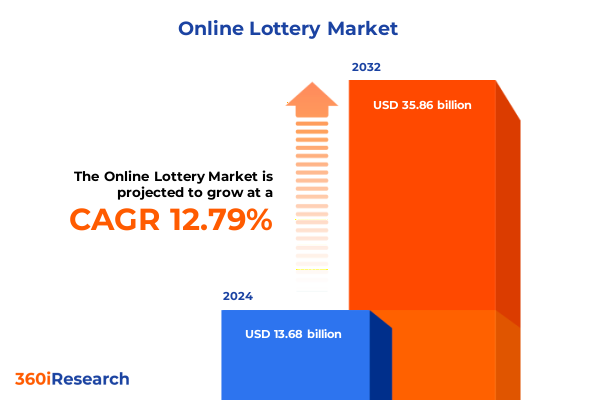

The Online Lottery Market size was estimated at USD 15.10 billion in 2025 and expected to reach USD 16.67 billion in 2026, at a CAGR of 13.14% to reach USD 35.86 billion by 2032.

Setting the Stage for an Era of Digital Lottery Innovation Driven by Evolving Consumer Behaviors and Emerging Technological Capabilities

The online lottery industry stands at a pivotal inflection point as digital technologies redefine how players engage with traditional lottery offerings. Fueled by widespread smartphone adoption and enhanced connectivity, lotteries across the globe are rapidly incorporating digital channels to meet rising consumer expectations. This transformation is underpinned by a significant surge in eInstant game revenues, which surged past one billion dollars in net revenues in the United States during fiscal 2024, marking a 39.2% year-over-year increase†. Concurrently, regulatory advances have enabled a growing number of jurisdictions to launch iLottery platforms, with 13 American lotteries offering some form of online lottery games-including draw products, eInstants, and subscription services-by mid-2024†.

Amid this digital renaissance, stakeholders are navigating a landscape shaped by evolving regulations, consumer behavior shifts, and technological innovation. Operators are balancing the integration of mobile apps, enhanced player-account management systems, and data-driven marketing with the imperative to uphold responsible gaming standards. A holistic understanding of these dynamics is crucial for decision-makers seeking to leverage emerging opportunities and mitigate associated risks. This executive summary provides a structured overview of the key trends, segmentation perspectives, regional nuances, corporate strategies, and actionable recommendations that define the contemporary online lottery market.

Unraveling the Technological, Regulatory, and Consumer-Driven Shifts Reshaping the Online Lottery Landscape into a Dynamic Digital Ecosystem

The online lottery landscape has been fundamentally reshaped by the convergence of advanced mobile technologies, data analytics, and personalized marketing. Mobile devices have become the primary touchpoint for many players, exemplified by the Virginia Lottery, where online sales surpassed retail for the first time in fiscal 2024-accounting for 55% of total sales between July 2023 and June 2024†. This milestone underscores the growing consumer preference for digital convenience and the critical need for seamless app-based experiences.

Regulatory frameworks are also evolving to foster innovation while ensuring consumer protection. States such as Connecticut and Georgia have introduced new game formats and subscription models, expanding digital draw game portfolios and subscription offerings. In Europe, Allwyn International reported that digital channels were the primary growth driver in 2024, with digital revenue climbing 20% year-over-year and representing 39% of group gross gaming revenue†. This illustrates how forward-looking licensing policies and technology upgrades-such as the planned UK National Lottery systems modernization scheduled for August 2025-are enabling operators to deliver enriched digital experiences.

Consumer expectations have been further elevated by innovations in game content and engagement tools. Personalized promotions powered by machine-learning models, omnichannel loyalty programs, and interactive eInstant offerings are becoming standard. These transformative shifts are redefining competitive benchmarks and compelling legacy operators and new entrants alike to invest in robust digital ecosystems that span mobile, web, and retail touchpoints.

Analyzing the Ripple Effects of the 2025 U.S. Tariff Regime on Technology Supply Chains and Operational Costs in the Online Lottery Sector

A series of U.S. tariff measures enacted in 2025 has introduced notable operational challenges for online lottery providers reliant on imported hardware and technology infrastructure. Beginning February 4, a 10% tariff was imposed on Chinese-origin goods, which was subsequently raised to 20% in early March alongside a 25% tariff on imports from Mexico and Canada†. These actions were further compounded by the announcement on April 2 of an additional 10% global baseline tariff, with escalations varying by country-China facing a reciprocal tariff of 125% despite temporary pauses for other partners†.

In response, the Office of the U.S. Trade Representative extended certain exclusions under Section 301 of the Trade Act to August 31, 2025, providing short-term relief for specific technology and innovation-related imports†. However, the fluctuating scope and rates of these tariffs have introduced uncertainty into procurement cycles for lottery terminal manufacturers and peripheral suppliers. Many point-of-sale devices and ticket-printing terminals are sourced from overseas manufacturers, particularly in Asia, and the increased cost of components-such as thermal printers and network modules-has pressured both margins and capital expenditure plans.

Operators have begun exploring mitigation strategies, including inventory stockpiling, supplier diversification, and leveraging exclusions for critically essential components. Moreover, some providers are accelerating the shift toward cloud-based digital platforms and consumer-facing apps to reduce dependence on in-store hardware. Nonetheless, the cumulative impact of these tariffs underscores the importance of flexible supply-chain strategies and ongoing regulatory monitoring to sustain seamless lottery operations.

Dissecting Market Segmentation to Reveal How Game Types, Platforms, Ticket Options, Price Tiers, Payment Methods, and Demographics Drive Online Lottery Dynamics

The online lottery market can be understood through multiple lenses, each revealing unique drivers of player engagement and revenue streams. Game type differentiation spans instant win formats, Keno, Lotto draws, pool betting, and raffles, with instant win offerings further enriched by digital raffles and scratch-card variants. These distinct formats cater to varying desire for immediacy and prize structures.

Platform considerations shape accessibility and user experience. Traditional desktop interfaces coexist with mobile channels, where dedicated apps-both Android and iOS-and mobile-optimized web portals each play pivotal roles. User preferences within these platforms influence session durations, conversion rates, and retention metrics.

Beyond platform, ticket types engage distinct purchase behaviors, encompassing multi-draw bundles, single-draw entries, and syndicate plays that appeal to group participation. Price tiers also segment the market, from low-price tickets targeting casual players to premium-tier offerings designed for high-frequency or high-stakes participants.

Payment method innovations broaden inclusion, ranging from traditional bank transfers and credit cards-spanning Visa, Mastercard, and American Express-to emerging channels such as cryptocurrency and eWallets, including Neteller, PayPal, and Skrill. Each payment mode carries implications for transaction speed, security, and demographic reach.

Finally, demographic segmentation by age-encompassing cohorts from 18–25, 26–40, 41–60, and 60+-underscores differing engagement levels and content preferences, guiding tailored marketing strategies. Together, these multifaceted segmentation dimensions offer a comprehensive framework to optimize product design, user acquisition, and retention across the online lottery ecosystem.

This comprehensive research report categorizes the Online Lottery market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Game Type

- Platform

- Ticket Type

- Ticket Price Tier

- Payment Method

- Customer Age Group

Exploring Regional Differentiators Highlighting Growth Drivers and Regulatory Nuances across Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics continue to influence online lottery performance, with nuanced characteristics across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, digital channels have gained significant traction. U.S. eInstant game revenues topped $1 billion in fiscal 2024, a 39.2% increase that underscores consumer appetite for instant digital engagement†. States such as Virginia have witnessed online sales eclipse retail for the first time, reflecting the strategic impact of mobile-first platforms†.

In Europe Middle East & Africa, incumbent operators and new licensees alike are prioritizing technology upgrades and digital expansion. Allwyn International’s digital segment drove 20% revenue growth in 2024, accounting for nearly 40% of total gross gaming revenue-a testament to the rising importance of omnichannel integration†. Global operator Allwyn has also been strategically expanding its footprint, acquiring state lottery contracts and leveraging advanced platform capabilities to enhance player experiences in diverse markets†.

Asia-Pacific exhibits a blend of innovation and regulatory complexity. South Korea leads with the highest regional user penetration rate of approximately 0.9% in 2024, driven by established digital channels and mobile-centric consumer habits†. Meanwhile, Australia has embraced international lottery services, exemplified by TheLotter Australia’s new mobile app launch in July 2024, enabling Australians to access major global draws via a seamless digital interface†. These examples illustrate how regional regulation and market maturity levels shape digital lottery trajectories worldwide.

This comprehensive research report examines key regions that drive the evolution of the Online Lottery market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Technology Providers and Operators Unveiling Strategic Moves and Capabilities Shaping the Online Lottery Competitive Landscape

Leading technology providers and lottery operators are executing strategic initiatives that redefine competitive benchmarks. Allwyn International has emerged as a powerhouse following its acquisition of major lottery contracts, with a 20% increase in digital revenue in 2024-driven by its UK National Lottery licence and state-of-the-art omnichannel platform†. The company’s dual focus on digital innovation and strategic acquisitions underpins its global expansion framework.

Scientific Games continues to solidify its position as a premier systems and content provider. Its Momentum ecosystem-incorporating enterprise gaming platforms, player account management, and digital content aggregation-powers both retail and iLottery operations, as evidenced by the North Dakota Lottery’s adoption of its advanced omnichannel system in late 2024†. Furthermore, the SG Content Hub has expanded to include virtual sports offerings, broadening content portfolios for digital lottery customers worldwide†.

International Game Technology (IGT) stands as a pure-play global lottery enterprise following its strategic separation from land-based gaming units. IGT’s award-winning iLottery platform now serves 11 jurisdictions, with recent launches in Connecticut and partnerships extending to Finland’s Bakehouse operator†. Its robust digital platform-featuring real-time player views, extensive bonusing capabilities, and cloud-based RGS deployment-reinforces IGT’s leadership in driving digital lottery transformation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Lottery market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Allwyn Entertainment plc

- Dusane Infotech Pvt. Ltd.

- International Game Technology PLC

- INTRALOT S.A.

- Intralot SA

- Jackpot.com plc

- Jumbo Interactive Limited

- Kindred Group plc

- Light & Wonder, Inc.

- Lottery.com, Inc.

- Lotto24 AG

- Lotto247 Group Ltd.

- Lottomatica Holding S.p.A.

- LottoSend Ltd.

- MultiLotto Ltd.

- NeoGames S.A.

- Novomatic AG

- OneLotto.com

- OPAP S.A.

- Playtech plc

- Pollard Banknote Limited

- Sisal Group S.p.A.

- The Hong Kong Jockey Club

Strategic Imperatives and Operational Best Practices for Industry Leaders to Capitalize on Digital Lottery Opportunities and Navigate Emerging Challenges

Industry leaders must prioritize agile digital adoption to capitalize on accelerating online lottery trends. Emphasizing modular, cloud-native platform architectures enables rapid feature deployment and seamless integration of new game content. Concurrently, operators should invest in advanced analytics and machine learning to refine player segmentation, personalize engagement, and optimize responsible gaming interventions.

Strategic partnerships with fintech and payment providers will be essential to broaden payment acceptance and reduce transaction friction. As players increasingly favor alternative payment methods, integrating cryptocurrency options and leading eWallets can unlock new demographic segments. In tandem, loyalty-driven marketing and subscription models should be enhanced through data-driven promotions and tiered rewards.

Supply-chain resilience must also be fortified against regulatory uncertainties such as import tariffs. Diversifying hardware sourcing, negotiating long-term component agreements, and leveraging exclusions for critical technologies can mitigate cost volatility. Additionally, exploring software-centric approaches-such as progressive digital draw products-can reduce dependence on physical terminals.

Finally, cultivating a culture of continuous innovation and cross-functional collaboration will ensure that organizations remain responsive to rapid regulatory shifts, emerging consumer expectations, and evolving technological capabilities.

Outlining Rigorous Research Methodology Leveraging Primary Interviews, Secondary Sources, and Data Triangulation to Ensure Robust Market Intelligence

This research integrates a multi-phased methodology to ensure the rigor and reliability of insights. Primary research encompassed in-depth interviews with senior executives, technology vendors, and regulatory stakeholders across key jurisdictions. These qualitative conversations provided firsthand perspectives on strategic priorities, operational challenges, and technology roadmaps.

Secondary research involved exhaustive reviews of public regulatory filings, industry association reports, and reputable news sources to establish a comprehensive factual foundation. Trade publications, government databases, and company press releases were systematically analyzed to triangulate data points and validate emerging trends.

Quantitative analysis leveraged proprietary databases and numeric datasets-encompassing digital transaction volumes, payment method adoption rates, and platform usage metrics-to identify statistically significant patterns. Cross-verification between multiple data sources ensured consistency and mitigated biases.

Together, these methodologies deliver an integrated view of the online lottery market, providing stakeholders with robust, actionable intelligence underpinned by transparent data governance and methodological integrity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Lottery market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Lottery Market, by Game Type

- Online Lottery Market, by Platform

- Online Lottery Market, by Ticket Type

- Online Lottery Market, by Ticket Price Tier

- Online Lottery Market, by Payment Method

- Online Lottery Market, by Customer Age Group

- Online Lottery Market, by Region

- Online Lottery Market, by Group

- Online Lottery Market, by Country

- United States Online Lottery Market

- China Online Lottery Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Insights and Key Takeaways Emphasizing Digital Transformation Imperatives and Strategic Priorities for Online Lottery Success

The trajectory of the online lottery industry is unequivocally digital, driven by consumer demand for immediacy, enhanced mobile experiences, and secure payment innovations. Operators that embrace holistic platform modernization-encompassing cloud-native architectures, integrated loyalty ecosystems, and AI-driven personalization-will forge sustainable competitive advantages.

Regional variations underscore the importance of tailored strategies: North American markets are rapidly scaling iLottery offerings, Europe emphasizes stringent regulatory compliance and platform robustness, while Asia-Pacific balances high mobile penetration with unique regulatory considerations. Leading providers such as Allwyn, Scientific Games, and IGT exemplify diverse approaches to digital transformation, underlining the critical role of strategic partnerships and technology leadership.

Ultimately, success will hinge on balancing opportunistic growth-through segmented product offerings and data-driven engagement-with prudent risk management in areas such as supply-chain stability and regulatory compliance. This executive summary equips decision-makers with the insights and recommendations necessary to navigate the complex, dynamic landscape of the global online lottery market.

Connect Directly with Ketan Rohom to Obtain the Definitive Online Lottery Market Research Report and Empower Your Strategic Decisions

Realize the value of in-depth market intelligence by securing your copy of the comprehensive online lottery market research report. Reach out to Ketan Rohom (Associate Director, Sales & Marketing) to explore tailored insights, unlock strategic analysis, and position your organization to lead in this rapidly evolving sector. Partner now to gain the actionable intelligence that will drive your success.

- How big is the Online Lottery Market?

- What is the Online Lottery Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?