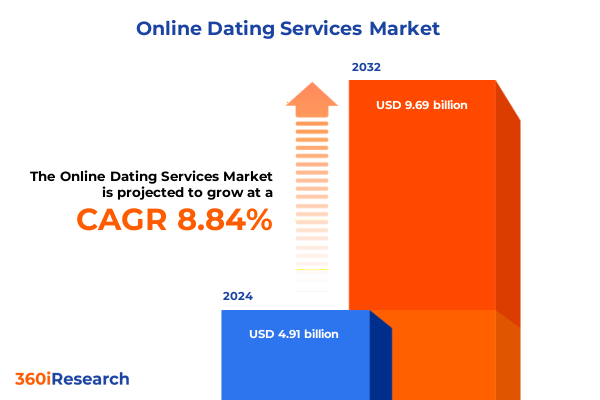

The Online Dating Services Market size was estimated at USD 5.34 billion in 2025 and expected to reach USD 5.81 billion in 2026, at a CAGR of 8.86% to reach USD 9.69 billion by 2032.

Understanding the Rapid Ascent and Evolving Dynamics of Online Dating Services in an Increasingly Connected Digital Ecosystem

The world of personal connection has undergone an unprecedented evolution, propelled by digital platforms that bridge geographical divides and reshape social dynamics in real time. Today’s online dating environment extends far beyond simple profile swipe mechanics, encompassing a rich ecosystem where matchmaking algorithms, multimedia communication channels, and community-driven features converge. This introduction unpacks how the fusion of ubiquitous mobile devices, shifting social mores, and sophisticated data analytics has catalyzed extraordinary adoption of digital courtship.

As social connectivity became ever more integral to modern life, individuals embraced online dating as a mainstream avenue to find companionship, companionship rooted in shared interests and values rather than chance encounters. Concurrently, rapid smartphone penetration democratized access to these platforms, ensuring that millions could engage with tailored experiences at any hour. Consequently, the industry has witnessed a transition from novelty to necessity, with users expecting seamless interfaces, robust privacy protections, and increasingly accurate matching mechanisms.

Looking ahead, sustained momentum is anticipated as new technologies-ranging from augmented reality-based dating events to AI-driven compatibility scoring-continue to refine user experiences. This introduction serves as the foundation for understanding how consumer behavior, technological innovation, and economic forces have collectively converged to define the modern online dating landscape and why a comprehensive strategic outlook is critical for stakeholders navigating this dynamic market.

Exploring the Pivotal Technological Innovations and Consumer Behavior Shifts Redefining the Online Dating Landscape

Technological breakthroughs and cultural shifts are actively reconfiguring how users engage with dating platforms, ushering in a series of transformative trends that extend well beyond mere profile matching. First, artificial intelligence has progressed from rudimentary recommendation engines to sophisticated compatibility assessments that analyze behavioral patterns, conversational nuances, and preference dynamics to curate high-probability connections. This advancement has raised user expectations for precision and personalization, effectively setting new benchmarks for service providers.

Simultaneously, the proliferation of immersive interactivity is altering user engagement paradigms. Video-based icebreaker features, real-time live-streamed social events, and gamified experiences have injected richer layers of communication and authenticity, countering the impersonality that once plagued virtual romance. These developments are reinforced by the growing emphasis on community-driven forums and in-app interest groups, which foster niche networks where users with specialized affinities-such as outdoor enthusiasts, creative professionals, and multicultural food aficionados-can interact in meaningful ways.

Furthermore, heightened regulatory scrutiny around data privacy and algorithmic transparency has compelled platforms to prioritize trust-building measures, including user-controlled data sharing, real-time consent mechanisms, and third-party audit protocols. In tandem, social media integration techniques now allow for seamless content sharing and cross-platform identity verification, streamlining sign-up processes while bolstering credibility. Altogether, these interwoven innovations and consumer-driven expectations are rapidly redefining competitive success criteria for online dating services.

Analyzing the Comprehensive Effects of 2025 United States Tariff Measures on Operational Costs and Service Delivery in Online Dating

In 2025, a suite of new tariff enactments by the United States government has exerted a multifaceted impact on the operational and financial frameworks underpinning online dating platforms. Measures targeting imported electronic devices, including smartphones and data center hardware, have influenced hardware acquisition costs for both consumers and service operators. As a result, margins on premium subscription tiers and in-app purchase revenues have experienced compression, prompting providers to revisit pricing structures and value propositions to safeguard adoption and retention.

Moreover, tariffs affecting software licensing and cloud-based infrastructure imports have indirectly shaped vendor negotiations, driving some platforms to explore localized data hosting solutions and domestic sourcing partnerships. This pivot has introduced both logistical challenges and long-term resilience opportunities, as providers balance tariff-induced cost volatility against the benefits of enhanced data sovereignty and faster service delivery. Consequently, some operators are reallocating budgets from global content marketing initiatives to technical infrastructure investments, ensuring uninterrupted platform performance and compliance with shifting trade regulations.

Despite these headwinds, innovative cost-mitigation strategies have emerged. Strategic bundling of subscription packages with partner brands, dynamic discounting mechanisms tied to user engagement milestones, and the integration of advertising-supported tiers have provided alternative revenue streams to counterbalance tariff-driven expenses. Ultimately, the cumulative impact of 2025 tariff policies underscores the imperative for agile supply chain management and proactive financial planning to maintain competitive positioning in an increasingly cost-sensitive environment.

Unveiling Critical Market Segmentation Insights Across Revenue Models Application Types Age Groups Gender Targets and Payment Channels

A nuanced understanding of market segmentation reveals the intricate architecture of the online dating sector, providing a roadmap to address diverse consumer preferences and monetization strategies. From a revenue perspective, platforms range from advertising-supported models to freemium entry points, one-time fee access, and multi-tiered subscriptions that span monthly, quarterly, and yearly commitments. Each approach carries distinct implications for lifetime value and churn management, necessitating tailored engagement tactics that align with user willingness to pay and feature expectations.

Turning to application types, the market encompasses hybrid solutions that blend web-based interfaces with dedicated mobile experiences, as well as standalone mobile and web platforms. Within mobile, the Android ecosystem and iOS environments command separate optimization priorities, reflecting differences in operating system capabilities, demographic usage patterns, and in-app monetization channels. By addressing platform-specific user flows and technical constraints, providers can deliver frictionless experiences that drive deeper engagement and higher conversion rates.

Demographic segmentation further enriches strategic focus through granular age group analysis. Platforms tailor communication styles and feature sets for emerging adults aged 18 to 24-subdivided into 18 to 20 and 21 to 24 cohorts-and prime adult users aged 25 to 34, which themselves bifurcate into 25 to 29 and 30 to 34 segments. Older demographics, including those aged 35 to 44 and 45 and above, often seek mature and purposeful match options, prompting differentiated marketing narratives and feature prioritization.

Gender targeting strategies introduce additional layers of refinement, spanning general audience services, inclusive offerings for the LGBTQ community-such as those designed for bisexual users, gay men, lesbian women, and transgender individuals-and niche gender-specific experiences that cater to specialized user needs. Finally, payment channels influence friction levels and global reach, as credit card processing, digital wallets like Alipay and PayPal, and in-app purchases through the Apple App Store and Google Play present diverse transaction ecosystems. By synthesizing these segmentation dimensions, industry participants can unlock deeper personalization and stronger revenue diversification.

This comprehensive research report categorizes the Online Dating Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Revenue Model

- Age Group

- Gender Targeting

- Payment Channel

- Application Type

Highlighting Distinctive Regional Patterns and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific Online Dating Markets

Geographic variations in user adoption, cultural preferences, and regulatory landscapes have created distinct regional profiles within the broader online dating industry. In the Americas, a high degree of smartphone penetration and evolving social attitudes toward nontraditional relationship formation have fueled sustained platform growth. Users in North and South America demonstrate a willingness to invest in premium subscription features and specialized matchmaker services, while the maturity of digital payment ecosystems supports seamless transactional experiences.

Meanwhile, the Europe, Middle East & Africa region exhibits remarkable heterogeneity. Western European markets, characterized by robust consumer privacy expectations and advanced mobile infrastructures, show strong demand for privacy-first matchmaking solutions and sophisticated algorithmic matching. In contrast, emerging markets within Eastern Europe, the Middle East, and Africa present fertile ground for freemium and advertising-supported models, where cost-sensitive cohorts balance functionality with affordability. Language diversity and varying cultural norms necessitate platform localization, impacting user interface design and community guidelines.

Across the Asia-Pacific landscape, rapid digitization and the rising influence of social commerce have given birth to unique cross-industry integrations, such as e-commerce-enabled dating experiences and live-streaming social events embedded within dating apps. Local players often leverage homegrown payment gateways and regional social networks to create immersive, socially attuned environments. As such, tailored marketing campaigns and culturally resonant features are critical to capturing share in one of the world’s most dynamic online dating arenas.

This comprehensive research report examines key regions that drive the evolution of the Online Dating Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Key Industry Players and Strategic Movements Shaping Competitive Dynamics in the Global Online Dating Services Arena

A diverse constellation of established and emerging companies is shaping the competitive contours of the global online dating sphere. Legacy players with decades of experience continue to leverage brand recognition and expansive user databases, while agile newcomers capitalize on narrow niches and cutting-edge technologies. Key incumbents maintain leading positions by continuously refining matchmaking algorithms and investing in ancillary features such as live-streaming events and AI-led conversation prompts.

At the same time, challenger brands are rapidly gaining traction by focusing on underserved audiences and innovative monetization strategies. Some firms specialize in community-driven dating experiences that unite users around shared interests like wellness, environmental advocacy, or content creation. Others differentiate through robust privacy controls, offering ephemeral chat features and encrypted messaging to address growing user concerns about data security. Strategic alliances between established platforms and fintech companies are also emerging as a potent tactic to streamline payments, loyalty programs, and rewards-based referral systems.

Across the ecosystem, mergers and acquisitions continue to realign market power, as leading conglomerates acquire specialty apps to broaden their service portfolios. Conversely, venture-backed startups are securing growth capital to expand into new regions or integrate advanced artificial intelligence capabilities. Collectively, these competitive maneuvers underscore the necessity for continuous innovation and strategic agility in a market defined by rapid technological advancement and evolving consumer expectations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Dating Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Badoo Trading Limited

- Blue Label Life

- Bumble Inc.

- Coffee Meets Bagel, Inc.

- Dating.com Group Limited

- eHarmony, LLC

- Grindr, LLC

- Happn

- Hello Group Inc

- HER Inc.

- Hily Corporation

- Joyride GmbH

- Match Group, Inc.

- Matrimony.com Limited

- MUZZ LTD

- ProSiebenSat.1 Media SE

- Spark Networks GmbH

- The Inner Circle

- The Meet Group, Inc.

- Zoosk, Inc.

Presenting Actionable Strategic Recommendations for Industry Stakeholders to Capitalize on Emerging Opportunities and Mitigate Risks Effectively

To thrive in this competitive landscape, industry leaders must embrace a forward-looking strategic framework that marries innovation with operational resilience. Prioritizing investments in artificial intelligence and machine learning capabilities will not only enhance the precision of match recommendations but also streamline content moderation and fraud detection processes, mitigating reputational risks. Equally important is the development of immersive multimedia features, such as augmented reality dating events and interactive storytelling modules, which foster genuine connection and discourage superficial engagements.

Simultaneously, companies should diversify revenue streams by layering advertising-supported tiers atop traditional subscription models and exploring partnerships with adjacent lifestyle brands to create co-branded experiences. This approach not only alleviates dependency on a single monetization channel but also enriches user value propositions through exclusive perks and loyalty incentives. Furthermore, strategic localization-encompassing language customization, culturally relevant content, and region-specific payment integrations-remains essential for capturing growth opportunities in fragmented markets.

Finally, robust supply chain and tariff management protocols can shield providers from unforeseen cost disruptions. By fostering partnerships with domestic hardware vendors and adopting granular dynamic pricing strategies, organizations can preserve margin integrity while continuing to offer competitive pricing. Collectively, these actionable recommendations equip industry stakeholders with the agility to anticipate emerging trends, safeguard profitability, and deliver unparalleled online dating experiences to an increasingly discerning global audience.

Detailing the Rigorous Research Methodology Employed to Ensure Validity Reliability and Comprehensive Analysis of the Online Dating Services Market

This analysis is underpinned by a rigorous combination of primary and secondary research methodologies designed to maximize data validity and reliability. Primary research involved in-depth interviews with senior executives, product managers, and marketing leads across established and emerging online dating platforms, complemented by targeted user surveys across multiple demographic cohorts to capture sentiment, usage patterns, and willingness-to-pay preferences.

Secondary research entailed a comprehensive review of regulatory filings, corporate annual reports, stakeholder presentations, and industry whitepapers. Proprietary databases tracking app store analytics, cloud infrastructure usage trends, and payment channel performance provided quantitative benchmarks, while third-party consumer research reports enriched contextual understanding of evolving social behaviors. Analytical techniques such as triangulation and cross-validation were employed to reconcile disparate data sources, ensuring consistency and accuracy.

To further strengthen insights, a blend of top-down and bottom-up approaches was utilized for synthesizing thematic findings, while scenario-planning exercises illuminated potential future developments related to technology adoption, regulatory changes, and economic shifts. Throughout the research process, strict adherence to ethical standards and data privacy regulations was maintained, ensuring that all data collection and analysis protocols were both compliant and transparent.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Dating Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Dating Services Market, by Revenue Model

- Online Dating Services Market, by Age Group

- Online Dating Services Market, by Gender Targeting

- Online Dating Services Market, by Payment Channel

- Online Dating Services Market, by Application Type

- Online Dating Services Market, by Region

- Online Dating Services Market, by Group

- Online Dating Services Market, by Country

- United States Online Dating Services Market

- China Online Dating Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2067 ]

Drawing Cohesive Conclusions That Synthesize Market Trends Competitive Insights and Strategic Imperatives for Online Dating Service Providers

The synthesis of our findings underscores a market poised for continued transformation, driven by technological innovation, evolving social dynamics, and macroeconomic forces. Precision-driven matchmaking algorithms and immersive communication features stand as the new hallmarks of differentiation, compelling providers to transcend basic functionality in favor of deeply personalized experiences. At the same time, cost pressures-amplified by recent tariff measures-highlight the critical importance of agile financial planning and diversified revenue approaches.

Key segmentation insights reveal that success hinges on the ability to tailor offerings across multiple dimensions, from subscription cadence and platform type to nuanced demographic targets and transaction mechanisms. Regional analysis further emphasizes that a one-size-fits-all strategy is untenable in an industry where cultural sensitivity and localized feature sets drive user adoption. Moreover, the interplay between established industry leaders and nimble newcomers suggests that competitive advantage will increasingly accrue to organizations that can rapidly iterate, integrate emerging technologies, and anticipate regulatory shifts.

Ultimately, decision-makers must balance the imperatives of innovation, operational resilience, and strategic focus. By leveraging deep market intelligence and adhering to a disciplined approach to product development and pricing, online dating service providers can navigate the complex interplay of consumer expectations and external constraints. This conclusion reaffirms the transformative potential of digital romance and the strategic imperatives that will define leadership in the years to come.

Encouraging Engagement with Ketan Rohom to Secure Comprehensive Market Intelligence and Enhance Strategic Decision Making for Online Dating Investments

To explore the full depth of this expansive market analysis and gain tailored strategic insights, reach out to Ketan Rohom, the Associate Director of Sales & Marketing, who will guide you through the report’s most impactful findings and help you integrate this intelligence into your organization’s strategic roadmap.

By engaging with sector specialists, leadership teams will not only secure access to unparalleled market data but also benefit from personalized consultations designed to amplify your competitive positioning in the rapidly evolving world of online dating services.

- How big is the Online Dating Services Market?

- What is the Online Dating Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?