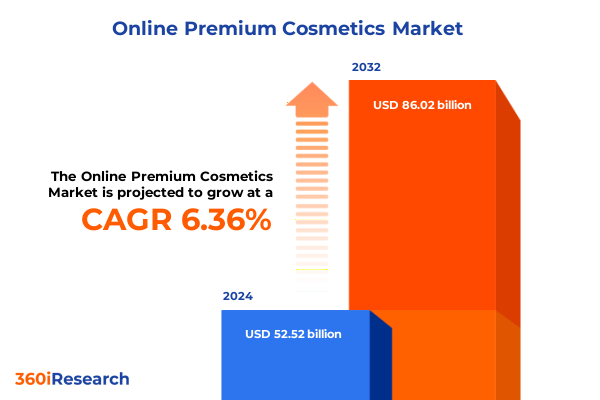

The Online Premium Cosmetics Market size was estimated at USD 55.81 billion in 2025 and expected to reach USD 58.97 billion in 2026, at a CAGR of 6.37% to reach USD 86.02 billion by 2032.

Navigating the Booming Premium Cosmetics Market Online Through Unparalleled Quality Innovation and Consumer-Centric Strategies Driving Growth

The online premium cosmetics market has witnessed an unprecedented surge in recent years, fueled by the convergence of digital innovation, evolving consumer tastes, and a heightened appetite for high-quality personal care experiences. Today’s discerning beauty enthusiasts seek more than just function; they demand authenticity, efficacy, and brand narratives that resonate with their values. As a result, brands operating in this space are compelled to refine their digital presence, enhance their storytelling, and deliver seamless omni-channel journeys that reflect the aspirational yet attainable nature of premium offerings. Moreover, the post-pandemic era has accelerated digital adoption across demographics, making e-commerce the primary battleground for market share and loyalty cultivation.

In this context, success hinges on a deep understanding of what drives premium beauty consumers online. Personalization has emerged as a critical differentiator, enabling brands to tailor experiences from product recommendations to post-purchase care. At the same time, social commerce and influencer partnerships are rewriting traditional marketing playbooks, fostering community-driven advocacy and real-time feedback loops. Against this backdrop, companies that can integrate cutting-edge digital tools-such as augmented reality try-on capabilities and AI-powered diagnostics-while preserving the human touch of expert guidance are best positioned to thrive. This executive summary sets the stage for a comprehensive exploration of the transformative trends, regulatory shifts, segmentation nuances, and strategic imperatives shaping the online premium cosmetics market today.

Unraveling the Major Transformative Shifts Redefining Online Premium Cosmetics From Seamless Digital Experiences to Sustainable Ingredient Transparency

Over the past two years, the premium cosmetics landscape has experienced transformative shifts as digital innovation, sustainability, and consumer empowerment converge to redefine value creation. Digital engagement is no longer supplementary-it is fundamental. Brands have leveraged augmented reality and virtual try-on technologies to simulate in-store experiences, enabling consumers to experiment with makeup and skincare regimens from the comfort of home. Moreover, AI-driven formulations and predictive analytics have unlocked new frontiers in personalization, allowing brands to anticipate skin concerns and deliver bespoke solutions at scale.

Sustainability has simultaneously risen to the forefront of consumer priorities. Transparent ingredient sourcing, eco-friendly packaging solutions, and carbon-neutral production processes have become essential components of a brand’s value proposition. As younger cohorts assert their purchasing power, they are holding companies to higher ethical standards, rewarding those with credible environmental commitments and social impact programs. Consequently, premium cosmetics players are investing in green chemistry, upcycling initiatives, and traceability technologies that not only preserve brand integrity but also foster long-term loyalty.

Additionally, omni-channel convergence is evolving beyond a buzzword into a strategic imperative. Marketplaces, direct-to-consumer platforms, and subscription services are blending to create unified ecosystems where data flows seamlessly, enriching both marketing intelligence and customer service. Social commerce on short-form video platforms has unlocked new customer acquisition channels, while live-streamed masterclasses and real-time consultations deepen engagement. Together, these shifts are forging a new paradigm in which brand agility, digital fluency, and purpose-driven storytelling determine success in the premium cosmetics sector.

Assessing the Cumulative Impact of the United States Tariffs Implemented in 2025 on the Online Premium Cosmetics Supply Chain and Pricing Dynamics

In 2025, the United States implemented a series of tariffs targeting select cosmetic ingredients, packaging components, and finished premium beauty products imported from key manufacturing hubs. These measures have rippled across the supply chain, elevating landed costs and prompting brands to reevaluate sourcing strategies. Companies reliant on specialized actives from regions such as East Asia and Europe have faced margin pressure, as tariff surcharges have diminished the cost advantage of overseas suppliers.

As a result, many premium cosmetics marketers have accelerated localization efforts, forging partnerships with domestic labs and ingredient innovators to safeguard supply continuity and mitigate future tariff risks. This shift toward nearshoring has driven increased collaboration between R&D teams and local suppliers, fostering the development of novel formulations that align with both regulatory requirements and premium positioning. Nonetheless, the transition has not been seamless; production timelines have extended as new quality control protocols and regulatory certifications are audited, necessitating proactive planning and inventory management.

Price sensitivity has also intensified at the consumer level. Even within the premium segment, shoppers are exhibiting heightened scrutiny around value, seeking transparent breakdowns of ingredient quality and ethical sourcing. Brands that have absorbed a portion of tariff-related costs to preserve accessible price points have enhanced perceived fairness, while those that opted for full pass-through have encountered resistance and increased cart abandonment. Consequently, strategic pricing models that balance margin preservation with consumer trust have become paramount to sustaining growth in this tariff-impacted environment.

Deriving Key Segmentation Insights That Illuminate Consumer Preferences Across Product Categories, Gender Demographics, Distribution Channels and Skin Concerns

A deep dive into product categories reveals nuanced consumer preferences across the premium cosmetics spectrum. Within bath and body care, formulations such as rich body lotions have garnered greater loyalty compared to shower gels, reflecting a prioritization of nourishing textures and indulgent sensory experiences. In the fragrance category, women’s scents continue to dominate premium sales, driven by innovation in sustainable fragrance chemistry, while men’s offerings gain traction through targeted grooming narratives and lifestyle-centric campaigns. Hair care remains vibrant, with shampoos leading demand followed by conditioners, while styling products serve as a growth lever for brands that successfully blend performance with clean ingredient claims. Makeup assortments show that foundations remain a cornerstone of the category, edged closely by eyeshadow palettes that capitalize on social-media-driven color trends, and lipsticks that resonate through limited-edition collaborations. Skincare stands out for its dynamic subsegments; moisturizers and serums have become the de facto entry points for new consumers, whereas facial cleansers and masks foster ongoing regimen adherence.

Gender dynamics continue to evolve, with female consumers driving the majority of premium beauty transactions, yet the male segment is expanding through purpose-built offerings that address specific grooming and skincare concerns. Meanwhile, distribution channel strategies have become increasingly diversified. Direct-to-consumer platforms offer brands complete control over customer data and brand experience, marketplaces deliver broad reach and convenience, online retailers provide curated discovery environments, and subscription services reinforce long-term loyalty with personalized replenishment models. Each channel demands tailored approaches to assortment, pricing, and customer service.

A focus on skin concerns underpins much of today’s product innovation. Treatments for acne remain a staple for younger demographics, anti-aging solutions resonate strongly among mature consumers, and brightening formulations draw interest from those seeking an even complexion. Hydration has emerged as a universal need, while sensitivity relief appeals to consumers prioritizing gentle, non-irritating ingredients. Brands that align their portfolios to these intersecting vectors of category, gender, channel, and concern are best poised to capture share and cultivate lasting relationships.

This comprehensive research report categorizes the Online Premium Cosmetics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Category

- Gender

- Distribution Channel

- Skin Concern

Unveiling Critical Regional Insights Highlighting Distinct Growth Trajectories Across the Americas Europe Middle East & Africa and Asia-Pacific

Regional disparities in the premium cosmetics landscape underscore the importance of tailored market strategies. In the Americas, digital penetration and direct-to-consumer maturity have created a hyper-competitive environment where brand storytelling and experiential engagement determine leadership. U.S. consumers exhibit strong loyalty to established luxury names, yet are increasingly receptive to emerging indie brands that showcase authentic narratives and socially conscious sourcing.

Across Europe, the Middle East, and Africa, regulatory frameworks around ingredient safety and sustainability drive product innovation. European markets demand rigorous eco-certifications, spurring brands to invest in green technology and carbon-neutral roadmaps. In the Middle East, premium cosmetics blend luxury heritage with modern digital convenience, while African markets are characterized by rapidly growing digital access and a burgeoning interest in locally-inspired beauty rituals.

The Asia-Pacific region remains the global growth engine, propelled by tech-savvy consumers and robust e-commerce ecosystems. Consumers in key markets such as South Korea and Japan continue to set beauty trends that reverberate worldwide, while emerging markets in Southeast Asia demonstrate outsized demand for clean, multifunctional products. Brands that can navigate complex cross-border regulations and local consumer behavior stand to gain a first-mover advantage in this dynamic, high-growth region.

This comprehensive research report examines key regions that drive the evolution of the Online Premium Cosmetics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape by Profiling Leading Companies Driving Innovation Growth Strategies Partnerships and Technological Advances

Leading players in the online premium cosmetics sphere have distinguished themselves through a blend of innovation, strategic partnerships, and digital prowess. Global heritage brands have leveraged extensive R&D capabilities to introduce novel ingredient modalities, such as biofermented actives and biotechnology-derived peptides, reinforcing their premium positioning. At the same time, agile indie brands have disrupted the market with direct-to-consumer agility, viral social campaigns, and community-driven product development.

Strategic alliances have also reshaped the competitive landscape. Collaborations between cosmetics companies and tech startups have accelerated the integration of AI skin analysis tools into e-commerce platforms, while partnerships with sustainable packaging innovators have addressed growing environmental concerns. In addition, a wave of mergers and acquisitions is consolidating market power, enabling brands to diversify portfolios and expand regional footprints rapidly.

Meanwhile, first-mover brands in subscription-based commerce have refined personalized replenishment models that increase customer lifetime value and provide invaluable data on consumption patterns. Through sophisticated CRM systems, these companies capture real-time feedback that informs future product iterations. Brands that maintain this virtuous cycle of innovation, data-driven engagement, and sustainable practices are setting the benchmark for success in the premium segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Premium Cosmetics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amorepacific Corporation

- Beiersdorf AG

- Chanel Limited

- Charlotte Tilbury Beauty Ltd

- Clarins S.A.

- Coty Inc.

- Fenty Beauty LLC

- Huda Beauty

- Kering S.A.

- KOSÉ Corporation

- L'Oréal S.A.

- La Prairie Group AG

- LVMH Moët Hennessy Louis Vuitton SE

- Natura &Co Holding S.A.

- Pat McGrath Labs

- PUIG BRANDS, S.A.

- Revlon, Inc.

- Shiseido Company, Limited

- Shu Uemura

- The Estée Lauder Companies Inc.

Proposing Actionable Recommendations That Empower Industry Leaders to Harness Emerging Technologies Strengthen Consumer Engagement and Drive Sustainable Growth

To capitalize on emerging trends and navigate an increasingly complex market environment, industry leaders should prioritize investment in advanced digital capabilities that enhance personalization and streamline customer journeys. Deploying AI-driven diagnostic tools and augmented reality try-on interfaces can deepen consumer trust and shorten purchase cycles, fostering stronger loyalty.

Simultaneously, supply chain resilience must be reinforced through diversified sourcing strategies and strategic nearshoring partnerships. By embedding agile manufacturing processes and forging relationships with domestic ingredient innovators, companies can mitigate tariff-related risks and accommodate shifts in consumer demand more rapidly.

Sustainability should remain central to long-term brand value. This entails not only adopting eco-friendly formulations and recyclable packaging but also transparently communicating progress and engaging consumers in shared environmental missions. Brands that effectively weave sustainability into the core of their narrative will resonate more deeply with purpose-driven consumers.

Finally, a holistic channel strategy is essential. Balancing direct-to-consumer control with the expansive reach of marketplaces, curated online retailers, and subscription models will optimize both customer acquisition and retention. Integrating data across these channels to form a unified view of the consumer will enable dynamic personalization and precise performance measurement, ensuring brands stay ahead of evolving preferences.

Outlining a Robust Research Methodology Combining Quantitative Data Analysis Qualitative Expert Interviews and Real-World Consumer Behavior Tracking

This research integrates a mixed-methods approach to deliver comprehensive insights into the online premium cosmetics market. Quantitative data were gathered through large-scale consumer surveys and e-commerce transaction analyses, capturing purchasing behaviors, channel preferences, and ingredient priorities across key demographics. This was complemented by secondary research, which entailed a systematic review of public financial disclosures, industry whitepapers, and regulatory filings to map competitive dynamics and tariff impacts.

On the qualitative side, expert interviews with senior executives, R&D specialists, and sustainability officers provided context around innovation pipelines, supply chain strategies, and emerging consumer sentiment. Ethnographic studies and digital focus groups enriched our understanding of evolving lifestyle trends and unarticulated consumer needs, while proprietary social listening tools tracked shifts in brand perceptions and topic virality across key regions.

Finally, rigorous data triangulation and validation processes were employed to ensure analytical robustness. Cross-referencing findings from diverse sources minimized bias and reinforced the reliability of strategic recommendations. This methodological rigor underpins the depth and accuracy of the insights presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Premium Cosmetics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Premium Cosmetics Market, by Product Category

- Online Premium Cosmetics Market, by Gender

- Online Premium Cosmetics Market, by Distribution Channel

- Online Premium Cosmetics Market, by Skin Concern

- Online Premium Cosmetics Market, by Region

- Online Premium Cosmetics Market, by Group

- Online Premium Cosmetics Market, by Country

- United States Online Premium Cosmetics Market

- China Online Premium Cosmetics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing the Core Findings and Strategic Implications That Position Stakeholders to Navigate the Evolving Premium Cosmetics Arena With Confidence and Agility

The findings of this report reveal a market in rapid flux, where digital innovation, sustainability, and consumer empowerment converge to shape the future of premium cosmetics. Tariff‐driven cost pressures have catalyzed a shift toward localized supply chains, while segmentation insights underscore the importance of aligning portfolios with evolving consumer concerns across categories and channels. Regional analysis highlights unique market dynamics in the Americas, EMEA, and Asia-Pacific, each presenting distinct opportunities and regulatory considerations.

Competitive profiling demonstrates that success in this arena belongs to brands that can marry heritage-driven R&D excellence with the agility of direct-to-consumer models and community-fuelled marketing. Actionable recommendations emphasize the critical role of emerging technologies, supply chain resilience, sustainability, and integrated channel strategies in driving growth and consumer loyalty.

Stakeholders equipped with these strategic imperatives are positioned to navigate complexity with confidence and agility. By leveraging robust data, embracing innovation, and remaining attuned to purpose-driven consumer values, companies can chart a course toward sustained leadership in the online premium cosmetics market.

Drive Strategic Decision-Making by Reaching Out to Ketan Rohom Associate Director Sales & Marketing to Secure Premium Cosmetics Market Research Report

To gain a competitive edge and make informed strategic decisions aligned with current market dynamics, reach out to Ketan Rohom Associate Director Sales & Marketing at your earliest convenience. By securing the premium cosmetics market research report, you will obtain the detailed insights and actionable intelligence required to optimize your product launches, refine distribution strategies, and enhance consumer engagement across every channel. Partnering with Ketan Rohom unlocks direct access to proprietary data, expert analysis, and tailored guidance that will empower your organization to navigate challenges, seize emerging opportunities, and accelerate growth in this rapidly evolving digital landscape.

- How big is the Online Premium Cosmetics Market?

- What is the Online Premium Cosmetics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?