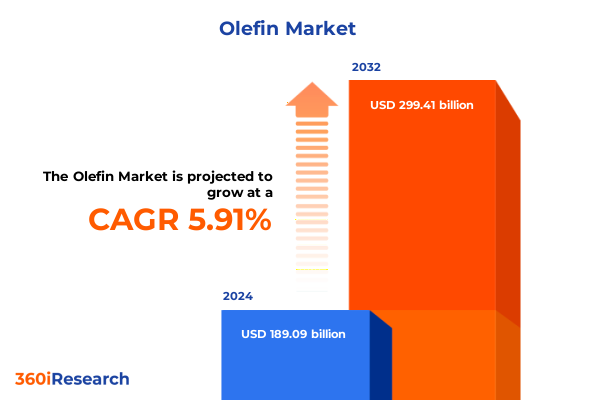

The Olefin Market size was estimated at USD 199.97 billion in 2025 and expected to reach USD 211.47 billion in 2026, at a CAGR of 5.93% to reach USD 299.41 billion by 2032.

Olefin Market Overview That Sets the Stage for Understanding Market Dynamics Driving Innovation and Growth in Petrochemical Supply Chains

The olefin market occupies a foundational position within the global petrochemical landscape, serving as a primary feedstock for a wide array of downstream applications ranging from plastics and synthetic rubbers to advanced performance materials. Olefins such as ethylene, propylene, and butadiene boast exceptional versatility, finding utility in sectors as diverse as packaging, automotive, construction, and textiles. This value chain complexity underscores the criticality of understanding supply–demand balances, feedstock dynamics, and emerging end-use requirements.

Against a backdrop of shifting energy paradigms and accelerating sustainability mandates, olefin producers are increasingly challenged to optimize feedstock flexibility, enhance process efficiencies, and integrate circular economy principles. The interplay between traditional naphtha cracking and emerging technologies such as catalytic dehydrogenation highlights a broader industry transition toward resource diversification. As geopolitical events, environmental policy pressures, and digitalization continue to influence competitiveness, stakeholders must navigate both near-term market volatilities and long-term structural shifts. In this executive summary, we establish a comprehensive baseline for grasping the market’s core dynamics, setting the stage for detailed analyses that follow.

Evolution of Production and Demand Patterns in the Olefin Industry Shaping the Future of Sustainable Feedstocks and Competitive Edge

In recent years, the olefin industry has witnessed transformative shifts driven by evolving feedstock availability, technological breakthroughs, and changing downstream demand profiles. The maturation of shale gas resources, particularly in North America, has catalyzed a rebalancing of global ethylene and propylene trade flows, delivering cost advantages to producers who can integrate lighter feedstocks into steam-cracking units. Concurrently, the rise of catalytic dehydrogenation pathways has unlocked new avenues for on-purpose propylene production, reducing reliance on traditional refinery-linked streams.

On the demand side, escalating focus on high-performance polymers and specialty chemicals has altered the traditional consumption mix. For instance, growth in multi-layer flexible packaging and advanced automotive composites has spurred greater uptake of polymer-grade olefins, while rubber monomer grade butadiene remains essential for tire manufacturing innovations. These shifts are further accentuated by tightening environmental regulations that incentivize less carbon-intensive processes and the adoption of renewable feedstocks. As a result, the olefin landscape is moving toward a more intricate, differentiated ecosystem where producers must leverage technological agility and strategic partnerships to maintain competitive edge.

Assessing the Aggregate Effects of Recent United States Tariff Measures on Olefin Supply Chains and Cost Structures Across Sectors in 2025

The United States government’s tariff measures introduced in early 2025 have introduced new cost considerations across the olefin supply chain, influencing both import parity and export competitiveness. Elevated duties on key petrochemical imports aimed to protect domestic producers, yet they simultaneously disrupted established trade routes and feedstock arbitrage opportunities. As a result, many downstream converters encountered margin squeezes when sourcing polymer-grade ethylene and propylene from traditional suppliers under the new tariff regime.

Moreover, the reallocation of trade flows triggered logistical challenges, with midstream infrastructure being repurposed to handle alternative feedstock origins. Pipeline allocations, storage footprint utilization, and shipping scheduling all required rapid recalibration. While domestic steam-cracker operators generally benefited from improved feedstock security, specialty grades and rubber monomers experienced tighter regional supply balances. Collectively, these tariff-induced distortions underscore the importance of resilient sourcing strategies and proactive cost management to mitigate the aggregate impacts on operational expenditure and end-market pricing.

Uncovering Core Insights from Product Technology Grade and End Use Industry Segmentation That Reveal Strategic Opportunities in the Olefin Market

A nuanced segmentation approach reveals distinct strategic opportunities across product type, technology, grade, and end-use industry categories. When examining product type segmentation, butadiene, ethylene, and propylene each display unique adoption patterns, with further distinctions between chemical-grade and polymer-grade applications as well as specialized rubber monomer grading for tire manufacturers. This granularity highlights areas where targeted capacity investments or process modifications can yield enhanced margins.

In the realm of technology, catalytic dehydrogenation methods such as butane dehydrogenation and propane dehydrogenation are increasingly deployed alongside steam-cracking processes-whether leveraging ethane, LPG, or naphtha feedstocks-to match regional feedstock economics. The choice of technology not only impacts conversion yields but also determines downstream purity specifications, influencing the overall value proposition to converters. Producers that can flexibly switch between dehydrogenation and cracking as feedstock costs fluctuate stand to capture differentiated pricing premiums.

Grade-based segmentation further delineates growth pathways. Chemical grades subdivided into industrial and technical tiers cater to specialized chemical synthesis, while fuel-grade olefins address energy applications ranging from gas to oil. Polymer-grade variants-spanning high-density, linear low-density, and low-density polymers-enable custom formulation of plastics for packaging, construction materials, and consumer goods. Finally, end-use segmentation across agriculture, automotive, construction, packaging, and textile markets underscores the breadth of end-market demand. Each end-use subset, from greenhouse film manufacturing to rigid packaging solutions, offers distinct performance requirements and regulatory drivers, inviting producers to align their product portfolios to end-market trends.

This comprehensive research report categorizes the Olefin market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Grade

- End Use Industry

Highlighting Distinct Regional Dynamics Across Americas Europe Middle East Africa and Asia Pacific Shaping Olefin Demand and Investment Patterns

Regional dynamics in the olefin market reveal stark differences in feedstock accessibility, regulatory frameworks, and investment landscapes. Within the Americas, the shale gas revolution continues to underpin low-cost ethane and propane feedstocks, enabling steam crackers to operate at superior cost curves. This abundance has attracted significant capacity expansions and downstream polymer integration, reinforcing North America’s competitive positioning in global trade.

Turning to Europe, the Middle East, and Africa, the interplay of mixed feedstock availability and stringent environmental mandates has propelled investments in advanced dehydrogenation technologies and ethylene recovery units. Regional policy initiatives focused on decarbonization and circular polymers are driving innovation in chemical recycling and waste-to-olefin projects, particularly along key petrochemical hubs in Western Europe and the Gulf Cooperation Council countries. EMEA producers are also exploring partnerships with renewable hydrogen suppliers to reduce carbon footprints in olefin production.

In the Asia-Pacific region, strong consumption growth across packaging, automotive, and electronics industries has fueled robust demand for polymer-grade olefins. Countries like China, India, and Southeast Asian economies are expanding steam-cracker capacities and integrating refinery-based propylene units to meet localized demand. At the same time, feedstock security concerns have spurred strategic alliances and long-term contracts for liquefied natural gas and naphtha imports. The divergent trajectories of each region underscore the need for market participants to adopt differentiated strategies tailored to local competitive and regulatory environments.

This comprehensive research report examines key regions that drive the evolution of the Olefin market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Competitive Positioning and Innovation Strategies of Leading Olefin Producers Fuelling Growth and Resilience in a Dynamic Market Environment

Leading players in the olefin sector are sharpening their competitive edge through targeted capacity expansions, strategic alliances, and technology partnerships. Integrated petrochemical majors continue to invest in cracker upgrades and co-located polymer facilities to boost downstream integration and margin capture. Mid-sized specialty producers, meanwhile, are carving out niches by focusing on high-purity grades and customized catalyst solutions that support advanced material applications.

Innovative supply agreements have also emerged as a differentiator, with companies leveraging long-term tolling arrangements and joint ventures to secure feedstock access and optimize plant utilization. Several global firms have introduced digital twins and advanced analytics platforms to enhance process performance, anticipate maintenance requirements, and streamline supply chain visibility. This technological adoption is critical for maintaining operational excellence and responding swiftly to market fluctuations.

In addition, select companies are forging collaborative research programs with academic institutions to advance next-generation catalytic systems and sustainable feedstock alternatives. By engaging across the value chain-from upstream ethane sourcing to downstream polymer compounding-these leaders are building resilience and unlocking incremental revenue streams in a market environment characterized by rapid change and evolving customer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Olefin market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BASF SE

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- Dow Inc.

- ExxonMobil Chemical Company

- Formosa Plastics Corporation

- INEOS Group Holdings S.A.

- LyondellBasell Industries N.V.

- Royal Dutch Shell plc

- Saudi Basic Industries Corporation

- Sumitomo Chemical Co., Ltd.

Guiding Actionable Strategic Priorities to Navigate Supply Risks Optimize Operations and Capitalize on Emerging Olefin Market Opportunities

Industry participants must prioritize strategic agility to navigate supply risks, optimize asset performance, and capitalize on evolving market drivers. First, diversifying feedstock sources through integrated dehydrogenation units or third-party tolling arrangements can mitigate exposure to raw material cost swings and geopolitical disruptions. Simultaneously, enhancing operational flexibility via modular plant designs and reversible process configurations enables a timely response to feedstock arbitrage opportunities.

Second, deepening customer partnerships by co-developing specialized grades and providing technical support fosters loyalty and creates entry barriers for competitors. Offering tailored solutions for renewable-based polymerization or high-temperature engineering applications positions producers as indispensable collaborators. Further, embracing digital initiatives-ranging from advanced process control to supply chain optimization tools-delivers measurable cost reductions and service improvements, reinforcing competitive differentiation.

Finally, committing resources to sustainable practices-from carbon capture integration to chemical recycling collaborations-will be a defining factor for long-term relevance. By transparently reporting environmental performance and engaging with stakeholders on circular economy objectives, companies can strengthen their social license to operate and anticipate tightening regulatory thresholds. These strategic imperatives serve as a roadmap for industry leaders aiming to secure enduring market leadership.

Explaining Robust Research Frameworks Data Gathering Techniques and Analytical Approaches Underpinning Insights into the Olefin Market

The insights presented in this summary draw upon a rigorous research framework that blends primary and secondary data sources. Expert interviews with industry stakeholders-including producers, technology licensors, and end-users-provided first-hand perspectives on emerging trends, technological bottlenecks, and investment priorities. These qualitative insights were complemented by an extensive review of technical whitepapers, patent filings, regulatory reports, and peer-reviewed literature to ensure a comprehensive understanding of process advancements.

Quantitative data was assembled from publicly available company disclosures, trade association statistics, and customs records to map global trade flows and feedstock pricing dynamics. This data underwent meticulous cross-validation and triangulation to reconcile discrepancies and enhance reliability. A proprietary database of facility capacities and technology deployments underpinned geospatial analyses, while scenario planning exercises allowed for stress-testing of tariff impacts and feedstock disruptions.

Analytical methodologies included value-chain segmentation, cost-curve modeling, and competitive benchmarking to spotlight areas of margin potential and operational vulnerability. The segmentation matrices were dynamically linked to end-use forecasts and regulatory pathway assessments, enabling a multi-dimensional view of market opportunities. Throughout, the research adhered to stringent quality protocols, ensuring that conclusions are robust, actionable, and transparently derived.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Olefin market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Olefin Market, by Product Type

- Olefin Market, by Technology

- Olefin Market, by Grade

- Olefin Market, by End Use Industry

- Olefin Market, by Region

- Olefin Market, by Group

- Olefin Market, by Country

- United States Olefin Market

- China Olefin Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2703 ]

Summarizing Key Takeaways and Strategic Imperatives That Synthesize Analysis and Chart the Path Forward for Olefin Industry Stakeholders

This executive summary synthesizes the critical forces reshaping the olefin industry and sets forth a clear agenda for stakeholders to follow. The evolution of feedstock trends and production technologies has introduced both opportunities and complexities, requiring an agile approach to capacity planning and portfolio management. Tariff-induced supply adjustments underscore the value of resilient sourcing strategies and flexible operational designs, while segmentation insights illuminate pathways for targeted growth across product, technology, grade, and end-use axes.

Regional analyses reveal that competitive landscapes vary significantly across the Americas, EMEA, and Asia-Pacific, each presenting unique combinations of feedstock economics, regulatory imperatives, and consumption patterns. Leading companies distinguish themselves through integrated value-chain investments, digital innovation, and sustainability commitments, reinforcing the importance of holistic strategies that encompass both cost efficiency and environmental performance. Ultimately, the companies that succeed will be those that embrace complexity, leverage advanced analytics, and forge collaborative ecosystems to drive continuous improvement.

By internalizing these takeaways, industry leaders can chart a strategic path that balances near-term resilience with long-term transformation. The convergence of technology, policy, and market demand creates a dynamic environment where proactive decision-making and interdisciplinary collaboration will define competitive leadership. As the olefin sector moves toward a more sustainable, diversified future, stakeholders equipped with these insights are poised to capitalize on emerging value pools and shape the market’s next phase of development.

Engaging with Associate Director of Sales and Marketing to Unlock Comprehensive Insights and Secure a Detailed Olefin Market Research Report Investment Today

To explore in-depth analyses, strategic recommendations, and granular insights into the olefin market, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. By connecting with Ketan, you can gain direct support in aligning this comprehensive market intelligence with your organization’s objectives, ensuring you stay ahead of evolving industry trends and capitalize on emerging opportunities. Engage today to secure your full market research report and empower your decision-making with data-driven clarity and expert guidance

- How big is the Olefin Market?

- What is the Olefin Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?