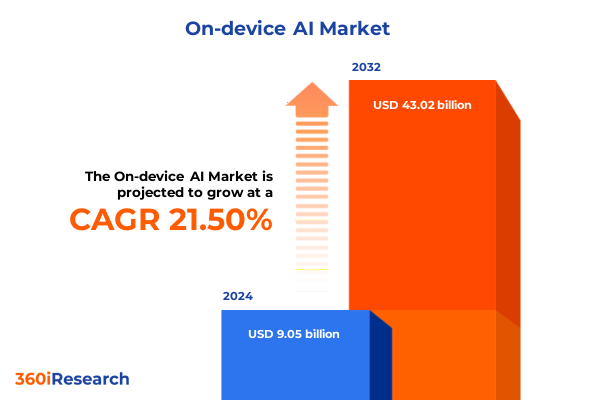

The On-device AI Market size was estimated at USD 9.05 billion in 2024 and expected to reach USD 10.90 billion in 2025, at a CAGR of 21.50% to reach USD 43.02 billion by 2032.

Unveiling the Transformative Potential of On-Device AI Across Industries and Its Role in Shaping Future Technology Ecosystems

The proliferation of powerful silicon architectures combined with lightweight AI frameworks has ignited a fundamental shift from centralized cloud processing toward decentralized on-device intelligence. By integrating advanced neural processing units, optimized memory hierarchies, and context-aware sensors directly into devices, organizations can now achieve ultra-low latency inference, enhance data privacy, and reduce dependency on continuous network connectivity.

This transition has been accelerated by Moore’s Law-driven improvements in chip efficiency, alongside maturing edge-optimized software libraries capable of running complex models within strict power and thermal envelopes. From smartphones and wearable health monitors to industrial IoT sensors and automotive systems, on-device AI is enabling devices to interpret, learn from, and adapt to their environments in real time.

Across industries, this paradigm empowers stakeholders to deliver seamless user experiences, ensure compliance with stringent data protection regulations, and unlock new business models focused on localized analytics. This executive summary outlines the macroeconomic influences, segmentation dynamics, regional variations, competitive landscape, and strategic recommendations that define the on-device AI ecosystem.

Key Drivers and Technological Breakthroughs That Are Catalyzing a Fundamental Transformation in the On-Device AI Ecosystem

Rapid advancements in edge computing architectures and specialized neural accelerators have driven the emergence of a new era in on-device intelligence. As organizations confront the limitations of centralized processing-such as high latency, bandwidth constraints, and growing privacy concerns-they are increasingly turning to local inference engines to execute machine learning workloads directly on end-user devices.

Hardware innovations have brought NPUs, GPUs, and CPUs into tighter convergence, delivering performance that once required rack-scale clusters. At the same time, energy-efficient sensor suites have evolved to capture high-fidelity data streams that feed on-device models, fueling use cases from real-time facial recognition to industrial anomaly detection. On the software side, the maturation of frameworks like TensorFlow Lite, Core ML, PyTorch Mobile, and ONNX Runtime has democratized the deployment of sophisticated algorithms on resource-constrained platforms.

This convergence of hardware and software has created fertile ground for novel applications, including immersive augmented reality, autonomous navigation across drones and robots, and always-on health monitoring in wearables. As the ecosystem expands, companies must navigate complex interoperability challenges, rapidly iterate on algorithmic performance, and anticipate evolving regulatory frameworks that govern data sovereignty and security.

Understanding How 2025 United States Tariff Measures Are Reshaping On-Device AI Supply Chains and Cost Structures Across Hardware and Software Components

In 2025, a series of targeted U.S. tariff implementations on semiconductor imports-ranging from AI chipsets and memory modules to advanced sensors-have exerted upward pressure on hardware procurement costs for device manufacturers. As tariffs raise the landed cost of critical components, original equipment manufacturers are confronted with narrower margins and must reconsider global supply chain strategies to maintain competitiveness.

This policy shift has accelerated the reshoring of chip fabrication and assembly operations, prompting regional suppliers to ramp up production capacity and offering an impetus for collaborative R&D aimed at cost-effective, power-efficient designs. Concurrently, software ecosystem participants face indirect impacts: higher hardware costs lead to tighter budgets for edge-optimized runtime environments, driving demand for open-source solutions and leaner algorithmic models that maximize performance per watt.

While short-term disruptions have emerged in lead times and pricing volatility, the cumulative effect is fostering a more resilient, diversified supplier network. Companies are increasingly investing in custom silicon development and forging strategic partnerships with domestic foundries and design houses. These initiatives not only mitigate tariff-induced risks but also reinforce national technology sovereignty goals and catalyze innovation across the on-device AI value chain.

Insightful Breakdown of Market Segmentation Revealing How Device Types, Components, Technologies, Applications, and Industries Drive On-Device AI Adoption Patterns

The on-device AI market can be contextualized through multiple layers of segmentation, each revealing distinct adoption patterns and innovation drivers. Device type segmentation highlights how embedded IoT endpoints serve industrial monitoring, PCs and laptops support enterprise edge analytics, smart home devices enable privacy-preserving automation, smartphones integrate consumer-centric AI features, and wearable devices drive personalized health insights.

Component segmentation underscores the interplay between hardware and software. On the hardware front, AI chipsets encompass CPU cores for general-purpose tasks, GPUs for parallel processing, and NPUs for tensor arithmetic, alongside memory subsystems and specialized sensors for environmental and biometric data capture. Within the software domain, AI algorithms span from classical decision trees and support vector machines to deep neural networks, all orchestrated through frameworks such as Core ML, ONNX Runtime, PyTorch Mobile, and TensorFlow Lite, and supported by development tools that streamline model training, optimization, and deployment.

Technology segmentation further delineates the market landscape. Computer vision capabilities-encompassing facial recognition, image classification, segmentation, and object detection techniques like RCNN, SSD, and YOLO-power applications in security and retail analytics. Deep learning architectures, including convolutional neural networks, generative adversarial networks, recurrent models such as GRU and LSTM, and transformer-based networks, unlock complex sequence and pattern evaluations. Traditional machine learning paradigms, ranging from reinforcement learning to supervised classification and regression, as well as unsupervised clustering and dimensionality reduction, remain foundational. Natural language processing modules spanning translation, speech recognition, and text analytics with entity recognition and sentiment analysis deliver conversational and contextual intelligence.

Application segmentation reveals domain-specific implementations. Autonomous navigation strategies span drone, robot, and vehicle guidance, delivering autonomy in logistics and mobility. Health monitoring solutions leverage activity recognition, heart rate tracking, and sleep pattern analysis to advance preventive care. Predictive maintenance platforms extend asset uptime in industrial settings, while recommendation engines and virtual assistants enrich consumer interactions. Finally, end-use industry segmentation demonstrates how automotive systems integrate ADAS functions like adaptive cruise control, automatic emergency braking, and lane departure warning, while consumer electronics, healthcare, manufacturing, and retail sectors harness on-device AI to drive operational efficiencies and enhance user experiences.

This comprehensive research report categorizes the On-device AI market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Device Type

- Data Type

- Technology

- Application

- End Use Industry

- Organization Size

Comparative Regional Landscape Analysis Highlighting How the Americas, EMEA, and Asia-Pacific Shape the Future of On-Device AI Implementation Worldwide

Regional dynamics play a pivotal role in shaping on-device AI deployment strategies. In the Americas, the combination of a mature semiconductor ecosystem, significant consumer electronics penetration, and an automotive sector primed for ADAS integration positions North America as a leader in both innovation and commercialization. Regulatory frameworks that balance data privacy with technological advancement further enable swift adoption.

Throughout Europe, the Middle East, and Africa, stringent data governance standards have spurred enterprises to prioritize on-device inference for compliance and sovereignty objectives. Strong industrial manufacturing bases in Germany and France, alongside burgeoning smart city initiatives in GCC nations, create a dual focus on precision automation and urban-scale analytics.

Asia-Pacific presents a heterogeneous but rapidly expanding market, driven by aggressive government investments in semiconductor self-reliance, a thriving smartphone ecosystem, and widespread deployment of smart home and consumer devices. China’s emphasis on domestic chipset development and South Korea’s lead in memory manufacturing underpin a robust supply chain, while Southeast Asian nations are emerging as key testbeds for smart healthcare and industrial IoT applications.

This comprehensive research report examines key regions that drive the evolution of the On-device AI market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Company Profiles and Collaborative Ecosystem Outlining How Key Technology Players and Emerging Startups Are Shaping On-Device AI Innovations

The competitive landscape of on-device AI is defined by the convergence of incumbent technology giants, specialized semiconductor providers, and agile startups. Leading platform vendors have integrated NPUs directly into flagship smartphones and IoT gateways, delivering turnkey solutions that balance performance with ease of integration. At the same time, semiconductor incumbents are diversifying their portfolios to offer custom AI accelerators tailored for industrial and automotive clients.

Emerging companies are pushing the boundaries of analog compute, memory-in-compute architectures, and novel NPU designs optimized for sparse workloads, enabling ultra-efficient inference in power-constrained environments. Collaborative ecosystems are forming as chip designers, framework maintainers, and application developers align roadmaps to ensure seamless interoperability and rapid time-to-market.

Strategic partnerships and acquisitions have accelerated knowledge sharing and resource pooling. By combining domain expertise-from low-level firmware optimization to high-level algorithm innovation-these alliances are reducing fragmentation and fostering a vibrant, standards-based ecosystem. This trend is particularly evident in initiatives that unify model interchange formats and optimize quantization techniques across hardware variants.

This comprehensive research report delivers an in-depth overview of the principal market players in the On-device AI market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Micro Devices, Inc.

- Amazon Web Services, Inc.

- Apple Inc.

- Arm Holdings plc

- Baidu Inc

- BlackBerry Limited

- BrainChip, Inc.

- C3.ai, Inc.

- Cisco Systems, Inc.

- Darktrace Holdings Limited

- General Motors Holdings LLC

- Google LLC

- Graphcore Limited

- HCL Technologies Limited

- Intel Corporation

- International Business Machines Corporation

- L&T Technology Services Limited

- MediaTek Inc.

- Meta Platforms, Inc.

- Microchip Technology Incorporated

- Microsoft Corporation

- Mobileye Global Inc.

- Nauto, Inc.

- Neurala, Inc

- NVIDIA Corporation

- Oracle Corporation

- Persistent Systems Limited

- Pointr Ltd

- Qualcomm Incorporated

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- Siemens AG

- Sony Group Corporation

- STMicroelectronics N.V.

- Taiwan Semiconductor Manufacturing Company Limited

- Tesla, Inc.

Actionable Strategic Guidance Offering Industry Leaders Practical Steps to Capitalize on On-Device AI Opportunities and Mitigate Emerging Challenges

Industry leaders must adopt a multi-faceted strategy to harness the full potential of on-device AI. Prioritizing investments in energy-efficient NPU architectures and advanced memory hierarchies will reduce power consumption and thermal constraints, enabling broader device applicability. Concurrently, embedding privacy-by-design frameworks and robust encryption techniques ensures compliance with evolving global data protection regulations.

On the software front, optimizing models through quantization, pruning, and hardware-aware compilation will be essential to deliver high-fidelity inference within strict resource budgets. Collaborative engagements with open-source communities and standardization bodies can streamline integration efforts and drive interoperability across heterogeneous platforms.

In parallel, organizations should diversify their supply chains by forging relationships with domestic and regional foundries, thereby mitigating geopolitical and tariff-related risks. Upskilling engineering teams through targeted training programs in edge-optimized algorithm development and cross-disciplinary system integration will further accelerate go-to-market timelines.

Comprehensive Methodological Framework Detailing the Research Design, Data Collection, and Analytical Techniques Underpinning the On-Device AI Market Study

The research underpinning this analysis is based on a rigorous, dual-pronged methodology integrating both qualitative and quantitative techniques. Primary research involved in-depth interviews with senior executives, technology architects, and industry thought leaders to validate market drivers, challenges, and technology preferences. These insights were complemented by comprehensive surveys targeting hardware suppliers, software developers, and end-use customers to quantify adoption trends and investment priorities.

Secondary research encompassed a thorough review of publicly available materials, including patent filings, regulatory announcements, and academic publications, to trace technological evolution and identify emerging innovation hotspots. This data was cross-verified through triangulation, ensuring consistency across disparate information sources.

Analytical frameworks, such as SWOT and Porter’s Five Forces, were applied to assess competitive dynamics, while scenario planning exercises evaluated the potential impact of geopolitical shifts and regulatory developments. Finally, the segmentation schema was stress-tested through expert workshops to confirm its relevance and granularity for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our On-device AI market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- On-device AI Market, by Component

- On-device AI Market, by Device Type

- On-device AI Market, by Data Type

- On-device AI Market, by Technology

- On-device AI Market, by Application

- On-device AI Market, by End Use Industry

- On-device AI Market, by Organization Size

- On-device AI Market, by Region

- On-device AI Market, by Group

- On-device AI Market, by Country

- United States On-device AI Market

- China On-device AI Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 4611 ]

Synthesis of the Critical Findings Highlighting Why On-Device AI Represents a Paradigm Shift and Outlines the Strategic Imperatives for Stakeholders

On-device AI represents a paradigm shift in how organizations approach data processing, balancing performance, privacy, and cost in ways that centralized architectures cannot. By executing intelligence at the point of collection, devices become autonomous agents capable of real-time decision-making, reducing reliance on network connectivity and safeguarding sensitive information.

Key findings highlight the critical interplay between hardware innovation-driven by custom NPUs, memory optimizations, and advanced sensors-and software evolution, including lightweight frameworks and hardware-aware model optimizations. Regional dynamics further underscore the importance of aligning deployment strategies with local regulatory frameworks and supply chain realities.

Stakeholders that embrace a holistic approach-integrating cross-stack co-design, diversified sourcing, and continuous skill development-will be best positioned to seize the transformative benefits of on-device AI. As the ecosystem matures, collaboration across industry consortia, open-source communities, and strategic partnerships will continue to drive interoperability, accelerate innovation, and unlock new value propositions.

Get in Touch with Ketan Rohom to Unlock Access to the Comprehensive On-Device AI Market Research Report and Empower Your Strategic Decisions

For organizations seeking to stay ahead of the curve in the rapidly evolving on-device AI landscape, engaging with Ketan Rohom, Associate Director of Sales & Marketing, provides a direct pathway to the in-depth analysis and strategic guidance necessary for decisive action. Through a tailored consultation, Ketan can walk you through the methodologies and nuanced insights that underpin the comprehensive market research report, ensuring your team grasps the full scope of emerging opportunities and competitive dynamics.

Initiating a dialogue with Ketan unlocks access to exclusive data sets, proprietary segmentation models, and scenario planning tools designed to support executive decision-makers. Whether you require detailed impact assessments on tariff shifts, region-specific deployment strategies, or partner ecosystem evaluations, this direct engagement ensures your investment delivers immediate value. Reach out to Ketan to schedule a personalized briefing today and transform these research findings into your next strategic advantage

- How big is the On-device AI Market?

- What is the On-device AI Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?