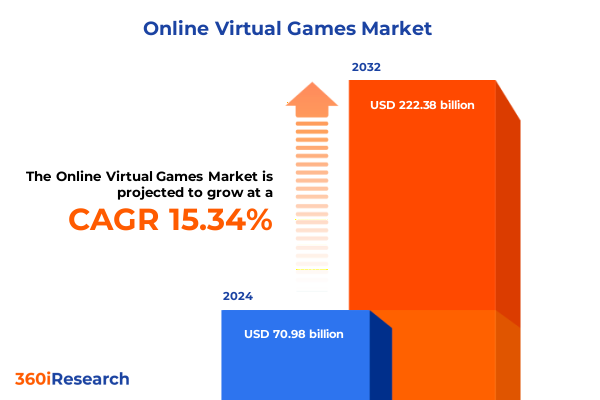

The Online Virtual Games Market size was estimated at USD 80.62 billion in 2025 and expected to reach USD 93.21 billion in 2026, at a CAGR of 15.59% to reach USD 222.38 billion by 2032.

Pioneering the Future of Online Virtual Gaming with a Comprehensive Overview of Market Dynamics Emerging in the Digital Entertainment Ecosystem

In today’s digital entertainment era, online virtual games have transcended traditional leisure roles to become vibrant social platforms and immersive experiences that engage millions of users across the globe. Advances in high-speed internet connectivity, real-time rendering engines, and sophisticated user interfaces have converged to deliver unparalleled levels of engagement, enabling players to inhabit richly detailed virtual worlds that respond dynamically to their actions and decisions. These developments have catalyzed a rapid expansion of virtual ecosystems, blurring the lines between gaming, social networking, and digital commerce.

Furthermore, the proliferation of cloud-based architectures and cross-platform compatibility has democratized access to high-fidelity experiences, allowing users on consoles, personal computers, and mobile devices to interact seamlessly. Emerging hardware innovations such as next-generation consoles, virtual reality headsets, and mobile GPUs have further fueled consumer expectations for hyper-realistic graphics and low-latency gameplay. Simultaneously, developers are harnessing advanced analytics and machine learning to personalize user journeys, optimize in-game economies, and bolster retention.

This executive summary provides an in-depth exploration of the forces driving evolution in online virtual gaming. It outlines transformative shifts in technology and player behavior, evaluates external factors such as tariff policies, and presents critical segmentation and regional insights. Additionally, it highlights the competitive strategies of leading companies and offers actionable recommendations for industry stakeholders. By synthesizing a comprehensive methodology and concluding with key takeaways, this overview equips decision-makers with the strategic context needed to navigate and capitalize on the rapidly changing virtual entertainment domain.

Uncovering Game-Changing Transformations Reshaping the Online Virtual Gaming Landscape Through Technological Innovation and User Behavior Evolution

The online virtual gaming sphere has undergone a profound metamorphosis driven by breakthroughs in cloud streaming, immersive technologies, and artificial intelligence. Cloud-based gaming services are eliminating hardware barriers, enabling players to access high-definition experiences on low-spec devices, while simultaneously shifting cost structures for developers and distributors. Virtual reality and augmented reality platforms are transforming user engagement by integrating physical movement and spatial audio into gameplay, fostering deeper emotional connections and opening new avenues for monetization.

Moreover, generative AI is being integrated to craft dynamic narratives and procedurally generated environments that adapt to individual player profiles, enhancing replayability and reducing development lead times. Blockchain-powered ecosystems are facilitating user-generated content economies, where players and creators can trade digital assets securely, creating novel revenue streams and fostering community ownership. Social gaming has also evolved, with cross-platform interactions and live-service models creating persistent worlds that host competitive tournaments, live events, and co-creative experiences.

As a result, the traditional boundaries between hardcore and casual gaming are dissolving, giving rise to a more inclusive and socio-technological environment. This shift compels stakeholders to reassess value propositions, address emerging regulatory frameworks, and invest in flexible architectures that support continuous innovation and community-driven growth. Through these tectonic transformations, the landscape is being rewritten, positioning online virtual games at the forefront of digital entertainment convergence.

Assessing the Cascading Effects of 2025 United States Tariff Policies on Online Virtual Gaming Hardware, Distribution Channels, and Consumer Pricing

The imposition of new United States tariffs in 2025 on imported electronic components and consumer hardware has introduced additional cost pressures across the online virtual gaming value chain. Manufacturers sourcing GPUs, memory modules, and specialized processors from overseas suppliers are confronting increased landed costs, which are cascading through production budgets and pricing strategies. This development has prompted some hardware vendors to reevaluate their supply networks, seek alternative sourcing within allied markets, and accelerate inventory planning to mitigate exposure to potential tariff escalations.

These shifts are also reverberating through distribution channels. Retailers and digital storefronts are reassessing promotional calendars to account for higher input expenses, while platform holders are exploring cooperative purchasing agreements and revising licensing terms to balance margin constraints. Concurrently, content creators and publishers are facing dilemmas around in-game pricing models, as player sensitivity to microtransaction fees and subscription adjustments intensifies amid broader economic headwinds.

In response, many industry participants are prioritizing vertical integration and strategic partnerships to control component pipelines and stabilize cost bases. Additionally, increased emphasis on software-as-a-service offerings reduces dependency on physical hardware sales, enabling firms to diversify revenue flows and create more resilient business models. Companies that proactively adapt to these tariff-driven realities by optimizing supply logistics and fortifying digital channels are likely to sustain competitive agility and preserve consumer trust.

Revealing Key Segmentation Insights Driving Market Penetration Across Platforms Revenue Models Genres Distribution Channels and Player Modes

A nuanced understanding of platform segmentation reveals that console ecosystems-encompassing both handheld and home console experiences-continue to drive premium engagement through exclusive titles and high-fidelity graphics. Handheld consoles are leveraging portability and specialized controls to target on-the-go gamers, while home consoles remain focal points for flagship franchises and immersive peripherals. Mobile platforms, divided between smartphones and tablets, harness the ubiquity of Android and iOS devices to deliver accessible gaming, with smartphone titles capitalizing on diverse hardware capabilities and tablet interfaces providing expanded screen real estate for more complex interactions. Meanwhile, personal computers operating on Windows, macOS, and Linux enable extensive customization, modding communities, and cloud gaming integration for users who demand flexibility and performance.

In the realm of revenue models, ad-supported frameworks-ranging from banner and interstitial advertisements to rewarded video spots-serve as entry points for free-to-play audiences. The free-to-play sector sustains itself through in-app advertising and purchases, enticing broader demographics with zero upfront cost and optional monetization. Subscription services, whether monthly or annual, offer curated libraries, exclusive content, and value-added features that foster long-term loyalty. Premium pricing remains relevant for high-profile releases and collector’s editions, targeting enthusiasts willing to pay for complete experiences without recurring fees.

Genre segmentation underscores diversity in player preferences: action titles, including fighting, platformer, and shooter variants, drive competitive engagement, whereas casual games-spanning arcade, hyper casual, and puzzle formats-capture casual user attention. Role-playing realms, from action RPGs to MMORPGs and tactical RPGs, emphasize narrative depth and cooperative play. Simulation genres cover life simulation and vehicle simulation, appealing to niche audiences seeking realistic or gamified replicas of everyday and specialized environments. Sports categories range from racing simulations to team-based competitions, and strategic offerings encompass real-time and turn-based experiences that challenge cognitive skills.

Distribution channels further shape market dynamics through browser-based HTML5 deployments, console storefronts such as PlayStation Store, Switch eShop, and Xbox Store, mobile marketplaces on Apple App Store and Google Play Store, and PC download venues like Epic Games Store and Steam. Finally, player modes-spanning single-player adventures to multiplayer experiences that include cooperative scenarios, offline local play, and expansive online ecosystems-drive social connectivity and emergent gameplay. Together, these segmentation insights illustrate the intricate tapestry of the online virtual gaming market, offering stakeholders a clear map of player segments and monetization opportunities.

This comprehensive research report categorizes the Online Virtual Games market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform

- Revenue Model

- Genre

- Player Mode

- Distribution Channel

Delivering Strategic Regional Intelligence Highlighting Diverse Market Dynamics and Opportunities Across the Americas EMEA and Asia Pacific Regions

Regional markets in the Americas exhibit robust demand for both AAA console titles and mobile-first experiences, underpinned by high smartphone penetration and widespread broadband connectivity. North American consumers are particularly receptive to subscription-based ecosystems and cloud gaming trials, while Latin American markets demonstrate rapid adoption of freemium mobile titles that cater to price-sensitive demographics.

In the Europe, Middle East & Africa region, regulatory frameworks and diverse linguistic landscapes create both challenges and opportunities. Western Europe’s mature console and PC user base contrasts with emerging markets in Eastern Europe and North Africa, where mobile gaming surges as the primary form of digital entertainment. Regulatory emphasis on data privacy and content standards drives companies to invest in localized compliance and community moderation tools.

The Asia-Pacific region remains the largest contributor to global active user counts, with East Asian markets maintaining leadership in competitive multiplayer genres and live-service innovations. Southeast Asia’s mobile-first culture fuels steady growth in casual and hyper casual segments, while Oceania’s high ARPU (average revenue per user) supports premium console and subscription models. Across APAC, strategic partnerships with telecom operators and 5G infrastructure rollouts are enabling low-latency cloud gaming adoption and enriched mixed-reality applications.

Collectively, these regional insights underscore the importance of tailored go-to-market strategies that address varying consumer preferences, regulatory environments, and technological readiness levels. Companies that align product roadmaps with localized demands and infrastructure capabilities will be best positioned to capture share and foster sustainable engagement across diverse geographies.

This comprehensive research report examines key regions that drive the evolution of the Online Virtual Games market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies of Leading Industry Players Shaping Innovation Monetization and Market Reach in the Global Online Virtual Gaming Ecosystem

Leading players in the virtual gaming domain are deploying multifaceted strategies to secure competitive advantage. Console manufacturers are leveraging exclusive content pipelines to drive hardware sales, while simultaneously expanding subscription-based services that bundle first-party and third-party titles. Meanwhile, platform-agnostic publishers are forging alliances with cloud providers to reduce friction for cross-device access and to tap into global server infrastructures.

Major studios are also investing heavily in proprietary engines and middleware to accelerate development cycles and to deliver distinctive visual fidelity. This vertical integration not only streamlines content pipelines but also deepens barriers to entry for indie newcomers. Conversely, emergent companies are differentiating through user-generated content platforms and open-world tools, empowering communities to create, share, and monetize their own assets and experiences.

Additionally, marketing and monetization strategies are evolving. Established franchises are exploring live-ops models with seasonal content drops, live events, and esports tie-ins to prolong engagement. At the same time, subscription and cloud-only titles experiment with hybrid monetization-combining free-to-play mechanics with optional premium upgrades. Cross-promotion across media properties, including film adaptations and branded merchandise, further expands IP value beyond traditional game ecosystems.

Finally, data-driven insights are central to strategic decision-making. By harnessing analytics on user behavior, monetization performance, and social interactions, companies can rapidly iterate on gameplay systems, tailor promotional campaigns, and optimize resource allocation. In an environment where agility is paramount, these competitive strategies underscore the diverse pathways to value creation in the global online virtual gaming ecosystem.

This comprehensive research report delivers an in-depth overview of the principal market players in the Online Virtual Games market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Activision Blizzard, Inc.

- Amazon.com, Inc.

- Apple Inc.

- Bandai Namco Entertainment Inc.

- Electronic Arts Inc.

- Epic Games, Inc.

- Google LLC by Alphabet Inc.

- Microsoft Corporation

- NetEase, Inc.

- Nintendo Co., Ltd.

- Roblox Corporation

- Sea Limited

- Sega Corporation

- Sony Group Corporation

- Square Enix Holdings Co., Ltd.

- Take-Two Interactive Software, Inc.

- Tencent Holdings Ltd.

- Ubisoft Entertainment SA

- Valve Corporation

- Zynga Inc.

Formulating Strategic Actionable Recommendations Enabling Industry Leaders to Enhance Growth Drive Innovation Navigate Regulatory and Technological Challenges

To thrive amid accelerating technological and regulatory change, industry leaders must prioritize flexible cloud-native architectures that support real-time scaling and cross-platform interoperability. Embracing modular development pipelines and containerized services will reduce time-to-market and enable seamless updates across diverse hardware configurations. In parallel, cultivating strategic partnerships with network providers ensures low-latency delivery, creating smoother experiences for users and mitigating churn.

Moreover, companies should adopt diversified monetization frameworks that balance ad-supported models, subscription offerings, and premium experiences. By leveraging machine learning to personalize pricing, content recommendations, and promotional incentives, firms can increase average revenue per user while maintaining satisfaction and trust. Sensitivity to regional economic conditions and regulatory constraints is critical when tailoring these revenue strategies.

Investment in AI-driven content generation can streamline resource-intensive development tasks and power dynamic in-game events, yet organizations must establish clear governance frameworks to address creative quality and ethical considerations. Similarly, exploring blockchain for secure digital asset ownership can unlock secondary marketplaces, though pilot programs should be scoped to manage risk and regulatory compliance.

Finally, leadership teams must foster a culture of continuous learning and rapid experimentation. By instituting metrics-driven reviews and cross-functional innovation labs, companies will be better equipped to identify emerging trends, validate new business models, and pivot in response to shifting player behaviors. These actionable recommendations collectively position industry stakeholders to harness growth, drive innovation, and navigate the complex challenges ahead.

Detailing Robust Mixed Methodology Approaches Integrating Primary Research Secondary Data Triangulation and Expert Consultations for Comprehensive Analysis

This analysis is underpinned by a mixed-methodology approach combining primary and secondary research. Primary data was gathered through structured interviews with senior executives spanning console manufacturers, middleware vendors, cloud service providers, and leading development studios. Expert consultations provided nuanced perspectives on regulatory developments, technological roadmaps, and evolving monetization frameworks.

Secondary research encompassed a thorough review of academic journals, industry white papers, patent filings, and company disclosures. Rigorous triangulation of historical data trends with desk-based intelligence ensured the validity of observed patterns and mitigated potential biases. In addition, web scraping of community forums, social media platforms, and user review aggregators offered insights into real-time sentiment shifts and emergent gameplay preferences.

Quantitative metrics such as active user counts, retention rates, and average session durations were contextualized through qualitative thematic analysis. This enabled a comprehensive understanding of key drivers and inhibitors across market segments. Supplementary benchmarking exercises were conducted to evaluate competitive positioning against analogous digital entertainment verticals.

Throughout the research process, strict adherence to ethical standards and data privacy regulations was maintained. Findings were synthesized via collaborative workshops with domain experts, ensuring that the final deliverables reflect both strategic relevance and operational applicability. This robust methodological foundation underlies the credibility and actionability of the insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Online Virtual Games market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Online Virtual Games Market, by Platform

- Online Virtual Games Market, by Revenue Model

- Online Virtual Games Market, by Genre

- Online Virtual Games Market, by Player Mode

- Online Virtual Games Market, by Distribution Channel

- Online Virtual Games Market, by Region

- Online Virtual Games Market, by Group

- Online Virtual Games Market, by Country

- United States Online Virtual Games Market

- China Online Virtual Games Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3180 ]

Drawing Together Strategic Conclusions Underscoring Critical Insights and Imperatives Forging the Next Chapter of Innovation in Online Virtual Gaming

The convergence of emerging technologies, evolving consumer behaviors, and shifting regulatory environments underscores an inflection point for online virtual gaming. Companies that recognize the transformative potential of cloud streaming, AI-driven personalization, and community-centric monetization will secure sustainable growth and differentiated market positions. Conversely, those slow to adapt risk obsolescence as agile competitors leverage modular architectures and data-driven strategies.

Region-specific dynamics, from North American subscription uptake to Asia-Pacific’s mobile dominance and EMEA’s regulatory complexities, highlight the necessity for tailored go-to-market plays. In parallel, the imposition of tariff policies in 2025 has illuminated the importance of supply chain resilience and cost diversification through software-led offerings.

As industry leaders navigate this multifaceted environment, core imperatives emerge: embrace modular, cloud-native infrastructures; foster iterative innovation through AI and blockchain; and cultivate deep regional insights that inform customized experiences. By synthesizing these strategic threads with a nuanced understanding of segmentation and competitive behavior, organizations can craft compelling value propositions that resonate across diverse player cohorts.

Ultimately, the path forward lies in balancing visionary experimentation with disciplined execution. This equilibrium will enable stakeholders to capture the next wave of opportunities and shape the future of digital entertainment, driving enduring engagement and financial outperformance in the online virtual gaming domain.

Empower Your Strategy Today by Connecting with Ketan Rohom for In-depth Insights and Access to the Market Research Report Tailored to Your Business Needs

Engaging directly with Ketan Rohom offers you the opportunity to translate these insights into strategic advantage for your organization. Through an in-depth conversation, you will gain clarity on how the latest shifts in technology, consumer behavior, and regulatory landscapes intersect with your unique goals. This call to action empowers your team to leverage firsthand expertise and secure early access to the full report, enabling you to make data-informed decisions that align with emerging market imperatives. By connecting with an experienced sales and marketing leader, you can customize the research deliverables to reflect your priorities, ensuring maximum relevance and impact. Seize this moment to strengthen your competitive positioning and drive innovation by reaching out today to secure your copy of the complete market research analysis.

- How big is the Online Virtual Games Market?

- What is the Online Virtual Games Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?