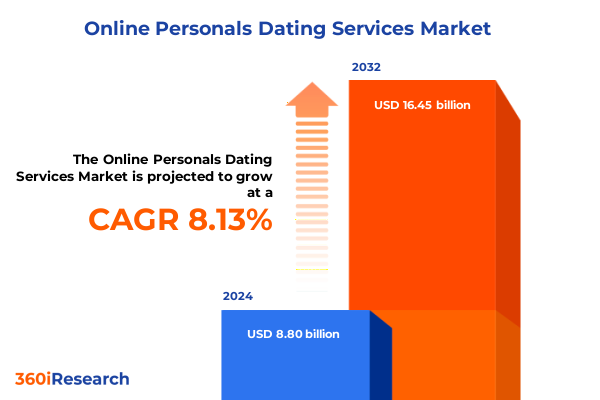

The Online Personals Dating Services Market size was estimated at USD 9.51 billion in 2025 and expected to reach USD 10.24 billion in 2026, at a CAGR of 8.14% to reach USD 16.45 billion by 2032.

Understanding the Evolution and Core Dynamics Shaping Today’s Online Dating Landscape for Strategic Market Positioning and Stakeholder Engagement

The online personals dating services industry has undergone a profound evolution, transitioning from simple profile directories to sophisticated digital ecosystems that facilitate meaningful human connections at scale. Over the past decade, consumer adoption has surged due to widespread smartphone penetration, evolving social norms, and growing comfort with virtual interaction. Consequently, this landscape now demands a deep understanding of user motivations, technology-driven expectations, and the regulatory environment that governs data privacy and content moderation.

As the market reaches new levels of maturity, key stakeholders must recognize how convenience, personalization, and trust form the three pillars sustaining platform growth. Consumers no longer view dating apps as mere novelty offerings; they expect seamless experiences, robust security protocols, and evidence of tangible matchmaking success. At the same time, demographic shifts-such as the increasing participation of users aged 45 and above-have diversified feature requirements and monetization strategies. This report’s opening analysis establishes a comprehensive view of these critical factors, setting the stage for targeted strategic initiatives.

Analyzing the Latest Technological, Behavioral, and Social Shifts Revolutionizing User Expectations and Engagement Models Across Dating Platforms

The online dating sphere has been reshaped by breakthroughs in artificial intelligence, the ubiquity of mobile wallets, and an unprecedented focus on user authenticity. Behavioral analytics and facial recognition safeguards now power algorithms that predict compatibility with remarkable precision. At the same time, traditional matching techniques-such as keyword and profile similarity-continue to play a supportive role, ensuring that platforms cater to a wide range of user preferences while balancing accuracy with inclusivity.

Moreover, the proliferation of short-form video and augmented reality features has redefined engagement models. Contemporary users seek dynamic, story-driven interactions rather than static photo galleries. Platforms responding to this demand have integrated livestream dating, virtual speed-dating events, and interactive icebreakers, thereby fostering a more immersive environment. These innovations not only heighten user engagement but also open new avenues for monetization through virtual gifting and branded experiences.

Concurrently, cultural and societal shifts have driven the normalization of online dating across diverse age groups and geographies. Inclusivity features, such as expanded gender identity options and specialized communities for shared interests, have broadened the addressable market. Consequently, service providers must continuously refine their value propositions to align with evolving social attitudes, regulatory requirements, and consumer privacy expectations.

Evaluating the Ramifications of United States Tariff Adjustments in 2025 on Consumer Costs, Platform Viability, and Service Accessibility in the Dating Sector

In 2025, cumulative adjustments to United States import tariffs on consumer electronics and data processing equipment have introduced new cost considerations for platform operators and end users alike. Although digital services themselves remain largely exempt from direct levies, increases in tariff rates on key hardware components-such as cameras, sensors, and chipsets-have driven up the retail price of smartphones and laptops. This, in turn, marginally elevated the total cost of access for end users who rely on mobile apps and web portals to connect with potential partners.

As a result, several platforms recalibrated their pricing structures to absorb portions of these hardware-induced expenses, taking care to preserve a competitive freemium entry point while protecting subscription margins. Smaller operators felt the strain more acutely, often passing costs through to premium tiers or limiting feature expansions. Conversely, larger firms leveraged economies of scale to negotiate better supply contracts, mitigating some tariff impacts and maintaining user-acquisition incentives without drastic price hikes.

Looking ahead, the indirect nature of these tariff adjustments underscores the importance of flexible cost-management strategies. Providers that diversify hardware partnerships, invest in cross-platform compatibility, and optimize data-processing efficiency are better positioned to shield consumers from price volatility. Moreover, strategic use of cloud-based infrastructures helps control operating expenses, ensuring service accessibility remains steady even amid shifting macroeconomic pressures.

Uncovering Key Segmentation Dimensions That Define User Demographics, Technological Preferences, and Monetization Choices Within Online Dating Services

A granular understanding of market segmentation reveals the driving forces behind user engagement and revenue generation. By platform, the industry bifurcates into mobile apps and web-based portals, with mobile experiences commanding the majority of daily active usage while websites continue to serve as discovery hubs for in-depth profile exploration and advanced search filters. This mobile-first orientation underscores the need for optimized in-app features such as swipe-based matching and push notifications, whereas desktop interfaces remain critical for users favoring comprehensive compatibility assessments.

When considering matching technology, a clear divide emerges between AI-powered solutions and traditional approaches. Providers leveraging behavioral analytics and machine learning algorithms deliver adaptive recommendation engines that refine suggestions based on evolving user interactions, preferences, and success metrics. In parallel, conventional systems continue to rely on keyword matching and profile attribute comparisons to ensure baseline functionality and inclusivity for users with simpler matchmaking criteria.

Age group demographics further shape content, communications, and community management strategies. Younger cohorts aged 18 to 24 gravitate toward video-centric features, ephemeral messaging, and gamified engagement loops, while the 25 to 34 segment values algorithmic precision and expanded search capabilities. Mature users between 35 and 44 yearn for stronger verification protocols and curated introductions, whereas the 45 and above group prioritizes safety assurances and personalized support services.

Finally, monetization models split into freemium access and subscription tiers, with premium plans available on both monthly and annual schedules. Freemium options encourage trial and social sharing, creating lead pipelines for upsell efforts. Subscription commitments, whether month-to-month or annual, provide predictable revenue streams and justify investments in advanced features like unlimited likes, boosted visibility, and priority customer support.

This comprehensive research report categorizes the Online Personals Dating Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service

- Matching Technology

- Payment Model

- Age Group

- Platform

Exploring Regional Market Variations Revealing How Cultural, Economic, and Technological Factors Shape Online Dating Behaviors Across Key Global Territories

Regional market dynamics reflect the interplay of cultural norms, regulatory environments, and technological infrastructure. In the Americas, particularly within the United States and Brazil, a mature competitive landscape emphasizes brand differentiation, data privacy compliance, and localized feature enhancements. Users in these markets expect intuitive mobile experiences, transparent moderation guidelines, and integration with digital payment ecosystems, including mobile wallets and peer-to-peer payment systems.

Across Europe, the Middle East, and Africa, diverse regulatory frameworks and linguistic environments create complex operational requirements. European users demand adherence to stringent data-protection laws, leading to heightened investments in encryption, consent management, and cross-border data transfer protocols. Meanwhile, Middle Eastern platforms tailor curated communities around shared cultural values and linguistic preferences, and select African markets prioritize low-bandwidth optimization and USSD-based onboarding to accommodate connectivity constraints.

In Asia-Pacific, rapid smartphone adoption and digital literacy drive exponential user growth. Markets such as India, China, and Southeast Asian nations exhibit a blend of domestic champions and global entrants, with features like in-app social commerce, livestream dating shows, and super-app integrations. Providers here focus on social trust metrics, built-in payment gateways, and influencer partnerships to foster community credibility and accelerate network effects.

This comprehensive research report examines key regions that drive the evolution of the Online Personals Dating Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Influential Market Players Highlighting Their Strategic Offerings, Competitive Edge, and Innovations Driving Growth in the Online Dating Sector

Leading players continue to differentiate through proprietary AI methodologies, network-effect strategies, and strategic alliances. For instance, one global pioneer has embedded nuanced sentiment analysis to fine-tune match suggestions, enabling deeper compatibility assessments and demonstrable increases in user retention. Another major competitor invests heavily in video-first experiences, rolling out interactive livestream events that encourage organic content creation and drive ancillary revenue through digital tipping features.

Emerging trailblazers have carved out niches by focusing on specific demographic cohorts or relationship types. A select few platforms cater exclusively to professionals with rigorous verification protocols and premium concierge services, while others target the LGBTQ+ community through identity-affirming design and localized community moderation. Strategic acquisitions have further intensified the competitive landscape, as larger firms integrate complementary services-such as group-dating apps or matchmaking agencies-to broaden their value propositions.

Additionally, nimble startups explore adjacent monetization models, experimenting with virtual gifting, brand partnerships, and exclusive event access. These innovative revenue streams not only deepen user engagement but also diversify income sources beyond subscription fees. Competitive edges increasingly hinge on ecosystem development, whereby platforms leverage third-party integrations, developer APIs, and cross-platform interoperability to enhance user stickiness and encourage platform-wide adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Personals Dating Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bumble Inc

- Caffè Nero

- Coffee Meets Bagel Inc

- Cupid Media Pty Ltd

- Facebook Dating

- Feeld Ltd

- Gleeden

- Grindr LLC

- Happn SAS

- HER

- Hily Corp

- Lex

- Love Group Global Ltd

- Match Group Inc

- Once Dating AG

- Paktor Pte Ltd

- ParshipMeet Holding GmbH

- People Interactive Pvt Ltd

- Raya App Inc

- Scruff

- Spark Networks SE

- Taimi Inc

- The Ashley Madison Agency

- The Hello Group

- TrulyMadly Matchmakers Pvt Ltd

Delivering Actionable Strategic Initiatives That Empower Industry Leaders to Enhance User Engagement, Optimize Offerings, and Sustain Competitive Advantage

Industry leaders must embrace a customer-centric innovation roadmap that prioritizes AI-driven personalization while safeguarding data privacy. By integrating advanced behavioral analytics, platforms can deliver hyper-relevant match recommendations, reducing user fatigue and improving conversion rates. Equally important is the implementation of robust security protocols-ranging from two-factor authentication to real-time content moderation-to build and sustain consumer trust.

Further, diversifying engagement formats through video profiles, virtual events, and gamified experiences can deepen platform loyalty. Creating multi-modal matchmaking journeys that combine asynchronous messaging with live interactions addresses a spectrum of user preferences. Coupling these features with tiered subscription incentives-such as bundled access to exclusive content or premium support-will optimize monetization while maintaining a low-barrier entry for new users.

Strategic geographic expansion necessitates tailored localization strategies. Operators should align product roadmaps with regional regulatory requirements and cultural nuances, leveraging partnerships with local payment providers, community influencers, and digital marketing agencies. Finally, continuous performance monitoring and iterative enhancements-supported by A/B testing and predictive analytics-will empower decision makers to refine features rapidly, ensuring sustained competitive advantage.

Outlining Rigorous Research Techniques and Data Collection Approaches That Ensure Confidence in Insights on Online Dating Service Trends

This research synthesizes multiple data sources and analytical techniques to ensure rigor and relevance. It commences with an extensive review of publicly available financial filings, regulatory disclosures, and company announcements to map competitive landscapes and strategic developments. Concurrently, proprietary consumer surveys and in-depth interviews with platform executives provide qualitative insights into user needs, technology roadmaps, and operational challenges.

Quantitative analysis leverages anonymized usage data from leading dating apps, combined with third-party analytics platforms, to identify usage patterns, feature adoption rates, and engagement metrics. These findings are triangulated with primary research outputs-such as stakeholder interviews and expert panels-to validate conclusions and surface emerging trends. Throughout the process, a quality control framework ensures data integrity, including cross-checking sources, eliminating outliers, and verifying methodological assumptions.

Where applicable, the study incorporates comparative case studies to illustrate best practices and cautionary examples. This mixed-method approach balances breadth and depth, delivering actionable intelligence that marries big-picture market perspectives with granular consumer behavior analysis. Ultimately, this methodology underpins the report’s strategic recommendations and ensures they are grounded in evidence and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Personals Dating Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Personals Dating Services Market, by Service

- Online Personals Dating Services Market, by Matching Technology

- Online Personals Dating Services Market, by Payment Model

- Online Personals Dating Services Market, by Age Group

- Online Personals Dating Services Market, by Platform

- Online Personals Dating Services Market, by Region

- Online Personals Dating Services Market, by Group

- Online Personals Dating Services Market, by Country

- United States Online Personals Dating Services Market

- China Online Personals Dating Services Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Core Findings and Strategic Implications Offering a Concise Perspective for Decision Makers in the Competitive Online Dating Sphere

In summation, the online dating services market stands at a pivotal juncture characterized by rapid technological progress, evolving user expectations, and nuanced regional dynamics. Providers that successfully integrate advanced AI-driven matching algorithms with immersive engagement formats will secure a sustainable growth trajectory. Equally, those that remain vigilant to macroeconomic pressures-such as the indirect effects of tariff-driven hardware cost increases-will preserve accessibility and trust among their user base.

Segmentation analysis highlights the importance of platform choice, matching technology, age demographics, and payment preferences in shaping user journeys and revenue strategies. Regional insights further emphasize the need for compliance with local regulations, cultural adaptation, and infrastructure optimization. Finally, competitive profiling reveals that innovation in feature design and strategic alliances will define the next era of market leaders.

This report equips decision makers with the contextual knowledge, analytical frameworks, and strategic recommendations necessary to navigate a complex environment. By aligning product roadmaps with evolving consumer needs and regulatory landscapes, industry stakeholders can unlock new value, foster deeper engagement, and maintain a decisive competitive edge.

Connect Directly with Our Sales Leader to Secure Comprehensive Market Insights and Unlock Growth Opportunities in Online Dating Services Today

To secure your authoritative guide to navigating the complexities and opportunities within the online dating services market, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing. He will provide detailed information on report features, customization options, and enterprise licensing agreements tailored to your strategic needs. Engage with his consultative approach to ensure your organization leverages these insights for immediate competitive advantage and long-term growth in the digital matchmaking arena.

- How big is the Online Personals Dating Services Market?

- What is the Online Personals Dating Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?