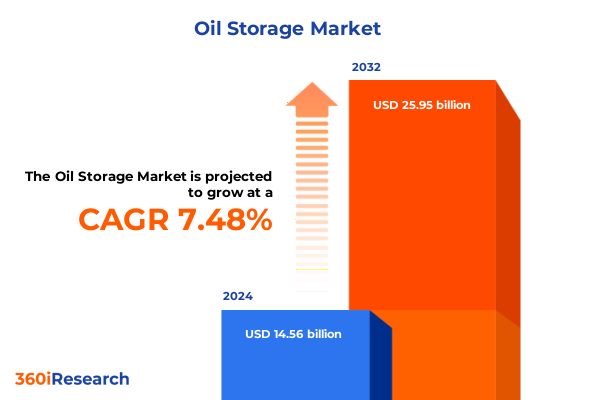

The Oil Storage Market size was estimated at USD 15.64 billion in 2025 and expected to reach USD 16.81 billion in 2026, at a CAGR of 7.49% to reach USD 25.95 billion by 2032.

Exploring the Critical Role of Robust Oil Storage Infrastructure in Balancing Market Volatility and Supporting Global Energy Security Objectives

Oil storage infrastructure occupies a pivotal position at the intersection of supply security, market stability, and geopolitical resilience. As global trade patterns and consumption cycles undergo unprecedented shifts, the capacity to store crude oil, refined products, and petrochemicals has emerged as a critical enabler of energy security. Industry participants are increasingly grappling with pronounced supply chain volatility driven by geopolitical tensions, evolving demand profiles, and the accelerating energy transition. In this context, storage facilities have transcended their traditional role as mere buffer zones, evolving into strategic assets that underpin refined product arbitrage, pricing flexibility, and rapid response mechanisms during supply disruptions.

Against this backdrop, market stakeholders are prioritizing investments in advanced storage solutions that offer enhanced safety, environmental compliance, and operational agility. Technological advancements in tank design, real-time inventory management, and remote monitoring are converging to redefine how storage operators optimize throughput and minimize risk exposure. Moreover, integration across midstream networks is fostering new business models, wherein storage capacity is leveraged to facilitate decarbonization initiatives, such as blending biofuels and supporting carbon capture endeavors. Consequently, a nuanced understanding of emerging storage trends is indispensable for decision-makers seeking to fortify their competitive position and ensure long-term resilience.

Unveiling the Transformative Shifts Driving Oil Storage Evolution Including Digital Innovations and Decarbonization Imperatives Reshaping Operations

The oil storage landscape is experiencing transformative shifts as digital innovation, environmental imperatives, and strategic realignments converge. Stakeholders are increasingly deploying data analytics and digital twin technologies to achieve predictive maintenance, optimize inventory cycles, and anticipate market swings. These digital tools are not only enhancing operational reliability but also enabling dynamic pricing models that capitalize on fleeting arbitrage opportunities between regional hubs. Simultaneously, the industry’s decarbonization agenda is reinforcing demand for low-emission storage solutions, with advancements in leak detection, vapor recovery units, and green insulation materials reducing the carbon footprint of traditional tank farms.

In parallel, the rise of integrated midstream players is reshaping competitive dynamics as storage is bundled with pipeline capacity, shipping logistics, and processing services. This vertical integration is fostering economies of scale and unlocking synergies in feedstock management. Moreover, the ascent of petrochemical and bio-refining sectors is introducing new storage requirements for specialty chemicals like ethylene and propylene, alongside conventional refined products. These shifts underscore the necessity for storage operators to adapt facility designs, augment product compatibility, and foster collaborative relationships with upstream and downstream partners. As a result, storage markets are evolving towards more interconnected, agile, and environmentally sensitive architectures.

Assessing the Far Reaching Cumulative Impact of United States Steel and Aluminum Tariffs on Oil Storage Infrastructure Costs and Supply Chains in 2025

The cumulative impact of United States tariffs on steel and aluminum has reverberated across the oil storage sector, elevating material costs and extending project timelines. In February 2025, a presidential proclamation reinstated a uniform 25 percent tariff on all steel imports, rescinding prior exemptions for key trading partners and applying stringent “melted and poured” standards to downstream products. This measure immediately increased base steel prices and constricted the availability of competitively priced imported materials, compelling storage terminal developers to reassess sourcing strategies and negotiate new supplier agreements.

As of June 4, 2025, the administration further escalated Section 232 duties to 50 percent for steel and aluminum imports, with the elevated rates taking effect at 12:01 am Eastern Daylight Time. This substantial increase disproportionately affected storage tank manufacturers reliant on imported specialty alloys and downstream components, driving up capital expenditure by as much as 15 to 20 percent in some projects. Industry leaders reported supply chain bottlenecks as vendors grappled with compliance complexities and sought to integrate higher domestic content in fabrication processes. The accelerated tariff regime has also intensified conversations around reshoring tank production and reinforcing domestic steel capacity, yet such strategies require lead times that strain near-term expansion plans.

Revealing Critical Market Segmentation Insights Across Product Types Storage Configurations Capacities and End Users Informing Strategic Positioning

A granular examination of market segmentation reveals nuanced dynamics across product types, storage configurations, capacities, and end users. When viewed through the lens of crude oil, petrochemicals, and refined products, the petrochemical segment-encompassing ethylene, propylene, and styrene-demands specialized containment tailored to chemical stability and regulatory compliance, while the refined products category, which includes diesel, gasoline, and jet fuel, prioritizes logistical flexibility and rapid throughput to navigate price differentials. Simultaneously, above-ground tanks, floating roof tanks, and underground caverns each deliver distinct advantages: above-ground installations facilitate ease of access and maintenance, floating roofs minimize evaporative losses for volatile commodities, and subterranean caverns offer unparalleled security and environmental safeguards.

Further differentiation emerges when considering storage capacity, as facilities below 50,000 KL support niche applications and short-term trading strategies, mid-tier capacities of 50,000 to 100,000 KL cater to regional distribution hubs, and super-regional terminals exceeding 100,000 KL underpin strategic reserve initiatives. Across these configurations, oil and gas companies leverage storage as an extension of upstream production planning, refineries integrate storage into feedstock sourcing and turnaround scheduling, and trading houses utilize inventory to optimize arbitrage across global markets. These intersecting dimensions underscore the importance of aligning infrastructure investments with specific product profiles and end-user strategies to maximize asset utilization and return on investment.

This comprehensive research report categorizes the Oil Storage market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Tank Type

- Tank Material

- Product Type

- Tank Design

- Location Type

- Application

Examining Pivotal Regional Dynamics in the Americas Europe Middle East Africa and Asia Pacific Driving Oil Storage Investments and Growth Trajectories

Regional dynamics exert a profound influence on oil storage evolution, with each geography presenting unique drivers and constraints. In the Americas, abundant shale supplies and the strategic use of SPR facilities have spurred investment in modular tank farms designed for rapid commissioning and integrated rail connectivity. Latin American nations, responding to energy security goals, are modernizing legacy storage networks, while North American operators are prioritizing digital retrofits to boost throughput and compliance.

Across Europe, the Middle East, and Africa, regulatory landscapes and diverging energy agendas shape storage demand. European markets emphasize cross-border pipeline integration and environmental licensing, while Gulf producers expand cavern and floating storage to support petrochemical exports. African economies, confronting underinvestment, are gradually ramping up infrastructure through public-private partnerships that target downstream value creation.

In the Asia-Pacific, robust import demand and refining capacity growth have triggered the largest storage additions globally. China’s coastal terminals are being outfitted with advanced automation systems, India’s strategic reserves initiative accelerates underground cavern projects, and Southeast Asian hubs are emerging as pivotal transshipment centers. These regional narratives highlight how policymakers, market structures, and resource endowments collectively drive storage strategies.

This comprehensive research report examines key regions that drive the evolution of the Oil Storage market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering Leading Oil Storage Market Players Their Strategic Initiatives Partnerships and Innovations Shaping Competitive Landscapes in 2025

Leading companies are deploying differentiated strategies to navigate the competitive oil storage terrain. Major global terminal operators are forging joint ventures with local partners to secure market access and navigate complex regulatory environments. Integration across the value chain has become a hallmark of industry leaders, as companies leverage pipeline networks, shipping charters, and refineries to create end-to-end supply solutions that optimize margins and mitigate spot market risks. Concurrently, specialized engineering firms are investing in proprietary tank designs and materials science research to offer modular, carbon-efficient solutions that address both environmental mandates and cost pressures. Strategic acquisitions remain prevalent as incumbents seek to bolster geographic footprints and product portfolios, while emerging players concentrate on niche segments such as LNG bunkering and renewable feedstock storage. This competitive interplay underscores a broader trend: innovation and collaboration are essential for sustaining profitability amid evolving market conditions and intensifying regulatory scrutiny.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oil Storage market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ascent Industries Co.

- Brooge Energy Limited

- Buckeye Partners, L.P.

- CaldwellTanks,Inc.

- China Petrochemical Corporation

- ConocoPhillips

- CST Industries, Inc.

- Denali Incorporated

- Energy Transfer LP

- Exolum Group

- Exxon Mobil Corporation

- Fox Tank Company

- Granby Industries Ltd.

- Gunvor Group Ltd.

- Indian Oil Corporation Limited

- Kinder Morgan, Inc.

- Koninklijke Vopak N.V.

- Mattr Corp.

- McDermott International, Inc.

- Mitsui O.S.K. Lines, Ltd.

- Odfjell Group

- Oiltanking GmbH by Marquard & Bahls AG

- ONEOK, Inc.

- Puma Energy Holdings Pte. Ltd.

- Snyder Industries, Inc.

- Superior Tank Co., Inc.

- T.F. Warren Group

- Tank Connection, Inc.

- TerraVest Industries Inc.

- Vicwest Inc.

- Vitol Tank Terminals International BV

- VTTI B.V.

Actionable Recommendations Guiding Industry Leaders Toward Digital Transformation Operational Resilience and Policy Advocacy in Oil Storage Markets

Industry leaders can strengthen their market position by embracing a multifaceted strategy that unites technological investment, operational excellence, and policy engagement. First, deploying advanced analytics platforms and digital twins will enable predictive maintenance, optimize asset utilization, and enhance safety metrics. Second, integrating green infrastructure solutions-such as vapor recovery units, solar-powered pumping stations, and low-emission coatings-will address environmental compliance and appeal to ESG-focused investors. Third, cultivating resilient supply networks through supplier diversity and nearshoring can mitigate tariff-driven cost escalation and reduce lead-time risks. Fourth, forming cross-sector partnerships with energy producers, midstream operators, and technology providers will expand service offerings and unlock bundled revenue streams.

Finally, proactive engagement with policymakers to advocate for tariff relief, streamlined permitting, and incentives for decarbonization projects will help shape a favorable regulatory environment. By executing these actions in concert, companies will be positioned to deliver robust financial performance, maintain regulatory alignment, and secure long-term strategic advantage in a rapidly transforming storage market.

Detailing Rigorous Research Methodology Combining Primary Expert Interviews Data Triangulation and Analytical Frameworks Powering Oil Storage Insights

The insights presented herein are grounded in a rigorous research methodology that synthesizes primary and secondary data within a robust analytical framework. Primary research included in-depth interviews with C-level executives, engineers, and policy experts, providing firsthand perspectives on investment priorities, operational challenges, and regulatory developments. Secondary research encompassed an exhaustive review of industry publications, government reports, and trade association data to contextualize market trends and validate company strategies.

Quantitative analysis leveraged data triangulation techniques, harmonizing multiple sources to ensure consistency and reliability of storage capacity figures, project timelines, and cost metrics. A dual bottom-up and top-down approach was employed to deconstruct market segments and verify aggregate trends. Complementing quantitative methods, qualitative assessments examined technological innovations, competitive dynamics, and geopolitical influences. Findings were subjected to expert panel validation to mitigate bias and confirm strategic implications. This comprehensive methodology underpins the credibility of the analysis and informs actionable insights for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oil Storage market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oil Storage Market, by Tank Type

- Oil Storage Market, by Tank Material

- Oil Storage Market, by Product Type

- Oil Storage Market, by Tank Design

- Oil Storage Market, by Location Type

- Oil Storage Market, by Application

- Oil Storage Market, by Region

- Oil Storage Market, by Group

- Oil Storage Market, by Country

- United States Oil Storage Market

- China Oil Storage Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2240 ]

Summarizing Key Findings Strategic Implications and Forward Looking Perspectives on the Oil Storage Market’s Evolving Role in Global Energy Security

This executive summary has highlighted critical dynamics reshaping the oil storage landscape, from tariff-induced cost pressures to the transformative potential of digital and environmental innovations. The interplay of strategic segmentation, regional growth trajectories, and competitive positioning underscores the imperative for agile, data-driven decision-making. As steel and aluminum duties remain in flux, storage operators must balance near-term cost management with long-term capacity planning, leveraging domestic fabrication and diversified sourcing to offset import constraints.

Looking ahead, the integration of advanced monitoring systems, green infrastructure solutions, and cross-sector partnerships will define the next frontier of storage excellence. Stakeholders that align infrastructure investments with evolving regulatory frameworks and sustainability goals will be well positioned to capitalize on market opportunities and buffer against volatility. Ultimately, proactive strategy formulation-underpinned by robust analytics and collaborative engagement-will determine which organizations emerge as leaders in the evolving storage ecosystem.

Connect with Associate Director Ketan Rohom to Acquire Comprehensive Oil Storage Market Research Report Empowering Your Strategic Decision Making

Engaging with Ketan Rohom offers a seamless pathway to acquiring in-depth market intelligence tailored for executives navigating the complexities of oil storage dynamics. By reaching out directly, stakeholders can access the full report and unlock granular insights that drive strategic investment decisions, operational optimizations, and competitive positioning. This interaction ensures that your organization remains informed about evolving trends, regulatory shifts, and technological breakthroughs shaping the storage landscape. Acting now will empower your teams to capitalize on market opportunities, mitigate emerging risks, and refine long-term growth strategies with precision. Connect today to transform high-level strategic goals into actionable plans underpinned by comprehensive analysis and expert guidance.

- How big is the Oil Storage Market?

- What is the Oil Storage Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?