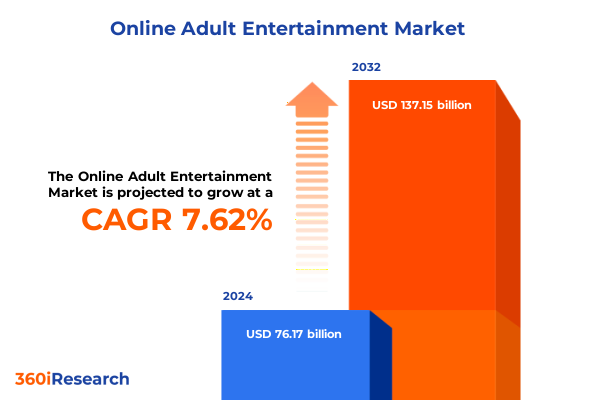

The Online Adult Entertainment Market size was estimated at USD 81.86 billion in 2025 and expected to reach USD 88.03 billion in 2026, at a CAGR of 7.64% to reach USD 137.15 billion by 2032.

Explore the Dynamic Evolution and Strategic Imperatives Shaping the Global Online Adult Entertainment Market in a Rapidly Changing Digital Ecosystem

The online adult entertainment ecosystem is experiencing an era of unprecedented digital transformation driven by evolving consumer behaviors and rapid technological advancements. As audiences demand richer, more immersive content experiences, platforms are investing heavily in infrastructure and tooling designed to deliver high-resolution video, interactive livestreams, and real-time communication features. This dynamic environment challenges operators to continuously refine their offerings to maintain user engagement and loyalty.

Strategic competition is intensifying as established brands and emerging contenders vie for attention across multiple content formats and delivery channels. Platforms once known exclusively for video streaming are now expanding into specialized niches such as adult gaming, virtual reality, audio erotica, and interactive chat services. These diversification efforts reflect a broader imperative to capture audience share by tailoring experiences to individual preferences and consumption patterns.

At the same time, regulatory frameworks and data privacy standards are evolving worldwide, compelling industry participants to adopt robust content moderation practices and compliance mechanisms. Balancing creative freedom, user safety, and legal requirements remains a critical challenge. As we navigate these complexities, this report provides an integrated analysis of the forces reshaping the online adult entertainment market and outlines strategic imperatives for sustaining growth in a rapidly changing digital economy.

Uncover the Technological Innovations and Consumer Behavior Transformations Rewriting Expectations for Online Adult Entertainment Platforms Worldwide

Immersive technologies are rapidly redefining user expectations within adult entertainment. Virtual reality experiences, once a niche novelty, have become mainstream; Pornhub reports VR videos being viewed over half a million times each day, with headset users engaging in significantly longer sessions compared to traditional viewers. This trend highlights the growing appetite for content that offers deeper sensory involvement and a heightened sense of presence.

Meanwhile, artificial intelligence is playing a pivotal role in content personalization and production efficiency. Automated content recommendation engines and AI-driven video editing tools enable platforms to streamline workflows and deliver tailored suggestions, while simultaneously raising important ethical questions about non-consensual deepfake imagery. Recent investigations into AI-generated non-consensual content in Europe underscore the urgent need for responsible AI governance and proactive detection methods.

On the mobile front, live streaming and real-time chat services are unlocking new avenues for creator-fan interaction. Platforms are enhancing interactivity by integrating two-way communication features, premium private messaging, and virtual tipping systems, all optimized for mobile interfaces. This shift toward more engaging, user-driven experiences is complemented by the rise of hybrid influencer platforms, where adult and mainstream creators converge. Notably, the founder of a leading adult subscription service has launched a new platform designed to bridge mainstream influencer content and adult offerings, emphasizing brand-friendly features and ethical AI integrations.

Assess the Far Reaching Effects of Recent United States Tariffs on Digital Infrastructure Costs and Consumer Engagement in the Adult Entertainment Sector

The imposition of new U.S. tariffs in 2025 has introduced cost pressures across the technology supply chain, particularly impacting hardware used in digital content delivery. Streaming devices, VR headsets, and server infrastructure components imported from Asia now attract higher duties, leading many platforms to reassess procurement strategies. Analysis suggests that tariffs on critical hardware may be passed on to consumers in the form of subscription price adjustments or device markups, potentially influencing user retention and acquisition costs.

In response to rising infrastructure expenses, leading platforms are exploring diversified supply chains and domestic hosting options to mitigate tariff-related disruptions. Some operators are accelerating investments in regional data center capacity to secure greater control over hosting costs and ensure service reliability. These strategic shifts demand substantial capital outlay but offer a hedge against unpredictable trade policies and fluctuating import duties.

Despite these headwinds, major technology firms have reported resilient performance ahead of tariff implementation, indicating a degree of market adaptability. Robust earnings in cloud services and AI chip sales reflect preemptive inventory build-ups and strategic stockpiling, which may buffer some cost increases in the short term. However, sustained tariff levels could prompt platforms to reevaluate expansion plans in cost-sensitive markets.

For the adult entertainment sector, the combination of hardware cost inflation and potential subscription pricing changes underscores the importance of operational agility. Platforms reliant on immersive hardware such as VR headsets and high-bandwidth streaming must align long-term technology roadmaps with evolving trade regulations to maintain both quality of service and price competitiveness.

Delve into Intricate Market Segmentation Revelations Illuminating Consumer Preferences Across Content Types Monetization Structures and Demographic Profiles

The online adult entertainment market is structured around multiple content categories, each demanding distinct production and distribution approaches. Traditional adult video and movie segments coexist with emerging adult games that leverage gamification mechanics, while audio and literature offerings cater to consumers seeking privacy and imagination-driven experiences. Live streams and real-time chat services further diversify the landscape by enabling one-to-one interactions and fostering community among creators and fans.

Monetization strategies are equally varied, ranging from ad-supported access models to freemium offerings where users can sample basic content before unlocking premium tiers. Pay-per-view events for exclusive live performances coexist alongside recurring subscription services that provide steady revenue streams. Platforms are increasingly blending these approaches to optimize lifetime value and accommodate different consumer willingness to pay.

Levels of interactivity also define market segments, with fully interactive formats such as VR-enabled environments and real-time cams offering immersive engagement, while non-interactive streams focus on on-demand video libraries. Semi-interactive experiences bridge these extremes through choose-your-own-adventure style narratives or periodic viewer polling, delivering engagement without the complexity of full real-time participant control.

Demographic segmentation reveals generational preferences that inform content strategy and marketing. Generation X audiences often gravitate toward nostalgia-driven themes and premium video collections, while Millennials seek a mix of subscription convenience and social community features. Generation Z favors mobile-first designs, short-form interactive clips, and social integrations that align with broader influencer culture.

Understanding gender and identity diversity among end users is critical for inclusive content creation. Female audiences prioritize platforms that emphasize empowerment, trust, and community standards. Male users frequently exhibit a higher propensity for immersive video experiences and gaming extensions. Non-binary consumers value bespoke, customizable offerings that respect fluid identities and promote safe, respectful engagement.

This comprehensive research report categorizes the Online Adult Entertainment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Content Type

- Monetization Models

- Interactive Type

- Age Group

- End-User

Reveal the Distinct Regional Nuances Shaping Consumer Engagement and Market Dynamics Across the Americas Europe Middle East Africa and Asia Pacific

The Americas region remains the largest revenue contributor for online adult entertainment, buoyed by advanced broadband infrastructure, high smartphone penetration, and mature payment ecosystems. In North America, regulatory measures addressing content moderation and age verification continue to evolve, prompting platforms to implement sophisticated compliance technologies. Latin American markets demonstrate strong mobile-first consumption trends and present growth opportunities for localized content in Spanish and Portuguese languages.

Within Europe, Middle East, and Africa, diverse regulatory landscapes challenge uniform content distribution. GDPR-driven privacy requirements in Western Europe demand rigorous data handling and consent management. Countries in the Middle East enforce strict censorship that necessitates VPN-based access solutions, while parts of Africa are witnessing nascent digital adoption momentum, driven by affordable smartphones and expanding mobile networks.

Asia-Pacific regions illustrate contrasting dynamics. Japan and South Korea lead in VR headset adoption and high-resolution streaming, encouraging platforms to introduce premium immersive content. China’s strict content controls and licensing restrictions channel user interest toward offshore platforms accessed via alternative networks. Meanwhile, India’s rapidly expanding digital user base and growing digital payment adoption create fertile ground for scaled subscription models and microtransaction-based content.

This comprehensive research report examines key regions that drive the evolution of the Online Adult Entertainment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminate Competitive Landscapes by Highlighting Strategic Innovations and Market Positions of Leading Providers in the Online Adult Entertainment Arena

The online adult entertainment arena is dominated by a handful of major proprietors whose strategic investments and technology roadmaps set industry benchmarks. One leading conglomerate, known for its flagship video portal, has continuously scaled its content library and diversified into high-definition VR offerings; the platform’s immersive videos are viewed over 500,000 times daily, underscoring its market leadership. This operator’s deep content moderation protocols and AI-driven recommendation systems further reinforce user retention.

A prominent subscription-based platform transformed the creator economy by enabling direct fan monetization; its founder has since launched a mainstream-facing spin-off designed to combine adult and non-adult influencer segments, integrating AI content insights and advanced creator tools to broaden appeal. This platform’s tiered revenue share and diversified content formats continue to influence platform economics across the sector.

Live streaming pioneers maintain significant market share in the interactive segment by offering robust tipping mechanisms, real-time chat integration, and mobile-optimized broadcast software. Their community-driven approach has established new engagement paradigms and attracted both independent creators and established brands seeking high levels of user interaction.

Emerging technology firms specializing in AI-powered content moderation, deepfake detection, and personalized recommendation engines are forming strategic partnerships with major platforms. These collaborations promise to enhance platform safety, accelerate content discovery, and drive incremental revenue growth through targeted advertising and subscription upsells.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Adult Entertainment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aylo Freesites Ltd (MindGeek)

- Fenix International (OnlyFans)

- Chaturbate

- FriendFinder Networks Inc.

- BongaCams

- LiveJasmin

- CamSoda

- XHamster

- Cybernet Entertainment LLC (Kink.com)

- ImLive

- MVVERSE Inc.

- Playboy Enterprises, Inc.

- VS Media, Inc. (Flirt4Free)

- BangBros

- FapHouse

- MyFreeCams

- BitLove Inc.

- CAM4.com

- Camming.tv

- daibouken.jp

- FanCentro

- Hentaimama

- HentaiStream.com

- JavBus

- Javhd.today

- Jerkmate

- JustForFans

- La Touraine, Inc. (Naughty America)

- LivePrivates

- MongerCash.com

- Nexxxt Level Talent Agency

- Paper Street Media LLC (TeamSkeet)

- SpankWire

- StreamateModels.com

- Technius Ltd (Stripchat)

Empower Industry Leaders with Targeted Initiatives to Enhance Resilience Adaptability and Profitability Amid Evolving Digital Entertainment Dynamics

To thrive amid shifting consumer demands and regulatory landscapes, industry leaders should diversify their technology stacks by investing in both emerging immersive experiences and robust mobile-first solutions. Balancing virtual reality, augmented reality, and interactive live formats with streamlined smartphone applications will ensure broad reach and sustained user engagement.

Strengthening content authenticity and user safety must remain a top priority. Deploying AI-driven moderation and consent verification tools can prevent the dissemination of illicit or non-consensual material, reinforcing trust among creators, consumers, and regulators. Proactive transparency in content policies will foster long-term platform credibility.

Operational resilience requires optimizing global supply chains for streaming hardware and infrastructure. Platforms should explore regional data center partnerships and alternative manufacturing hubs to insulate operations from import tariffs and geopolitical uncertainties. Localizing hosting capabilities will also reduce latency and enhance the viewing experience.

Expanding and hybridizing monetization models will maximize revenue potential. A balanced mix of subscription tiers, pay-per-view events, and contextually relevant advertising will cater to diverse willingness-to-pay profiles. Platforms can further differentiate by introducing limited-edition digital collectibles or loyalty-based rewards that align with consumer interests.

Navigating varied regional regulations calls for tailored compliance frameworks. Localized content strategies, inclusive payment options, and adaptive age-verification measures will enable platforms to enter new markets quickly while adhering to cultural norms and legal requirements.

Discover the Rigorous Multi Tiered Research Methodology Ensuring Data Reliability Through Strategic Data Collection Analysis and Expert Validation Processes

This research employs a mixed-method approach, beginning with comprehensive primary interviews drawn from leading platform executives, content creators, and technology partners. In-depth surveys conducted across diverse end-user cohorts provided firsthand perspectives on consumption behavior and feature preferences.

Secondary research included rigorous analysis of publicly available regulatory filings, quarterly earnings reports, reputable news sources, and technology whitepapers. Industry associations and trade publications were consulted to validate emerging trends and benchmark technological advancements.

Data triangulation techniques were applied to reconcile insights from multiple sources, ensuring consistency and reliability. A robust segmentation modeling process further refined our understanding of distinct market cohorts based on content type, monetization strategy, interactive engagement levels, demographic profiles, and geographic regions.

Expert validation workshops were convened to scrutinize preliminary findings, fostering an iterative feedback loop that enhanced data granularity and contextual relevance. Continuous monitoring of trade policies and competitive developments allows for dynamic report adjustments to reflect evolving market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Adult Entertainment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Adult Entertainment Market, by Content Type

- Online Adult Entertainment Market, by Monetization Models

- Online Adult Entertainment Market, by Interactive Type

- Online Adult Entertainment Market, by Age Group

- Online Adult Entertainment Market, by End-User

- Online Adult Entertainment Market, by Region

- Online Adult Entertainment Market, by Group

- Online Adult Entertainment Market, by Country

- United States Online Adult Entertainment Market

- China Online Adult Entertainment Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesize Key Insights and Strategic Imperatives to Navigate Future Opportunities and Challenges in the Evolving Online Adult Entertainment Market Landscape

The online adult entertainment industry stands at a crossroads of technological innovation, shifting consumer expectations, and complex regulatory dynamics. Immersive formats like virtual reality and real-time interactive experiences are reshaping engagement standards, while AI-driven content personalization and moderation tools redefine operational efficiencies and trust frameworks.

Geopolitical factors, including 2025 tariff measures, are exerting tangible cost pressures on hardware-dependent service providers, prompting strategic adjustments in supply chains and infrastructure investments. Simultaneously, segmentation insights reveal nuanced preferences across content types, monetization models, interaction levels, age groups, and gender identities, highlighting the imperative for tailored platform strategies.

Regional considerations from the Americas through EMEA to Asia-Pacific underscore the importance of localized compliance, payment mechanisms, and cultural adaptation. Leading companies continue to differentiate through technology partnerships, creator empowerment initiatives, and diversified revenue structures, yet emerging entrants are swiftly adopting AI-driven features to capture niche market share.

As the landscape evolves, stakeholders who proactively integrate innovation, compliance, and consumer-centric models will be best positioned to navigate future opportunities and challenges. Collaboration among technology providers, creators, and policymakers will define the next chapter of sustainable growth and responsible content delivery.

Transform Your Strategic Outlook Secure Access to In Depth Market Intelligence by Connecting with the Associate Director of Sales Marketing

If you’re ready to translate these insights into strategic advantage and gain unparalleled clarity into market dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report tailored to your organizational goals. Engage directly to access proprietary analysis, detailed segmentation breakdowns, and expert guidance that will inform your next strategic decisions. Connect today to unlock the actionable intelligence that will propel your business forward in the rapidly evolving online adult entertainment landscape

- How big is the Online Adult Entertainment Market?

- What is the Online Adult Entertainment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?