotics, digital twin and AI-based predictive maintenance, hydrogen and renewable energy integration, and IoT-enabled asset monitoring, serves as both a performance enabler and a differentiator among engineering firms. Moreover, the choice between offshore and onshore applications often affects regulatory complexity, environmental considerations, and community engagement strategies, while the end-user landscape-from government bodies and regulatory authorities to independent exploration and production companies, national oil companies, international oil companies, petrochemical manufacturers, pipeline operators, and refinery owners-drives demand for bespoke engineering offerings and performance guarantees.

This comprehensive research report categorizes the Oil & Gas Engineering Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Services Type

- Project Type

- Contract Type

- Technology Used

- Application

- End-user

Examining Geographic Nuances in Oil & Gas Engineering Services Across the Americas Europe Middle East Africa and Asia-Pacific Regions for Growth Drivers

Regional dynamics in oil and gas engineering services exhibit stark contrasts shaped by resource endowments, policy environments, and infrastructure maturity. In the Americas, abundant shale reserves and revitalized offshore exploration have fostered a dual focus on rapid well interventions in unconventional plays and large-scale midstream expansions. Regulatory frameworks in leading producer states have prioritized emissions reduction and pipeline safety, prompting a surge in upstream digitalization and gas processing plant modernization projects that integrate advanced monitoring and simulation tools.

Across Europe, the Middle East, and Africa, diverse market conditions range from the highly regulated North Sea arena, where decommissioning and asset integrity projects dominate, to the resource-rich nations of the Middle East leveraging engineering services to accelerate downstream petrochemical capacity and integrate hydrogen into existing networks. In sub-Saharan Africa, burgeoning offshore exploration projects drive demand for subsea engineering and floating production units, while regional authorities increasingly mandate local content and community engagement to maximize socioeconomic benefits.

The Asia-Pacific region continues to witness robust growth driven by gas-to-power initiatives, LNG terminal installations, and petrochemical expansions across Southeast Asia. Advanced economies in East Asia are emphasizing digital twin and AI-enabled asset monitoring to extend the operational lifespan of legacy secondary refining assets, whereas emerging markets in South Asia focus on greenfield refinery and pipeline projects to meet rising domestic energy demand. Throughout this region, engineering service providers are balancing the need for technology transfers with joint-venture structures to align with local regulatory imperatives and optimize capital utilization.

This comprehensive research report examines key regions that drive the evolution of the Oil & Gas Engineering Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Oil & Gas Engineering Service Providers and Innovators Shaping Industry Standards and Driving Competitive Differentiation Through Innovation

Leading engineering service providers have differentiated themselves through strategic investments in research and development, diversified service portfolios, and targeted alliances that enhance their ability to deliver turnkey solutions. Global giants known for their deep domain expertise and expansive geographic reach continue to set the pace by integrating next-generation technologies into conventional engineering frameworks, thereby enabling digital twin capabilities, AI-driven maintenance regimes, and hydrogen blending processes within traditional hydrocarbon environments.

A cadre of specialized mid-tier firms has emerged with niche competencies, focusing on high-value segments such as subsea well completion engineering, automated drilling robotics, and flare mitigation systems. These players often collaborate with equipment manufacturers to co-develop modular platforms that expedite on-site assembly and streamline lifecycle support. Additionally, consultancy-driven entities are leveraging data analytics to provide performance benchmarking and regulatory compliance advisory services, enhancing value for end-users especially in markets with stringent environmental oversight.

Smaller boutique companies have carved strategic positions by aligning closely with national oil companies and independent E&P operators, offering agile project execution models and local content expertise that complement the capacities of larger multinationals. These firms frequently employ cost-reimbursable or time-and-material contract structures to manage uncertainty in emerging-market developments, while also piloting renewable integration projects that set the stage for future hydrogen and carbon capture endeavors. Together, this tiered competitive landscape underscores the vital role of innovation, partnership networks, and operational flexibility in shaping provider distinctions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Gas Engineering Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aker Solutions ASA

- Baker Hughes Company

- Bechtel Corporation

- Chiyoda Corporation

- Element Materials Technology

- Fluor Corporation

- Halliburton

- Hatch Ltd.

- JGC Corporation

- John Wood Group PLC

- KBR Inc.

- L&T Technology Services

- Lloyd’s Register Group Limited

- M&H

- McDermott International, Ltd

- Petrofac Limited

- Quest Global

- SAIPEM SpA

- Schlumberger Limited

- Stress Engineering Services Inc.

- TechnipFMC plc

- Tetra Tech, Inc.

- Toyo Engineering Corporation

- Worley Limited

- WSP Global Inc.

Strategic Action Plans for Industry Leaders to Leverage Digitalization Sustainability and Supply Chain Resilience in Oil & Gas Engineering Services

Industry leaders should prioritize the rapid integration of digital twin and AI-based predictive maintenance platforms to anticipate equipment failures, optimize maintenance schedules, and reduce downtime. By embedding IoT-enabled asset monitoring within new and existing facilities, operators can harness real-time performance data to drive continuous improvement initiatives and unlock cost efficiencies across the asset life cycle.

In light of tariff-driven cost pressures, supply chain resilience must be fortified through diversified sourcing strategies and strategic partnerships with domestic fabricators. Organizations should evaluate long-term agreements that incentivize local manufacturing capabilities, thereby mitigating exposure to future tariff escalations and geopolitical disruptions. Concurrently, embracing modular design philosophies for compressor stations, pipeline segments, and subsea assemblies will accelerate project timelines and reduce capital intensity.

Sustainability imperatives demand that companies expand hydrogen and renewable integration into conventional oil and gas projects. Executives should commission pilot projects to validate the technical and economic viability of hydrogen blending within gas processing plants and refining complexes. Additionally, contract models ought to be recalibrated to align provider incentives with environmental performance targets, with performance-based clauses that reward carbon intensity reductions and emissions control enhancements.

Robust Research Methodology Integrating Primary Expert Consultations and Secondary Data Analytics to Ensure Unbiased Oil & Gas Engineering Market Intelligence

This research initiative was underpinned by a dual-phase methodology combining comprehensive primary interviews with industry stakeholders and rigorous secondary data analysis. The primary phase engaged senior executives, project engineers, technology vendors, and regulatory officials through structured conversations aimed at eliciting qualitative insights on evolving service models, technology adoption barriers, and regional market nuances.

In parallel, the secondary phase involved exhaustive examination of industry journals, regulatory filings, corporate annual reports, and relevant trade publications to validate emerging trends and cross-verify anecdotal observations. Data triangulation techniques were employed to reconcile discrepancies between stakeholder interviews and published sources, ensuring both depth and breadth in the final analysis.

Quantitative data, including project counts, equipment docket volumes, and patent filings related to digital twin, robotics, and renewable integration, were synthesized to provide a robust contextual framework without engaging in market sizing or share estimations. Throughout this process, strict adherence to ethical research standards and confidentiality agreements assured the integrity of findings, while continuous peer review by subject matter experts bolstered the report’s credibility and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Gas Engineering Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Gas Engineering Services Market, by Services Type

- Oil & Gas Engineering Services Market, by Project Type

- Oil & Gas Engineering Services Market, by Contract Type

- Oil & Gas Engineering Services Market, by Technology Used

- Oil & Gas Engineering Services Market, by Application

- Oil & Gas Engineering Services Market, by End-user

- Oil & Gas Engineering Services Market, by Region

- Oil & Gas Engineering Services Market, by Group

- Oil & Gas Engineering Services Market, by Country

- United States Oil & Gas Engineering Services Market

- China Oil & Gas Engineering Services Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesis of Key Findings Highlighting Critical Trends Challenges and Opportunities Guiding Decision-Makers in Oil & Gas Engineering Services Landscape

The collective analysis highlights a watershed moment in oil and gas engineering services, where technological innovation, regulatory complexities, and tariff-induced economic pressures converge to reshape the sector’s operating paradigm. Digital transformation initiatives such as 3D modeling, automated drilling, and AI-driven predictive maintenance have transitioned from pilot programs to mainstream expectations, underpinning asset reliability and operational efficiency.

Simultaneously, the escalation of United States tariffs in 2025 has underscored the critical importance of supply chain agility and domestic manufacturing alliances. Firms that proactively adapted to these headwinds through modular engineering designs and diversified vendor networks have demonstrated superior resilience.

Regionally, the Americas continue to capitalize on unconventional resources and digitalization, while Europe, the Middle East, and Africa navigate decommissioning imperatives alongside downstream expansion. In Asia-Pacific, the interplay of brownfield modernization and greenfield investments in LNG and petrochemicals signals robust future activity. Against this backdrop, leading service providers have differentiated through technology-enabled offerings and strategic partnerships, setting the stage for next-generation hydrogen and carbon capture solutions.

These collective insights furnish decision-makers with a nuanced understanding of sectoral inflection points, equipping them to align organizational strategies with prevailing industry dynamics and emergent value pools.

Empowering Executives to Make Informed Investments in Oil & Gas Engineering Solutions Through Direct Collaboration with Ketan Rohom Sales & Marketing Leader

As industry executives seek to capitalize on evolving opportunities, direct engagement with Ketan Rohom as a pivotal interlocutor offers a streamlined pathway to access comprehensive research insights, detailed service offerings, and tailored consultancy solutions geared to optimize project outcomes and strategic initiatives within the dynamic oil and gas engineering services sector. By connecting with Ketan Rohom, decision-makers can gain personalized guidance on integrating innovative engineering methodologies, clarify report nuances, and negotiate bespoke data packages that align precisely with organizational objectives.

This call-to-action underscores the value of collaboration between forward-thinking leaders and subject matter experts, ensuring that critical decisions regarding technology adoption, regulatory compliance strategies, and supply chain optimization are grounded in the latest market intelligence. The seamless process facilitated by Ketan Rohom embodies a commitment to thought leadership and operational excellence, empowering stakeholders to translate granular research findings into actionable plans that drive tangible results and sustainable competitive advantage.

- How big is the Oil & Gas Engineering Services Market?

- What is the Oil & Gas Engineering Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?