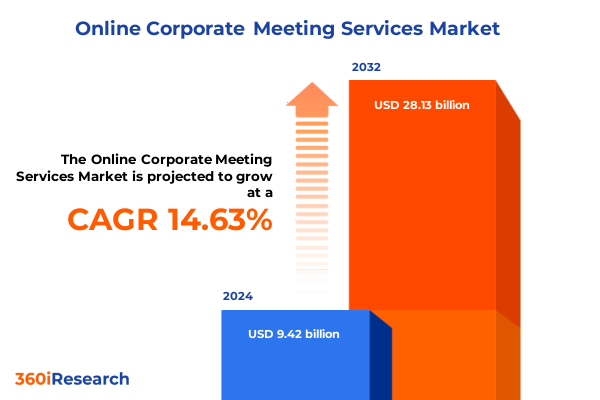

The Online Corporate Meeting Services Market size was estimated at USD 10.84 billion in 2025 and expected to reach USD 12.22 billion in 2026, at a CAGR of 14.59% to reach USD 28.13 billion by 2032.

Unveiling the Dynamic Evolution of Online Corporate Meeting Services Amidst Accelerating Hybrid Work Trends and Digital Transformation Advances

Online corporate meeting services have become an indispensable pillar of modern enterprise connectivity, catalyzed by the convergence of hybrid work preferences, globalization, and digital transformation initiatives. This market embodies an ecosystem of audio, video, and web-based platforms that enable seamless interaction across geographies, time zones, and organizational boundaries. As businesses embrace distributed teams and remote collaboration, the demand for reliable, high-fidelity communication channels has surged, prompting rapid innovation in areas such as artificial intelligence-driven noise cancellation, real-time language translation, and immersive conferencing experiences.

Against this backdrop, technology providers are introducing next-generation capabilities that blend synchronous and asynchronous interactions, high-definition visuals, and enriched collaboration tools. Organizations are rethinking traditional office paradigms and investing in integrated meeting ecosystems that support everything from quick check-ins to large-scale virtual events. The intersection of cultural shifts toward flexibility and the maturation of digital infrastructure underscores the pivotal role of meeting services as both productivity enhancers and enablers of strategic alignment.

In light of these drivers, this executive summary navigates through the fundamental trends, regulatory influences, segmentation nuances, and regional dynamics shaping the corporate meeting services landscape. It aims to furnish decision-makers with a clear, authoritative perspective on transformative developments, the cumulative impact of recent tariff policies, and actionable recommendations for securing competitive advantage in a fast-evolving environment.

Exploring Pivotal Technological and Adoption Shifts Including Asynchronous Workflows AI-Driven Engagement and Visual Fidelity Elevating Corporate Collaboration

The landscape of online corporate meeting services is undergoing transformative shifts driven by advancements in networking infrastructure, user expectations, and emerging use cases. High-definition visual fidelity is now complemented by AI-powered features such as automated transcription, speaker tracking, and intelligent camera control, fostering more engaging and accessible sessions. Concurrently, asynchronous workflows-characterized by on-demand content sharing and interactive discussion boards-are increasingly integrated into platforms to accommodate global teams operating across disparate schedules.

Moreover, the proliferation of edge computing and 5G connectivity is enabling ultra-low latency experiences, permitting real-time collaboration in bandwidth-constrained environments. This shift not only elevates video and audio quality but also lays the groundwork for immersive technologies like mixed reality and holographic conferencing. Meanwhile, interoperability standards are gaining traction, empowering enterprises to bridge diverse ecosystems and avoid vendor lock-in through seamless integration with productivity suites and enterprise resource planning systems.

Finally, the democratization of video endpoints-from dedicated hardware to browser-based and mobile applications-has expanded accessibility, allowing small and large organizations alike to tailor meeting experiences to their operational and security requirements. Taken together, these technological and adoption shifts underscore a move toward more fluid, intelligent, and inclusive corporate collaboration models that redefine how teams communicate and innovate.

Assessing the Cumulative Effects of 2025 United States Tariffs on Corporate Meeting Hardware Software and Service Delivery Ecosystems

In 2025, the United States’ imposition of additional tariffs on imported meeting room hardware and related electronic components has had a cumulative ripple effect across the corporate conferencing ecosystem. As hardware costs rose for endpoints such as cameras, microphones, and interactive displays, solution providers faced margin pressures that translated into altered pricing structures, with some vendors passing incremental expenses on to enterprise customers. This dynamic prompted many organizations to re-evaluate the balance between on-premises infrastructure and cloud-based subscription models, seeking to mitigate upfront capital expenditures.

Furthermore, software licensing agreements have begun to reflect the impact of these trade measures, with bundled offerings gaining prominence as vendors strive to maintain value propositions in the face of regulatory headwinds. From a service perspective, managed and professional services engagements have adapted by incorporating supply chain risk assessments, localized procurement strategies, and hybrid deployment planning to offset exposure to tariff-affected components. Consequently, decision-makers are factoring in a wider range of total cost of ownership considerations when evaluating new rollouts or platform upgrades.

Looking ahead, companies are exploring alternative sourcing strategies-such as dual-country manufacturing and regional assembly hubs-to alleviate tariff burdens and sustain competitive pricing. These strategic responses highlight the ongoing interplay between geopolitical developments and technology adoption roadmaps, emphasizing the need for agile planning in meeting service infrastructures.

Synthesizing Multifaceted Segmentation Insights to Illuminate Solution Deployment Organization Size Component and Industry Dynamics Shaping Market Trajectories

A granular view of the online meeting services market emerges when examining its multifaceted segmentation landscape. By solution type, organizations choose between audio conferencing delivered over both legacy PSTN lines and modern VoIP networks, video conferencing optimized in high-definition or standard definition, and web conferencing architectures that support both asynchronous collaboration portals and synchronous live interactions. These distinctions inform both feature requirements and integration pathways, as enterprises weigh the trade-offs between fidelity, scalability, and budget constraints.

Turning to deployment mode, the market spans pure cloud offerings, hybrid cloud orchestrations, and on-premises infrastructures. Cloud solutions bifurcate into private and public models to address varying security mandates and latency thresholds, while on-premises implementations differentiate between hosted services managed by third-party operators and self-hosted environments fully controlled by internal IT teams. Such diversity enables organizations to align meeting solutions with their compliance frameworks and network architectures.

Component segmentation further refines the landscape by dividing services-encompassing both managed service engagements that handle day-to-day operations and professional services that guide implementations-and solutions, which span dedicated hardware endpoints and software applications. Additionally, market needs diverge according to organization size: large enterprises frequently prioritize enterprise-grade security, deep analytics, and extensive customization, whereas small and medium enterprises focus on rapid deployment, cost efficiency, and user-friendly interfaces. Meanwhile, end-user industry requirements span banking, capital markets, insurance, higher education, K-12, clinics, hospitals, IT services, telecom operators, and retail, each vertical exhibiting unique preferences around features like encryption, compliance, or interactive learning tools.

This comprehensive research report categorizes the Online Corporate Meeting Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Solution Type

- Component

- Organization Size

- End User Industry

- Deployment Mode

Profiling Key Regional Variations in Adoption Infrastructure and Growth Potential Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a pivotal role in shaping the adoption patterns and feature priorities of online corporate meeting services. In the Americas, established network infrastructure and early cloud adoption have driven enterprises toward integrated platforms that support extensive customization, premium service agreements, and advanced analytics capabilities. Leading organizations leverage these tools to support hybrid work policies, cross-border collaboration, and large-scale virtual events, fueling demand for high reliability and localized support.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and data sovereignty mandates has fostered nuanced deployment strategies. Enterprises in this region often balance the benefits of public cloud agility with private or hybrid architectures to address GDPR, industry-specific compliance, and regional latency considerations. The result is a diversified ecosystem in which cross-border collaboration thrives alongside localized, sovereign cloud initiatives that safeguard sensitive communications.

Asia-Pacific markets continue to register rapid infrastructure investments and rising digital literacy, particularly in emerging economies. Mobile-first conferencing solutions have gained traction with a workforce that relies heavily on smartphones for daily communications, while metropolitan centers drive demand for high-performance, multi-site meeting rooms. This blend of mobile-optimized applications and enterprise-scale deployments underscores the region’s dual focus on accessibility and performance.

This comprehensive research report examines key regions that drive the evolution of the Online Corporate Meeting Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players Their Strategic Initiatives Partnerships and Technological Differentiators Driving Competitive Advantage

Key players in the corporate meeting services arena are constantly refining their value propositions through strategic partnerships, technology integrations, and differentiated feature sets. Zoom has cemented its reputation for ease of use and broad device compatibility, while Microsoft Teams distinguishes itself by embedding meeting capabilities directly within a comprehensive productivity suite that spans collaboration, file sharing, and workflow automation. Cisco continues to emphasize enterprise-grade security and hybrid on-premises/cloud solutions through its portfolio of hardware endpoints and cloud-based services.

Meanwhile, Google Meet integrates naturally with a suite of cloud-native applications and adds value through advanced machine learning features such as automated captioning and noise suppression. Other specialized providers differentiate through audio excellence, with certain platforms offering Dolby-enhanced sound quality and adaptive audio routing to ensure clarity in complex acoustic environments. Service-focused companies are strengthening their offerings with professional services for integration and managed services for ongoing operations, reflecting a shift toward outcome-based engagement models.

Competition has also spurred ecosystem expansions, with vendors forging alliances across telephony providers, security firms, and systems integrators. These collaborative networks aim to streamline implementations, enhance interoperability, and deliver end-to-end support-from network assessments to user training-underscoring the vital role of partnerships in sustaining competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Corporate Meeting Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 8x8, Inc.

- Adobe Inc.

- Amazon.com, Inc.

- Avaya Holdings Corp.

- Cisco Systems, Inc.

- Citrix Systems, Inc.

- Dialpad, Inc.

- Google LLC

- GoTo Group Inc.

- LogMeIn, Inc.

- Microsoft Corporation

- RingCentral, Inc.

- Slack Technologies, LLC

- TeamViewer AG

- UberConference

- Zoom Video Communications, Inc.

Recommending Strategic Actionable Steps for Industry Leaders to Enhance Connectivity Optimize Resources and Secure Sustainable Competitive Growth

Industry leaders looking to thrive in the digital collaboration space should prioritize a blend of security, scalability, and user experience when selecting and deploying meeting services. Investing in platforms that offer robust, end-to-end encryption and granular access controls will safeguard sensitive communications and build organizational trust. To optimize resource utilization, teams should embrace cloud-native architectures with flexible subscription models that adapt as user counts and usage patterns evolve.

Moreover, embedding AI- driven features-such as real-time language translation, intelligent meeting summaries, and automated resource scheduling-can drastically reduce administrative burdens and enhance participant engagement. Supply chain resilience must also be a key consideration; leaders are advised to cultivate relationships with multiple hardware vendors and explore regional assembly options to mitigate impacts from trade policies or logistical disruptions.

Finally, fostering an interoperable ecosystem through open APIs and standardized protocols will enable seamless integration with existing productivity tools, learning management systems, and customer relationship platforms. This approach not only streamlines workflows but also supports continuous innovation, positioning enterprises to capitalize on emerging technologies such as mixed reality and spatial audio as part of a long-term collaboration strategy.

Describing Rigorous Multi Stage Research Methodology Integrating Primary Expert Consultations Secondary Data Analysis and Triangulation Techniques

This research leveraged a multi-stage methodology to ensure rigor, accuracy, and relevance. Initially, an extensive secondary research phase collated insights from industry publications, regulatory filings, and white papers to construct a foundational understanding of market drivers, challenges, and emerging technologies. Subsequently, primary research was conducted through structured interviews with senior executives, IT architects, and end-users across diverse industries, eliciting firsthand perspectives on adoption priorities and implementation experiences.

The data gathered underwent a process of triangulation, cross-validating quantitative findings from surveys with qualitative inputs from expert consultations and case studies. This approach enabled the reconciliation of discrepancies and bolstered confidence in key trend identifications. Moreover, a dedicated advisory panel comprising subject matter experts provided periodic reviews and methodological oversight, ensuring that final conclusions reflect the most current market realities and stakeholder viewpoints.

Finally, advanced analytical tools and frameworks were applied to distill the comprehensive dataset into actionable insights, weaving together segmentation analyses, regional assessments, and strategic implications. This meticulous process underscores the integrity of the report and its capacity to guide informed decision-making in the online corporate meeting services domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Corporate Meeting Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Corporate Meeting Services Market, by Solution Type

- Online Corporate Meeting Services Market, by Component

- Online Corporate Meeting Services Market, by Organization Size

- Online Corporate Meeting Services Market, by End User Industry

- Online Corporate Meeting Services Market, by Deployment Mode

- Online Corporate Meeting Services Market, by Region

- Online Corporate Meeting Services Market, by Group

- Online Corporate Meeting Services Market, by Country

- United States Online Corporate Meeting Services Market

- China Online Corporate Meeting Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2385 ]

Concluding Key Strategic Findings Emphasizing Market Dynamics Technological Drivers and Pathways for Future Innovation in Corporate Meeting Services

The online corporate meeting services market stands at the intersection of technological innovation, shifting work paradigms, and evolving regulatory landscapes. High-definition audio and video capabilities are now complemented by AI-powered enhancements, enabling organizations to foster deeper engagement, streamline communications, and support both synchronous and asynchronous collaboration. Geopolitical factors such as tariff adjustments have prompted strategic supply chain adaptations and renewed emphasis on cost-effective cloud models, highlighting the importance of flexible deployment strategies.

Segmentation insights reveal that solution types, deployment modes, and component categories each cater to distinct organizational priorities, while industry verticals-from finance to education to healthcare-exhibit specialized requirements around security, compliance, and user experience. Regional analyses underscore the diversity of adoption trends, from mature markets in the Americas to burgeoning digital ecosystems in Asia-Pacific and the nuanced regulatory contexts across Europe, the Middle East, and Africa.

In sum, enterprises must navigate a constellation of factors-technological advancements, tariff influences, and localized demands-to select the optimal conferencing solutions for their operational imperatives. By synthesizing these strategic considerations, decision-makers can chart a course toward resilient, future-proof collaboration infrastructures.

Engage with Our Associate Director of Sales Marketing to Secure Your Comprehensive Market Research Report for Informed Strategic Decision Making

To explore the full spectrum of insights and secure a comprehensive deep-dive into the evolving online corporate meeting services market, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. Engage in a personalized consultation to understand how tailored data, strategic analyses, and actionable guidance can inform critical decisions regarding technology investments, go-to-market strategies, and competitive positioning. By partnering with our expert sales team, you can gain early access to exclusive findings on emerging trends, tariff implications, segmentation dynamics, and regional nuances that will shape the future of digital collaboration. Don't miss this opportunity to leverage specialist support in aligning your corporate objectives with data-driven insights, ensuring you stay ahead in a landscape defined by hybrid work, AI innovations, and shifting regulatory frameworks. Reach out today to request your market research report and empower your leadership team with the clarity and confidence needed for decisive action and sustainable growth

- How big is the Online Corporate Meeting Services Market?

- What is the Online Corporate Meeting Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?