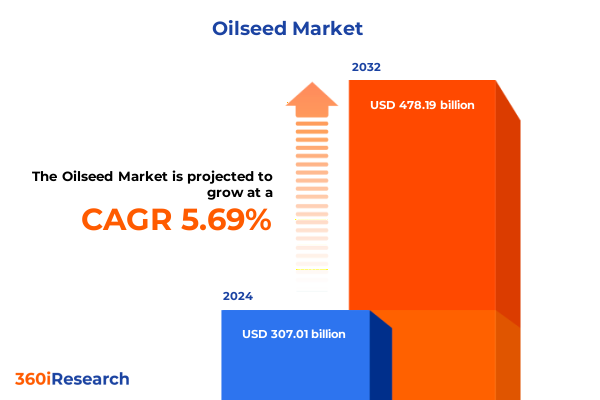

The Oilseed Market size was estimated at USD 324.54 billion in 2025 and expected to reach USD 341.58 billion in 2026, at a CAGR of 5.69% to reach USD 478.19 billion by 2032.

Unveiling the Growing Importance of Oilseeds in a Fast Evolving Global Food And Industrial Landscape Driven By Demand And Environmental Imperatives

The global oilseed market is experiencing unprecedented dynamism as evolving consumption trends, sustainability imperatives, and shifting geopolitical landscapes converge to reshape production and trade. Oilseeds have long been foundational to agrarian economies, serving as critical inputs for culinary oils, animal feeds, and industrial applications. In recent years, growing consumer awareness around health and environmental impact has elevated the prominence of plant-based oils, driving innovation across value chains. Stakeholders are now balancing cost efficiencies with the imperative to adopt cleaner extraction methods and source from regions with robust regulatory frameworks. Amid these pressures, producers, processors, and exporters alike are recalibrating strategies to capture emerging opportunities while mitigating risks in a landscape that is both increasingly competitive and complex.

Furthermore, advancements in agronomic practices and seed genetics are enabling yield improvements and resilience against climate variability, bolstering supply prospects in major oilseed hubs. At the same time, evolving dietary patterns-marked by a rising preference for high-protein plant sources-are amplifying demand for by-products such as meal and hulls. As downstream industries prioritize traceability and environmental stewardship, market participants are investing in digital traceability platforms, carbon footprint assessments, and certifications spanning canola, peanut, soybean, and sunflower supply chains. This introductory analysis establishes the foundational context for understanding the drivers, challenges, and transformative shifts apportioning the future trajectory of the oilseed sector.

Examining Revolutionary Developments In Oilseed Production Technology Sustainability Practices And Market Access Transforming Industry Foundations

The oilseed industry is currently undergoing transformative shifts as the interplay between technology adoption and sustainability benchmarks redefines competitive dynamics. Cold pressing, enzymatic extraction, expeller pressing, and solvent extraction methodologies are being juxtaposed not only for their cost-effectiveness but also for their environmental footprints. Investment in enzymatic processes, for instance, is gaining traction among premium oil producers seeking to minimize solvent residues and energy consumption. Simultaneously, refiners are differentiating offering lines of hydrogenated oil, RBD oil, and virgin oil to cater to diverse consumer segments seeking functional and clean-label attributes.

Parallel to these extraction innovations, digital supply-chain platforms have emerged to provide end-to-end traceability across crude oil flows and finished hulls, fostering greater trust among end users in bakery and confectionery applications, edible oil products, and biodiesel feedstocks. This digitization wave extends beyond traceability, with data analytics solutions optimizing yield performance and reducing waste in refining facilities. In addition, cross-sector collaborations are accelerating the development of biodegradable lubricants and cosmetic formulations sourced from sunflower and soybean fractions. These collective shifts underscore a new paradigm in which technology and sustainability coalesce, forging resilient oilseed ecosystems that are fit for the demands of the next decade.

Analyzing The Far Reaching Consequences Of United States Tariff Adjustments On Oilseed Trade Patterns Supply Chains And Pricing Structures In 2025

In 2025, alterations to United States tariff structures have exerted a cumulative influence on global oilseed trade flows, prompting both immediate disruptions and longer-term strategic recalibrations. Elevated duties on select import categories have narrowed price differentials, inspiring major processors to re-optimize sourcing networks and pivot to regions offering comparative cost advantages. This reorientation has resulted in contracted volumes from traditional suppliers, while amplifying engagement with alternative origins that could fulfill quality and compliance standards without incurring steep levies. As a consequence, storage terminal utilizations in the Gulf Coast have shifted to accommodate new inbound streams, and logistic corridors have been rerouted to mitigate transit bottlenecks.

Moreover, commodity prices have exhibited heightened volatility, driven in part by the anticipatory stockpiling behavior of end users seeking tariff insulation. Food processors and industrial biodiesel manufacturers have recalibrated procurement cycles to leverage hedging instruments and secure futures positions, all amidst narrowing margins. The shifting trade calculus has also yielded upward pressure on domestic crush margins, incentivizing local processors to increase capacity investments while simultaneously exploring the production of higher-value refined oils. Consequently, the evolving tariff landscape is not merely a regulatory footnote but a critical catalyst reshaping the competitive contours of the oilseed economy in North America and beyond.

Deriving Comprehensive Insights From Oilseed Market Segmentation Across Types Forms Processing Methods Applications And Distribution Channels

The multifaceted segmentation of the oilseed market reveals nuanced growth pockets and demand drivers that vary across product categories, processing technologies, and end-use applications. Within the oilseed type spectrum, soybean maintains a dominant foothold due to its high oil content and versatile meal applications, whereas canola and sunflower oils are carving out premium positioning in health-driven consumer segments. Peanut oil likewise retains strong regional appeal, particularly in bakery and confectionery channels, where its functional properties and flavor profile are highly prized.

Moving into product form, crude oils and hulls continue to underpin the commodity trade ecosystem, but refined oil variants are emerging as primary profit centers; hydrogenated oil caters to bakery formulators seeking structural stability, while RBD oil underpins mainstream edible oil markets, and virgin oil offers a clean-label narrative. Processing technology segmentation highlights a clear upward trajectory for cold pressing in niche organic markets, while solvent extraction remains the workhorse for high-volume producers prioritizing extraction efficiency. Furthermore, enzymatic extraction is transitioning from pilot to commercial scales, offering optimized yield and lower environmental impact.

Application-wise, the feed sector continues to drive meal demand with livestock feed commanding the largest share, followed by burgeoning aquaculture feed and premium pet feed segments targeting functional nutrition. In contrast, food applications are centered on edible oils for retail kitchens alongside specialty bakery and confectionery ingredients experiencing renewed demand amid lifestyle trends. Industrial consumption is primarily anchored by biodiesel production, yet cosmetics, lubricants, and soaps & detergents represent adjacent growth platforms fueled by sustainability mandates and regulatory incentives.

Distribution channels reflect an enduring reliance on offline networks with grocery stores, specialty stores, and supermarket & hypermarket formats capturing bulk volumes, even as online sales proliferate through direct-to-consumer and B2B e-marketplaces. This diverse segmentation matrix underscores the importance of tailoring strategies that align with specific value-chain dynamics and growth trajectories across oilseed types, product forms, processing technologies, applications, and channels.

This comprehensive research report categorizes the Oilseed market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Oilseed Type

- Product Form

- Processing Technology

- Application

- Distribution Channel

Highlighting Regional Dynamics And Unique Trends In Oilseed Production Consumption And Trade Across The Americas EMEA And Asia Pacific Markets

Regional analysis uncovers distinct patterns shaping oilseed production, consumption, and trade across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, the United States and Brazil continue to lead global soybean output, underpinned by scale efficiencies, advanced agronomy, and robust infrastructure for export and domestic crush activities. This region’s strong feed demand, driven by expansive livestock and aquaculture sectors, supports a resilient meal market while refining capacity expansions in the Gulf and Atlantic corridors reflect ambitions to capture higher value refined oil volumes.

Conversely, Europe Middle East and Africa is characterized by a diversified oilseed portfolio with sunflower playing a pivotal role in Eastern European production and refining hubs in Western Europe serving both culinary and biodiesel markets. Regulatory frameworks focusing on renewable energy directives have elevated biodiesel feedstock imports, fostering trade partnerships with key exporters. Meanwhile, in North Africa and the Middle East, domestic processing investments are on the rise to secure edible oil supplies and reduce import reliance amid tariff and currency fluctuations.

Asia Pacific remains the world’s largest consumer block, with China and India accounting for the lion’s share of edible oil and protein meal demand. Here, soybean imports are critical to sustaining crushing throughput, and local governments are incentivizing canola and sunflower cultivation to diversify supply. Refinery modernization projects are underway in Southeast Asia to produce higher-quality virgin and RBD oils for both domestic consumption and re-export. Additionally, rapid growth in the region’s e-commerce ecosystem is spurring online distribution innovations that enhance access to premium oilseed products across urban and semi-urban centers.

This comprehensive research report examines key regions that drive the evolution of the Oilseed market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players In The Oilseed Industry Spotlighting Strategic Initiatives Innovation Partnerships And Competitive Positioning In A Rapidly Changing Market

Leading industry participants are deploying differentiated strategies to strengthen their market positions and capitalize on evolving end-use demands. Vertical integration remains a core theme among global oilseed conglomerates that control upstream seed production, crushing operations, and downstream refining assets. These integrated models facilitate margin capture across crude oil, hulls, and refined oil value streams while enabling swift responses to tariff shifts and feedstock cost variations.

Innovation partnerships are also rising in prominence as players collaborate with technology providers to advance membrane filtration, enzymatic extraction, and digital traceability capabilities. Such alliances not only enhance operational efficiencies but also underpin sustainability claims in cosmetics, lubricants, and biodiesel segments. Moreover, select companies are building brand equity in health-oriented food sectors by launching virgin oil lines with transparent sourcing credentials and certifications, appealing to consumers in premium retail and specialty channels.

Furthermore, several top processors are expanding their application portfolios through joint ventures in aquaculture feed and pet nutrition, tapping into high-growth protein segments. On the distribution front, omnichannel strategies are gaining traction; conventional distribution through supermarket & hypermarket outlets is being complemented by proprietary e-commerce platforms that leverage direct engagement with industrial buyers and culinary professionals. Collectively, these corporate maneuvers highlight a strategic emphasis on agility, sustainability, and customer-centric innovation across the oilseed landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oilseed market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ag Processing Inc

- Archer Daniels Midland Company

- Astra Agro Lestari

- BASF SE

- Bayer AG

- Bunge Limited

- Cargill Incorporated

- CHS Inc.

- COFCO International

- Corteva Agriscience

- Fuji Oil Co., Ltd.

- Golden Agri-Resources Ltd.

- GrainCorp Limited

- Groupe Limagrain Holding

- KLK Alami Edible Oils

- KWS SAAT SE & Co. KGaA

- Louis Dreyfus Company B.V.

- Marico Limited

- Marubeni Corporation

- Olam Agri

- Patanjali Foods Ltd

- Savola Group

- Syngenta Group

- Viterra Inc.

- Wilmar International Limited

Presenting Targeted Strategic Recommendations For Industry Leaders To Capitalize On Emerging Opportunities Mitigate Risks And Drive Sustainable Growth In Oilseeds

Industry leaders should prioritize investments in advanced processing technologies that reduce environmental impact while maximizing oil recovery rates. By evaluating the cost-benefit tradeoffs of enzymatic extraction versus traditional solvent methodologies, decision makers can position their operations for both regulatory compliance and premium asset utilization. In addition, strengthening digital supply-chain transparency is critical: adopting block chain and IoT-enabled traceability solutions not only mitigates reputational risk but also unlocks new pricing premiums in specialty food and cosmetics applications.

Moreover, diversification of sourcing channels is imperative in the wake of tariff volatility. Stakeholders are advised to cultivate relationships with alternative origin suppliers and consider strategic reserves to buffer against abrupt trade disruptions. On the product front, developing hydrogenated and virgin oil variants with clear functional and clean-label positioning can capture value in bakery and nutraceutical markets. Simultaneously, participants should explore co-processing opportunities that integrate feed and industrial applications, thereby optimizing by-product utilization and enhancing overall process economics.

Finally, a proactive approach to partnerships and alliances will be instrumental. Collaborative ventures with downstream biodiesel producers, cosmetics manufacturers, and specialty feed formulators can facilitate shared investments in sustainability credentials and market development. By embracing a holistic strategy that unites technology, traceability, and strategic sourcing, industry leaders can navigate the complexities of the oilseed sector and secure a trajectory of sustainable growth.

Detailing The Rigorous Research Methodology Employed Including Data Collection Validation And Analytical Frameworks Underpinning The Oilseed Market Insights

The findings presented herein are derived from a rigorous research methodology integrating primary and secondary data sources, expert interviews, and multi-layered validation protocols. Initially, comprehensive secondary research was carried out to map existing production statistics, trade flows, and regulatory frameworks, drawing from governmental reports, industry publications, and academic studies. This was complemented by in-depth interviews with C-level executives, processing engineers, agronomists, and end-use buyers to capture nuanced perspectives on technological adoption, sustainability initiatives, and market access challenges.

Quantitative and qualitative data sets were triangulated using both top-down and bottom-up analytical frameworks to ensure consistency and accuracy. Market dynamics were cross-verified against trade data and pricing intelligence, while segmentation insights were validated through targeted surveys and focus groups with key stakeholders across the value chain. To further enhance credibility, findings were subjected to peer review by subject-matter experts in extraction technologies and agricultural economics. All methodologies conformed to best-practice research standards, ensuring that the insights and recommendations offered are both robust and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oilseed market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oilseed Market, by Oilseed Type

- Oilseed Market, by Product Form

- Oilseed Market, by Processing Technology

- Oilseed Market, by Application

- Oilseed Market, by Distribution Channel

- Oilseed Market, by Region

- Oilseed Market, by Group

- Oilseed Market, by Country

- United States Oilseed Market

- China Oilseed Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing Key Learnings Strategic Imperatives And Future Outlook For Stakeholders Navigating The Oilseed Market Environment

This executive summary has distilled the critical trends, challenges, and strategic pathways that define the contemporary oilseed market. From the transformative impacts of processing innovations and digital traceability to the recalibrations necessitated by tariff adjustments, stakeholders must adopt a forward-looking stance that integrates technology, sustainability, and diversified sourcing. Segmentation analysis underscores the heterogeneity of demand across canola, peanut, soybean, and sunflower oils, as well as the varied prospects in refined oil forms and application sectors ranging from biodiesel to specialty bakery ingredients.

Regional dynamics further illustrate the imperative of tailored market entry and expansion strategies, with the Americas, EMEA, and Asia-Pacific each presenting unique production strengths and consumption drivers. Leading companies are thus called upon to refine their value-chain configurations, forge strategic partnerships, and invest in high-value product lines that resonate with evolving consumer and industrial requirements. As the industry advances, success will hinge on the ability to harness data-driven insights, respond agilely to policy shifts, and deliver transparent, sustainable offerings. In embracing these strategic imperatives, market participants can position themselves at the forefront of the oilseed sector’s next phase of growth.

Take Action Now Connect With Ketan Rohom Associate Director Sales And Marketing To Secure Access To An In Depth Oilseed Market Research Report

To deepen your strategic understanding and harness the full potential of the dynamic oilseed landscape, reach out to Ketan Rohom, Associate Director, Sales and Marketing, for a personalized discussion on how this comprehensive report can inform your next key initiative. Engaging with Ketan will provide you with tailored insights, customized data highlights, and guidance on the most relevant sections aligned to your organization’s priorities. Secure direct access to exclusive findings and explore bespoke add-ons that align with your strategic imperatives. Connect today to unlock the critical intelligence that will empower your decision-making and position you at the forefront of innovation in the oilseed sector

- How big is the Oilseed Market?

- What is the Oilseed Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?