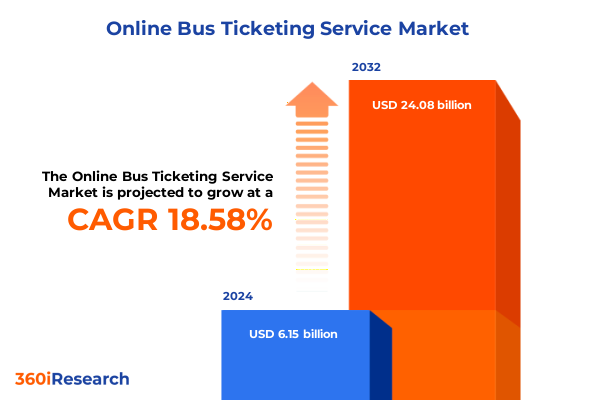

The Online Bus Ticketing Service Market size was estimated at USD 7.32 billion in 2025 and expected to reach USD 8.57 billion in 2026, at a CAGR of 18.52% to reach USD 24.08 billion by 2032.

Discovering the Evolution and Strategic Importance of Online Bus Ticketing in a Rapidly Digitizing and Customer-Centric Transportation Ecosystem

The online bus ticketing industry has undergone a fundamental transformation, rising from a niche convenience to a central pillar of modern intercity travel. With the proliferation of high-speed internet, the democratization of smartphones, and shifts in consumer expectations toward seamless digital experiences, consumers now demand instant access to schedules, real-time availability, and frictionless payment options. As a result, the ecosystem has evolved beyond simple transaction portals into sophisticated platforms that integrate dynamic pricing engines, personalized itineraries, and loyalty-driven engagement.

Early pioneers in this sector laid the groundwork with basic web-based booking tools, yet recent years have witnessed an acceleration towards mobile-first solutions. This shift has redefined the customer journey from discovery to boarding, enabling operators to engage users with location-based offers, push notifications for service disruptions, and contextual travel recommendations. Moreover, the integration of third-party mobility services-ranging from ride-hailing connections to on-demand shuttle partnerships-has blurred the lines between point-to-point bus travel and end-to-end multimodal journeys.

Consequently, industry stakeholders now face the imperative to reimagine traditional operational models, embracing AI-driven personalization and data analytics to optimize route planning, manage capacity, and anticipate demand fluctuations. In turn, these capabilities are reshaping the competitive terrain, compelling both established carriers and digital-native challengers to innovate continually in order to capture market share and win customer loyalty in a rapidly digitizing transportation ecosystem.

Harnessing Artificial Intelligence, Sustainability Imperatives, and Strategic Alliances to Revolutionize Online Bus Booking and Mobility Integration

The online bus ticketing landscape is experiencing a wave of transformative shifts that are redefining how consumers plan, book, and experience travel. Foremost among these shifts is the widespread adoption of AI and machine learning algorithms to drive predictive analytics. Operators leverage these technologies to forecast demand, tailor promotional offers, and dynamically adjust pricing in response to real-time booking patterns and external variables such as weather and local events. This degree of sophistication elevates revenue management to levels previously confined to the airline and hospitality sectors.

Parallel to the rise of advanced analytics, sustainable mobility considerations are gaining prominence. Buyers increasingly seek eco-friendly travel options, prompting platforms to highlight carbon footprint metrics and incentivize low-emission coach services. By showcasing greener alternatives and offset partnerships, operators can appeal to environmentally conscious riders and align with broader corporate responsibility agendas.

Furthermore, the ecosystem is witnessing an influx of strategic alliances between bus operators, technology vendors, and mobility aggregators. These partnerships facilitate seamless ticketing integrations, enabling passengers to access a spectrum of transit modes-train, bus, and shared micro-transit-through a single digital interface. As mobility-as-a-service frameworks take shape, industry players must navigate a more interconnected market while differentiating through superior user experience and operational resilience.

Taken together, these transformative shifts underscore the imperative for continuous innovation. Organizations that harness intelligent automation, align with sustainability trends, and forge collaborative networks will be best positioned to lead in this rapidly evolving landscape.

Evaluating the Consequences of 2025 U.S. Import Tariffs on Bus Components and Their Ripple Effects on Digital Ticketing and Fleet Operations

In 2025, the cumulative impact of United States tariffs on bus components and associated operational supplies has reverberated across the online ticketing sector, affecting cost structures and service availability. Tariffs levied on imported chassis, braking systems, and seating assemblies have elevated maintenance and procurement expenses for fleet operators, thereby influencing service frequency and fare structures. While some carriers have absorbed these additional costs to maintain competitive pricing, others have begun to pass a portion of the burden onto customers, prompting observable fare volatility during peak seasons and strategic corridors.

Simultaneously, the tariff environment has accelerated interest in domestic sourcing and local manufacturing of critical bus parts. Several leading operators have initiated partnerships with U.S.-based suppliers to secure long-term supply agreements, mitigating exposure to import levies and supply-chain disruptions. These efforts have led to a gradual restructuring of procurement strategies, compounding procurement cycles and necessitating new quality assurance protocols.

Moreover, the implications extend beyond operational considerations to technology providers offering booking platforms and digital services. Increased costs in hardware components for self-service kiosks, onboard Wi-Fi routers, and vehicle-mounted digital signage have influenced rollout schedules for next-generation amenities. Against this backdrop, digital platforms are exploring software-driven enhancements-such as cloud-based ticket validation, mobile boarding passes, and contactless fare collection-to deliver incremental value while containing capital expenditure.

Ultimately, this tariff-induced environment underscores the industry’s resilience and adaptability. Operators that proactively realign supply chains, optimize asset utilization, and prioritize digital innovations will be well-equipped to navigate elevated cost pressures and sustain service quality in a complex regulatory landscape.

Uncovering Distinct Traveler Profiles by Booking Channel, Ticket Itinerary Preferences, Payment Behaviors, and Purpose-Driven Passenger Needs

Market segmentation analysis reveals nuanced user behaviors and preferences that inform targeted strategies across various dimensions. When evaluating distribution channels, mobile applications have surged ahead of traditional web portals as the primary point of sale, driven by on-the-go booking habits and integrated location services for route planning. Conversely, desktop website bookings remain relevant for group travel and detailed itinerary comparisons, indicating a persistent need for robust, full-featured booking platforms.

Ticket type segmentation further underscores divergent traveler objectives. Single-leg, one-way tickets cater predominantly to spontaneous or cost-conscious passengers seeking the most affordable, direct travel options. Meanwhile, round-trip reservations appeal to business executives and leisure travelers engaged in multi-day itineraries, reflecting a preference for package-style convenience and streamlined rebooking.

Payment method preferences also illustrate critical opportunities for differentiation. While credit cards maintain dominance due to broad acceptance and reward incentives, emerging digital wallets and UPI integrations are rapidly gaining traction among tech-savvy cohorts. Debit cards and net banking continue to serve a significant segment of users who prioritize transaction security and lower fees, but the acceleration of UPI-based payments signals an impending shift toward instant, mobile-first settlement flows.

Lastly, customer typologies-spanning business versus leisure travelers-highlight distinct service expectations. Corporate passengers demand flexible ticket modifications, priority seating, and clear invoicing for expense management, whereas leisure travelers prioritize cost transparency, promotional bundles, and loyalty-driven perks. Understanding these segmentation pillars enables operators to design customized offerings and communication strategies that resonate with each traveler archetype.

This comprehensive research report categorizes the Online Bus Ticketing Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Booking Platform

- Ticket Type

- Payment Method

- Customer Type

Analyzing Varied Digital Adoption Patterns and Mobility Innovations Across the Americas, EMEA, and Asia-Pacific Regions

Regional insights reveal divergent growth trajectories and consumer expectations across major territories. In the Americas, robust digital infrastructure and a mature intercity bus network support high adoption of mobile-first booking experiences, with operators emphasizing premium amenities, onboard connectivity, and loyalty integrations to stimulate repeat purchases. Moreover, regulatory frameworks in the United States and Canada increasingly support integrated ticketing platforms, enabling cross-border journey planning and real-time schedule coordination.

Across Europe, the Middle East, and Africa, regulatory harmonization and cross-border mobility initiatives have accelerated platform consolidation. Passengers benefit from unified interfaces that aggregate services across multiple carriers, facilitating streamlined journey planning in regions where borders and jurisdictions once posed operational complexities. Meanwhile, the Middle East is witnessing a surge in luxury coach offerings tied to tourism expansion, and African markets are fast embracing mobile money solutions to overcome traditional banking limitations.

In the Asia-Pacific region, burgeoning urbanization and evolving consumer preferences are fueling demand for high-frequency express services and premium intercity connectivity. Markets in Southeast Asia leverage QR code ticketing and mobile wallets such as UPI and local equivalents, driving rapid conversions from cash-based transactions. Simultaneously, operators are integrating last-mile shuttle linkages and micro-transit options into their digital platforms, reflecting a holistic approach to regional mobility demands.

Understanding these regional dynamics is crucial for tailoring platform features, forging local partnerships, and optimizing service portfolios in alignment with each market’s digital maturity, regulatory environment, and consumer behavior patterns.

This comprehensive research report examines key regions that drive the evolution of the Online Bus Ticketing Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Operators and Innovative New Entrants Shaping Service Delivery Through Strategic Tech Investments and Partnerships

Key industry participants have differentiated themselves through a blend of technology investments, strategic partnerships, and service innovation. Established operators have modernized their legacy systems with cloud-native booking engines and mobile app interfaces, ensuring smoother transactional flows and robust data analytics capabilities. These enhancements have enabled them to deliver personalized promotions, manage dynamic seat inventories, and respond swiftly to operational disruptions.

Emerging digital-native challengers have capitalized on agile development frameworks to introduce AI chatbots, voice-enabled search, and integrated loyalty ecosystems. Their lean organizational structures facilitate rapid feature rollouts and seamless third-party integrations, from payment gateways to real-time traffic data providers. As a result, these challengers often set the pace for user experience benchmarks, pushing incumbents to accelerate their own digital roadmaps.

Collaboration has also emerged as a core competitive differentiator. Leading players have forged alliances with ride-sharing platforms, rail operators, and airport shuttle services to construct end-to-end multimodal itineraries. This approach enhances customer convenience and fosters broader travel ecosystem partnerships that extend beyond traditional bus-only operations.

Furthermore, some companies are pioneering sustainability initiatives by deploying electric or hybrid coach fleets and providing transparent carbon offset options during checkout. These efforts resonate with environmentally conscious customers and reinforce brand positioning as forward-thinking mobility providers. By blending technological prowess with strategic alliances and green credentials, these organizations are shaping the future contours of the online bus ticketing market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Bus Ticketing Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbhiBus Marketing Private Limited

- ApniBus

- BAOLAU Pte Ltd

- Bookaway

- Booking Holdings Inc

- BookMe

- Busbud Inc

- Buser

- BusFor

- BusOnlineTicket com Pte Ltd

- CheckMyBus

- Cleartrip Pvt Ltd

- ClickBus

- Easy Trip Planners Ltd

- Easybook com Pte Ltd

- FlixMobility GmbH

- Greyhound Lines Inc

- IntrCity SmartBus

- Jatri

- Le Travenues Technology Ltd

- MakeMyTrip Ltd

- National Express Group PLC

- Omio International GmbH

- Redbus Online Private Limited

- Travelyaari Private Limited

Implementing Seamless Mobile Enhancements, Strategic Mobility Alliances, Diverse Payment Integrations, and Sustainability Initiatives to Drive Growth

Industry leaders can capitalize on emerging opportunities by adopting a series of targeted, actionable initiatives. To begin with, prioritizing mobile user experience enhancements-such as one-click repeat booking, biometric authentication, and real-time support chat-will bolster consumer engagement and minimize friction during peak booking periods. In tandem, investing in AI-driven demand forecasting tools can refine pricing strategies and inform dynamic seat allocation, boosting revenue without compromising customer satisfaction.

Secondly, operators should cultivate strategic alliances with adjacent mobility providers, including ride-hailing and shared micro-transit services, to create seamless first-mile and last-mile connections. Such integrations not only expand addressable markets but also strengthen brand ecosystems through cross-promotion and shared loyalty rewards.

Thirdly, embracing diverse payment ecosystems will be critical. By integrating emerging digital wallets, UPI channels, and localized mobile money solutions, businesses can capture tech-forward demographics and reduce transaction abandonment. Moreover, offering installment payment options and digital invoicing will cater to corporate segments and high-value customers.

Finally, embedding sustainability into core value propositions-through fleet electrification roadmaps, partnership-based carbon offset programs, and transparent environmental impact disclosures-will resonate with the growing cohort of eco-conscious travelers. Collectively, these recommendations will empower industry leaders to navigate evolving market demands, optimize operational efficiencies, and drive long-term loyalty.

Leveraging Expert Interviews, Authoritative Secondary Sources, Quantitative Databases, and Scenario Planning to Validate Market Insights

The research methodology underscores a balanced combination of primary and secondary data collection complemented by rigorous analytical frameworks. Primary research involved structured interviews with senior executives across leading bus operators, mobility integrators, and technology vendors. These conversations yielded firsthand insights into strategic priorities, operational challenges, and innovation roadmaps.

Complementing firsthand learnings, secondary research drew upon a wide array of authoritative industry publications, regulatory filings, and reputable academic studies to construct a broad contextual foundation. Proprietary databases tracked consumer sentiment, booking channel performance, and payment adoption trends across key markets, providing quantitative benchmarks that informed segmentation and regional analyses.

Data triangulation techniques ensured consistency by cross-verifying insights derived from distinct sources. Qualitative findings from expert interviews were mapped against quantitative consumption patterns, enabling a nuanced understanding of emerging trends and market drivers. Additionally, the methodology incorporated scenario planning workshops to test the resilience of strategic recommendations under varying tariff regimes and technological adoption curves.

Through this comprehensive approach-anchored by both expert testimony and empirical data-the study offers robust, actionable intelligence designed to guide decision-makers in navigating the complexities of the online bus ticketing landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Bus Ticketing Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Bus Ticketing Service Market, by Booking Platform

- Online Bus Ticketing Service Market, by Ticket Type

- Online Bus Ticketing Service Market, by Payment Method

- Online Bus Ticketing Service Market, by Customer Type

- Online Bus Ticketing Service Market, by Region

- Online Bus Ticketing Service Market, by Group

- Online Bus Ticketing Service Market, by Country

- United States Online Bus Ticketing Service Market

- China Online Bus Ticketing Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Digital Innovation, Supply Chain Resilience, and Consumer-Centric Strategies to Define the Future of Online Bus Ticketing

The convergence of digital innovation, evolving consumer expectations, and regulatory developments is charting a new course for the online bus ticketing sector. As operators embrace intelligent automation, sustainable practices, and strategic alliances, the customer journey is becoming more seamless, personalized, and environmentally responsible. Segmentation insights reveal the imperative to tailor offerings by booking platform, ticket type, payment preferences, and traveler purpose, while regional dynamics highlight the necessity for localized strategies that align with market maturities and regulatory frameworks.

At the same time, the 2025 U.S. tariff environment has underscored the importance of resilient supply chains and domestic sourcing strategies to mitigate cost pressures and safeguard service consistency. Meanwhile, leading companies are demonstrating how agile digital roadmaps, multimodal integrations, and green credentials can forge competitive advantage in a crowded marketplace.

By synthesizing these insights, industry stakeholders are equipped to make informed decisions that balance operational efficiency, customer-centricity, and long-term sustainability. The strategic recommendations articulated herein offer a clear roadmap for enhancing digital platforms, expanding payment ecosystems, and forging partnerships that deliver holistic mobility experiences.

Ultimately, the future of online bus ticketing will be determined by those organizations that can seamlessly integrate emerging technologies, anticipate regulatory shifts, and remain attuned to shifting traveler priorities-thereby unlocking new avenues for growth and differentiation.

Connect with Ketan Rohom to access the comprehensive market intelligence and elevate your strategic decision making in bus ticketing

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the definitive market analysis and gain a competitive advantage in the evolving online bus ticketing landscape.

- How big is the Online Bus Ticketing Service Market?

- What is the Online Bus Ticketing Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?