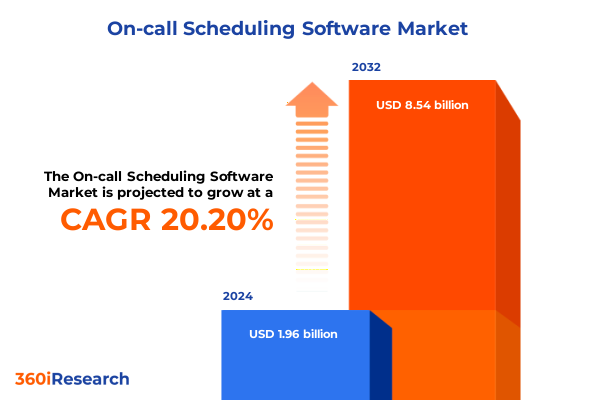

The On-call Scheduling Software Market size was estimated at USD 2.35 billion in 2025 and expected to reach USD 2.78 billion in 2026, at a CAGR of 20.20% to reach USD 8.54 billion by 2032.

Understanding the Critical Role and Rapid Evolution of Automated On-Call Scheduling Software in Data-Driven Workforce Management Environments

On-call scheduling software has emerged as an indispensable tool for modern organizations striving to deliver seamless, around-the-clock services. Designed to automate shift assignments and streamline escalation paths, this technology ensures that the right personnel are available at the right time, reducing response gaps and compliance risks. In sectors where rapid incident resolution and continuous support are non-negotiable-from healthcare facilities to IT operations teams-on-call scheduling platforms have become central to operational resilience.

Driven by increasingly complex workforce requirements, enterprises are integrating predictive analytics into scheduling platforms to forecast staffing needs and mitigate coverage gaps before they arise. AI-powered engines analyze historical call volumes, employee preferences, and organizational policies to recommend optimal rosters that adapt dynamically to demand fluctuations. This fusion of data-driven intelligence with automated scheduling reflects a broader shift toward proactive workforce management and continuous improvement practices.

Moreover, the proliferation of mobile and cloud-native architectures has empowered distributed teams to access and update schedules in real time, regardless of location. Instant notifications of on-call assignments, seamless calendar synchronization, and intuitive user interfaces have elevated employee engagement and satisfaction by reducing manual errors. As organizations pursue greater agility and cost-effectiveness, on-call scheduling software stands out for its capacity to enable rapid schedule adjustments, ensure consistent service levels, and support hybrid or fully remote work environments.

With regulatory landscapes tightening and service-level expectations rising, on-call scheduling solutions are no longer optional; they are fundamental to maintaining compliance, protecting customer experience, and preserving staff well-being. In this fiercely competitive climate, understanding the capabilities, integrations, and transformative potential of these platforms is essential for any organization seeking to enhance operational efficiency and workforce empowerment.

Navigating the Transformative Shifts in On-Call Scheduling that are Redefining Operational Efficiency and Team Collaboration Dynamics

The on-call scheduling software landscape has undergone seismic changes as organizations embrace cross-industry collaboration to drive innovation. Strategic partnerships between technology providers and sectors such as retail, healthcare, and logistics have led to more specialized scheduling capabilities. These collaborative initiatives have accelerated feature development, enabling solutions that address unique operational challenges across diverse use cases, from last-mile delivery coordination to clinic staffing optimization.

Artificial intelligence and predictive analytics have become foundational elements of scheduling platforms, moving beyond basic automation to deliver true prescriptive insights. Machine learning models now ingest real-time operational data, factoring in variables like project milestones, incident histories, and regulatory windows to generate optimized on-call rotations. This shift toward algorithm-driven scheduling has not only improved coverage reliability but has also enabled resource planning models that balance cost efficiency and staff satisfaction.

At the same time, the rise of hybrid and remote working models has transformed expectations around accessibility and flexibility. Distributed teams require tools that support multiple time zones, varied communication channels, and rapid schedule notifications. On-call scheduling vendors have responded by integrating mobile-first designs, community cloud options, and advanced notification workflows that ensure every team member stays informed regardless of their physical location. This evolution has strengthened organizations’ ability to maintain operational continuity amid fluctuating workplace norms.

Assessing the Layered Effects of 2025 U.S. Tariff Measures on Infrastructure Costs, Supply Chains, and Software Service Economics

In early April 2025, the United States implemented broad reciprocal tariffs that introduced new cost pressures across technology infrastructure and service delivery chains. These measures include levies on critical construction materials such as steel, aluminum, and copper-components underlying data center build-outs-resulting in an immediate 3–5% uptick in capital expenditures for cloud and colocation providers. As a consequence, software vendors faced higher depreciation and lease costs, forcing many to weigh absorption of expenses against passing them through to end users.

Beyond physical hardware, the tariff framework has extended to imported computing equipment, with the United States importing tens of billions of dollars of servers, networking gear, and storage arrays from China, Mexico, and Taiwan. This escalation of import duties has rippled down to SaaS subscription pricing, as service providers adjust to increased operational outlays. Concurrently, IDC’s mid-year analysis noted that projected global IT spending growth rates for 2025 were revised downward from pre-tariff forecasts, with momentum slowing significantly in response to tariff-induced inflationary pressures and supply chain interruptions.

Software development services have not been immune. Tariffs on outsourced engineering and testing services-formerly a cost-efficient resource for mid-market ISVs-have risen by 10–15%, prompting a strategic re-evaluation of offshore contracts. Many companies are exploring near-shoring and resourcing models closer to home in Mexico and Central America to mitigate these new operational costs, while others are accelerating investments in domestic talent pipelines to maintain budgetary discipline.

Finally, the broader uncertainty over retaliatory measures targeting digital services in the European Union and beyond has compounded concerns. Threats to impose reciprocal duties on cloud offerings, digital media, and financial transaction platforms have created a climate of unpredictability. Enterprises are responding by delaying non-critical digital transformation projects and adopting more conservative budgeting postures, which may further dampen demand for advanced on-call scheduling features in the near term.

Collectively, these tariff initiatives have recalibrated cost structures, disrupted supply chains, and introduced renewed emphasis on budgeting agility. Industry participants are now prioritizing strategic vendor partnerships, flexible pricing schemes, and scenario planning tools to navigate this complex environment.

Unveiling Deep Market Segmentation Insights Spanning Deployment Models, Pricing Structures, Organizational Scales, and Industry Verticals

The market for on-call scheduling software can be dissected across deployment preferences, pricing frameworks, organizational scale, and industry use cases. In terms of deployment, providers are offering cloud solutions-both public cloud for rapid scalability and private alternatives for higher data residency control-alongside hybrid architectures that leverage community cloud networks and multi-cloud resilience to meet stringent regulatory or availability requirements. This variety allows enterprises to align deployment strategies with critical considerations such as latency, security, and cost predictability.

Pricing models have bifurcated between traditional subscription contracts and more granular, consumption-based approaches. Subscription agreements remain popular among institutions seeking budget consistency and value-added service tiers, while pay-as-you-go options have materialized for organizations with variable usage patterns, enabling them to avoid fixed commitments during quieter operational periods.

Organization size further delineates vendor choice and feature adoption. Large enterprises often gravitate toward comprehensive solutions that integrate with existing ITSM, communication, and business intelligence platforms, capitalizing on advanced analytics and automation. Conversely, small and medium enterprises favor leaner, plug-and-play offerings that deliver essential on-call management capabilities without the overhead of extensive customization or heavy deployment.

Finally, industry verticals shape the critical functionality set. Financial institutions spanning banking, capital markets, and insurance demand rigorous audit trails and compliance workflows. Public sector entities-ranging from federal agencies to state governments and utilities-require robust governance controls and high-availability scheduling. Healthcare providers, including clinics, hospitals, and pharmaceutical operations, emphasize seamless integration with EHR systems and patient care coordination. Network providers, service operators, and software vendors in the IT and telecommunications sector prioritize incident-driven escalation paths and real-time collaboration. Manufacturing firms in automotive, electronics, and industrial machinery leverage scheduling platforms to maintain 24/7 production oversight. Retail and e-commerce businesses, whether brick-and-mortar or online, focus on managing consumer support and fulfillment teams during peak and off-peak periods.

This comprehensive research report categorizes the On-call Scheduling Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Deployment Model

- Pricing Model

- Organization Size

- Industry Vertical

Analyzing Regional Market Dynamics Across Americas, EMEA, and Asia-Pacific for Strategic On-Call Scheduling Software Adoption

Geographic dynamics exert a profound influence on the adoption and evolution of on-call scheduling software. In the Americas, industry leaders are capitalizing on advanced cloud infrastructure and a mature regulatory environment to integrate AI-driven scheduling optimizations and real-time analytics across diverse sectors. North American organizations, in particular, leverage high digital literacy, widespread mobile workforce practices, and established data privacy frameworks to deploy cutting-edge on-call workflows.

Within Europe, the Middle East, and Africa, stringent data residency laws and sector-specific compliance mandates have steered demand toward private and community cloud configurations. Public utilities and government bodies in this region often demand granular control over sensitive information, driving the adoption of hybrid models. Meanwhile, emerging markets in the Middle East and key African economies are investing heavily in digital transformation agendas, opening new avenues for flexible, cloud-native scheduling solutions.

Asia-Pacific represents the fastest-growing hub for on-call scheduling software, fueled by rapid digitalization initiatives across manufacturing, retail, and healthcare verticals. Mobile-first markets such as India and Southeast Asia are embracing simplified, user-centric interfaces, while mature markets such as Japan, South Korea, and Australia are advancing adoption of comprehensive, AI-enabled platforms. Regional telecommunication expansions and growing e-commerce volumes further highlight the critical role of agile scheduling to support continuous operational uptime and customer engagement.

This comprehensive research report examines key regions that drive the evolution of the On-call Scheduling Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Leading On-Call Scheduling Software Providers’ Strategic Innovations, Partnerships, and Market Positioning

Leading software providers continue to differentiate by embedding advanced analytics, AI-driven automation, and ecosystem integrations into their core offerings. QGenda, known for its healthcare-focused workforce management suite, has been selected by major academic medical centers to streamline on-call rotations, enhance physician engagement, and optimize resource utilization-demonstrating the power of vertical specialization. PagerDuty has further expanded its incident management portfolio by launching agentic AI modules designed to autonomously balance on-call assignments, alert teams to emerging conflicts, and reconcile scheduling gaps in real time, underscoring a trend toward self-driving operational workflows.

Other market participants are pursuing strategic partnerships to bolster feature sets and extend market reach. Integration alliances with communication platforms, IT service management suites, and DevOps toolchains have become table stakes, enabling providers to offer centralized dashboards and unified alerting across disparate systems. This collaborative approach not only enhances user experience but also drives stickiness in competitive procurement cycles, as enterprises seek seamless interoperability across their technology stacks.

This comprehensive research report delivers an in-depth overview of the principal market players in the On-call Scheduling Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Atlassian Corporation Plc

- Calamari Sp. z o.o.

- Deputy Limited

- Homebase Ltd.

- Humanity.com, Inc.

- Kronos Incorporated

- MySchedule, Inc.

- Planday

- Push Operations Inc.

- Rotageek Ltd.

- Sage Group plc

- ScheduleAnywhere, Inc.

- Shiftboard, Inc.

- ShiftNote, LLC

- Snap Schedule, Inc.

- When I Work, Inc.

- Zip Schedules, Inc.

Formulating Actionable Recommendations to Empower Industry Leaders in Maximizing the Value of On-Call Scheduling Solutions

Industry leaders seeking to maximize the value of on-call scheduling investments should begin by conducting comprehensive process audits to identify critical coverage gaps and manual touchpoints, establishing a baseline for automation impact. By mapping existing shift patterns, escalation paths, and compliance requirements, executives can align software configurations to operational priorities and risk thresholds.

Next, a phased deployment strategy is recommended. Begin with a focused pilot in a single department, leveraging core scheduling features and basic integrations. This approach allows for iterative refinement based on user feedback and performance metrics. Following pilot validation, expand to additional teams, introducing advanced modules such as predictive analytics and dynamic capacity planning.

Organizations should also negotiate flexible pricing structures that accommodate both subscription and consumption-based billing, ensuring cost alignment with usage profiles. Engaging in scenario planning exercises can help forecast expenses under varying demand scenarios, fostering budgetary resilience. Simultaneously, investing in end-user training and change management programs will drive adoption and mitigate resistance by highlighting efficiency gains and morale benefits.

Finally, forge strategic partnerships with providers committed to open APIs and ecosystem integration. By embedding on-call scheduling workflows within broader incident response, communication, and project management tools, companies can deliver a unified experience that enhances visibility, accelerates resolution times, and elevates organizational agility.

Detailing a Rigorous Research Methodology Combining Qualitative and Quantitative Analyses for Market Insights Validity

This research combines rigorous primary interviews with CIOs, IT operations managers, and workforce planning specialists across key verticals, supplemented by a comprehensive survey of over two hundred organizations. Secondary research encompassed analysis of regulatory frameworks, tariff announcements, and corporate earnings reports to contextualize macroeconomic influences.

Quantitative modeling techniques were employed to assess deployment trends, pricing preferences, and feature adoption rates. Data sources included publicly available industry reports, company press releases, and proprietary databases tracking software usage patterns. Triangulation of qualitative insights with quantitative findings ensured the reliability of key segmentation and regional market dynamics.

To ensure analytical integrity, the study applied scenario-based stress testing to evaluate the impact of tariff escalations and economic headwinds. Vendor positioning assessments leveraged a multi-criteria scoring framework evaluating product functionality, integration depth, and strategic roadmap alignment. Overall, this blended methodology provides a robust foundation for actionable market intelligence and strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our On-call Scheduling Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- On-call Scheduling Software Market, by Deployment Model

- On-call Scheduling Software Market, by Pricing Model

- On-call Scheduling Software Market, by Organization Size

- On-call Scheduling Software Market, by Industry Vertical

- On-call Scheduling Software Market, by Region

- On-call Scheduling Software Market, by Group

- On-call Scheduling Software Market, by Country

- United States On-call Scheduling Software Market

- China On-call Scheduling Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Future Outlook for On-Call Scheduling Software in Modern Organizational Contexts

The convergence of AI-enabled scheduling, cloud and hybrid deployment options, and nuanced pricing models has set the stage for a new era in on-call workforce management. As organizations balance cost pressures from evolving tariff environments with growing service-level expectations, the imperative for flexible, data-driven scheduling solutions has never been clearer. Regional disparities in regulation, infrastructure maturity, and digital transformation agendas will continue to shape provider strategies and adoption pathways.

Stakeholders must remain agile, leveraging iterative deployment and integration strategies to harness the full potential of emerging capabilities. With careful alignment of technology investments to process optimization and human-centric design, enterprises can sustain high availability, compliance adherence, and employee engagement-cornerstones of operational excellence in an increasingly volatile landscape.

The insights presented here underscore the need for a holistic, strategic approach to on-call scheduling software, one that acknowledges both macroeconomic headwinds and micro-level user experience considerations. By doing so, organizations will be well-equipped to navigate complexity, drive continuous improvement, and realize tangible performance gains.

Take the Next Step Toward Optimized On-Call Scheduling Excellence with Our Comprehensive Market Research Report

Don't let uncertainty around workforce demands and market dynamics slow down your operational progress. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore how our in-depth report equips you with a clear strategic blueprint. Gain access to actionable intel on evolving deployment preferences, regional growth drivers, and competitive landscapes. Partner with an expert to secure critical insights and elevate your on-call scheduling strategy today

- How big is the On-call Scheduling Software Market?

- What is the On-call Scheduling Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?