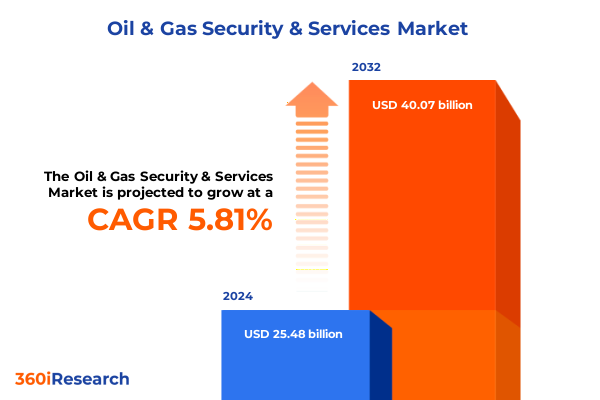

The Oil & Gas Security & Services Market size was estimated at USD 26.73 billion in 2025 and expected to reach USD 28.04 billion in 2026, at a CAGR of 5.95% to reach USD 40.07 billion by 2032.

Navigating the Evolving Security and Service Demands of the Global Oil and Gas Industry in an Era of Heightened Threats and Rapid Technological Change

The oil and gas sector confronts an unprecedented convergence of security threats, operational complexities, and regulatory imperatives. Against the backdrop of volatile geopolitical tensions, critical infrastructure faces sophisticated cyberattacks, insider risks, and physical security breaches that jeopardize operational continuity and stakeholder trust. This executive summary provides a strategic compass for industry leaders seeking to fortify their security posture, optimize service delivery, and future-proof investments in a landscape defined by rapid technological change and evolving threat vectors.

Drawing upon the latest industry developments, this section introduces the foundational challenges and opportunities shaping the security and services ecosystem for oil and gas operators. It underscores the critical intersections between digital transformation initiatives and traditional security frameworks, highlighting the imperative for an integrated, multi-layered approach to threat detection, response, and resilience. By framing the discussion around key market forces-from regulatory shifts to supply chain vulnerabilities-this introduction sets the stage for a deeper exploration of how organizations can navigate complexity, harness innovation, and achieve sustainable security excellence.

Embracing Technological Convergence and Regulatory Evolution to Redefine Security and Service Models in Oil and Gas Operations

The oil and gas security and services landscape has undergone transformative shifts driven by the convergence of digitalization, regulatory evolution, and heightened geopolitical volatility. Advanced analytics and AI-powered monitoring solutions have emerged at the forefront of defense strategies, enabling real-time threat detection and predictive maintenance that transcend traditional perimeter-based security. Operators now integrate cybersecurity software and physical surveillance feeds through unified platforms that deliver holistic situational awareness-a paradigm shift from siloed toolsets that often hindered rapid response.

Simultaneously, regulatory frameworks have evolved to mandate more stringent risk management protocols and cross-border collaboration among industry stakeholders. Heightened scrutiny of pipeline integrity, refining processes, and offshore operations has propelled service providers to develop comprehensive consulting, implementation and integration, support and maintenance, and training offerings tailored to complex compliance requirements. These changes underscore the necessity for adaptable service models that can respond to dynamic market demands while maintaining cost efficiency and operational resilience.

Finally, the proliferation of edge computing and cloud-native architectures in security deployments has redefined how data processing and storage are managed within on-premises and cloud environments. This technological evolution not only enhances scalability and flexibility, but also introduces new vectors for vulnerability, prompting a reevaluation of deployment strategies and governance frameworks across the industry.

Assessing the Strategic Repercussions of 2025 Tariff Increases on Security Hardware Procurement and Service Delivery Models in the United States

The imposition of a new wave of United States tariffs in 2025 has exerted significant influence on the procurement strategies and cost structures of oil and gas security and service providers. Tariffs on imported hardware components such as access control readers, controllers and panels, sensors and detectors, and surveillance cameras have elevated capital expenditure requirements, compelling organizations to reassess supply chains and negotiate strategic sourcing partnerships. These cost pressures have driven a growing interest in domestically manufactured solutions and alliance-based procurement to mitigate exposure to trade-related price volatility.

On the services front, increased duties have indirectly affected consulting, implementation and integration, support and maintenance, and training budgets, as providers face higher operational overheads that are cascaded to end users. In response, service firms have accelerated the adoption of remote diagnostics, virtual training modules, and cloud-based support platforms to preserve service quality while containing costs. This shift underscores the critical role of digital channels in maintaining continuity of security services in a tariff-inflated market.

Software vendors offering analytics & AI software, cybersecurity software, PSIM software, and video management software have also felt the impact of tariffs through higher costs for on-premises servers and networking equipment. Consequently, many have pivoted toward subscription-based, cloud-native delivery models that obviate the need for extensive local infrastructure, enabling oil and gas operators to bypass hardware-related cost inflation altogether and maintain access to advanced security capabilities.

Leveraging Multi-Dimensional Segmentation Insights Across Solution Types, End-User Verticals, and Deployment Modes to Guide Targeted Security Investments

A nuanced understanding of market segmentation is essential for tailoring security and service offerings to the distinct requirements of oil and gas operators. When examining the landscape by solution type, hardware components encompass access control readers, controllers and panels, sensors and detectors, and surveillance cameras that form the backbone of physical protection strategies. Complementary to hardware, services such as consulting, implementation and integration, support and maintenance, and training ensure that solutions are customized, deployed, and managed to meet stringent operational and compliance standards. Software capabilities round out this segmentation with analytics and AI software that deliver predictive insights, cybersecurity software that safeguards digital assets, PSIM software that orchestrates multi-vector data streams, and video management software that enables centralized monitoring across geographically dispersed sites.

Considering end-user segmentation, downstream operators in petrochemical, refining, and retail environments require solutions that address high-volume processing and public safety considerations. Midstream stakeholders in distribution, pipeline, and storage contexts focus on infrastructure integrity and rapid incident response to protect critical transit arteries. Upstream activities, whether offshore or onshore, emphasize adaptive security frameworks that can operate under variable environmental conditions and remote connectivity constraints.

Finally, deployment mode further differentiates market opportunities between cloud and on-premises implementations. Cloud-based models offer scalability, streamlined updates, and reduced local infrastructure requirements, which appeal to operators seeking rapid deployment and flexible resource allocation. Conversely, on-premises deployments continue to be favored by organizations with stringent data sovereignty, latency, or regulatory constraints, requiring robust local control over hardware and software components.

This comprehensive research report categorizes the Oil & Gas Security & Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Operation

- Application

- End User

Analyzing Regional Divergences in Regulation, Technological Adoption, and Service Demand Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping security priorities and service adoption within the oil and gas sector. In the Americas, regulatory regimes emphasize pipeline safety, cybersecurity mandates, and cross-border data sharing protocols, driving strong demand for advanced analytics and integrated surveillance solutions. North American operators increasingly invest in AI-enabled anomaly detection capabilities, while Latin American markets focus on scalable, cost-effective services to address both legacy infrastructure and emerging production sites.

The Europe, Middle East & Africa region presents a complex tapestry of security requirements. European operators adhere to stringent privacy regulations, pushing software providers to embed robust data protection and encryption measures into their solutions. Middle Eastern markets, characterized by vast offshore developments and critical energy corridors, prioritize physical perimeter security reinforced by real-time monitoring and rapid response services. In Africa, rising production volumes coupled with geopolitical instability have created urgent demand for comprehensive consulting and training services to bolster local security postures.

Asia-Pacific oil and gas markets exhibit a rapid transition toward cloud-native security platforms. Regulatory encouragement for digital transformation in countries like Australia, China, and India has accelerated adoption of cloud-based analytics and video management software. Additionally, the proliferation of onshore unconventional resources in the region has catalyzed the deployment of integrated services models that combine hardware installation, workforce training, and remote system support to ensure operational efficiency across dispersed locations.

This comprehensive research report examines key regions that drive the evolution of the Oil & Gas Security & Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Diverse Competitive Landscape of Integrated System Integrators, Specialized Component Manufacturers, and Innovative Software Vendors

Leading players in the oil and gas security and services space demonstrate differentiated capabilities across hardware manufacturing, service delivery, and software innovation. Large global system integrators have leveraged their extensive consulting practices to deliver end-to-end security programs, incorporating implementation and integration services that align with major operator digital roadmaps. These firms often maintain dedicated support and maintenance divisions staffed with subject-matter experts and leverage remote diagnostics to ensure high system availability.

In parallel, specialized vendors have emerged that focus on high-performance surveillance cameras and advanced sensor technologies, marrying precision hardware with proprietary analytics algorithms. Their investments in machine learning and edge computing enable rapid anomaly detection, reducing reliance on cloud connectivity for mission-critical applications. Complementing these offerings, software-focused companies are expanding their PSIM and cybersecurity software suites to include modular architectures that integrate seamlessly with legacy and third-party systems, allowing operators to scale security capabilities iteratively.

A third cohort of market participants consists of boutique service providers that excel in workforce training and localized implementation. These firms cultivate deep domain expertise in refining and petrochemical security challenges, offering customized scenario-based training programs that enhance operational readiness. Together, these diverse players form a dynamic competitive landscape, each contributing unique strengths to address the multifaceted security and services needs of the global oil and gas industry.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil & Gas Security & Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allied Universal Holdings LP

- Certis Security Holding Pte. Ltd.

- G4S plc

- GardaWorld International Protective Services LP

- GDI Integrated Facility Services Inc.

- ICTS International N.V.

- Prosegur Compañía de Seguridad, S.A.

- Securitas AB

- Stanley Security Solutions, Inc.

Empowering Integrated Governance, Strategic Partnerships, and Workforce Excellence to Strengthen Security Posture and Service Delivery

Industry leaders must adopt a proactive, holistic approach to security and service strategy to remain resilient and competitive. First, integrating cybersecurity and physical security operations under a unified governance framework will streamline threat intelligence sharing and accelerate incident response across the enterprise. Developing cross-functional teams that bridge IT, OT, and security disciplines is critical for breaking down silos and ensuring cohesive strategy execution.

Second, organizations should diversify their supplier base to mitigate the impact of supply chain disruptions and tariffs. Establishing strategic partnerships with domestic manufacturers, regional technology hubs, and specialized service providers can reduce dependency on single sources and enhance procurement agility. Concurrently, investing in cloud-based delivery models for software and support services will alleviate capital expenditure constraints and enable scalable, pay-as-you-grow deployments.

Finally, continuous workforce development through targeted training, simulation exercises, and certification programs will arm personnel with the skills needed to operate advanced analytics platforms and respond effectively to emerging threats. Organizations that prioritize people-centric strategies alongside technological investments will cultivate a security culture that drives innovation, reduces risk, and sustains operational excellence.

Employing Rigorous Primary Interviews, Extensive Secondary Analysis, and Iterative Expert Validation to Ensure Robust and Actionable Research Outcomes

This research leverages a rigorous combination of primary and secondary methodologies to ensure depth, accuracy, and practical relevance. Primary research included in-depth interviews with senior security and operations executives across upstream, midstream, and downstream segments, along with detailed discussions with hardware manufacturers, software developers, and service providers. These conversations yielded firsthand insights into current deployment challenges, investment drivers, and innovation priorities.

Secondary research involved a comprehensive review of industry white papers, regulatory publications, technical standards, and trade association reports. Publicly available product releases, patent filings, and corporate filings were analyzed to track technology roadmaps and competitive positioning. Data triangulation techniques were applied to cross-validate findings, combining qualitative interview inputs with quantitative indicators where available.

Throughout the study, an iterative validation process engaged a panel of subject-matter experts to refine assumptions, challenge preliminary conclusions, and confirm the relevance of strategic recommendations. This methodological rigor underpins the credibility of our insights and ensures that the resulting analysis aligns with real-world decision-making processes within the oil and gas security ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil & Gas Security & Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil & Gas Security & Services Market, by Solution Type

- Oil & Gas Security & Services Market, by Operation

- Oil & Gas Security & Services Market, by Application

- Oil & Gas Security & Services Market, by End User

- Oil & Gas Security & Services Market, by Region

- Oil & Gas Security & Services Market, by Group

- Oil & Gas Security & Services Market, by Country

- United States Oil & Gas Security & Services Market

- China Oil & Gas Security & Services Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1749 ]

Transforming Security Challenges into Sustainable Competitive Advantages Through Integrated Strategies and Innovation in Oil and Gas Operations

In an environment of escalating threats, evolving regulatory demands, and rapid technological advancement, oil and gas operators face a critical imperative to adopt integrated, agile security and service strategies. The convergence of physical and cyber domains, coupled with the ripple effects of trade policy shifts and regional regulatory divergence, demands solutions that are both comprehensive and adaptable. By leveraging multi-vector analytics, cloud-native architectures, and workforce-centric initiatives, organizations can build resilient defenses capable of anticipating and mitigating risks across the full asset lifecycle.

Strategic alignment between procurement, technology, and talent management will be the hallmark of successful operators, enabling them to navigate cost pressures, supply chain disruptions, and compliance obligations with confidence. As the industry continues to embrace digital transformation, the most forward-thinking companies will differentiate themselves through collaborative partnerships, innovative service models, and a culture of continuous improvement. These foundational principles will not only safeguard critical infrastructure but also drive operational efficiency and long-term value creation.

The insights presented in this executive summary offer a roadmap for decision-makers seeking to fortify their security posture, optimize service delivery, and capitalize on emerging opportunities within the dynamic oil and gas market. By applying these strategic imperatives, organizations can transform challenges into competitive advantages and achieve sustainable growth in an increasingly complex landscape.

Initiate Your Strategic Advantage by Securing This Comprehensive Oil and Gas Security and Services Market Research Report Today

To gain comprehensive, actionable intelligence on emerging trends, competitive dynamics, and strategic imperatives in the rapidly evolving oil and gas security and services market, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Unlock exclusive expert analyses, deep-dive regional breakdowns, and tailored insights designed to empower your organization’s decision-making and drive sustained growth. Engage today to secure your organization’s position at the forefront of security innovation.

- How big is the Oil & Gas Security & Services Market?

- What is the Oil & Gas Security & Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?