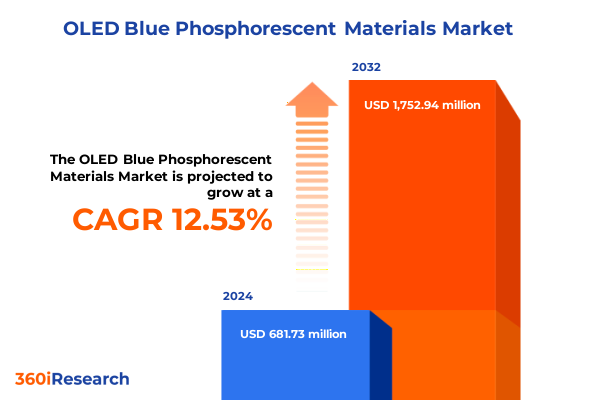

The OLED Blue Phosphorescent Materials Market size was estimated at USD 760.38 million in 2025 and expected to reach USD 859.38 million in 2026, at a CAGR of 12.67% to reach USD 1,752.94 million by 2032.

Understanding the Strategic Importance and Technological Challenges of Blue Phosphorescent OLED Materials in Next-Generation Display and Lighting Applications

Organic light-emitting diodes (OLEDs) have become the benchmark for high-contrast, energy-efficient displays in smartphones, televisions, monitors, and emerging wearable devices. Among the RGB emissive layers, blue remains the most challenging due to its high photon energy, which accelerates exciton-induced degradation. Unlike red and green OLED subpixels that harness phosphorescence to convert nearly every electron into light, blue OLEDs have historically relied on fluorescent emitters with limited internal quantum efficiency (IQE) and shorter operational lifetimes. This inefficiency constrains overall panel performance, diminishing battery life in portable electronics and raising costs for large-area installations.

Recent research breakthroughs are illuminating a path forward. Innovations such as new electron injection materials extend blue pixel lifetimes, while advanced optical designs expedite exciton radiative decay. Material science efforts are focused on developing host-guest systems with stable phosphorescent complexes, tunable singlet-triplet energy gaps, and reduced exciton quenching under high current densities. As display makers pursue ever-higher peak brightness for HDR content, ensuring blue subpixel stability is paramount to unlocking full-color, long-lasting OLED panels for next-generation consumer and automotive markets.

In this context, understanding the evolving landscape of blue emissive materials, their performance envelopes, and the strategic implications for suppliers and integrators is critical. This report examines the technological, regulatory, and competitive forces shaping the development and adoption of blue phosphorescent OLED materials, offering decision-makers a robust foundation for navigating the shifting market dynamics.

Exploring the Latest Breakthroughs That Are Shaping the Future of Blue Phosphorescent OLED Materials and Display Technologies

The landscape of blue OLED materials is undergoing transformative shifts driven by breakthroughs in both molecular design and device architecture. Phosphorescent organic light-emitting diodes (PHOLEDs) have long promised up to fourfold higher IQE over fluorescent emitters, yet deep blue PHOLEDs lagged behind green and red counterparts due to exciton-induced molecular breakdown. The University of Michigan’s recent demonstration of a double-sided polariton-enhanced Purcell (PEP) cathode and anode structure has matched blue subpixel lifetimes with green PHOLED performance, marking the first time blue light can sustain extended operation at commercially relevant luminance levels.

Concurrently, solution-processable thermally activated delayed fluorescence (TADF) exciplex materials are unlocking multifunctionality by eliminating the need for heavy-metal dopants. These exciplex systems achieve near-100% IQE while maintaining high external quantum efficiency (EQE) in blue emission, and they can be fabricated using scalable liquid processing techniques. The ability to combine fluorescent and TADF emitters in so-called hyperfluorescence architectures further enhances color purity, driving toward wide color gamuts without sacrificing device longevity.

Beyond emissive layer chemistry, innovations in device stacking-such as tandem OLED configurations-distribute the exciton burden across multiple junctions, reducing exciton fusion losses and mitigating hot-exciton damage. Simultaneously, advanced charge injection layers and novel host materials engineered at the molecular level are lowering driving voltages and mitigating charge imbalance. These converging advances are setting the stage for an inflection point in blue OLED performance, with path-breaking prototypes expected to enter pilot production lines within the next 12 to 18 months.

Examining the Cumulative Effects of 2025 United States Section 301 Tariffs on OLED Blue Phosphorescent Material Supply Chains and Costs

In January 2025, the United States implemented significant tariff increases under Section 301 of the Trade Act of 1974, imposing a 50% duty on semiconductor imports and raising rates to 50% on solar wafer and polysilicon imports from China. Although these measures target technology transfer practices and aim to fortify domestic supply chains, they have also introduced upstream cost pressures for materials critical to OLED emissive layer fabrication, including organic semiconductors and specialized dopants sourced globally.

The cumulative impact of these tariffs has reverberated through the supply chain, compelling material producers and display manufacturers to re-evaluate sourcing strategies. Higher duties on semiconductor substrates have led to increased landed costs for key wafers used in thin-film encapsulation and device prototyping, while elevated tariffs on polysilicon have influenced pricing for transparent conductive oxide precursors. To mitigate cost volatility and delivery risks, several stakeholders are expanding local production capabilities, negotiating exclusion extensions, and exploring alternative material chemistries that circumvent tariff classifications. These adaptive strategies highlight the resilience of the industry in balancing compliance with economic viability amid evolving trade policies.

Deriving Key Insights from a Multi-Dimensional Segmentation of Blue Phosphorescent OLED Materials Across Applications and Technologies

Analysts segment the blue phosphorescent OLED materials market along intersecting dimensions of application, end-user industry, technology, and panel size to pinpoint demand drivers and adoption barriers. Applications bifurcate into display and lighting domains, with displays further subsegmented into monitors, smartphones, tablets, televisions across large, medium, and small panels, and wearable devices; lighting segments include architectural, automotive, and general illumination contexts. End-user industries span automotive, consumer electronics, healthcare, hospitality, and retail, each imposing specific performance criteria for blue emitter stability, color fidelity, and energy consumption.

On the technology axis, the market coexists among flexible, rigid, and transparent display formats, where emitter layer integration must account for mechanical compliance, bending radius, and optical transparency requirements. Meanwhile, panel size segmentation into large, medium, and small categories influences device architecture choices, as large-area applications prioritize uniform lifetime across extensive pixel arrays, whereas smaller panels demand peak energy efficiency for battery-constrained devices.

By integrating these segmentation lenses, stakeholders can tailor material development roadmaps to address segment-specific constraints-such as enhancing environmental robustness for architectural lighting, optimizing driving schemes for automotive displays with stringent safety standards, or refining bendable substrates for next-generation foldable smartphones. This multi-dimensional framework reveals high-priority growth pockets and informs resource allocation for both R&D and commercialization initiatives.

This comprehensive research report categorizes the OLED Blue Phosphorescent Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Panel Size

- Application

- End User Industry

Unveiling How Regional Dynamics Are Shaping Demand and Innovation in Blue Phosphorescent OLED Materials Across the Americas, EMEA, and Asia-Pacific

Regional dynamics profoundly influence the trajectory of blue phosphorescent OLED materials, with each geographic cluster exhibiting distinct strengths, challenges, and strategic imperatives. In the Americas, strong end-user demand for high-performance smartphones, gaming monitors, and automotive infotainment systems has fueled early adoption of premium OLED technologies, even as the region lacks large-scale manufacturing capacity. Regulatory developments-most notably an ITC ruling targeting unauthorized display imports-underscore the importance of securing compliant supply chains and highlight potential constraints on panel availability for local integrators.

Within Europe, Middle East & Africa (EMEA), leading automotive OEMs and luxury consumer electronics brands are adopting OLED dashboards, infotainment displays, and premium TVs, bolstered by an emphasis on sustainability and energy efficiency. Competition from state-backed Chinese manufacturers has prompted regional alliances and targeted investments in high-end OLED advanced manufacturing, ensuring that EMEA retains a foothold in innovation clusters despite cost-competitive pressures.

In Asia-Pacific, the region commands global supply chain dominance in OLED panel production, supported by massive investments from South Korean conglomerates and Chinese display firms. Recent commitments, such as Samsung Display’s $1.8 billion investment in an OLED fabrication facility in Vietnam, reinforce Asia-Pacific’s role as the primary manufacturing hub for next-generation display materials and advanced device architectures.

This comprehensive research report examines key regions that drive the evolution of the OLED Blue Phosphorescent Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Innovations by Leading Companies in Blue Phosphorescent OLED Material Development and Commercialization

Several key players are driving innovation and commercialization in blue phosphorescent OLED materials. Universal Display Corporation maintains a leadership position through its UniversalPHOLED® technology, leveraging an extensive patent portfolio and active collaboration with academic institutions. At SID Display Week 2025, the company showcased advancements in plasmonic PHOLED architectures and highlighted its contributions to tandem device engineering, underscoring its strategic focus on energy efficiency and lifetime enhancement.

Kyulux is emerging as a formidable contender in the hyperfluorescence segment, having secured $28.6 million in Series C funding to accelerate mass production of its TADF-based emitter systems. Its fourth-generation materials promise narrow emission bandwidths, high internal quantum efficiencies, and competitive lifetimes, positioning the company to challenge both phosphorescent and traditional fluorescent emitters in premium display applications.

In parallel, deep-tech startups such as Noctiluca have demonstrated proprietary electron injection materials that significantly extend blue pixel lifetimes in laboratory tests. By focusing on electron transport layer dopants and injection layer innovations, these smaller firms are carving out niches and forging partnerships with leading display manufacturers, injecting agility and specialized expertise into the market.

This comprehensive research report delivers an in-depth overview of the principal market players in the OLED Blue Phosphorescent Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Idemitsu Kosan Co., Ltd.

- Japan New Chisso Corporation (JNC)

- Kyulux Inc.

- LG Chem

- LG Display

- Merck KGaA

- OSSILA

- Qnity Electronics

- Samsung Display Co., Ltd.

- SFC Co., Ltd.

- Shine Materials Technology Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Universal Display Corporation

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Advances in Blue Phosphorescent OLED Materials and Technologies

To stay at the forefront of blue phosphorescent OLED materials, industry leaders should prioritize strategic collaborations with academic research centers specializing in TADF and plasmonic enhancement techniques, thereby fast-tracking the translation of lab-scale breakthroughs into pilot production. Furthermore, establishing cross-functional partnerships across material suppliers, panel manufacturers, and device integrators will enable a holistic approach to optimizing stack architecture and driving down cost per lumen.

Leaders should also actively engage in tariff exclusion processes and explore alternative precursor chemistries that mitigate exposure to trade-related cost increases. By diversifying supplier bases across multiple regions and investing in local or near-shore production capabilities, companies can bolster supply chain resilience while maintaining competitive pricing.

Finally, adopting modular R&D frameworks that allow rapid iteration of emitter-host combinations and device prototypes will be essential. Leveraging advanced simulation tools for exciton dynamics and optical cavity design can shorten development cycles, reduce resource expenditure, and accelerate time-to-market for next-generation blue PHOLED solutions.

Detailing a Rigorous Research Methodology Combining Primary and Secondary Data Collection for Comprehensive Blue Phosphorescent OLED Material Analysis

This research leverages a mixed-methods approach combining primary and secondary data sources to develop a comprehensive understanding of blue phosphorescent OLED materials. Primary insights were gathered through interviews with material scientists, display integrators, and supply chain executives, providing real-time perspectives on technology adoption and manufacturing challenges. Secondary research encompassed analysis of peer-reviewed journals, patent filings, and industry white papers to trace the evolution of emissive layer chemistries and device architectures.

Quantitative validation of qualitative findings was achieved by cross-referencing trade data, customs filings, and tariff schedules to assess the financial impact of regulatory measures. In addition, key performance indicators-including external quantum efficiency, operational lifetime benchmarks, and cost-per-square-inch metrics-were mapped to segmentation parameters across applications, technologies, and panel sizes. This triangulation of data sources ensures robust, actionable insights for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our OLED Blue Phosphorescent Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- OLED Blue Phosphorescent Materials Market, by Technology

- OLED Blue Phosphorescent Materials Market, by Panel Size

- OLED Blue Phosphorescent Materials Market, by Application

- OLED Blue Phosphorescent Materials Market, by End User Industry

- OLED Blue Phosphorescent Materials Market, by Region

- OLED Blue Phosphorescent Materials Market, by Group

- OLED Blue Phosphorescent Materials Market, by Country

- United States OLED Blue Phosphorescent Materials Market

- China OLED Blue Phosphorescent Materials Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Consolidating Insights to Illuminate the Path Forward for Blue Phosphorescent OLED Materials in Evolving Display and Lighting Markets

The evolution of blue phosphorescent OLED materials reflects a concerted response to longstanding performance limitations, with recent advances closing the gap between blue and green subpixel lifetimes and energy efficiencies. Innovations in emitter-host systems, optical design elements such as Purcell enhancement, and hybrid TADF-based hyperfluorescence architectures are collectively redefining material performance benchmarks.

Regulatory headwinds, notably elevated tariffs on semiconductor substrates and precursor chemicals, have underscored the importance of supply chain diversification and local production resilience. While these measures introduce near-term cost pressures, they also catalyze investment in domestic capabilities and alternative chemistries, potentially reshaping the competitive landscape.

As major players ramp up production and new entrants secure strategic funding, the market stands poised for the first wave of commercial blue PHOLED deployments. Stakeholders who integrate multi-dimensional segmentation insights with region-specific strategies will be well-positioned to lead the next phase of OLED display and lighting innovation.

Engage with Ketan Rohom to Secure Your Comprehensive Blue Phosphorescent OLED Materials Market Research Report Today

For a comprehensive perspective on the blue phosphorescent OLED materials market and to gain immediate access to in-depth analysis, contact Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full market research report tailored for strategic decision-making.

- How big is the OLED Blue Phosphorescent Materials Market?

- What is the OLED Blue Phosphorescent Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?