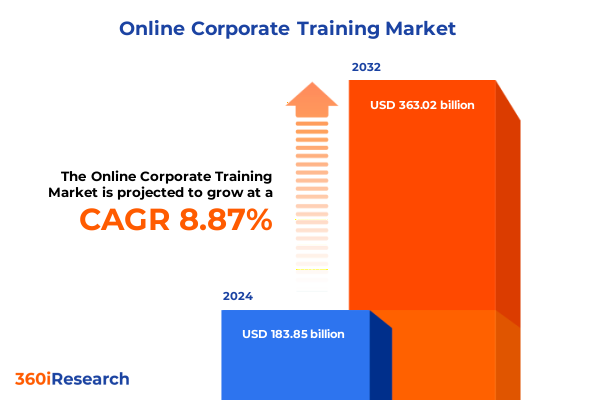

The Online Corporate Training Market size was estimated at USD 198.32 billion in 2025 and expected to reach USD 213.92 billion in 2026, at a CAGR of 9.02% to reach USD 363.02 billion by 2032.

Setting the Stage for Evolving Corporate Learning Landscapes by Unveiling Core Objectives, Strategic Context, and Executive-Level Imperatives to Drive Change

The executive summary serves as a concise yet comprehensive gateway to understanding the evolving corporate training domain, highlighting critical themes and strategic imperatives that resonate at the executive level. It delineates the purpose of the report, situating it within the broader context of rapid digital transformation, workforce volatility, and rising demands for scalable learning solutions. By framing the current business climate, this introduction establishes the importance of proactive learning strategies in driving organizational resilience and sustained competitive advantage.

Within this foundational section, readers will gain clarity on the report’s objectives, scope, and structure. It outlines the primary focus areas-namely the transformative shifts reshaping training delivery, the implications of recent United States tariff policies on training ecosystems, and the insights derived from a rigorous segmentation analysis. Furthermore, the introduction underscores the intended audience of senior decision-makers, learning and development executives, and strategic planners, priming stakeholders for the actionable insights and recommendations that follow.

Exploring the Confluence of Technology Advancements, Workforce Expectations, and Digital Innovation Shaping the Future of Corporate Training Experiences

In recent years, the corporate training landscape has undergone a series of transformative shifts driven by emerging technologies, evolving learner expectations, and the imperative for greater agility in skill acquisition. Digital platforms that integrate artificial intelligence and machine learning have enabled adaptive learning paths, delivering personalized content that aligns with individual strengths, performance gaps, and career aspirations. Mobile accessibility and microlearning modules have further democratized training access, empowering employees to engage with bite-sized content in real time, irrespective of geographic constraints.

Concurrently, immersive technologies such as virtual reality and augmented reality are redefining experiential learning by simulating complex scenarios-ranging from safety protocols to leadership simulations-within controlled environments. Organizations are also pivoting toward competency-based models, emphasizing the mastery of critical capabilities rather than time-bound course completions. As a result, stakeholders are increasingly embedding data analytics and learning experience platforms into their ecosystems to track outcomes, optimize content efficacy, and foster a culture of continuous improvement. These interconnected shifts underscore the pivotal role of innovation in crafting resilient learning architectures for the future.

Assessing the Cumulative Effects of Recent United States Tariff Policies on Training Infrastructure, Technology Costs, and Organizational Learning Ecosystems

The cumulative impact of United States tariff policies introduced in 2025 has reverberated across training infrastructure and technology procurement, prompting organizations to reevaluate sourcing strategies and supply chain dependencies. Tariffs imposed on imported training hardware components-particularly those sourced from key Asian markets-have elevated acquisition costs for interactive devices, virtual reality headsets, and other specialized equipment. As a result, training budgets have been reallocated toward software-based solutions and domestic procurement channels to mitigate cost pressures and minimize lead times.

Moreover, the tariff landscape has accelerated collaborative innovation between training providers and technology vendors to develop cost-effective alternatives and localized production capabilities. Companies have explored modular learning workstations and cloud-native platforms to circumvent hardware constraints, enabling scalable deployment without compromising interactivity or content richness. Simultaneously, policy shifts have underscored the importance of regulatory compliance training, as imported components often fall under evolving trade guidelines. Collectively, these factors have reshaped the investment calculus for corporate learning, driving agile responses to external economic levers.

Unearthing Strategic Segmentation Perspectives on Delivery Methods, Learner Profiles, Content Domains, Course Durations, Organization Size, and Industry Verticals

An in-depth examination of delivery method segmentation reveals a tripartite structure encompassing blended learning environments, where digital modules complement instructor-led sessions; traditional classroom settings led by expert facilitators; and fully self-paced programs that empower learners to navigate training at their own rhythm. Each modality caters to distinct organizational needs, whether fostering peer collaboration in live workshops, ensuring uniformity in compliance instruction, or scaling technical certifications through on-demand portals.

When analyzing training content segmentation, the landscape divides into compliance and regulatory modules, soft skills curricula, and technical upskilling tracks. Compliance offerings encompass health and safety standards alongside industry-specific legislation, ensuring adherence to legal frameworks and risk mitigation protocols. Soft skills initiatives target communication proficiencies and emotional intelligence development, fostering adaptive leadership and team cohesion. Meanwhile, technical skills programs span data analytics fundamentals and programming languages, equipping employees with the proficiencies required for digital transformation endeavors.

Learner type segmentation differentiates entry-level cohorts-focused on foundational soft skills and introductory software training-from mid-level managers engaging in leadership skill enhancement and strategic decision-making workshops. Senior executives access advanced modules centered on innovative thinking and technology adaptation, aligning executive acumen with emerging digital imperatives. These tiers underscore the necessity of role-based customization to optimize training impact across organizational hierarchies.

Evaluation by course duration further distinguishes between long-term programs, culminating in recognized certifications and diplomas, and short-term initiatives, delivered as intensive seminars and interactive workshops. Certification pathways provide depth and formal accreditation, while condensed engagements offer rapid skill infusion and targeted capability reinforcement. Finally, organizational context segmentation recognizes distinctions between large enterprises and small to medium-sized businesses, as well as vertical nuances across finance and banking, healthcare, information technology, manufacturing, and retail sectors. This multidimensional framework enables stakeholders to tailor learning strategies with precision and contextual relevance.

This comprehensive research report categorizes the Online Corporate Training market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Delivery Method

- Training Content

- Learner Type

- Course Duration

- Corporate Size

- Vertical

Revealing Regional Dynamics Influencing Corporate Learning Trends and Adoption Patterns Across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a pivotal role in shaping corporate learning adoption and modality preferences. In the Americas, strong investment in digital learning infrastructures and a mature ecosystem of online platforms have driven rapid uptake of blended solutions that blend virtual classrooms with on-demand libraries. Organizations in North America, in particular, leverage advanced analytics and integrated learning experience platforms to continuously refine curriculum effectiveness and measure return on learning investment, while Latin American markets are increasingly embracing mobile-first delivery to overcome connectivity constraints.

In Europe, the Middle East, and Africa, the learning landscape is characterized by a diverse tapestry of regulatory environments, leading to robust compliance training frameworks in sectors such as financial services and manufacturing. European Union directives on data protection and workplace safety have catalyzed region-wide standardization of training requirements, while Middle Eastern organizations prioritize leadership development to support ambitious economic diversification goals. Across sub-Saharan Africa, digital initiatives are gradually expanding access to self-paced training, enabling skills enhancement despite infrastructure limitations.

The Asia-Pacific region exhibits a dual trajectory: advanced markets like Japan, Australia, and South Korea champion immersive learning technologies to future-proof talent pipelines, whereas emerging economies in Southeast Asia and India are rapidly scaling low-cost, self-paced platforms to address skill gaps in high-growth sectors. Cultural preferences for instructor-led and cohort-based learning coexist with digital innovation, fostering hybrid models that blend the best of both approaches. These nuanced regional insights inform targeted strategies for market entry, content localization, and partnership development.

This comprehensive research report examines key regions that drive the evolution of the Online Corporate Training market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies, Innovative Offerings, and Collaborative Partnerships Among Leading Corporate Training Providers Shaping Industry Evolution

Leading corporate training providers are differentiating through a combination of platform innovation, expansive content libraries, and strategic partnerships. Global digital learning platforms have embedded AI-driven recommendation engines that dynamically curate modules based on user performance and organizational objectives. These systems also integrate with talent management suites, enabling seamless credentialing and career path alignment. Meanwhile, specialized vendors are enhancing their offerings with immersive technologies, launching virtual reality modules for soft skills simulations and technical upskilling scenarios.

Collaborations between training firms and academic institutions have given rise to co-branded certifications, adding credibility through recognized accreditation while addressing niche compliance requirements. Several providers have also established partner ecosystems, working with global consultancies to deliver end-to-end talent solutions that encompass diagnostic assessments, curriculum design, and impact measurement. In parallel, a subset of nimble entrants focuses on microlearning stacks tailored to specific industries, delivering rapid-deployment seminars and workshops that respond to regulatory updates or technological disruptions. This mosaic of competitive strategies underscores the importance of agility, content depth, and ecosystem integration in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Corporate Training market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allen Communications Learning Services

- Business Training Library, LLC

- City & Guilds Group

- Coggno Inc.

- Coursera Inc.

- D2L Corporation

- Disprz.

- Docebo S.p.A.

- Education Nest

- Franklin Covey Co.

- Go Sharp Technology & Consulting Pvt. Ltd.

- GP Strategies Corporation

- Harvard Business School Online

- Kitaboo

- Oracle Corporation

- Protouchpro Services Private Limited

- Simplilearn Solutions

- skillbetter.ai

- Skillsoft

- TRAININGFOLKS

- Udemy, Inc.

Empowering Industry Leaders with Actionable Strategies to Enhance Learning Effectiveness, Drive Engagement, and Build Future-Ready Workforce Capabilities

To effectively navigate the evolving corporate training terrain, industry leaders should embrace a tiered delivery architecture that balances live facilitator engagement with interactive digital modules. By weaving instructor-led and self-paced components into cohesive learning journeys, organizations can accommodate diverse learner preferences and reinforce knowledge retention through multimodal reinforcement. In parallel, integrating advanced analytics and learner experience metrics into program design will illuminate performance trends and guide continuous optimization of curriculum content.

Strategic investment in immersive learning technologies can elevate experiential skill development, particularly for leadership simulations and complex technical scenarios. However, to ensure broad accessibility, pilot implementations within critical business units should precede enterprise-wide rollouts, allowing for iterative refinement and user feedback incorporation. Furthermore, aligning training initiatives with enterprise talent and succession planning frameworks will reinforce strategic coherence and maximize retention of newly acquired capabilities.

Leaders should also prioritize content localization and cultural adaptation to resonate with global workforces, tailoring compliance modules to regional regulatory nuances and embedding culturally relevant case studies. Partnerships with specialized providers and academic institutions can bolster content credibility and expedite curriculum updates in response to emerging trends. Finally, fostering a learning culture that incentivizes peer coaching, knowledge sharing, and recognition of skill achievements will drive engagement, reinforce accountability, and sustain momentum toward long-term organizational agility.

Detailing a Robust Hybrid Research Framework Integrating Primary Stakeholder Engagement and Secondary Data Analysis to Deliver In-Depth Market Insights

This research employed a robust hybrid framework combining qualitative and quantitative approaches to ensure depth and validity of insights. Primary data collection encompassed in-depth interviews with senior learning and development executives, training directors, and technology managers across diverse industries, supplemented by structured surveys targeting end users and key stakeholders to capture preferences and pain points. This direct engagement provided nuanced perspectives on modality adoption, content efficacy, and organizational readiness.

Secondary analysis leveraged authoritative whitepapers, industry association reports, and peer-reviewed publications to contextualize primary findings within broader macroeconomic and policy environments. Desk research on tariff regulations, technology trends, and regional market dynamics enriched the narrative, while cross-validation against public filings and corporate disclosures enhanced reliability. Data triangulation processes ensured consistency across sources, fostering a cohesive understanding of the corporate training ecosystem and enabling actionable recommendations grounded in both empirical evidence and expert opinion.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Corporate Training market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Corporate Training Market, by Delivery Method

- Online Corporate Training Market, by Training Content

- Online Corporate Training Market, by Learner Type

- Online Corporate Training Market, by Course Duration

- Online Corporate Training Market, by Corporate Size

- Online Corporate Training Market, by Vertical

- Online Corporate Training Market, by Region

- Online Corporate Training Market, by Group

- Online Corporate Training Market, by Country

- United States Online Corporate Training Market

- China Online Corporate Training Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Concluding Insights on Strategic Imperatives and Future Pathways for Corporate Learning Leaders to Capitalize on Emerging Opportunities in Dynamic Market Contexts

In conclusion, the corporate training landscape is undergoing rapid evolution, driven by technological innovation, shifting workforce expectations, and regulatory imperatives. Organizations that anticipate these trends-by embracing adaptive learning platforms, integrating immersive modalities, and proactively managing cost implications related to supply chain and tariff changes-will position themselves to secure a strategic advantage. The segmentation insights highlight the importance of tailoring delivery methods, content domains, learner focus, and program durations to specific organizational and vertical contexts.

Regional nuances underscore the need for localized approaches that respect regulatory requirements and cultural preferences, while competitive analysis reveals the value of ecosystem partnerships and continuous innovation. By synthesizing these insights, leaders can craft comprehensive learning strategies that not only address immediate capability gaps but also foster a resilient culture of continuous development. Ultimately, this report equips decision-makers with a cohesive blueprint for driving impactful, future-oriented learning initiatives across global operations.

Engage with Ketan Rohom to Unlock Exclusive Access to Comprehensive Corporate Training Market Research and Drive Data-Driven Learning Strategies

For organizations seeking unparalleled clarity and actionable intelligence in corporate training, engaging with Ketan Rohom as your primary strategic partner will catalyze the transformation of your learning ecosystem and accelerate strategic decision-making in dynamic environments.

As the Associate Director of Sales & Marketing, Ketan Rohom possesses deep domain expertise and a proven track record in aligning market research insights to client objectives, ensuring you derive maximum value from the comprehensive corporate training report. Reach out to Ketan to secure your copy, unlock bespoke consultations, and harness evidence-based strategies that will propel your talent development initiatives to new heights.

- How big is the Online Corporate Training Market?

- What is the Online Corporate Training Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?