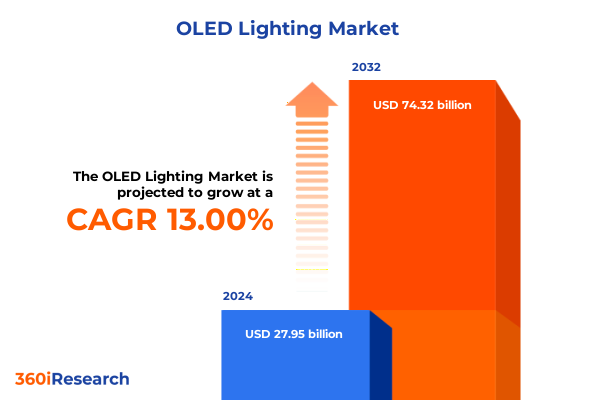

The OLED Lighting Market size was estimated at USD 31.42 billion in 2025 and expected to reach USD 35.33 billion in 2026, at a CAGR of 13.08% to reach USD 74.32 billion by 2032.

Exploring the Evolution and Strategic Significance of OLED Lighting as a Pioneering Solution for Next-Generation Illumination Systems

The field of organic light-emitting diode (OLED) lighting has undergone rapid evolution in recent years, distinguished by its unparalleled ability to deliver thin, uniform illumination with remarkable energy efficiency characteristics. In the first quarter of 2025, OLED panel shipments rose by 4% year-on-year, driven by accelerated adoption across televisions, tablets, monitors, smartphones, and emerging applications such as automotive displays and augmented reality glasses. Despite this increase in unit volumes, revenue growth remained modest due to ongoing pricing pressures and macroeconomic factors, underscoring the technology’s maturation and competitive dynamics within broader display and lighting markets.

Beyond conventional glass-based panels, the versatility of OLED lighting manifests in flexible form factors that conform to curved surfaces, rigid modules suited for architectural fixtures, and transparent designs that blend seamlessly into windows and display elements. Transparent OLED installations have already begun to redefine aesthetic and functional integration in both automotive and smart building environments, allowing light generation without sacrificing visibility or natural daylight ingress.

As organizations seek innovative illumination solutions, OLED lighting is increasingly leveraged for architectural accents, automotive exterior and interior lighting, decorative displays, and dynamic signage. The convergence of its unique attributes-ultra-thin profiles, diffuse glow, and precise color rendering-positions OLED as a transformative medium in next-generation lighting applications, setting the stage for deeper insights into market drivers and strategic imperatives.

How Technological Advances in Flexible Transparent and Digital OLED Lighting Are Driving Paradigm-Shifting Changes Across Multiple Industries

Recent years have witnessed seismic shifts in OLED lighting technology, driven by breakthroughs in material science and manufacturing processes. Flexible OLED modules now support bending radii that enable seamless integration into curved architectural surfaces and automotive body panels. This transition from flat rigid panels to adaptable substrates has unlocked new design paradigms, allowing luminaire makers and OEMs to explore previously unattainable form factors and immersive lighting experiences. Transparent OLED displays meanwhile facilitate the overlay of digital content onto real-world backdrops, merging functional illumination with interactive visual communication in environments ranging from retail storefronts to smart windows.

In parallel, the advent of transparent OLED head-up displays is reshaping automotive interiors and safety landscapes, projecting critical driving information directly onto windshields without compromising driver visibility. This integration underscores the dual role of OLED as both a lighting and display technology, amplifying its appeal among automotive OEMs seeking to enhance driver assistance systems, infotainment overlays, and passenger engagement features.

On the fabrication front, digital OLED architectures featuring individually addressable segments have matured into commercially viable solutions. The introduction of second-generation digital OLED rear lighting panels, as showcased by OEM collaborations at major trade events, demonstrates the ability to render dynamic light signatures, optimize power consumption, and heighten brand recognition through programmable illumination. Such modularity and programmability mark a pivotal shift, empowering automakers and lighting designers with unprecedented creative control and functional adaptability.

Examining the Far-Reaching Effects of United States Section 301 Tariff Increases on OLED Lighting Materials and Supply Chain Dynamics

The United States’ ongoing trade policy adjustments in 2025 have introduced material headwinds for OLED lighting supply chains. On January 1, 2025, the Office of the United States Trade Representative enacted Section 301 tariff increases on select imports from China, raising duties on solar polysilicon and wafer products to 50% and on specific tungsten derivatives to 25%. Although these measures primarily target photovoltaic and semiconductor sectors, the ripple effects extend to OLED lighting manufacturers reliant on intermediate substrates, encapsulation films, and ancillary components that share similar processing requirements.

In addition, reciprocal tariffs levied on optical films and OLED organic materials have introduced uncertainty around AMOLED material costs and availability. Industry commentators warn that heightened duties on these foundational compounds may drive input cost inflation, strain existing supplier relationships, and compel design adjustments to mitigate financial impact. Elevated material procurement expenses could prompt OEMs to reevaluate sourcing strategies, potentially accelerating regional diversification or near-shoring initiatives in search of more stable tariff environments and reduced logistical complexity.

Confronted with these shifting trade landscapes, companies across the OLED lighting ecosystem are exploring alternative manufacturing footprints, forging strategic partnerships, and intensifying supplier due diligence to sustain production continuity. By proactively addressing tariff exposure through supply chain redesign and material innovation, stakeholders aim to uphold competitive pricing while safeguarding technology roadmaps against future policy fluctuations.

Uncovering Key Segmentation Perspectives in the OLED Lighting Market Across Type Technology Color Application and End User Dimensions

A comprehensive understanding of OLED lighting market segmentation reveals nuanced dynamics that shape product strategies and customer value propositions. Within the ‘Type’ dimension, flexible OLED lighting modules cater to curved architectural panels and ergonomic automotive fixtures, while rigid OLED units serve as the foundation for flat lighting and display installations; concurrently, transparent modules enable luminous windows and interactive signage, unlocking dual-use interfaces.

Evaluating the market through a ‘Technology’ lens highlights the coexistence of active-matrix OLED (AMOLED) panels, which support high-resolution imaging and dynamic light modulation, and passive-matrix OLED (PMOLED) counterparts, valued for their cost-efficient fabrication in smaller or simpler lighting applications. Such differentiation informs both R&D roadmaps and go-to-market strategies, as design teams balance resolution requirements against manufacturing scalability.

A further playbook emerges when considering ‘Light Color’: while standard white OLED solutions dominate general illumination, colored segments-spanning blue, green, and red wavelengths-elevate visual impact in signage and decorative environments. The strategic deployment of colored OLED not only enhances brand storytelling through vibrant hues but also supports specialized use cases such as horticultural lighting, where precise spectral outputs drive biological responses.

Application-specific segmentation underscores OLED’s versatility across architectural lighting, automotive exterior and interior installations, backlighting enhancements, decorative accents, general lighting fixtures, and signage panels. Intersecting these applications with expansive ‘End User’ categories-from automotive OEMs seeking exterior safety and interior ambiance to commercial verticals including healthcare, industrial, offices, and retail environments, and hospitality settings such as hotels and restaurants, to residential projects spanning indoor and outdoor installations-illuminates the tailored requirements that guide product roadmaps and market engagement models.

This comprehensive research report categorizes the OLED Lighting market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Light Color

- Application

- End User

Delineating Regional OLED Lighting Trends and Opportunities Across the Americas Europe Middle East Africa and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of OLED lighting adoption and innovation. In the Americas, a synergy between automotive OEMs in North America and boutique architectural firms in South America has fueled adoption of advanced OLED modules. United States manufacturers and standards bodies collaborate to promote energy-efficient lighting codes, while a growing number of pilot projects in Canada and Brazil demonstrate OLED’s potential for sustainable commercial and residential applications.

Europe, the Middle East, and Africa collectively offer a tapestry of market drivers and regulatory environments. Western European nations pursue stringent energy regulations that position OLED lighting as a tool for carbon reduction in heritage sites and contemporary edifices, whereas Middle Eastern real estate developers integrate OLED façades and hospitality lighting to differentiate luxury properties. In sub-Saharan Africa, niche deployments underscore OLED’s appeal for low-profile installations and off-grid lighting solutions where minimal power consumption and longevity are prized.

Asia-Pacific stands as both a manufacturing powerhouse and an early adopter of OLED lighting technologies. Major panel producers in South Korea and Japan advance AMOLED manufacturing architectures, while Chinese and Taiwanese suppliers focus on cost-competitive PMOLED lines. Meanwhile, Southeast Asian design studios and real estate conglomerates incorporate transparent OLED screens into smart buildings, and Australian research institutions explore horticultural and marine lighting applications, reflecting the region’s versatility in commercializing OLED innovations.

This comprehensive research report examines key regions that drive the evolution of the OLED Lighting market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Strategic Movements and Collaborative Innovations Among Leading Companies Shaping the Global OLED Lighting Landscape

Industry leaders are redefining the boundaries of OLED lighting through strategic alliances, product innovation, and targeted investments. OLEDWorks, collaborating with Marelli, secured the AutoTech “Collaborative Partnership of the Year” award for the 2024 Audi Q6 e-tron rear light platform, leveraging second-generation digital OLED 2.0 technology with high-contrast, software-controlled segments that exemplify how co-creation accelerates go-to-market timelines and enhances brand identity.

At CES 2025, OLEDWorks unveiled next-gen automotive lighting innovations under its Atala brand, detailing partnerships with Audi to equip the A5 and S5 models with dynamic digital OLED rear panels featuring hundreds of individually addressable segments. This milestone underscores the company’s leadership in marrying aesthetic flexibility with intelligent light signatures that adapt in real time to driving scenarios and user preferences.

Other key players such as LG Display, Konica Minolta Pioneer, and OSRAM are advancing the field through transparent panels, TADF-based material systems, and hybrid OLED-LED architectures. Konica Minolta Pioneer’s transparent OLED light panel prototype, capable of 70% transparency when off and delivering 3,000 cd/m² when active, exemplifies the push toward multifunctional lighting surfaces. Meanwhile, OSRAM’s second-generation digital OLED modules integrate real-time animation capabilities into automotive rear lighting, further solidifying the competitive landscape. Through these initiatives, leading suppliers continue to differentiate on performance, sustainability, and modularity to capture diverse application and end-user needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the OLED Lighting market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acuity Brands, Inc.

- BLACKBODY

- Cooper Lighting, LLC

- EMDE development of light GmbH

- Fagerhult Group AB

- Idemitsu Kosan Co., Ltd.

- Inuru GmbH

- Kaneka Corporation

- Konica Minolta, Inc.

- LG Corporation

- OLEDWorks LLC

- OSRAM GmbH

- Signify N.V.

- Sumitomo Chemical Co., Ltd.

- Trilux GmbH & Co. KG

- Universal Display Corporation.

- Zumtobel Group AG

Actionable Strategies for Industry Leaders to Capitalize on OLED Lighting Innovations While Mitigating Supply Chain and Policy Risks

To maintain a competitive advantage in the evolving OLED lighting ecosystem, industry leaders should prioritize diversification of their material supply base by partnering with alternative AMOLED and PMOLED suppliers across North America, Europe, and Asia. By developing secondary sourcing channels outside of China, organizations can mitigate tariff exposure and enhance supply chain resilience.

Investing in advanced manufacturing capabilities-such as roll-to-roll printing for flexible substrates and automated segmentation assembly for digital OLED modules-will reduce production costs and accelerate time-to-market. Concurrently, R&D budgets should target novel organic and TADF materials that eliminate reliance on rare metals, lower power consumption, and extend device lifetimes.

Furthermore, companies would benefit from forging cross-industry collaborations with automotive OEMs, architectural firms, and horticultural research institutions to co-create application-specific solutions, thereby expanding addressable markets. Engaging with standards bodies and policy makers to shape energy-efficiency regulations can drive broader adoption of OLED lighting. Finally, incorporating sustainability metrics into product roadmaps and communicating lifecycle benefits will support brand differentiation and align with global decarbonization goals.

Rigorous Methodological Framework Underpinning the Comprehensive Research Approach to the OLED Lighting Market Analysis

This report integrates a robust research methodology that combines extensive secondary research with expert interviews and primary data collection. Secondary sources include industry white papers, regulatory filings, patent databases, and technical journals to establish foundational knowledge and identify emerging trends. Primary research encompassed in-depth interviews with R&D heads, manufacturing leaders, and senior executives at leading OLED lighting organizations to validate market dynamics and capture strategic intent.

Market segmentation analysis was executed by categorizing data across five core dimensions: Type, Technology, Light Color, Application, and End User. Regional insights were developed by mapping production and adoption metrics across the Americas, Europe, Middle East & Africa, and Asia-Pacific. Quality control protocols involved triangulating data from multiple sources, ensuring consistency and accuracy in the insights presented.

Statistical models and thematic trend analysis were used to interpret qualitative inputs and quantitative indicators. The resulting framework offers a comprehensive view of stakeholder strategies, technology roadmaps, and market enablers, providing readers with a holistic perspective on the global OLED lighting landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our OLED Lighting market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- OLED Lighting Market, by Type

- OLED Lighting Market, by Technology

- OLED Lighting Market, by Light Color

- OLED Lighting Market, by Application

- OLED Lighting Market, by End User

- OLED Lighting Market, by Region

- OLED Lighting Market, by Group

- OLED Lighting Market, by Country

- United States OLED Lighting Market

- China OLED Lighting Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesis of Critical Insights and Forward-Looking Perspectives on the Evolving OLED Lighting Ecosystem and Market Dynamics

The convergence of technological innovation, evolving applications, and dynamic trade policies has positioned OLED lighting as a transformative force within the broader illumination and display markets. Flexible, transparent, and digital OLED modules are reshaping design possibilities in automotive, architectural, decorative, and horticultural spaces, while regional initiatives and regulatory frameworks continue to influence adoption trajectories.

Tariff-driven supply chain recalibrations and material sourcing strategies underscore the importance of proactive risk management, as stakeholders navigate new trade landscapes and material cost pressures. In response, leading companies are forging strategic alliances, investing in advanced manufacturing processes, and pioneering novel material systems to sustain competitive differentiation.

By synthesizing critical segmentation insights with regional and company-level analyses, this executive summary illuminates the pathways through which OLED lighting will advance in the near term. As the industry matures, ongoing collaboration among OEMs, material suppliers, and standards bodies will be essential to unlocking the full potential of OLED-based illumination solutions.

Connect with Ketan Rohom to Secure In-Depth OLED Lighting Market Intelligence and Transform Strategic Decision Making Today

To explore these comprehensive insights and empower your organization with actionable market intelligence, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings deep expertise in OLED lighting dynamics and can guide you through tailored research packages that align with your strategic objectives. Engage with Ketan to unlock detailed data on technology advancements, supply chain scenarios, and custom segmentation analyses that will drive your decision making. By partnering with Ketan, you gain not only a robust report but also a dedicated advisor for ongoing support, ensuring you stay ahead of industry trends. Don’t miss the opportunity to transform your lighting innovations-contact Ketan today to secure access to the full market research report and chart a path to sustained growth in the OLED lighting space.

- How big is the OLED Lighting Market?

- What is the OLED Lighting Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?