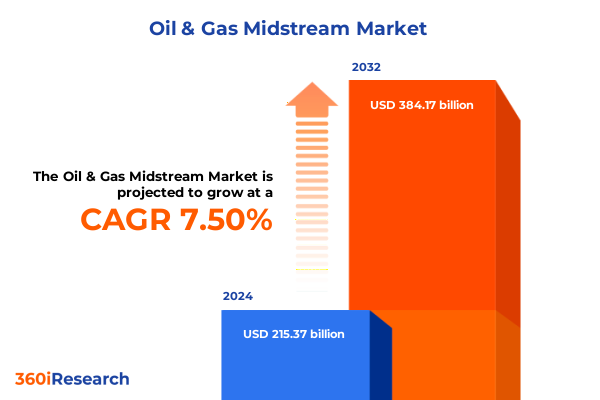

The Oil & Gas Midstream Market size was estimated at USD 230.93 billion in 2025 and expected to reach USD 247.62 billion in 2026, at a CAGR of 7.54% to reach USD 384.17 billion by 2032.

Envisioning a Resilient Oil and Gas Midstream Sector Through Unprecedented Geopolitical Shifts and Breakthrough Technological Innovations

The oil and gas midstream landscape is undergoing a period of profound evolution shaped by an interplay of geopolitical pressures, rapid technological breakthroughs, and shifting energy demands. As infrastructure expands and modernizes to address capacity constraints and environmental imperatives, stakeholders are compelled to reexamine traditional approaches to asset utilization and risk management. This introduction sets the stage for a comprehensive exploration of how these dynamics converge to redefine market priorities, influence capital allocation, and create opportunities for innovation.

Against a backdrop of fluctuating tariff regimes, new trade patterns, and an increasing emphasis on decarbonization, midstream operators find themselves navigating a complex maze of regulatory requirements and competitive threats. Advances in pipeline monitoring, digital twins, and predictive maintenance offer the promise of enhanced safety and operational efficiency, yet they also demand significant upfront investment and organizational change. Consequently, executives must balance short-term profitability with long-term resilience, while maintaining agility to pivot as external forces shift. Through this executive summary, we outline the critical levers that will shape midstream strategies in the coming years, providing decision-makers with the context needed to chart a sustainable path forward.

Tracing Critical Transformations Redefining Infrastructure, Operations, and Competitive Dynamics in the Midstream Oil and Gas Ecosystem

The midstream sector has experienced transformative shifts as emerging technologies and market realignments challenge established operational paradigms. Digitalization initiatives, from IoT-enabled sensors to advanced analytics platforms, are revolutionizing monitoring and control processes, enabling real-time visibility across sprawling pipeline networks and storage facilities. These developments not only reduce unplanned downtime and environmental risk but also open the door to new service offerings, such as condition-based maintenance and automated throughput optimization.

Simultaneously, the rise of renewable fuels and the transition toward low-carbon energy sources are prompting midstream companies to diversify their portfolios, venturing into hydrogen transport and bio-liquids logistics. Strategic partnerships and joint ventures are proliferating as incumbents collaborate with technology providers and new entrants to pilot novel infrastructure solutions. These alliances carry the potential to reshape competitive dynamics, with first-mover advantages accruing to those who successfully bridge traditional midstream capabilities with frontier technologies and integrated service models.

Examining the Aggregate Effects of 2025 United States Tariffs on Infrastructure Investment, Supply Chain Resilience, and Competitive Positioning

United States tariffs enacted in 2025 have exerted multifaceted effects on midstream operations, influencing everything from equipment procurement costs to cross-border trade volumes. The increased duties on pipeline components and compression units have elevated capital expenditures, prompting project developers to seek alternative supply chains or to renegotiate contract structures to mitigate margin erosion. This tariff environment has highlighted the fragility of long-standing procurement strategies and underscored the importance of supply chain diversification.

Moreover, tariffs have redistributed trade flows, incentivizing domestic manufacturing but also placing pressure on import-dependent service providers. Some midstream firms have accelerated plans to localize fabrication capabilities, while others have pursued tariff classification challenges and temporary exemptions. These maneuvers illustrate the sector’s resilience but also reveal the administrative and financial overheads associated with navigating a more protectionist trade landscape. As operators adjust their investment priorities, alignment between procurement teams, legal counsel, and strategic planners has become increasingly critical to maintain project timelines and cost targets.

Unraveling Comprehensive Segmentation Insights Spanning Diverse Product Categories Services Modes and End User Applications in Midstream

Deep segmentation analysis shows that midstream markets are influenced by a complex array of product categories, each exhibiting distinct demand drivers and logistical requirements. Heavy, light, and medium crude grades demand specialized handling and transport solutions, while associated gas, conventional gas, shale gas, and tight gas each carry unique processing and compression considerations. Liquid byproducts such as butane, ethane, and propane further complicate network balancing, requiring tailored storage and fractionation capabilities. Refined streams including diesel, gasoline, and jet fuel introduce additional constraints around terminal operations and environmental compliance.

Parallel segmentation by service highlights the necessity for end-to-end solutions encompassing offshore and onshore compression, floating and land-based liquefaction, fractionation and gas processing, as well as tank farms, terminals, and underground cavern storage. Transportation modes span barge and pipeline networks to rail, ships, and truck fleets, each with its own safety protocols and route optimization challenges. When analyzed by mode alone, coastal and river barges differ markedly from offshore and onshore pipelines in regulatory oversight and risk profiles, while carload rail and unit trains present logistics planning intricacies. The LNG carrier and tanker segments must be integrated with flatbed and tanker trucking to create cohesive multimodal corridors.

End user segmentation further enriches this landscape. Commercial users ranging from retail sites to transport hubs have unique throughput patterns, whereas industrial consumers in fertilizer, petrochemical, and refining sectors require uninterrupted supply. Power generation facilities, whether gas fired or oil fired, demand reliability and responsive dispatch capabilities, while residential markets depend on consistent delivery for cooking and heating. Together, these segmentation lenses illuminate nuanced demand pockets and reveal opportunities for value-add services that enhance asset utilization and customer satisfaction.

This comprehensive research report categorizes the Oil & Gas Midstream market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Product Transported

- Transportation Type

- End User

Highlighting Regional Market Nuances and Growth Drivers Across the Americas Europe Middle East Africa and Asia Pacific Territories

Regional market dynamics demonstrate that strategic initiatives must be tailored to local drivers and regulatory contexts. In the Americas, abundant shale reserves have catalyzed a sprawling infrastructure build-out, characterized by vast pipeline networks, export terminals, and gas processing facilities. Regulatory reforms and environmental scrutiny continue to shape project approvals, making stakeholder engagement and community outreach critical success factors. Investment in digital solutions to streamline permitting and compliance workflows is on the rise, reflecting the need for proactive governance.

Across Europe, the Middle East, and Africa, the interplay between mature pipeline systems and emerging cross-border corridors underscores a delicate balance between legacy infrastructure optimization and greenfield expansions. The region’s energy transition policies are accelerating the retrofit of existing assets for hydrogen and CO₂ transport, while geopolitical considerations call for diversified supply routes. Local content requirements and sovereign wealth fund partnerships often dictate project structures, driving collaboration between state-owned and private midstream operators.

In the Asia-Pacific arena, surging demand for natural gas and refined products has fueled growth in liquefaction, storage, and deepwater port facilities. The region’s archipelagic geography and rapidly evolving regulatory frameworks present both challenges and opportunities for operators willing to invest in agile logistics models. Tariff structures, power availability, and land-use regulations vary significantly across markets, motivating companies to adopt flexible commercial architectures that can pivot among multiple value chains.

This comprehensive research report examines key regions that drive the evolution of the Oil & Gas Midstream market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements Financial Fortitude and Collaborative Initiatives Among Leading Midstream Oil and Gas Enterprises Globally

Key players in the midstream space are demonstrating a blend of traditional strengths and forward-looking initiatives to secure competitive advantage. Many have leveraged their balance sheet capacity to pursue bolt-on acquisitions, integrating complementary assets such as storage terminals or LPG export facilities. Others have formed strategic alliances with technology firms to pilot digital twins, cybersecurity frameworks, and AI-driven maintenance programs, reducing unplanned downtime by preemptively identifying operational anomalies.

At the same time, partnerships between midstream operators and financial investors have unlocked new capital for infrastructure modernization. These joint ventures are targeting projects that align with sustainability goals, such as electrified compression stations and low-carbon fuels corridors. Collaboration between service providers and original equipment manufacturers is also on the rise, resulting in co-development agreements that expedite the commercial deployment of next-generation compressors, heat exchangers, and modular processing units. Across all initiatives, the ability to synthesize market intelligence with technological expertise is a key differentiator for leading enterprises.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Gas Midstream market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cheniere Energy

- DT Midstream

- Enbridge

- Energy Transfer

- EnLink Midstream

- Enterprise Products Partners

- Kinder Morgan

- MPLX

- ONEOK

- Pembina Pipeline

- Plains All American Pipeline

- Targa Resources

- TC Energy

- TC PipeLines

- Williams Companies

Translating Emerging Trends into Concrete Strategies to Enhance Operational Agility Sustainability and Market Competitiveness for Industry Leaders

Industry leaders should prioritize the integration of digital platforms that provide end-to-end visibility into asset performance, supply chain status, and regulatory compliance. By investing in scalable cloud architectures and standardized data schemas, organizations can more effectively harness advanced analytics to optimize throughput, reduce emissions, and manage risk. Cross-functional governance structures will ensure that digital roadmaps align with business objectives, promoting organizational buy-in and reducing deployment timelines.

Simultaneously, companies must embed sustainability into their core operational strategies. Pursuing low-carbon transportation corridors and investing in hydrogen or bio-liquid logistics will position organizations to capture emerging market segments while preempting regulatory constraints. Establishing transparent reporting frameworks and pursuing third-party certifications can bolster stakeholder confidence and unlock access to green financing instruments.

Finally, midstream executives should cultivate agile procurement ecosystems by diversifying supplier networks and exploring localized manufacturing partnerships. Flexible contracting mechanisms, such as modular procurement and build-to-order frameworks, will help mitigate the effects of tariff volatility and geopolitical disruptions. In conjunction with scenario-based strategic planning, these measures will enhance resilience and ensure that long-term capital projects remain on track.

Detailing Rigorous Methodological Approaches Employed to Ensure Robust Data Collection Analysis and Validation in Midstream Market Research

Our research methodology combines primary and secondary data sources to ensure a holistic view of the midstream sector. We conducted in-depth interviews with executives, technical experts, and regulatory authorities to capture firsthand insights into evolving operational challenges and strategic priorities. These qualitative inputs were triangulated with financial disclosures, industry whitepapers, and publicly available trade data to validate emerging themes and quantify impact drivers.

To segment the market, we employed a bottom-up approach, mapping asset fleets and throughput capacities across product types, service categories, and transportation modes. Geographic analysis leveraged proprietary GIS datasets and regional regulatory filings to identify corridor capacities, expansion plans, and potential bottlenecks. Statistical modeling was used to stress-test assumptions under multiple tariff and demand scenarios, providing robustness checks and sensitivity analyses.

Data validation consisted of iterative feedback loops with subject matter experts and cross-referencing with third-party databases to mitigate potential biases. The combination of rigorous qualitative research and quantitative modeling ensures that our findings accurately reflect the complexities of the global midstream landscape, delivering strategic clarity for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Gas Midstream market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Gas Midstream Market, by Service

- Oil & Gas Midstream Market, by Product Transported

- Oil & Gas Midstream Market, by Transportation Type

- Oil & Gas Midstream Market, by End User

- Oil & Gas Midstream Market, by Region

- Oil & Gas Midstream Market, by Group

- Oil & Gas Midstream Market, by Country

- United States Oil & Gas Midstream Market

- China Oil & Gas Midstream Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Path Forward for Stakeholders in the Oil and Gas Midstream Realm

In synthesizing our analysis, several strategic imperatives emerge. Digital transformation remains a catalyst for enhanced operational resilience, while sustainability drivers are reshaping long-term investment priorities. Tariff dynamics have underscored the importance of agile procurement and supply chain diversification, prompting operators to forge closer partnerships with local manufacturers and logistics providers. Region-specific nuances demand tailored approaches, with each territory presenting unique regulatory, environmental, and infrastructure considerations.

Moving forward, midstream stakeholders must balance the dual imperatives of modernization and cost control. Those companies that successfully integrate advanced technologies into standardized operating models and adapt their portfolios to low-carbon energy carriers will be best positioned to capture growth opportunities. By drawing on the segmentation and regional insights outlined herein, executives can develop targeted strategies that optimize asset utilization, strengthen competitive positioning, and drive sustainable returns.

Engage Directly with Associate Director Ketan Rohom to Unlock Exclusive Insights and Secure Access to the Comprehensive Midstream Market Report

To secure unparalleled insights into evolving midstream dynamics and position your organization at the forefront of strategic decision-making, reach out to Associate Director Ketan Rohom. His expertise in market intelligence and deep understanding of industry drivers will guide you in tailoring research solutions that address your unique challenges. Engage directly to explore bespoke consulting opportunities, gain early access to detailed analyses, and leverage our comprehensive data assets to refine your operational and commercial strategies. Connect now to initiate a partnership designed to accelerate your growth trajectory and drive sustained competitive advantage in the global oil and gas midstream sector.

- How big is the Oil & Gas Midstream Market?

- What is the Oil & Gas Midstream Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?