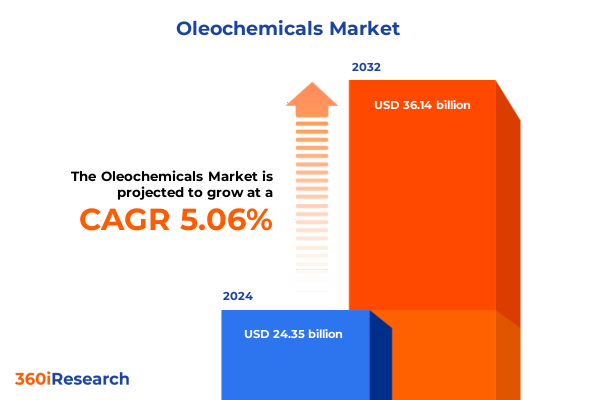

The Oleochemicals Market size was estimated at USD 25.47 billion in 2025 and expected to reach USD 26.66 billion in 2026, at a CAGR of 5.12% to reach USD 36.14 billion by 2032.

Setting the Stage for a Comprehensive Examination of the Global Oleochemical Landscape and Its Strategic Imperatives with Key Trends and Opportunities Unveiled

The oleochemical sector occupies a critical intersection between traditional chemical manufacturing and the growing imperative for renewable and sustainable feedstocks. As society’s demand for bio-based products intensifies and regulatory frameworks tighten around petrochemical reliance, the industry has embarked on a profound evolution. Derived primarily from natural oils and fats, oleochemicals offer versatile building blocks for end uses ranging from personal care formulations to industrial lubricants, affording manufacturers the opportunity to align environmental stewardship with commercial performance. In this context, stakeholders require a clear, nuanced understanding of how emerging supply chain dynamics, evolving consumer preferences, and technological advancements converge to redefine competitive advantage.

Against this backdrop, this executive summary lays out a structured exploration of the most influential drivers, strategic inflection points, and actionable takeaways shaping the current and near-term trajectory of the oleochemical market. The aim is to furnish decision-makers with a synthesis of key industry trends, tariff impacts, segmentation insights, regional variations, and company strategies that collectively chart a path toward resilient, profitable growth. By synthesizing these elements, executives can gauge where to focus investments, prioritize innovation, and strengthen partnerships without relying on quantitative market sizing or forecasts. Instead, the emphasis is on qualitative depth, strategic alignment, and evidence-based recommendations that reflect the landscape’s complexity.

Navigating the Pivotal Transformative Shifts Reshaping Oleochemical Production Supply Chains and Market Dynamics Worldwide

Over the past decade, the oleochemical landscape has undergone a series of transformative shifts that extend far beyond incremental improvements in product formulations. Most notably, the urgency of the circular economy paradigm has catalyzed a reconfiguration of supply chains, as manufacturers integrate byproducts from biodiesel and refined vegetable oil processes into their production footprints. This circular approach has unlocked new revenue streams for waste management and refined feedstock sourcing, while simultaneously driving down raw material volatility and fostering closer collaboration between renewable resource suppliers and chemical producers.

At the same time, advancements in green chemistry have elevated the performance profile of oleochemical derivatives. Novel catalysts and enzymatic processing techniques now enable more selective functionalization of fatty acids and alcohols, granting formulators unprecedented control over product purity, biodegradability, and regulatory compliance. Meanwhile, heightened geopolitical tensions and trade disruptions have prompted major players to diversify sourcing locations and invest in domestic capacity, thus minimizing exposure to single-source dependencies and strengthening supply chain resilience. Taken together, these shifts underscore a broader trend toward sustainability-driven innovation, in which environmental objectives and profitability reinforce one another through circular integration, advanced processing technologies, and strategic geographic rebalancing.

Evaluating the Broad and Lasting Implications of United States Tariff Measures Announced in 2025 on Oleochemical Trade and Industry Resilience

In 2025, the United States implemented a suite of tariff adjustments targeting a range of intermediate and finished oleochemical products, aiming to bolster domestic capacity and safeguard local manufacturing interests. These measures, which include increased duties on select fatty acid imports and glycerol derivatives, have reverberated throughout the global trade network. For domestic producers, the higher import levies have provided a window of opportunity to expand proprietary facilities and secure long-term supply agreements with regional feedstock suppliers. As a result, investments in local processing infrastructure have accelerated, with several new plants coming online to meet diverted demand.

Conversely, downstream formulators reliant on low-cost imports have confronted margin pressures and procurement complexity, prompting many to reevaluate product portfolios and pursue alternative raw material sources. Some have shifted toward in-house synthesis capabilities, while others have renegotiated long-term contracts to lock in favorable pricing. Across the board, the introduction of these tariffs has catalyzed a recalibration of global sourcing strategies, intensifying efforts to balance cost-competitiveness with supply security. Companies that proactively adapted by diversifying feedstock origins, investing in technological upgrades, and forging strategic alliances have emerged in stronger positions to navigate ongoing policy volatility.

Unlocking Segmentation Insights Across Product Types Sources Distribution Channels Forms and End Use Industries to Drive Strategic Decision Making

Deep examination of product type segmentation reveals how each chemical category commands distinct dynamics. Fatty acids maintain a foundational role, yet the bifurcation between saturated and unsaturated species has become increasingly pronounced as formulators seek tailored physicochemical profiles. Within saturated fatty acids, palmitic and stearic derivatives deliver stability and texture in personal care and industrial applications alike, whereas unsaturated variants such as linoleic and oleic acids underpin high-performance emulsification and lubricity. Fatty alcohols, too, have gained traction as eco-friendly surfactant precursors, while fatty amines offer versatile intermediates for corrosion inhibitors and flotation agents. Beyond these, glycerol stands out as a critical co-product finding renewed demand in pharmaceuticals and specialty polymers, and methyl esters continue to traverse sectors from biodiesel to solvent engineering. Soap noodles round out this spectrum, illustrating the enduring relevance of traditional oleochemical formulations in household care and artisanal production.

Turning to source-based insights, the dichotomy between animal-derived and plant-based feedstocks has sharpened. Ethical sourcing, traceability, and carbon neutrality now underpin procurement decisions, with many end-users opting for certified supply chains to meet ESG benchmarks. In parallel, distribution channel segmentation underscores the impact of digital transformation; direct sales models have deepened customer engagement through customized formulations, distribution partners have leveraged scale to optimize logistics, and online retail channels are opening doors for niche product lines. The form of oleochemicals-liquid versus solid-also drives differentiation in storage, transport, and handling protocols, influencing infrastructure investments. Finally, the tapestry of end-use industries, spanning automotive, construction, household care, industrial cleaning, personal care, and textile, demonstrates how each vertical imposes unique performance requirements, regulatory constraints, and innovation trajectories. Collectively, these segmentation lenses offer a granular view of where value creation surfaces across the oleochemical value chain.

This comprehensive research report categorizes the Oleochemicals market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Source

- Distribution Channel

- Form

- End Use Industry

Deriving Key Regional Perspectives from Americas Through EMEA to AsiaPacific Market Dynamics and Growth Drivers in Oleochemical Sector

Regional dynamics in the oleochemical sector are shaped by distinct feedstock availability, regulatory regimes, and end-market consumption patterns. In the Americas, abundant resources such as soybean oil and tall oil drive a robust oleochemical cluster, with manufacturers capitalizing on integrated biorefinery models to streamline co-product valorization. Meanwhile, downstream processors benefit from proximity to major consumer markets and logistic corridors, enhancing responsiveness to evolving demand in personal care and industrial applications.

Across Europe, the Middle East, and Africa, the landscape is characterized by stringent sustainability standards and ambitious carbon-reduction targets. European Union directives on renewable content and waste management have incentivized investments in high-purity specialty fatty acids, while in the Middle East, sovereign wealth funds are channeling resources into chemical parks that integrate palm-based feedstocks sourced from international partners. African economies, rich in native oilseed crops, are beginning to attract greenfield projects aimed at local beneficiation and export of refined intermediates.

In the Asia-Pacific region, the rapid expansion of palm oil production in Southeast Asia has positioned Malaysia and Indonesia as dominant exporters of supply, fueling capacity growth for fatty alcohols, glycerol, and methyl ester production. Simultaneously, burgeoning consumer markets in China and India drive demand for value-added personal care and cleaning formulations. These regional profiles illustrate how local endowments and regulatory landscapes shape investment opportunities, competitive intensity, and innovation pathways around the world.

This comprehensive research report examines key regions that drive the evolution of the Oleochemicals market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives and Competitive Positioning of Leading Oleochemical Producers Shaping the Industry’s Future Value Chain

Leading oleochemical producers have deployed strategic initiatives to enhance their competitive positioning and capture emerging market opportunities. Global chemical majors have pursued vertical integration, securing upstream access to renewable feedstocks through joint ventures and long-term offtake agreements. This approach has enabled more predictable cost structures and supply continuity, particularly amid feedstock price volatility. Simultaneously, specialist firms have carved out niches by advancing proprietary green chemistry platforms, delivering high-performance derivatives with reduced environmental footprints.

A wave of mergers and acquisitions has reshaped the industry’s competitive topology, as established players consolidate market share and integrate complementary portfolios. Partnerships with research institutions and technology providers have accelerated product development cycles, while strategic alliances between regional producers and logistics operators have optimized cross-border distribution networks. In parallel, companies have strengthened their sustainability credentials by obtaining certifications for responsible sourcing and demonstrating transparent lifecycle assessments. These collective actions underscore a shared recognition that growth in the oleochemical value chain will be driven by differentiation in product innovation, operational resilience, and the ability to navigate evolving regulatory expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oleochemicals market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AAK AB

- BASF SE

- Cargill, Incorporated

- Emery Oleochemicals LLC

- Godrej Industries Limited

- IOI Corporation Berhad

- Kuala Lumpur Kepong Berhad

- Musim Mas Holdings Pte. Ltd.

- Oleon NV

- Vantage Specialty Chemicals, Inc.

- Wilmar International Limited

Implementing Actionable Recommendations to Enhance Operational Resilience and Accelerate Sustainable Growth Across the Oleochemical Value Chain

To capitalize on market momentum and foster long-term resilience, industry leaders should prioritize a multifaceted strategy that integrates innovation, supply chain agility, and stakeholder collaboration. First, accelerating investment in advanced catalytic and bioprocessing technologies will unlock higher yields, lower energy consumption, and new product functionalities. By establishing dedicated innovation hubs and forging partnerships with academic laboratories, organizations can shorten time-to-market and enhance portfolio diversity.

At the same time, diversifying feedstock sources-spanning non-food-grade oils, agricultural residues, and renewable waste streams-can mitigate raw material risks and align procurement with sustainability goals. Developing flexible processing infrastructure capable of handling variable feedstock inputs will further bolster supply chain robustness. Moreover, enhancing digital traceability through blockchain or other ledger technologies will provide transparency across the value chain, supporting ESG reporting and reinforcing customer trust.

Finally, cultivating collaborative ecosystems-engaging upstream growers, downstream formulators, logistics partners, and regulatory bodies-will streamline new product introductions and ensure alignment with environmental and safety standards. By fostering open innovation platforms and establishing precompetitive research consortia, industry stakeholders can share best practices, reduce duplication of effort, and collectively advance the transition to a circular, low-carbon oleochemical economy.

Explaining Robust Research Methodology Underpinning the Credibility Validity and Reliability of the Comprehensive Oleochemical Market Analysis

This analysis draws upon a rigorous research methodology designed to ensure credibility, validity, and reliability. The foundational framework encompasses comprehensive secondary research, including peer-reviewed journals, industry white papers, regulatory publications, and technology patent filings. These sources were systematically cross-referenced to construct an exhaustive inventory of production processes, raw material profiles, and regulatory milestones across major oleochemical segments.

Primary research was conducted through structured interviews with senior executives, technical directors, and procurement specialists representing feedstock suppliers, chemical manufacturers, and end-use formulators. These discussions provided nuanced perspectives on strategic priorities, operational challenges, and innovation roadmaps. To mitigate bias, key findings were triangulated by comparing independent data sets and validating emerging themes through consensus workshops with external subject-matter experts.

Quantitative validation of qualitative insights was achieved through a layered approach, mapping supply chain economics, cost drivers, and technological adoption rates across regions. Finally, internal quality assurance protocols, including peer reviews and iterative revisions, were applied to ensure that the conclusions and recommendations reflect the most current industry developments and maintain methodological rigor at every stage.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oleochemicals market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oleochemicals Market, by Product Type

- Oleochemicals Market, by Source

- Oleochemicals Market, by Distribution Channel

- Oleochemicals Market, by Form

- Oleochemicals Market, by End Use Industry

- Oleochemicals Market, by Region

- Oleochemicals Market, by Group

- Oleochemicals Market, by Country

- United States Oleochemicals Market

- China Oleochemicals Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Key Takeaways and Concluding Insights to Illuminate the Path Forward for Stakeholders in the Oleochemical Ecosystem

The collective insights presented here underscore a pivotal moment for the oleochemical sector, where sustainability imperatives, technological innovation, and evolving trade policies converge to redefine competitive advantage. Segmentation analysis illuminates the differentiated trajectories of product types, from fatty acids and alcohols to glycerol and methyl esters, while regional examinations reveal how feedstock endowments and regulatory regimes shape investment landscapes around the globe. The 2025 tariff adjustments in the United States have further highlighted the importance of supply chain resiliency and strategic sourcing.

Key players are responding with forward-looking strategies, embracing vertical integration, advanced processing platforms, and collaborative research networks to accelerate new product launches and strengthen market positioning. For organizations seeking to navigate this dynamic environment, the imperative is clear: invest in circular processing technologies, diversify feedstock portfolios, and deepen stakeholder engagement to secure sustainable growth. As environmental regulations tighten and consumer demand for bio-based solutions intensifies, those who align operational excellence with innovation will shape the future of the oleochemical ecosystem.

Engaging Directly with Ketan Rohom for Personalized Insight and Tailored Access to the Definitive Oleochemical Market Research Report

To explore how these insights can inform your strategic priorities and operational planning, reach out directly to Ketan Rohom to discuss bespoke solutions and secure immediate access to the definitive oleochemical market research report tailored to your organization’s objectives.

- How big is the Oleochemicals Market?

- What is the Oleochemicals Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?