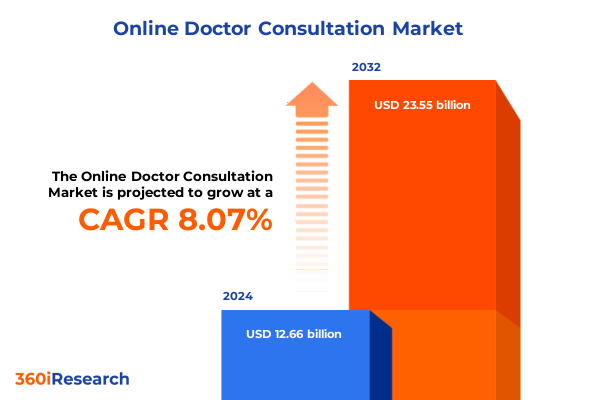

The Online Doctor Consultation Market size was estimated at USD 7.85 billion in 2024 and expected to reach USD 8.52 billion in 2025, at a CAGR of 8.76% to reach USD 15.39 billion by 2032.

Exploring the Evolution of Virtual Healthcare Access and Its Role in Shaping Patient-Centered Care through Digital Doctor Consultations

Online doctor consultation has evolved from a niche convenience offering to an integral pillar of modern healthcare delivery, reshaping how patients and providers interact. Fueled by widespread mobile device ownership and robust internet infrastructure, digital platforms now enable seamless access to general practitioners, mental health professionals, and specialists without requiring in-person visits. In parallel, consumer expectations for on-demand, personalized care continue to rise, prompting healthcare organizations to rethink traditional delivery models and integrate remote consultation capabilities across their services.

As virtual care gains traction, regulatory bodies have adapted to encourage broader adoption by updating licensure guidelines and reimbursement policies. This shift is underscored by greater provider acceptance, driven by proven improvements in patient satisfaction and reduced overhead costs. Moreover, the integration of data analytics and secure digital records ensures continuity of care across channels, bridging the gap between telemedicine and in-clinic visits. Together, these developments mark a new era of patient-centered care defined by flexibility, speed, and resilience in the face of evolving public health needs.

Uncovering Key Technological, Regulatory, and Behavioral Transformations Driving the Rapid Adoption of Online Doctor Consultation Services

The online doctor consultation landscape has been transformed by converging technological, regulatory, and consumer behavioral shifts that together accelerate adoption. Cutting-edge artificial intelligence and machine learning tools now support automated triage and symptom analysis, empowering patients to receive preliminary guidance instantaneously. Simultaneously, wearable devices and remote monitoring systems feed real-time biometric data into virtual consults, enhancing diagnostic accuracy and enabling proactive care management. These innovations are complemented by improved interoperability standards, which streamline data exchange between digital platforms and electronic health record systems.

On the policy front, governments around the world have revised telehealth regulations to reduce cross-state licensure barriers and expand reimbursement parity for virtual visits. This regulatory momentum has emboldened providers to invest in telemedicine infrastructure and fostered partnerships between healthcare networks and technology vendors. Meanwhile, consumers have developed greater trust in digital modalities; many now view virtual consultations as equivalent to in-person visits for routine care and mental health support. As a result, healthcare decision-makers are increasingly prioritizing digital channels within their strategic roadmaps, recognizing that agility and scalability in service delivery are paramount in a rapidly evolving healthcare ecosystem.

Analyzing the Far-Reaching Consequences of United States 2025 Tariffs on Online Healthcare Platforms and Global Digital Health Supply Chains

The implementation of targeted tariffs by the United States in 2025 has introduced a range of secondary effects on the procurement of medical devices and hardware integral to telehealth solutions. Equipment suppliers faced higher import costs on certain diagnostic tools and video conferencing peripherals, prompting service providers to reevaluate sourcing strategies. In response, some vendors have accelerated domestic manufacturing partnerships, while others have sought alternative low-tariff jurisdictions to maintain equipment affordability without compromising functionality.

Beyond hardware, the broader digital health supply chain has experienced ripple effects, as delays at key logistical nodes increased lead times for new equipment roll-outs. Providers have adjusted by extending depreciation schedules and incorporating nearshoring practices to reduce exposure to tariff volatility. At the same time, software-centric aspects of telemedicine-such as virtual platform subscriptions and cloud-based data storage-remain comparatively insulated from tariff pressures. This dichotomy underscores the importance of a diversified procurement approach, balancing in-house development with strategic vendor alliances to sustain cost efficiency and service quality.

Deriving Actionable Segmentation Insights from Service Type, Consultation Mode, Device Preference, and End User Profiles in Telehealth

Deep analysis of service type segmentation reveals that general consultation, encompassing both illness-focused visits and routine wellness checkups, continues to serve as the entry point for many patients new to telehealth, delivering broad appeal through convenient scheduling and flexible follow-up options. Mental health consultation has emerged as another growth driver, with counseling, psychiatry, and psychology services experiencing robust uptake as destigmatization efforts and digital anonymity reduce barriers to care. Within specialist consultation, cardiology, dermatology, and neurology offerings have expanded as remote diagnostic tools and home-based monitoring devices have achieved clinical validation, enabling more complex case management at a distance.

Exploring consultation mode segmentation highlights the rise of asynchronous chat as a complementary channel, allowing patients to submit symptoms and medical histories at their convenience while providers respond within defined timeframes. Live chat maintains its role in rapid triage scenarios, whereas phone consultation-via callback services and traditional voice calls-remains vital for populations with limited bandwidth or smartphone access. Video consultation has solidified its position as the preferred medium for clinical assessments, with live video sessions facilitating real-time interaction and on-demand video offerings catering to urgent, nonemergent care needs.

Device preference data underscores the ubiquity of smartphones across service usage, led by Android and iOS platforms for both video and chat engagements, while desktops running macOS or Windows remain important in workplace or campus environments. Tablet consultations, through both Android tablets and iOS tablets, have seen moderate adoption among older patient segments seeking larger screens without the complexity of desktop setups. These device trends emphasize the necessity for platform developers to deliver consistent, responsive experiences across operating systems and form factors.

Finally, end user segmentation paints a picture of diverse customer archetypes: enterprises are investing in corporate wellness initiatives and forging partnerships with insurance companies to integrate telehealth into benefits programs; hospitals and clinics, whether private outpatient centers or public health networks, leverage digital consults to optimize patient throughput and reduce ED congestion; and individual patients, spanning adult populations as well as pediatric guardians, seek direct-to-consumer platforms that deliver both episodic and chronic care management through user-friendly interfaces.

This comprehensive research report categorizes the Online Doctor Consultation market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Consultation Modality

- Platform Type

- Payment Model

- Channel Type

- End User

Highlighting Distinctive Regional Dynamics across Americas, Europe Middle East Africa, and Asia Pacific in the Online Doctor Consultation Market

Regional dynamics play a pivotal role in defining the traction and deployment strategies for online doctor consultation platforms. In the Americas, strong patient awareness and favorable insurance frameworks in the United States have driven hybrid care models, combining in-clinic visits with telemedicine follow-ups. Canada’s single-payer system has approached virtual care more conservatively, prioritizing pilot programs at provincial levels while managing regulatory oversight to ensure equitable access.

Within Europe, Middle East, and Africa, market heterogeneity is pronounced. Western European countries with established digital health infrastructures have expanded reimbursement schemes to include telepsychiatry and remote monitoring, whereas Eastern European markets adopt digital platforms at a more measured pace, constrained by budgetary allocations and legacy health IT systems. In the Middle East, rapid digital transformation initiatives have integrated virtual consultations into national health agendas, particularly in the Gulf Cooperation Council region, while African nations focus on leveraging mobile-based consultation to address physician shortages and rural access challenges.

Asia-Pacific presents a dynamic landscape characterized by high smartphone penetration and tech-savvy populations. In China and India, leading telehealth companies have harnessed artificial intelligence to manage volumes at scale, partnering with local hospitals to digitalize outpatient services. Meanwhile, mature markets like Australia and Japan emphasize data privacy and interoperability standards in their telemedicine regulations, ensuring that growth aligns with patient safety and quality benchmarks. Together, these regional insights illuminate the need for nuanced market entry and scaling strategies tailored to distinct healthcare ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Online Doctor Consultation market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Innovations of Leading Telemedicine Providers Shaping Market Direction and Differentiation in Virtual Care

Leading telemedicine providers have pursued a range of competitive strategies to differentiate their offerings and capture market share. One prominent player has integrated AI-driven triage within its platform, reducing clinician workload by automating initial symptom assessments and routing cases to the appropriate specialist. Another has formed strategic alliances with national insurance schemes to secure preferred provider status, bundling teleconsultations with wellness and chronic disease management programs.

Technology-driven startups have carved niches by focusing on specific specialties such as dermatology or mental health, employing proprietary imaging algorithms and secure video encryption to streamline referral processes. At the same time, established healthcare networks have accelerated acquisitions of digital platforms, leveraging their extensive provider networks to broaden service availability. Across the board, investments in user experience design, multilingual support, and 24/7 coverage capabilities underscore a collective shift toward more immersive, patient-centric engagements.

Innovation is further evidenced by partnerships between telehealth platforms and consumer electronics companies, delivering co-branded remote monitoring kits that sync seamlessly with video call software. This integration of hardware and software ecosystems has elevated expectations for end-to-end care continuity, positioning these companies at the forefront of virtual care transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Doctor Consultation market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 1mg by Tata Digital

- American Well Corporation

- Apollo Hospitals Enterprise Limited

- Dialogue Health Technologies Inc.

- DocGenie

- Doctolib

- Doctor On Demand by Included Health, Inc.

- Doktorse Nordic AB

- GoodRx Holdings, Inc.

- HealthTap, Inc.

- K Health, Inc.

- Kry International AB

- Lemonaid Health, Inc.

- LiveHealth Online

- Lybrate India Private Limited by GHV Advanced Care Private Limited

- Maple Corporation

- MDLIVE by Evernorth Group, LLC

- Medifyhome Health Solutions Private Limited

- Medintu Healthtech Private Limited

- MFine by Novocura Tech Health Services Private Limited

- PlushCare, Inc.

- Practo Technologies Private Limited

- Push Doctor Limited

- Sesame Care, Inc.

- Teladoc Health, Inc.

- TytoCare Ltd.

- Virtuwell

- WebDoctors LLC

- Zocdoc, Inc

Empowering Industry Leaders with Practical Strategies to Enhance Service Delivery, Optimize Operations, and Capitalize on Emerging Telehealth Opportunities

Industry leaders should prioritize the integration of advanced triage engines into their platforms, ensuring that patient inquiries are accurately categorized and directed to the right provider swiftly. By embedding symptom-checking algorithms and decision-support tools, organizations can optimize clinician utilization and strengthen patient trust through consistent, transparent care pathways. Beyond technology, refining data security measures in compliance with HIPAA and international privacy standards will reinforce stakeholder confidence and mitigate the risks associated with sensitive health information exchange.

To capitalize on evolving consumer preferences, executives should expand their service portfolios to include a balanced mix of asynchronous chat, live phone callbacks, and video-based consultations. Such multimodal engagement strategies accommodate diverse patient needs, from quick follow-ups to in-depth cognitive behavioral therapy sessions. Furthermore, partner ecosystems-comprising employer groups, insurance carriers, and community health centers-should be cultivated to broaden market reach and create integrated care journeys that drive retention and clinical adherence.

In light of recent tariff-driven supply chain shifts, procurement teams should diversify hardware sourcing by establishing regional assembly capabilities and negotiating long-term agreements with multiple vendors. Concurrently, investing in nearshore software development and local data center capacity can shield operations from cross-border logistical disruptions. By coupling these initiatives with data-driven performance monitoring and agile process frameworks, leaders will position their organizations to scale rapidly while maintaining service excellence.

Detailing a Robust Mixed-Method Research Framework Integrating Qualitative Insights and Quantitative Analysis for Telemedicine Market Understanding

This research adopts a mixed-method approach that combines qualitative and quantitative techniques to ensure comprehensive market understanding. Primary research involved in-depth interviews with C-level executives, clinical directors, and frontline providers to capture experiential insights on platform adoption, user satisfaction, and operational challenges. Simultaneously, patient surveys were conducted across demographic cohorts to quantify preferences and identify barriers to entry, providing a granular view of demand dynamics.

Secondary research complemented these efforts through systematic review of peer-reviewed journals, industry white papers, and regulatory filings, enabling validation of emerging trends and cross-referencing of competitive initiatives. Quantitative data analysis leveraged platform usage logs and anonymized billing records to map service utilization patterns, while thematic coding of interview transcripts revealed strategic priorities and pain points. Together, these methods deliver actionable intelligence that blends statistical rigor with real-world practitioner perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Doctor Consultation market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Doctor Consultation Market, by Service Type

- Online Doctor Consultation Market, by Consultation Modality

- Online Doctor Consultation Market, by Platform Type

- Online Doctor Consultation Market, by Payment Model

- Online Doctor Consultation Market, by Channel Type

- Online Doctor Consultation Market, by End User

- Online Doctor Consultation Market, by Region

- Online Doctor Consultation Market, by Group

- Online Doctor Consultation Market, by Country

- United States Online Doctor Consultation Market

- China Online Doctor Consultation Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Critical Insights on the Future Trajectory of Online Doctor Consultations within a Rapidly Evolving Healthcare Ecosystem

In conclusion, the online doctor consultation sector stands at the intersection of technological innovation, regulatory evolution, and shifting consumer behaviors. The confluence of AI-enabled triage, multichannel engagement modes, and device-agnostic design has created a versatile model capable of addressing routine and specialized care remotely. At the same time, the cumulative effects of policy shifts-including the United States’ 2025 tariffs-underscore the need for adaptive procurement strategies and resilient supply chains.

Strategic segmentation across service types, consultation modes, devices, and end users reveals diverse opportunities for tailored value propositions. Regional nuances further demand localized go-to-market approaches. By leveraging the strategic insights and actionable recommendations presented here, industry stakeholders can navigate this complex landscape with clarity, ensuring sustainable growth and enhanced patient outcomes in the rapidly evolving telehealth ecosystem.

Encouraging Stakeholders to Engage with Ketan Rohom for Tailored Market Intelligence That Propels Strategic Decision-Making in Telehealth

If you are ready to gain unparalleled market intelligence that addresses your specific business challenges and accelerates your telehealth growth roadmap, reach out to Ketan Rohom, who brings advanced expertise in sales and marketing for digital health research. By partnering with him, you will receive a tailored approach that aligns with your organization’s objectives, whether you’re seeking competitive benchmarks, segmentation deep-dives, or strategic advisory on tariff impacts. Engage today to secure your executive summary, comprehensive methodology details, and actionable guidance that will inform every critical decision in your upcoming planning cycle.

- How big is the Online Doctor Consultation Market?

- What is the Online Doctor Consultation Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?