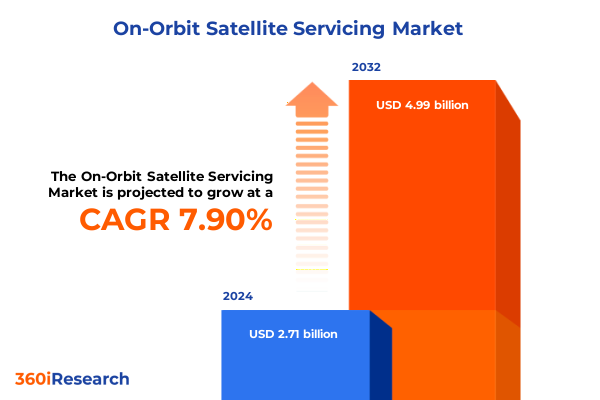

The On-Orbit Satellite Servicing Market size was estimated at USD 2.91 billion in 2025 and expected to reach USD 3.13 billion in 2026, at a CAGR of 7.99% to reach USD 4.99 billion by 2032.

Exploring the Dynamic On-Orbit Satellite Servicing Ecosystem Driven by Technological Breakthroughs and Strategic Industry Collaborations

On-orbit satellite servicing is emerging as a cornerstone of the space economy, introducing a paradigm shift in the way satellites are maintained, upgraded, and decommissioned. Historically, satellites followed a one-and-done deployment model, each mission constrained by a fixed operational lifespan. However, the confluence of advanced robotics, autonomous systems, and precision docking technologies has redefined the possibilities, enabling orbit adjustment, refueling, assembly, and debris remediation capabilities that extend mission duration and optimize asset utilization.

In examining the evolving on-orbit servicing landscape, it becomes clear that cross-sector collaboration and public–private partnerships are accelerating innovation. Government agencies are increasingly embracing commercial models to bolster resilience and reduce risk, while leading aerospace corporations and nimble startups are forging alliances to develop scalable servicing platforms. This foundational overview highlights the technological maturity curve, the evolving regulatory framework, and the shift toward sustainable orbital operations, setting the stage for deeper analysis of transformative shifts and strategic imperatives.

Moreover, as satellite architectures diversify to include large telecommunications constellations alongside agile small satellites for scientific observation and environmental monitoring, the demand for in-orbit maintenance solutions continues to climb. Servicing missions promise to mitigate orbital debris, address congestion in key orbital corridors, and enable on-demand upgrades such as sensor replacements or modular payload swaps. This introduction underscores the strategic impetus for on-orbit servicing, emphasizing its potential to transform satellite economics, enhance mission agility, and foster long-term sustainability of critical space assets.

Unveiling the Transformational Shifts Shaping On-Orbit Satellite Servicing Through Advanced Robotics, AI Innovations, and Evolving Regulatory Frameworks

The on-orbit satellite servicing domain is undergoing transformative shifts underpinned by advancements in artificial intelligence, robotics, and autonomous maneuvering. Recent breakthroughs in machine vision and AI-driven navigation have enabled servicing spacecraft to conduct complex proximity operations with minimal human intervention. Collaborative robotics systems now facilitate in-space assembly of modular satellite buses, while dexterous manipulators execute high-precision repairs and upgrades on orbiting platforms. These technological disruptions are redefining mission architectures and expanding the horizon of possible servicing engagements.

Concurrently, regulatory frameworks are evolving to accommodate the unique safety and liability considerations intrinsic to in-orbit operations. Policymakers worldwide are harmonizing guidelines around debris mitigation, active removal protocols, and licensing regimes. This global regulatory convergence is fostering a more predictable operational environment, reducing barriers to entry, and incentivizing investment. In parallel, sustainability initiatives are placing greater emphasis on end-of-life disposal and long-term debris management, reinforcing the imperative for proactive servicing interventions.

Business models are also shifting, as pay-as-you-go service offerings and mission-as-a-service contracts emerge to lower entry costs and align stakeholder incentives. Commercial operators and defense agencies are increasingly structuring multi-mission agreements with service providers, embedding performance-based metrics that reward mission flexibility. Taken together, these transformative elements are recalibrating market dynamics, positioning on-orbit servicing as an indispensable component of modern space operations.

Assessing the Far-Reaching Impact of United States 2025 Tariff Policies on the Cost Dynamics and Strategic Viability of On-Orbit Servicing Missions

The introduction of United States tariffs in early 2025 has introduced complex cost dynamics into the on-orbit satellite servicing supply chain. Increased duties on precision manufacturing equipment, rare earth components, and specialized sensors have elevated hardware expenses for service providers. As many critical subsystems are sourced or produced domestically within tariff-affected categories, these additional levies are translating to higher production outlays and lengthened procurement cycles.

Service operators are mitigating these pressures by optimizing modular spacecraft designs to reduce reliance on high-tariff components. Strategic stockpiling of key parts ahead of tariff adjustments and the pursuit of alternative suppliers in non-tariffed jurisdictions have emerged as short-term countermeasures. In the medium term, companies are investing in vertical integration strategies, seeking to internalize manufacturing capabilities for critical subsystems and thereby insulate themselves from further duty escalations.

At the same time, service providers are exploring cost-sharing partnerships with end users to distribute tariff impacts along the value chain. Joint development agreements, where mission sponsors co-finance hardware adaptations, are gaining traction. These collaborative arrangements are reinforcing the sector’s resilience and underscoring the importance of flexible contracting structures. Consequently, the cumulative impact of 2025 tariff measures is reshaping procurement strategies, driving supply chain diversification, and catalyzing innovation in component design and sourcing practices.

Illuminating Critical Market Segmentation Insights Revealing Diverse Service Types, Satellite Categories, Orbit Profiles, Applications, and End User Dynamics

Market segmentation offers a nuanced lens through which to discern demand patterns and competitive positioning in on-orbit satellite servicing. Service offerings span active debris removal & orbit adjustment missions tasked with clearing congested orbital corridors, assembly operations that integrate modular satellites into larger structures, refueling tasks that extend the functional life of aging spacecraft, and robotic servicing interventions for maintenance and repairs. Each service type addresses distinct operational imperatives and requires specialized technical capabilities.

Satellite platforms themselves range from large communications vessels to medium-sized data relay satellites and compact small satellites, each presenting unique servicing challenges and payload requirements. Operating altitude exerts a significant influence, whether in the high geostationary orbit band where large, fixed-position assets predominate, in the increasingly crowded low Earth orbit region hosting small satellite constellations, or in the medium Earth orbit zone that supports navigation systems.

Functional utilization spans diverse applications, from bolstering communication infrastructure and advancing environmental monitoring objectives to facilitating scientific research missions and enhancing surveillance & security networks. End users encompass commercial operators with subsectors including satellite broadband providers, satellite television operators, and telecommunication companies; government and defense agencies tasked with national security and space policy mandates; and research institutions pursuing exploratory or observational science initiatives. This segmented perspective highlights how different stakeholder groups, operational altitudes, and service types converge to drive specialized demand for on-orbit servicing solutions.

This comprehensive research report categorizes the On-Orbit Satellite Servicing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Satellite Type

- Orbit Type

- Application

- End Users

Deciphering Regional Dynamics That Drive On-Orbit Satellite Servicing Adoption Across the Americas, EMEA, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping the trajectory of on-orbit satellite servicing adoption. In the Americas, robust commercial satellite deployment and significant defense budgets are driving demand for servicing technologies that enhance sustainability and mission readiness. The United States, in particular, is leveraging public–private partnerships to de-risk early-stage servicing demonstrations and foster domestic supply chain development.

Across Europe, the Middle East & Africa, varied regulatory environments and multilateral collaborations are advancing joint debris-removal exercises and in-orbit maintenance pilot projects. Europe’s space agencies emphasize harmonized licensing and debris mitigation standards, while emerging markets in the Middle East are investing in satellite servicing capacity to support regional connectivity and security objectives.

In the Asia-Pacific realm, rapid growth of satellite constellations for broadband access and Earth observation is propelling investment in refueling and life-extension services. Government initiatives in nations such as Japan and Australia are funding technology demonstrators to validate autonomous docking and on-orbit robotic workflows. Simultaneously, major commercial satellite operators are forging partnerships to localize servicing capabilities within the region, underscoring the strategic imperative of regional presence and supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the On-Orbit Satellite Servicing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Shaping the Competitive Landscape of On-Orbit Satellite Servicing Industry’s Future Direction

Key industry players are spearheading technological innovation and forging strategic alliances to secure leading positions in the on-orbit servicing segment. Established aerospace incumbents with deep heritage in satellite manufacturing are expanding their portfolios to include life-extension services, leveraging proprietary docking mechanisms and ground control infrastructure. In parallel, agile startups are introducing disruptive service models underpinned by modular spacecraft architectures and AI-driven autonomous rendezvous capabilities.

Partnerships between prime contractors and specialized robotics integrators are accelerating qualification of in-orbit assembly and maintenance platforms. Joint ventures are aligning satellite operators with mission service providers to co-develop tailored solutions for niche applications such as orbital debris removal and payload reconfiguration. Additionally, collaborative research initiatives with defense agencies are yielding secure communication and navigation upgrades that enhance servicing mission safety.

Investment flows from venture capital and strategic corporate backers are fueling a wave of mission demonstrators and pilot programs. This influx of capital is enabling rapid iteration in control algorithms, sensor fusion systems, and flexible propulsion modules. As a result, companies across the value chain-from component suppliers to service integrators-are carving out specialized roles, fostering healthy competition, and collectively advancing the industry toward routine, cost-effective on-orbit operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the On-Orbit Satellite Servicing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- A. Schulman, Inc.

- Airbus SE

- Akzo Nobel N.V.

- Albemarle Corporation

- Ampacet Corporation

- Arkema Group

- Astrobotic Technology Inc.

- Astroscale Holdings Inc.

- Astroscale Japan Inc.

- Baerlocher GmbH

- ClearSpace

- Croda International Plc

- Defense Advanced Research Projects Agency

- Dow Inc.

- High Grade Industries Pvt. Ltd.

- Honeybee Robotics, LLC by Blue Origin

- Indian Space Research Organisation

- Informa PLC

- Kaneka Corporation

- L3Harris Technologies

- Lanxess AG

- Lockheed Martin Corporation

- Maxar Technologies Holdings Inc.

- MDA Corporation

- Mitsubishi Chemical Corporation

- Momentus Inc.

- Moog Inc.

- National Aeronautics and Space Administration

- Northrop Grumman Corporation

- Obruta Space Solutions Corp.

- Orbit Fab, Inc.

- OrbitGuardians

- Redwire Corporation

- RTP Company

- Saudi Basic Industries Corporation

- Skycorp Inc.

- SpaceX

- Thales Alenia Space

- Voyager Space Holdings, Inc.

Empowering Industry Leaders with Actionable Recommendations to Capitalize on Emerging Trends and Overcome Operational Challenges in On-Orbit Servicing

To capitalize on the burgeoning opportunities in on-orbit satellite servicing, industry leaders should prioritize investment in modular, scalable spacecraft platforms that accommodate mission variability and rapid reconfiguration. Embracing open architecture standards will facilitate interoperability across diverse service ecosystems, enabling seamless integration of third-party modules and collaborative servicing campaigns.

Organizations should also establish strategic alliances with component manufacturers and software developers to co-create advanced autonomy solutions. By embedding machine learning algorithms at the spacecraft level, operators can reduce ground intervention, enhance safety margins during proximity operations, and accelerate response times for servicing tasks. Integrating cybersecurity protocols from the outset will safeguard mission integrity as servicing spacecraft transition between multiple clients and orbital regimes.

Furthermore, decision-makers ought to engage proactively with international and national regulatory bodies to shape favorable licensing frameworks and debris mitigation policies. Aligning corporate sustainability goals with emerging environmental standards will not only mitigate regulatory risk but also enhance public perception and investor confidence. Finally, cultivating talent in robotics, AI, and space systems engineering through targeted training programs and academia-industry partnerships will ensure a skilled workforce capable of driving future innovation and sustaining competitive advantage.

Unveiling a Robust Multi-Phase Research Methodology Integrating Qualitative and Quantitative Analyses to Deliver Comprehensive On-Orbit Servicing Insights

Our research methodology integrates a multi-phase approach combining qualitative insights with rigorous quantitative analysis to ensure holistic market understanding. Initially, expert interviews and executive roundtables with satellite operators, regulatory authorities, and technology providers laid the groundwork for identifying critical success factors and emerging use cases. These qualitative inputs guided the development of a detailed service taxonomy and operational framework.

Subsequently, we conducted in-depth case studies of landmark on-orbit servicing missions and pilot programs, synthesizing technical performance data with business model analysis. This phase involved cross-validation of mission telemetry, procurement records, and partnership agreements to distill best practices and risk mitigation strategies. A parallel competitive benchmarking exercise assessed vendor capabilities in robotics, autonomous navigation, and ground control interfaces.

Finally, scenario-based modeling evaluated the interplay of tariff impacts, technology adoption rates, and regional regulatory harmonization on service deployment timelines. Iterative stakeholder reviews refined the findings, ensuring alignment with real-world operational constraints and strategic objectives. This robust methodology delivers a nuanced, actionable perspective of the on-orbit satellite servicing landscape, empowering decision-makers with evidence-based insights and strategic clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our On-Orbit Satellite Servicing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- On-Orbit Satellite Servicing Market, by Service Type

- On-Orbit Satellite Servicing Market, by Satellite Type

- On-Orbit Satellite Servicing Market, by Orbit Type

- On-Orbit Satellite Servicing Market, by Application

- On-Orbit Satellite Servicing Market, by End Users

- On-Orbit Satellite Servicing Market, by Region

- On-Orbit Satellite Servicing Market, by Group

- On-Orbit Satellite Servicing Market, by Country

- United States On-Orbit Satellite Servicing Market

- China On-Orbit Satellite Servicing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Critical Findings and Strategic Imperatives to Forge a Path Ahead in the Rapidly Evolving On-Orbit Satellite Servicing Realm

The synthesis of our research highlights a clear trajectory toward sustained growth and technological maturation in on-orbit satellite servicing. Advances in robotics, AI-driven autonomy, and modular spacecraft design are converging to make in-space servicing missions increasingly reliable and cost-effective. Regulatory convergence and evolving environmental standards are reinforcing the imperative for proactive debris management and asset life-extension strategies.

Tariff-driven supply chain realignment has underscored the importance of procurement agility and manufacturing localization, prompting strategic partnerships that distribute risk and foster innovation in component design. Segmentation analysis reveals differentiated demand signals across service types, satellite classes, orbital regimes, applications, and end users, enabling providers to tailor offerings with precision. Regional insights underscore the critical influence of government programs in seeding early demonstrations and co-financing mission demos, setting the stage for broader commercial adoption.

As industry leaders translate these findings into action, the path forward will be defined by collaborative development models, open system architectures, and integrated sustainability frameworks. By aligning technological prowess with strategic partnerships and regulatory engagement, stakeholders will unlock the full potential of on-orbit servicing to drive operational resilience, extend satellite lifespans, and safeguard the long-term viability of space environments.

Seize the Opportunity: Connect with Associate Director of Sales & Marketing to Unlock Exclusive Access to Comprehensive On-Orbit Satellite Servicing Research

To explore the full breadth of insights and secure a tailored understanding of on-orbit satellite servicing, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engaging with Ketan ensures personalized guidance through the depth of research findings, facilitating seamless access to proprietary analyses, actionable data, and technology roadmaps crafted for strategic decision-making. By collaborating with Ketan, stakeholders can align their investment priorities, refine partnership strategies, and leverage exclusive briefings that illuminate the opportunities within active debris removal, in-orbit assembly, refueling operations, and beyond. Don’t miss this opportunity to transform abstract insights into concrete, data-driven initiatives. Reach out to gain privileged entry to the comprehensive on-orbit satellite servicing market report and propel your organization to the forefront of space innovation.

- How big is the On-Orbit Satellite Servicing Market?

- What is the On-Orbit Satellite Servicing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?