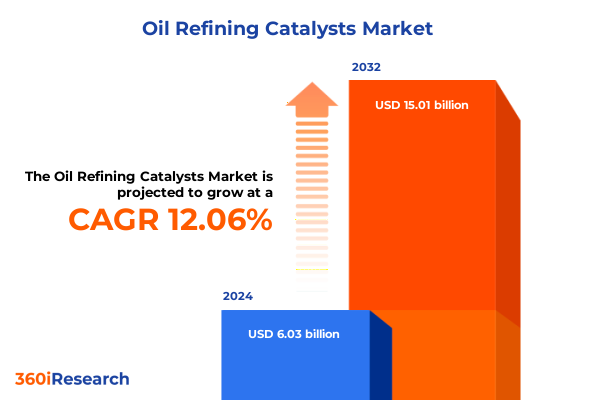

The Oil Refining Catalysts Market size was estimated at USD 6.78 billion in 2025 and expected to reach USD 7.62 billion in 2026, at a CAGR of 12.02% to reach USD 15.01 billion by 2032.

Exploring the Critical Role of Catalysts in Modern Oil Refining and Their Pivotal Influence on Process Efficiency, Environmental Performance, and Product Quality

The refining of crude oil into valuable end products hinges critically on the performance of catalysts that drive chemical transformations. Within modern refineries, catalysts facilitate the breaking of large hydrocarbon molecules into lighter fractions, the removal of contaminants, and the rearrangement of molecular structures to meet stringent product specifications. As feedstocks have grown more complex and environmental regulations more demanding, the role of catalysts has transcended simple reaction accelerants to become central enablers of both operational efficiency and environmental compliance.

Over the past decade, refinery operators have witnessed catalysts evolve from standard formulations to advanced materials engineered at the molecular level. These next-generation catalysts leverage tailored pore structures, optimized active sites, and robust supports to deliver higher conversion rates, improved selectivity, and longer service life. Such enhancements translate into reduced energy consumption, lower greenhouse gas emissions, and minimized downtime for catalyst regeneration or replacement. Consequently, decision-makers must understand not only the fundamental chemistry of catalytic processes but also how innovations in catalyst design directly bear upon refining margins and sustainability targets.

This executive summary distills the essential considerations for stakeholders navigating the dynamic catalyst landscape. By examining transformative technology shifts, regulatory impacts, market segmentation nuances, and regional and supplier insights, this report equips leadership teams with the strategic clarity needed to drive operational excellence and future-proof their refining portfolios.

Unveiling Overarching Paradigm Shifts in Refinery Catalyst Technologies and How Emerging Innovations Are Redefining Industry Standards and Competitive Dynamics

The catalyst industry is undergoing a profound transformation driven by the convergence of material science breakthroughs and digital process optimization. Traditional alumina-based and zeolitic catalysts are now being complemented by nanostructured composites, hybrid metal oxides, and tailored molecular sieves that offer unprecedented performance in cracking, reforming, and hydroprocessing applications. This shift from one-size-fits-all formulations to bespoke catalyst solutions is reshaping how refineries approach feedstock variability and product slate flexibility.

Simultaneously, digital tools such as advanced process control, machine learning analytics, and real-time monitoring systems are enabling proactive catalyst management strategies. Operators can now predict deactivation patterns, optimize regeneration cycles, and dynamically adjust process parameters to extract maximal value from catalyst inventories. The integration of digital twin simulations further accelerates the development and scale-up of novel catalyst formulations by facilitating rapid in silico screening of active sites and support materials.

Looking ahead, sustainability imperatives are spurring interest in catalysts that not only enhance yields but also contribute to lower carbon footprints through reduced hydrogen consumption and minimized waste streams. Research partnerships between technology providers, academic institutions, and refinery operators are catalyzing a wave of green innovation, with a growing focus on biocatalysts, carbon capture catalysts, and recycling-friendly materials. As these transformative shifts unfold, stakeholders must anticipate rapidly shifting competitive dynamics and ensure their catalyst strategies remain aligned with emerging environmental, economic, and operational imperatives.

Assessing the Cumulative Effects of United States Tariffs Through 2025 on Oil Refining Catalyst Supply Chains, Cost Structures, and Strategic Sourcing Decisions

Since the imposition of Section 301 tariffs on chemical imports and Section 232 tariffs on steel and aluminum equipment in recent years, the oil refining catalyst market has experienced notable upheaval. Many catalyst formulations and support media rely on specialized steel components for reactor internals and packaging, and any increase in metal tariffs has fed through to elevated total catalyst deployment costs. Concurrently, import duties on precursor chemicals from key producing regions have altered global supply chains, prompting some operators to source locally or regionally to mitigate expense volatility.

Throughout 2023 and 2024, refiners in the United States recalibrated their procurement strategies as tariff adjustments took effect. Local catalyst manufacturers benefited from protective measures, expanding capacity to serve domestic demand, while international suppliers explored tariff engineering solutions, such as recalibrating country-of-origin claims or reclassifying precursor imports to qualify for preferential rates. However, these workarounds often required complex logistics and increased lead times, thereby influencing inventory management practices at refinery sites.

Cumulatively through early 2025, the net effect of U.S. trade measures has been a moderate uptick in catalyst acquisition costs counterbalanced by improved supply security and incentivized investment in domestic catalyst R&D. Refinery capital budgets have shifted to prioritize in-house catalyst evaluation facilities and co-development partnerships, reducing dependence on imported technologies. As tariff regimes remain subject to political negotiation and potential reprieve, industry players must continuously monitor trade policy developments to optimize sourcing strategies and maintain cost competitiveness.

Decoding Key Market Insights Through Comprehensive Segmentation of Catalyst Types, Applications, Feedstocks, Forms, and Reactor Configurations

The catalyst market’s complexity becomes apparent when dissected along multiple analytical dimensions that shape both product design and downstream applications. By catalyst type, developers have refined formulations for alkylation processes to boost isooctane yields, while reforming catalysts now target enhanced aromatic production pathways to meet petrochemical feedstock demands. Refiners have also turned to fluid catalytic cracking materials optimized for distillate recovery as well as gasoline production, balancing yield profiles in response to changing fuel consumption patterns. In the realm of hydrocracking, catalysts engineered for high-throughput diesel production and selective wax conversion offer refiners increased operational flexibility, and hydrotreating catalysts have evolved to deliver stringent sulfur removal and tailor wax isomerization profiles for improved lubricant streams.

Applications further dictate catalyst specifications, whether refining lubricants through base oil production and additive integration, converting naphtha to feedstocks such as butadiene, ethylene, and propylene for downstream petrochemicals, or adjusting process conditions for transportation fuel segments including diesel, gasoline, and jet fuel. The particular chemical environment of each application influences active metal selection, support material design, and promoter incorporation.

Feedstock diversity introduces additional variables, as catalysts must accommodate sour or sweet crude oils, heavy and light naphtha cuts, bitumen-rich residual streams, and vacuum gas oil fractions. Innovations in catalyst robustness and tolerance have been critical to handling variations in nitrogen, sulfur, and metal contaminant levels inherent across feedstock types. Form factor also remains a pivotal consideration, with extrudate, pellet, powder, and spherical shapes offering distinct trade-offs in attrition resistance, mass transfer, and packing density. Finally, reactor configuration-whether fixed bed variants like packed or trickling beds, fluidized beds operating in bubbling or circulating modes, or moving bed systems running continuous or cyclic regimens-imposes further constraints on catalyst life cycle management and process optimization.

Taken together, these segmentation lenses underscore the importance of tailoring catalyst solutions to the specific demands of process chemistry, operational design, and economic objectives.

This comprehensive research report categorizes the Oil Refining Catalysts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Catalyst Type

- Feedstock

- Catalyst Form

- Reactor Type

- Application

Mapping Regional Dynamics in the Global Oil Refining Catalyst Market Across the Americas, Europe Middle East Africa, and Asia Pacific Realm

Geographical variations in refining infrastructure, regulatory environments, and feedstock availability have led to distinct regional catalyst market dynamics. In the Americas, the abundance of light sweet crude and rigorous fuel quality standards have fueled demand for high-performance hydroprocessing and hydrotreating catalysts, as refiners prioritize ultra-low sulfur diesel and biofuel integration. Investment in shale-derived feedstocks has further prompted refiners to adopt versatile catalyst formulations capable of handling high olefin content with minimized coke formation.

Across Europe, the Middle East, and Africa, catalyst suppliers navigate a complex mosaic of mature European refineries facing incremental upgrades, rapidly expanding Middle Eastern capacity driven by sovereign wealth investment, and an emerging African refining sector seeking to reduce product import reliance. Stringent emissions regulations in the European Union have catalyzed adoption of next-generation catalysts for carbon reduction, while Middle Eastern operators emphasize high-throughput cracking and aromatics catalysts to maximize export yields. In Africa, the market is characterized by selective catalyst imports and technology transfers tailored to modular refining units that aim for rapid deployment.

The Asia-Pacific region presents a diverse tapestry of catalyst demand. In China and India, ongoing refinery construction and deep conversion projects have created opportunities for advanced hydrocracking, FCC, and residue-upgrading catalysts. Southeast Asian nations are investing in mid-scale refinery upgrades that balance gasoline production with petrochemical integration, driving uptake of multifunctional catalysts. Meanwhile, regulatory tightening in Australia and Japan around sulfur limits and greenhouse gas emissions has spurred refiners to adopt specialized hydrotreating catalysts and invest in regeneration capabilities. Together, these regional factors shape a dynamic catalyst landscape influenced by feedstock shifts, environmental imperatives, and capital investment cycles.

This comprehensive research report examines key regions that drive the evolution of the Oil Refining Catalysts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Catalyst Suppliers and Strategic Partnerships Driving Innovation and Competitive Strength in the Oil Refinery Catalyst Landscape

Leading catalyst suppliers have positioned themselves at the forefront of innovation through targeted R&D investments, strategic collaborations, and tailored service offerings. Global technology providers have leveraged their extensive laboratory networks and pilot-scale facilities to fast-track catalyst development cycles, enabling quicker commercialization of breakthrough materials. Partnerships with refinery operators and academic institutions have yielded co-development programs that align catalyst properties with specific process requirements, creating a competitive moat around proprietary technologies.

While established companies maintain broad portfolios spanning nitrides, zeolites, and metal oxide catalysts, newer entrants are carving out niches by focusing on specialized applications such as carbon capture synergies or bio-feedstock upgrading. Many suppliers now offer integrated performance guarantees that encompass on-site testing, monitoring, and regeneration services, reflecting a shift from product sales to outcome-based contracting. This service evolution reinforces customer loyalty and drives incremental revenue through long-term maintenance agreements.

In parallel, mergers and acquisitions continue to reshape the competitive landscape as firms seek scale advantages and geographic reach. By acquiring regional catalyst producers, large multinationals have bolstered their local presence and reduced logistical complexity. Conversely, some niche players have attracted private equity interest by showcasing high-growth potential in sustainable catalyst segments and circular economy initiatives. Overall, the industry is characterized by a balance between incumbent scale and agile innovators, each contributing to a robust pipeline of technology advances.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil Refining Catalysts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- Arkema S.A.

- Axens SA

- BASF SE

- Chempack

- Chevron Corporation

- Clariant AG

- Criterion Catalysts & Technologies L.P.

- DuPont de Nemours, Inc.

- Evonik Industries AG

- ExxonMobil Corporation

- Haldor Topsoe A/S

- JGC Catalysts & Chemicals Ltd.

- Johnson Matthey PLC

- Lummus Technology

- Shell Catalysts & Technologies B.V.

- Sinopec Catalyst Co., Ltd.

- UOP LLC

- W. R. Grace & Co.

- Zeolyst International

Actionable Strategies and Best Practices for Industry Leaders to Strengthen Supply Chains, Enhance Catalyst Performance, and Drive Sustainable Growth

Industry leaders aiming to solidify market position should prioritize the establishment of resilient, multi-source supply chains that mitigate tariff exposure and logistical uncertainties. Engaging in long-term agreements with both domestic and international catalyst manufacturers can create optionality and foster competitive pricing. Concurrently, investing in in-house testing capabilities and pilot reactors will accelerate the translation of academic breakthroughs into operational realities, ensuring that refiners capture first-mover advantages in deploying advanced catalysts.

Implementing a data-driven catalyst management program is critical to maximizing asset utilization. By integrating advanced analytics, machine learning insights, and real-time condition monitoring, refineries can proactively forecast deactivation trends, schedule timely regenerations, and optimize catalyst inventories. Such strategies will enhance process reliability, extend run lengths, and lower overall refining costs.

Sustainability imperatives demand a parallel focus on green catalyst initiatives. Leaders should collaborate on R&D projects that target reduced hydrogen consumption, enhanced tolerance to renewable feedstocks, and compatibility with carbon capture and utilization schemes. Joint ventures with specialty chemical companies and pilot deployments in demonstration units will validate emerging technologies and pave the way for broader adoption. Altogether, these recommendations ensure that catalyst strategies remain aligned with both economic and environmental objectives in a rapidly evolving energy landscape.

Detailing a Robust Research Framework Combining Primary Interviews, Secondary Source Analysis, and Data Triangulation to Deliver In-Depth Catalyst Market Intelligence

This market research report was developed through a meticulously designed methodology combining primary and secondary research to ensure robust and unbiased insights. In the primary research phase, over thirty in-depth interviews were conducted with refinery technical leaders, catalyst manufacturers, engineering procurement and construction firms, and industry consultants. These discussions provided firsthand perspectives on technological adoption, tariff mitigation tactics, and process optimization challenges.

Secondary research comprised a comprehensive review of technical journals, patent filings, regulatory filings, and corporate disclosures. Detailed analyses of conference proceedings, trade association white papers, and peer-reviewed articles further enriched the understanding of emerging catalyst chemistries and application trends. Statistical triangulation of data points from multiple sources validated key findings and mitigated potential biases.

Quantitative data was synthesized through cross-tabulation of segmentation parameters, enabling a holistic view of how catalyst type, application, feedstock, form, and reactor configuration interact. Qualitative insights were distilled into strategic recommendations by mapping technological readiness levels against industry adoption barriers. An iterative peer-review process involving data scientists and subject matter experts ensured accuracy, relevance, and clarity in every section of the report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil Refining Catalysts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil Refining Catalysts Market, by Catalyst Type

- Oil Refining Catalysts Market, by Feedstock

- Oil Refining Catalysts Market, by Catalyst Form

- Oil Refining Catalysts Market, by Reactor Type

- Oil Refining Catalysts Market, by Application

- Oil Refining Catalysts Market, by Region

- Oil Refining Catalysts Market, by Group

- Oil Refining Catalysts Market, by Country

- United States Oil Refining Catalysts Market

- China Oil Refining Catalysts Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Summarizing Principal Findings and Strategic Implications for Stakeholders Navigating the Evolving Oil Refining Catalyst Industry Landscape

The oil refining catalyst market stands at a critical juncture where technological innovation, regulatory pressures, and trade dynamics converge to reshape strategic imperatives. Advanced catalysts are no longer simply additives but pivotal enablers of higher conversion, reduced environmental impact, and flexible product slates. Meanwhile, the cumulative effect of tariff measures has prompted a reassessment of sourcing strategies, driving investment in domestic capabilities and collaborative development initiatives.

Through nuanced segmentation analysis, it becomes clear that success lies in aligning catalyst design with specific process chemistries, feedstock characteristics, and reactor configurations. Geographically, regional dynamics influence product demand and regulatory compliance priorities, creating distinct market pockets that require tailored approaches. At the same time, the competitive landscape continues to evolve as suppliers differentiate through innovation, service integration, and strategic partnerships.

Looking forward, the key to sustained performance lies in marrying data-driven asset management with proactive R&D investments in green and digital catalyst technologies. By implementing the actionable recommendations outlined herein, industry stakeholders can navigate the evolving landscape, capitalize on emerging opportunities, and secure long-term operational resilience.

Engage with Ketan Rohom to Unlock Exclusive Insights and Secure Your Comprehensive Oil Refining Catalyst Market Research Report Today

Unlock unparalleled insights into the oil refining catalyst market by collaborating directly with Ketan Rohom (Associate Director, Sales & Marketing). Gain access to a comprehensive report packed with strategic analyses, in-depth segmentation breakdowns, and actionable recommendations designed to empower your organization. This report offers a holistic understanding of current tariffs, regional dynamics, leading suppliers, and emerging technological innovations shaping the refinery catalyst landscape. Contact Ketan Rohom today to explore flexible licensing options, tailor research deliverables to your unique needs, and accelerate decision-making with data-driven clarity. Secure your competitive advantage in an evolving market by partnering with our research team for the definitive catalyst market intelligence resource.

- How big is the Oil Refining Catalysts Market?

- What is the Oil Refining Catalysts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?