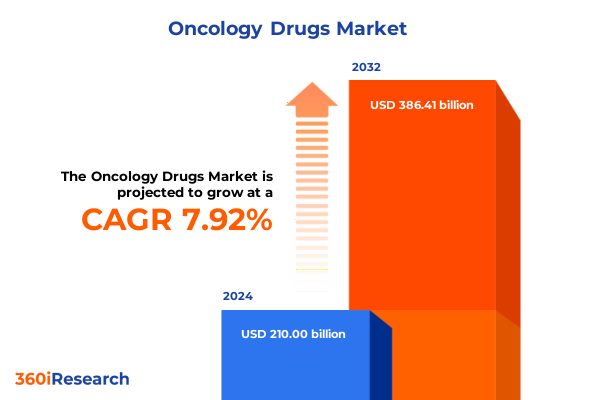

The Oncology Drugs Market size was estimated at USD 225.54 billion in 2025 and expected to reach USD 242.62 billion in 2026, at a CAGR of 7.99% to reach USD 386.41 billion by 2032.

Groundbreaking Therapeutic Innovations and Market Dynamics Shaping the Modern Oncology Drugs Landscape for Industry Decision-Makers

The contemporary oncology landscape is defined by an unprecedented convergence of scientific breakthroughs and shifting stakeholder imperatives that are redefining cancer care. Over the past five years, the field has transitioned from reliance on broad-spectrum cytotoxic chemotherapies to precision-driven interventions that harness the body’s immune system and target molecular drivers of malignancy. This paradigm shift is underpinned by robust R&D efforts, with novel modalities such as CAR T-cell therapies, bispecific antibodies, and antibody-drug conjugates rapidly entering late-stage clinical development and regulatory review. Among these, checkpoint inhibitors have emerged as a cornerstone of immuno-oncology, expanding into earlier lines of therapy and across multiple tumor types as real-world evidence confirms their durable efficacy and manageable safety profiles.

Transitioning from concept to clinical routine, innovations such as liquid biopsy platforms and AI-enabled biomarker analyses are streamlining patient stratification and accelerating the move toward truly personalized regimens. This executive summary distills the critical market dynamics, policy shifts, and technological advances that are shaping the direction of oncology drug development and commercialization. By synthesizing primary stakeholder insights with comprehensive secondary data, this analysis provides a rigorous foundation for informed decision-making amid a rapidly evolving competitive and regulatory environment.

Transformative Advancements from Immunotherapies to Bispecific and Cellular Therapies Reshaping Cancer Treatment Approaches Globally

The oncology treatment paradigm has undergone a profound transformation driven by the maturation of immunotherapies and the emergence of next-generation precision modalities. Checkpoint inhibitors targeting PD-1, PD-L1, and CTLA-4 pathways have demonstrated survival benefits in an expanding array of malignancies, including head and neck cancers, melanoma, and lung cancers, reflecting data revealed at the 2025 ASCO annual meeting and subsequent real-world studies. In parallel, CAR T-cell therapies have transcended hematologic malignancies, with early clinical evidence suggesting efficacy in select solid tumor indications such as gastric and glioblastoma, underscoring the potential for engineered cell therapies to address historically intractable cancers.

Further compounding these gains, the integration of bispecific T-cell engagers and multispecific antibody formats is catalyzing synergistic treatment regimens that harness multiple immune pathways simultaneously. These agents, including recently approved constructs for multiple myeloma and aggressive lymphomas, are moving beyond proof-of-concept to broader clinical adoption. Concurrently, the advent of subcutaneous formulations for established monoclonal antibodies is enhancing patient convenience and expanding administration settings beyond major clinics, thereby reshaping care delivery models.

Comprehensive Evaluation of How United States 2025 Tariff Measures on Pharmaceutical Imports Are Influencing Oncology Drug Access and Supply Costs

In April 2025, the U.S. implemented a universal 10% global tariff on all imports, encompassing critical active pharmaceutical ingredients (APIs), medical equipment, and drug intermediates, in a bid to incentivize domestic production. Concurrently, under Section 232 probes, proposed tariffs of up to 25% on finished pharmaceutical products and APIs sourced from key partners, notably China and India, have introduced significant cost pressures upon importers and manufacturers alike. Against this backdrop, industry analyses estimate that a 25% levy on pharmaceutical imports could inflate U.S. drug expenditures by as much as $51 billion annually, translating into potential price increases of up to 12.9% if fully passed on to end users.

The cumulative effect of layered tariffs threatens to exacerbate existing drug shortage challenges, particularly for generic chemotherapies and supportive agents vital to oncology infusion centers. Experts warn that marginally profitable products may be discontinued rather than subjected to elevated import duties, further narrowing the supply base and impeding patient access. To mitigate these risks, leading drugmakers are reshoring key manufacturing processes and forging direct engagements with federal agencies to secure strategic exemptions, highlighting a broader industry pivot toward supply chain resilience amid escalating trade policy uncertainty.

In-Depth Examination of Market Segmentation by Drug Class, Administration Route, Molecule Type, Indication, End User and Distribution Dynamics

Segmenting the oncology drugs market yields critical insights into therapeutic demand, innovation trajectories, and adoption patterns. By drug class, chemotherapy agents remain foundational in combination regimens, yet the fastest growth is observed in immunotherapy agents-particularly CAR T-cell constructs and checkpoint inhibitors with evolving dual-target modalities. Within targeted therapies, the expansion of monoclonal antibodies, both chimeric and humanized, and small molecule kinase inhibitors continues to refine treatment specificity and tolerability profiles.

When viewed through the lens of administration route, injectable formulations, whether delivered intravenously or subcutaneously, dominate in hospital and specialty clinic settings due to the requirement for clinical monitoring, whereas oral agents facilitate outpatient adherence and convenience. Distinctions based on molecule type further underscore the dual prominence of biologics-spanning monoclonal antibodies and emerging vaccine platforms-and small molecules engineered for intracellular targets. Delving into indication segmentation reveals differential dynamics between blood cancers, where cellular therapies have vaulted into standard-of-care, and solid tumors, where early-line immunotherapies are progressively replacing cytotoxic backbones. Finally, end-user and distribution channel divisions underscore evolving stakeholder roles, with hospitals and specialty clinics at the forefront of novel therapy delivery and online pharmacies gaining traction for oral regimens requiring less intensive monitoring.

This comprehensive research report categorizes the Oncology Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Class

- Route of Administration

- Molecule Type

- Indication

- End User

- Distribution Channel

Strategic Regional Insights Highlighting Key Growth Drivers and Challenges in the Americas, Europe Middle East Africa, and Asia-Pacific Oncology Markets

Regional dynamics in the oncology drugs landscape are shaped by diverse regulatory frameworks, reimbursement environments, and patient access pathways. The Americas, led by the United States, remain the epicenter of oncology innovation, propelled by substantial R&D investment, favorable intellectual property protections, and robust uptake of premium-priced immunotherapies. Canada and Latin America exhibit selective adoption trends, with market entry timelines often impacted by local health technology assessments and budgetary constraints.

In Europe, the Middle East, and Africa, regulatory harmonization via the European Medicines Agency streamlines new therapy approvals, yet pricing negotiations and reimbursement decisions introduce variability in market access and timelines. Emerging markets in the region are witnessing accelerated uptake of biosimilar oncology agents, easing budgetary pressures and creating capacity for later-generation modalities. Meanwhile, the Asia-Pacific corridor stands out as the fastest-growing region, fueled by rising cancer incidence, expanding healthcare infrastructure, and government initiatives to bolster domestic biomanufacturing, particularly in China, Japan, and South Korea.

This comprehensive research report examines key regions that drive the evolution of the Oncology Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Corporate Intelligence on Leading Pharmaceutical Players Driving Oncology Innovation Through Strategic Partnerships and Pipeline Developments

A cadre of multinational pharmaceutical leaders is driving the current oncology renaissance through sizeable R&D investments, strategic partnerships, and an expanding mid- and late-stage pipeline. Roche, buoyed by robust half-year 2025 financials, reported a 6% increase in operating profit on the strength of breast cancer and immunology products, and is augmenting U.S. manufacturing capacity to buffer tariff-induced cost pressures. Pfizer’s elevated focus on oncology was underscored by the appointment of its oncology division head, Chris Boshoff, to chief R&D officer, signaling intensified prioritization of biomarker-driven assets and antibody-drug conjugate innovations.

Merck & Co., anchored by the blockbuster performance of Keytruda-its PD-1 inhibitor spanning over a dozen indications-continues to fortify its immuno-oncology leadership through strategic collaborations and license agreements targeting bispecific and novel checkpoint modalities. Novartis, leveraging its Kisqali CDK4/6 inhibitor and radioligand therapy assets, has solidified its presence in breast and prostate cancer, while its recent bolt-on acquisitions and CAR T-cell alliances are positioning it for sustained innovation across both hematologic and solid tumor indications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Oncology Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Agenus Inc.

- Amgen Inc.

- Après-demain SA

- Aspen Pharmacare Holdings Limited

- Astellas Pharma Inc.

- AstraZeneca PLC

- Bayer AG

- BeiGene, Inc.

- Bristol-Myers Squibb Company

- C.H. Boehringer Sohn AG & Co. KG

- Cipla Limited

- Eli Lilly and Company

- GSK plc

- Johnson & Johnson Services, Inc.

- Merck KGaA

- Pfizer Inc.

- Puma Biotechnology, Inc.

- Roche Holding AG

- Shorla Oncology

- Sun Pharmaceutical Industries Ltd

- Sutro Biopharma, Inc.

- Takeda Pharmaceutical Company Limited

- Viatris Inc.

Strategic Actionable Recommendations Empowering Industry Leaders to Navigate Supply Chain Disruptions, Regulatory Shifts, and Emerging Therapeutic Opportunities

Industry leaders should prioritize the acceleration of domestic manufacturing capabilities to mitigate the operational and financial risks posed by escalating tariff regimes. Establishing regional production hubs for active pharmaceutical ingredients and finished biologics will not only cushion the impact of import levies but also enhance supply chain transparency and responsiveness. Engaging proactively with regulatory authorities to secure targeted tariff exemptions and leveraging Section 301 carve-outs for critical oncology inputs can further safeguard continuity of care while fostering government-industry collaboration.

Simultaneously, pharmaceutical companies must intensify cross-sector partnerships, integrating digital diagnostics, AI-driven biomarker analytics, and precision manufacturing platforms to streamline development timelines and reduce R&D attrition. Embracing flexible distribution models that blend hospital networks, specialty clinics, and online pharmacy channels will optimize patient access across therapeutic modalities. Moreover, investing in real-world evidence generation and post-marketing surveillance will reinforce product differentiation and inform adaptive reimbursement strategies in an era of value-based healthcare contracting.

Robust Research Methodology Combining Primary Stakeholder Interviews, Comprehensive Secondary Sources, and Rigorous Data Triangulation Techniques

This analysis is grounded in a comprehensive secondary research phase, drawing upon industry reports, peer-reviewed publications, and proprietary data from leading oncology conferences. Quantitative market and clinical trial databases were triangulated to validate trends in novel modality adoption and regional uptake. Global tariff impacts were assessed using government tariff schedules and industry-commissioned financial analyses to ensure accuracy in cost and supply chain projections.

Primary research encompassed in-depth interviews with key opinion leaders, including oncologists, policy experts, and supply chain executives, complemented by structured surveys across major pharmaceutical companies. These qualitative insights were synthesized to contextualize regulatory developments, pricing dynamics, and stakeholder sentiment. Rigorous data triangulation and peer review protocols were employed throughout to uphold methodological transparency and ensure the integrity of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Oncology Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Oncology Drugs Market, by Drug Class

- Oncology Drugs Market, by Route of Administration

- Oncology Drugs Market, by Molecule Type

- Oncology Drugs Market, by Indication

- Oncology Drugs Market, by End User

- Oncology Drugs Market, by Distribution Channel

- Oncology Drugs Market, by Region

- Oncology Drugs Market, by Group

- Oncology Drugs Market, by Country

- United States Oncology Drugs Market

- China Oncology Drugs Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2862 ]

Conclusive Perspectives Underscoring the Imperative for Collaborative Innovation and Strategic Adaptation in the Evolving Oncology Drugs Sector

In conclusion, the oncology drugs sector stands at a pivotal inflection point characterized by the rapid maturation of immunotherapies, precision cellular treatments, and novel molecular entities that collectively promise enhanced patient outcomes. Concurrently, shifting trade policies and tariff regimes necessitate strategic pivots in supply chain configuration and manufacturing footprints to preserve access and contain costs. Only through integrated approaches that blend scientific innovation, agile operational models, and proactive regulatory engagement can stakeholders fully capitalize on the transformative potential of next-generation oncology therapies.

Looking forward, the synergy of advancing modalities-ranging from bispecific antibodies to adaptive cell therapies-and the parallel evolution of diagnostic and digital health ecosystems will continue to reshape treatment algorithms. As the industry navigates this complex terrain, data-driven decision-making and collaborative partnerships will be essential to realizing the goal of personalized, accessible, and sustainable cancer care.

Exclusive Invitation from Ketan Rohom to Engage With Customized Oncology Market Intelligence and Secure the Definitive Research Report Today

Are you ready to propel your strategic initiatives with unparalleled depth of insight? Connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to secure exclusive access to the comprehensive oncology drugs market research report. This customized analysis will equip you with the intelligence needed to navigate evolving regulatory environments, optimize investment decisions, and capitalize on emerging therapeutic trends. Reach out today to discuss tailored licensing options and embark on a journey toward data-driven excellence in oncology.

- How big is the Oncology Drugs Market?

- What is the Oncology Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?