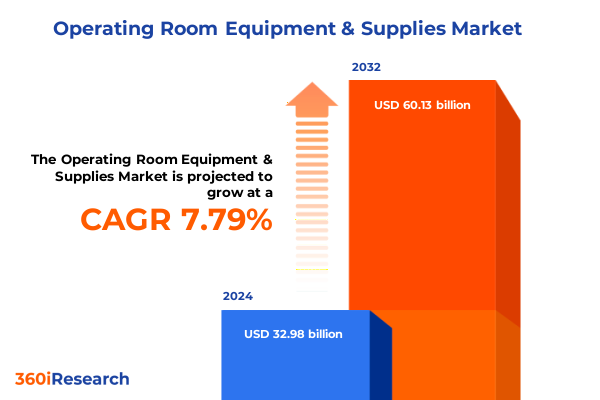

The Operating Room Equipment & Supplies Market size was estimated at USD 34.98 billion in 2025 and expected to reach USD 37.10 billion in 2026, at a CAGR of 8.04% to reach USD 60.13 billion by 2032.

Comprehensive Overview of Operating Room Equipment & Supplies Market Dynamics and Strategic Drivers Influencing Surgical Innovations

The operating room equipment and supplies sector stands at the confluence of medical innovation, technological advancement, and ever-evolving clinical demands. As healthcare systems worldwide strive to improve patient outcomes and drive operational efficiency, the instruments and devices deployed within surgical theatres have become pivotal to achieving these goals. From advanced imaging solutions to precision-driven surgical tables, the breadth of solutions encompasses both legacy platforms and cutting-edge digital integrations that redefine procedural workflows.

In recent years, interdisciplinary collaboration among clinicians, engineers, and regulatory experts has accelerated the pace of innovation. This has ushered in an era marked by the digital convergence of robotics, data analytics, and minimally invasive techniques. Such integration not only enhances surgeon visibility and dexterity but also elevates postoperative patient recovery through reduced trauma and shorter hospital stays. Consequently, hospitals and ambulatory centers are reassessing their equipment strategies to balance cost considerations with the imperative for advanced clinical capabilities.

This executive summary delves into the transformative shifts reshaping the landscape, evaluates the cumulative impact of emerging tariff measures, and distills key segmentation, regional, and competitive insights. Through a structured analysis, industry leaders will gain clarity on prevailing trends, strategic hotspots, and pragmatic recommendations essential for navigating the dynamic operating room equipment environment moving forward.

Emerging Forces Redefining Operating Room Equipment & Supplies Ecosystem and Catalyzing Next-Generation Surgical Efficiency and Safety

The operating room equipment landscape has undergone profound transformation driven by technological breakthroughs and shifting clinical protocols. Digitally enabled systems now form the backbone of perioperative care, integrating real-time data exchange between surgical suites and remote monitoring platforms. This interoperability has facilitated a departure from siloed instrumentation toward cohesive surgical ecosystems that optimize workflow efficiency and enhance safety through advanced automation and predictive maintenance.

Simultaneously, the proliferation of minimally invasive and robotic-assisted approaches has intensified demand for instrumentation that supports high-precision maneuvers within confined anatomical spaces. Manufacturers have responded by refining endoscopic optics, developing intelligent insufflation controls, and embedding haptic feedback within robotic interfaces. These advancements have collectively reduced the procedural learning curve for specialists and amplified the adoption of tier-one technologies in both academic and community settings.

Moreover, heightened emphasis on sustainability and lifecycle management is compelling providers to scrutinize the total cost of ownership. Operating room integration systems and sterilization platforms are now evaluated not only on performance metrics but also on energy consumption, sterilization cycle efficacy, and compatibility with eco-friendly consumables. Consequently, vendors are investing in modular designs that facilitate component-level upgrades, thereby extending product lifecycles and aligning with institutional environmental commitments.

Analysis of United States 2025 Tariff Policies Impacting Operating Room Equipment Supply Chains, Manufacturing Costs, and Procurement Strategies

In 2025, United States tariff policies have exerted tangible effects on the procurement and manufacturing strategies for surgical instrumentation and supporting technologies. Progressive tariff impositions on select imported devices have led healthcare purchaser groups and distributors to reassess sourcing paradigms, with a notable shift toward domestic production and nearshoring initiatives to mitigate added cost burdens. Consequently, original equipment manufacturers have accelerated investments in U.S.-based assembly lines to preserve price competitiveness while maintaining adherence to stringent quality standards.

The ripple effects of these measures extend beyond direct import duties. Ancillary components such as imaging cameras, insufflators, and electrosurgical accessories have seen lead times fluctuate as supply chains realign to accommodate localization efforts. Scrutiny over vendor resilience has intensified, prompting many stakeholders to diversify their supplier portfolios and implement dual-sourcing frameworks that balance cost, capacity, and compliance with evolving trade regulations.

Simultaneously, innovative financing models have surfaced to alleviate immediate capital outlay pressures. Leasing arrangements and performance-based contracts offer flexibility, enabling facilities to access premium operating room integration systems and robotic platforms without incurring steep upfront fees. These adaptive strategies underscore the industry’s collective pursuit of financial agility amid a shifting regulatory milieu.

Holistic Exploration of Key Market Segmentation Insights Shaping Product Development, Adoption Patterns, and End-User Requirements in the Surgical Arena

A nuanced understanding of product segmentation reveals critical pathways for product developers and purchasing teams alike. Within the core equipment category, endoscopy solutions have subdivided into flexible and rigid platforms, each catering to distinct procedural requirements from gastrointestinal diagnostics to orthopedic interventions. Imaging solutions further diversify into intraoperative C-arm systems, high-definition endoscopy cameras, and surgical microscopes, enabling surgeons to visualize complex anatomical structures with unmatched clarity. Parallel advancements in fluid management technologies, encompassing both warming devices and insufflation systems, underscore the relentless pursuit of patient safety and optimal physiological parameter control during prolonged procedures.

Technological segmentation delineates between open surgical instruments, the traditional workhorse of the operating theatre, and the specialized platforms supporting both minimally invasive and robot-assisted procedures. This differentiation underscores the growing interplay between human dexterity and machine precision, as device developers tailor solutions to bridge tactile familiarity with digital augmentation. Practitioners in specialties such as cardiovascular, neurosurgery, and urology are at the forefront of deploying these innovations, leveraging application-specific instrumentation innovations to expand procedural capabilities and reduce perioperative risk.

End-user segmentation completes the strategic framework, highlighting the divergent purchasing priorities among hospitals, ambulatory surgical centers, and specialty clinics. Hospitals often require comprehensive integration across multiple surgical disciplines, whereas ambulatory centers emphasize throughput optimization and lean consumable management. Specialty clinics, in turn, demand highly focused instrumentation sets calibrated for high-volume, procedure-specific workflows. Recognizing these distinct requirements fosters targeted product roadmaps and service offerings that resonate with each segment’s operational realities.

This comprehensive research report categorizes the Operating Room Equipment & Supplies market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Equipment Type

- Technology

- Application

- End User

Strategic Regional Insights Revealing Distinct Growth Drivers, Investment Priorities, and Regulatory Landscapes Across Global Operating Room Equipment Markets

Regional dynamics exert significant influence on the trajectory of operating room equipment investments and regulatory compliance. In the Americas, robust infrastructure modernization programs and heightened emphasis on surgical throughput have catalyzed procurement of advanced integration systems and energy-efficient sterilization platforms. Healthcare networks are aligning capital expenditure with value-based care mandates, fostering partnerships that underscore equipment standardization and data-driven performance benchmarking.

In Europe, the Middle East, and Africa region, regulatory harmonization efforts have streamlined device approvals, enabling faster market entry for innovative surgical lighting, robotic-assisted platforms, and imaging modalities. Concurrently, public–private collaborations are mobilizing resources to upgrade outdated operating theatres, particularly in emerging markets, driving demand for scalable, modular solutions that can adapt to diverse clinical settings.

Asia-Pacific continues to lead in adoption momentum due to rising surgical volumes and expanding access to private healthcare services. Governments across the region are prioritizing domestic manufacturing capabilities to support national health objectives, prompting global vendors to forge joint ventures and technology licensing agreements. These strategic alliances facilitate knowledge transfer while maintaining alignment with regional procurement guidelines and localized value propositions.

This comprehensive research report examines key regions that drive the evolution of the Operating Room Equipment & Supplies market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Critical Analysis of Leading Industry Players’ Strategic Initiatives, Collaborations, and Competitive Differentiators Driving the Operating Room Equipment Sector

Leading participants are differentiating through a combination of strategic alliances, targeted acquisitions, and proprietary technology development. Major medical device manufacturers are augmenting their portfolios with AI-enabled imaging analytics and intraoperative decision support tools, forging alliances with software innovators to deliver holistic surgical solutions. Concurrently, specialist firms in endoscopy and fluid management are leveraging niche capabilities to establish premium product lines that capture clinical endorsement in key therapeutic areas such as neurosurgery and orthopedics.

Collaborative frameworks between OEMs and academic medical centers have become increasingly prevalent, as co-development programs accelerate the translation of research breakthroughs into commercially viable instruments. These partnerships often incorporate shared risk–reward models, encouraging rapid prototyping and iterative feedback cycles that refine product ergonomics and clinical performance. In parallel, distribution and service networks have been expanded through acquisitions of logistics providers, ensuring comprehensive aftermarket support and reducing total cost of ownership for end users.

Competitive differentiators also stem from an organization’s ability to provide end-to-end solutions. Vendors that bundle integration platforms with training, remote maintenance, and analytics services are securing tier-one contracts, leveraging their capacity to minimize downtime and drive measurable improvements in surgery scheduling and outcomes. This convergence of hardware, software, and service underscores the shift toward solution-oriented business models in the operating room equipment sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Operating Room Equipment & Supplies market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun Melsungen AG

- Baxter International Inc.

- Cardinal Health, Inc.

- Getinge AB

- Johnson & Johnson

- Karl Storz GmbH & Co. KG

- Medtronic plc

- Siemens Healthineers AG

- STERIS plc

- Stryker Corporation

- Zimmer Biomet Holdings, Inc.

Strategic and Pragmatic Recommendations Empowering Industry Leaders to Enhance Innovation, Streamline Supply Chains, and Accelerate Market Penetration

Industry leaders seeking to maintain a competitive edge should prioritize investment in modular platforms that facilitate upgrades without wholesale system replacements. Embracing open-architecture designs will enable seamless integration of emerging technologies and foster long-term partnerships with software innovators. Additionally, cultivating a robust domestic manufacturing footprint can mitigate tariff-related cost pressures while enhancing supply chain transparency and responsiveness.

Stakeholders should also explore diversified procurement strategies, including performance-based contracts that align equipment costs with uptime guarantees and clinical outcomes. This model not only appeals to value-based care frameworks but also incentivizes vendors to deliver continuous improvements in reliability and support. Furthermore, establishing dedicated training centers will expedite clinician adoption of advanced systems, enhancing user proficiency and accelerating return on investment.

Sustainability considerations should inform product development roadmaps and procurement decisions alike. Prioritizing energy-efficient sterilization and lighting solutions, as well as exploring reusable instrument platforms, can contribute to institutional environmental goals while reducing lifecycle expenses. By proactively addressing these areas, organizations can enhance operational resilience and position themselves to capitalize on the next wave of surgical innovation.

Transparent and Rigorous Research Methodology Underpinning Data Collection, Validation Processes, and Analytical Rigor in the Operating Room Equipment Study

This study employed a blended methodology that combined primary interviews with key opinion leaders, surgeons, and procurement directors alongside comprehensive secondary research of regulatory filings, patent databases, and peer-reviewed literature. Primary engagements were conducted through structured interviews and workshops, facilitating in-depth exploration of clinical challenges and purchasing criteria across diverse healthcare settings.

Secondary data collection encompassed analysis of publicly available financial disclosures and trade intelligence platforms to map competitive landscapes and tariff developments. Data triangulation ensured consistency between market narratives and quantifiable metrics, while iterative validation sessions with advisory board members refined the interpretation of emerging trends. Both bottom-up and top-down analytical frameworks were applied to cross-verify findings, enhancing the robustness of segmentation insights and regional assessments.

A rigorous quality assurance process, including peer reviews and editorial oversight, further ensured that analytical outputs adhere to the highest standards of accuracy and relevance. This multi-stage validation protocol underpins the confidence stakeholders can place in the strategic recommendations and market interpretations presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Operating Room Equipment & Supplies market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Operating Room Equipment & Supplies Market, by Equipment Type

- Operating Room Equipment & Supplies Market, by Technology

- Operating Room Equipment & Supplies Market, by Application

- Operating Room Equipment & Supplies Market, by End User

- Operating Room Equipment & Supplies Market, by Region

- Operating Room Equipment & Supplies Market, by Group

- Operating Room Equipment & Supplies Market, by Country

- United States Operating Room Equipment & Supplies Market

- China Operating Room Equipment & Supplies Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Comprehensive Conclusion Synthesizing Core Findings and Strategic Implications for Stakeholders in the Dynamic Operating Room Equipment and Supplies Market

In conclusion, the operating room equipment and supplies sector is undergoing a period of dynamic evolution, propelled by digital integration, procedural innovation, and shifting trade policies. The maturation of minimally invasive and robot-assisted technologies, coupled with robust research collaborations, has elevated the standards of surgical care while presenting new considerations for procurement and lifecycle management. Concurrently, tariff measures have reshaped supply chain strategies, reinforcing the imperative for localized manufacturing and diversified sourcing.

Segmentation analysis has revealed the multifaceted nature of demand across product types, technologies, applications, and end users, emphasizing the importance of tailored solutions that address specific clinical and operational objectives. Regional insights underscore the heterogeneous growth trajectories and regulatory ecosystems that must be navigated, while competitive analysis highlights the centrality of strategic alliances and integrated service models in securing market leadership.

The recommendations outlined herein offer a roadmap for stakeholders to harness innovation, optimize cost structures, and reinforce supply chain resilience. By integrating methodological rigor with actionable intelligence, this executive summary provides the strategic clarity necessary for decision-makers to thrive in an increasingly complex surgical environment.

Engage with Our Associate Director to Unlock Comprehensive Insights and Secure Your In-Depth Operating Room Equipment Market Research Report Today

We invite you to connect directly with our Associate Director, Sales & Marketing, Ketan Rohom, to explore how this comprehensive report can inform your strategic initiatives and fuel your growth in the operating room equipment space. Engaging with Ketan offers a streamlined path to obtain in-depth data, tailored insights, and expert guidance that align with your organization’s unique priorities. By securing this market research report, you will gain the competitive intelligence necessary to navigate evolving regulatory landscapes, optimize supply chains, and capitalize on emerging technological trends. Reach out to schedule a personalized consultation and discover the actionable intelligence that will empower your decision-making and drive long-term success in surgical innovation and procurement strategies.

- How big is the Operating Room Equipment & Supplies Market?

- What is the Operating Room Equipment & Supplies Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?