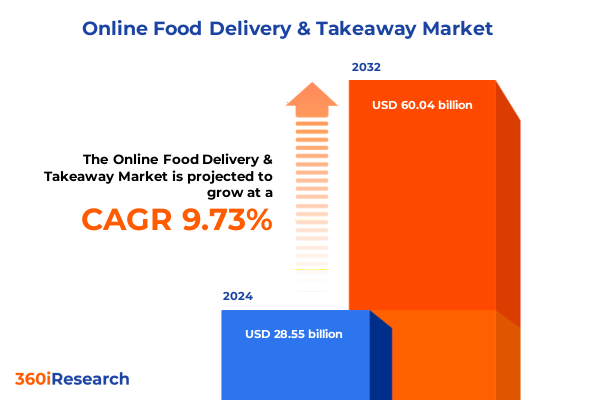

The Online Food Delivery & Takeaway Market size was estimated at USD 31.39 billion in 2025 and expected to reach USD 34.18 billion in 2026, at a CAGR of 9.70% to reach USD 60.04 billion by 2032.

Embark on a Comprehensive Exploration of How Online Food Delivery and Takeaway Services Are Reshaping Consumer Behavior and Business Strategies Today

The contemporary landscape of online food delivery and takeaway services has undergone an extraordinary evolution, driven by rapid technological innovation, shifting consumer behaviors, and dynamic operational models. In the United States alone, consumers place well over four billion orders annually through digital platforms that offer unparalleled convenience, personalized experiences, and an expanding array of menu options. As restaurants and foodservice operators integrate advanced logistics, contactless delivery, and AI-driven personalization, the industry’s complexity and competitive intensity continue to multiply.

Against this backdrop, businesses must stay informed about the latest breakthroughs in autonomous delivery, the proliferation of ghost kitchens, and emerging sustainability imperatives. Furthermore, global trade policies and tariff adjustments are increasingly shaping cost structures and supply chain resilience. This executive summary provides a structured overview of key market transformations, tariff impacts, segmentation insights, regional variations, and leading competitive strategies, offering a foundation for informed decision-making and strategic planning in this fast-paced sector.

Unprecedented Technological, Operational, and Consumer Behavior Shifts Redefining the Online Food Delivery and Takeaway Landscape in 2025

Technological breakthroughs are fundamentally altering the economics and customer experience of last-mile food delivery. Companies are deploying ground-based autonomous robots and aerial drones to navigate urban environments, address labor shortages, and reduce delivery times. Since 2019, investments of approximately $3.5 billion in robotics and drone technology have fueled pilot programs in cities such as Chicago and Los Angeles, leading to faster, more reliable service at lower per-delivery costs. Regulatory frameworks are evolving in parallel, with advocates urging policymakers to adapt safety standards and ensure equitable access in diverse neighborhoods.

Moreover, the emergence of ghost kitchens and virtual restaurant brands is revolutionizing operational efficiency and market entry. Delivery-only kitchen models allow restaurateurs to test new concepts without significant real estate investments, reduce overhead, and rapidly expand into suburban and Tier 2 markets that were previously underserved. These digital-first ventures leverage integrated order management systems and third-party delivery partnerships to offer highly specialized menus that cater to niche tastes and dietary preferences.

Sustainability and transparency have also taken center stage, as consumers and regulators demand eco-friendly packaging, reduced carbon footprints, and responsible sourcing. Innovative companies are adopting AI-powered waste-tracking tools, smart energy management in commercial kitchens, and compostable packaging solutions that align with environmental objectives without compromising profitability. This convergence of operational innovation, digital marketing, and values-driven consumption is setting new standards for customer loyalty and brand differentiation.

Examining the Multifaceted and Cumulative Effects of 2025 United States Tariff Policies on the Online Food Delivery and Takeaway Sector

Beginning in early 2025, sweeping tariff measures enacted by the U.S. government have driven average import rates from just above 2% to roughly 15%, marking the highest levels since the mid-20th century. A range of essential imports for the foodservice sector-including aluminum and plastic packaging, kitchen equipment, and specialty ingredients-are subject to increased duties, which in turn elevate costs across the supply chain and compel operators to reassess sourcing strategies.

Takeout packaging has been particularly affected, with restaurants reporting up to a 15% increase in the cost of containers and beverage vessels due to tariffs on aluminum and plastics. As a result, many brands are pursuing bulk purchasing agreements, exploring reusable alternatives, and prioritizing partnerships with domestic suppliers to mitigate the financial impact. Equipment budget overruns have also become commonplace, as surcharges on steel and electronics erode planned capital expenditures and delay expansions.

Ingredient volatility is another critical concern, with tariffs on imports such as avocados, seafood, and specialty oils resulting in menu price adjustments and profitability challenges. Operators are employing menu engineering techniques, conducting frequent cost analyses, and introducing high-margin limited-time offers to preserve margins under fluctuating cost conditions. Additionally, tariff-induced inflation contributes to reduced consumer discretionary spending, prompting the sector to emphasize value propositions through bundled promotions and loyalty initiatives.

The unpredictability of trade policy further complicates long-term planning, as sudden rate changes can ripple through vendor contracts and financial forecasts. Building flexibility into supply agreements and investing in scenario-based contingency planning are essential steps for maintaining resilience amid an uncertain trade environment.

Revealing Critical Segmentation Dimensions That Illuminate Service Types, Cuisine Preferences, Order Channels, and Payment Methods Transforming Market Strategies

The market for online food delivery and takeaway services can be understood through multiple segmentation lenses, each revealing unique consumer and operational dynamics. When considering service type, the landscape is divided between delivery services-encompassing both express and standard delivery options that cater to varying demands for speed and cost-and takeaway offerings, which include curbside pickup for speed and convenience alongside in-store pickup that supports incremental dine-in engagement. Understanding which segment drives volume in specific trade areas guides resource allocation and marketing focus.

Cuisine segmentation further shapes platform strategies, as operators curate offerings across casual dining, ethnic cuisine, fast food, and fine dining. Ethnic categories span Chinese, Indian, Italian, and Mexican kitchens, each with distinct preparation, packaging, and delivery requirements. Tailoring menu development and promotional campaigns to these culinary subsegments enhances platform relevance and customer satisfaction.

Order channel preferences-ranging from desktop web portals, including progressive web apps and traditional websites, to mobile applications on Android and iOS ecosystems, as well as phone-based channels such as call centers and direct phone orders-drive channel-specific user experiences and technology investments. Optimizing each interface for speed, reliability, and user friendliness increases order conversion and reduces drop-off rates.

Finally, payment method segmentation highlights the importance of accommodating consumer habits and regional payment infrastructures. Platforms that support card transactions-spanning credit and debit cards-alongside cash and digital wallets such as Apple Pay, Google Pay, and PayPal, provide flexibility and reduce friction at checkout, ultimately fostering higher repeat engagement.

This comprehensive research report categorizes the Online Food Delivery & Takeaway market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Cuisine

- Payment Method

- Order Channel

Uncovering Distinct Regional Dynamics Driving Online Food Delivery and Takeaway Growth Patterns Across the Americas, EMEA, and Asia-Pacific in 2025

In the Americas, particularly in the United States and Canada, the rapid rollout of autonomous delivery pilots and drone trials is reshaping customer expectations for speed and convenience. Platforms are integrating robotics in urban centers, while rural and suburban expansions rely on electric vehicle fleets and micro-fulfillment hubs to meet growing service levels. Moreover, strategic alliances with grocery and retail partners are broadening the scope of grocery and convenience deliveries alongside traditional restaurant orders.

Across Europe, the Middle East, and Africa, consolidation is a prevailing theme as regional champions seek economies of scale and technology synergies. The acquisition of Just Eat Takeaway.com by Prosus to create a unified pan-European delivery powerhouse exemplifies this drive for competitive scale, with enhanced AI investments aimed at improving route optimization, customer matching, and cost efficiency. Regulatory variations across these jurisdictions demand agile compliance frameworks and localized marketing approaches to address data protection, rider welfare, and urban delivery restrictions.

In the Asia-Pacific region, rapid urbanization and mobile-first consumer behavior have fueled the expansion of cloud kitchens, hyperlocal quick-commerce networks, and super-app ecosystems. Delivery-only facilities, often housing multiple virtual brands under one roof, leverage AI-driven demand forecasting and real-time logistics to promise sub-30-minute deliveries in major markets. Investments in micro-fulfillment centers and predictive analytics are lowering operating costs and improving service reliability, reinforcing the region’s position at the vanguard of last-mile innovation.

This comprehensive research report examines key regions that drive the evolution of the Online Food Delivery & Takeaway market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing the Strategic Maneuvers, Technological Innovations, and Competitive Positioning of Leading Online Food Delivery Platforms in 2025

Among leading U.S. platforms, DoorDash’s strategic emphasis on acquisitions, subscription growth, and technology integration underscores its ambition to consolidate both domestic and international markets. Its approximately $3.9 billion acquisition of Deliveroo expands DoorDash’s footprint across Europe and Asia, while the $1.2 billion purchase of SevenRooms enhances merchant services and in-store revenue capabilities. Concurrently, DoorDash’s DashPass subscription program has surpassed 22 million members, reinforcing customer loyalty and order frequency.

Uber Eats is similarly diversifying beyond food delivery through its Uber One subscription service and strategic stake acquisitions, including an 85% share in Trendyol’s food delivery operations. These moves position Uber Eats within super-app ecosystems and broaden its reach into new customer segments and geographies.

Grubhub, undergoing a transformation following its sale to Wonder and a workforce realignment affecting approximately 20% of employees, is investing in robotics partnerships to offset labor constraints. Its alliance with autonomous technology provider Avride to deploy sidewalk delivery robots on college campuses reflects a broader industry shift toward automation and cost optimization.

Global players such as Delivery Hero and Just Eat Takeaway leverage their multi-regional presence to drive scale benefits and share technological capabilities across networks. Delivery Hero’s investments in digital marketing and AI routing algorithms, combined with Just Eat Takeaway’s expansion into adjacent categories such as retail and grocery, illustrate the diverse strategic approaches companies are adopting to sustain growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Food Delivery & Takeaway market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bundl Technologies Pvt. Ltd.

- Coupang, Inc.

- Deliveroo plc

- Delivery Hero SE

- DoorDash, Inc.

- Foodpanda GmbH

- Glovoapp23 S.L.

- Grubhub Inc.

- iFood S.A.

- Just Eat Takeaway.com N.V.

- Meituan

- Menulog Pty. Ltd.

- Postmates, Inc.

- Rappi S.A.

- SkipTheDishes

- Uber Technologies, Inc.

- Wolt Enterprises Oy

- Woowa Brothers Corp.

- Zomato Ltd.

Delivering Actionable Strategies to Strengthen Operational Resilience, Customer Satisfaction, and Growth in the Online Food Delivery and Takeaway Sector

Industry leaders should prioritize investments in automation and robotics to enhance delivery efficiency and address persistent labor shortages. Deploying autonomous ground vehicles and aerial drones, backed by a clear regulatory engagement strategy, can reduce per-delivery costs and improve service consistency, as evidenced by the $3.5 billion invested in robotics since 2019. Simultaneously, integrating AI-driven route optimization and real-time tracking ensures accurate ETAs and higher customer satisfaction.

Given the rising cost pressures from U.S. tariffs, companies must diversify supplier networks, negotiate fixed-price contracts, and explore near-shore or domestic sourcing alternatives. Embedding tariff clauses into vendor agreements and conducting quarterly cost reviews will mitigate exposure to sudden duty hikes, which have driven average import rates to around 15% in 2025.

Expanding ghost kitchen footprints and virtual brands in suburban and Tier 2 markets offers a capital-efficient path to market growth. Leveraging cloud kitchens for experimentation and rapid menu iteration, combined with targeted subscription models, enhances customer retention and stabilizes revenue streams. Additionally, implementing sustainable packaging solutions and carbon-tracking tools can strengthen brand trust among environmentally conscious consumers and align with regulatory expectations on eco-compliance.

Finally, fostering a super-app ecosystem through partnerships or in-house service diversification creates a holistic customer journey, driving higher lifetime value and cross-category engagement. By adopting these actionable strategies, industry leaders can build resilient business models that thrive amid evolving consumer demands and economic uncertainties.

Detailing the Methodological Framework Combining Primary Interviews, Advisory Insights, and Rigorous Data Validation for This Online Food Delivery Study

This study integrates primary and secondary research methodologies to ensure comprehensive and reliable insights. Primary data collection involved structured interviews with industry stakeholders, including delivery platform executives, independent restaurateurs, and logistics service providers, to capture firsthand perspectives on operational challenges and strategic priorities. Complementing these discussions, advisory panels comprising technology experts, supply chain analysts, and regulatory specialists reviewed preliminary findings to validate interpretations and identify emerging trends.

Secondary research incorporated an in-depth review of industry reports, trade publications, and regulatory filings, excluding estimates from market forecasting websites. Key sources included financial disclosures from leading public companies, policymaker announcements on trade measures, and academic studies on consumer behavior. Data triangulation techniques were applied to reconcile disparate information streams and ensure consistency across thematic areas.

Quantitative analyses utilized time-series data on order volumes, subscription growth, and automation investments, derived from reputable financial media and regulatory databases. Qualitative insights were enriched through case studies of technology pilots and M&A transactions. Throughout the research process, rigorous cross-validation and peer reviews were conducted to uphold the highest standards of accuracy, objectivity, and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Food Delivery & Takeaway market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Food Delivery & Takeaway Market, by Service Type

- Online Food Delivery & Takeaway Market, by Cuisine

- Online Food Delivery & Takeaway Market, by Payment Method

- Online Food Delivery & Takeaway Market, by Order Channel

- Online Food Delivery & Takeaway Market, by Region

- Online Food Delivery & Takeaway Market, by Group

- Online Food Delivery & Takeaway Market, by Country

- United States Online Food Delivery & Takeaway Market

- China Online Food Delivery & Takeaway Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2067 ]

Summarizing Core Findings and Strategic Imperatives That Will Shape the Future of Online Food Delivery and Takeaway Markets Worldwide

The convergence of technological innovation, evolving consumer expectations, and global trade dynamics has set the stage for significant transformation in the food delivery and takeaway sector. Autonomous delivery robots, AI-driven personalization, and ghost kitchen expansion are reshaping service models, while sustainability imperatives and tariff pressures demand greater operational resilience. Regional variations underscore the importance of localized strategies, whether in the technology-savvy urban centers of the Americas, the regulatory patchwork of EMEA, or the fast-commerce environments of Asia-Pacific.

Leading platforms are responding with targeted acquisitions, diversified service offerings, and subscription models that deepen customer engagement. Meanwhile, nimble newcomers are capitalizing on niche opportunities and mobile-first consumer trends. To navigate this complexity, industry participants must embrace data-driven decision-making, flexible supply chains, and sustainable practices that balance cost efficiency with environmental responsibility.

Ultimately, success will hinge on the ability to integrate emerging technologies, cultivate strategic partnerships, and adapt to shifting market conditions. Organizations that proactively align their operational capabilities with consumer preferences and regulatory requirements are best positioned to secure a competitive advantage, foster lasting customer loyalty, and drive profitable growth in this dynamic industry.

Connect with Associate Director Ketan Rohom to Unlock Comprehensive Market Intelligence and Drive Strategic Growth in the Food Delivery and Takeaway Industry

Engaging with Ketan Rohom offers a unique opportunity to access tailored market intelligence and strategic support that can catalyze your organization’s success in the highly competitive food delivery and takeaway environment. As Associate Director of Sales & Marketing, he is positioned to guide you through the intricate landscape of emerging technologies, evolving consumer preferences, and regulatory developments affecting your operational and strategic decisions. By partnering with him, you can benefit from in-depth analyses of service innovations, segmentation strategies, and regional dynamics that are shaping industry trajectories.

Whether you are focused on optimizing your delivery network, enhancing customer engagement, or navigating tariff-induced cost challenges, Ketan Rohom can connect you with proprietary insights and advisory services designed to address your specific priorities. His expertise spans end-to-end market assessments, competitor benchmarking, and practical recommendations that support both short-term performance improvement and long-term growth objectives.

Contact Ketan to explore how this comprehensive market research report can equip your leadership team with actionable data, foresights into disruptive trends, and a strategic roadmap to unlock new revenue streams. Take the next step toward informed, data-driven decision-making and position your organization for sustainable success in the rapidly evolving food delivery and takeaway sector.

- How big is the Online Food Delivery & Takeaway Market?

- What is the Online Food Delivery & Takeaway Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?