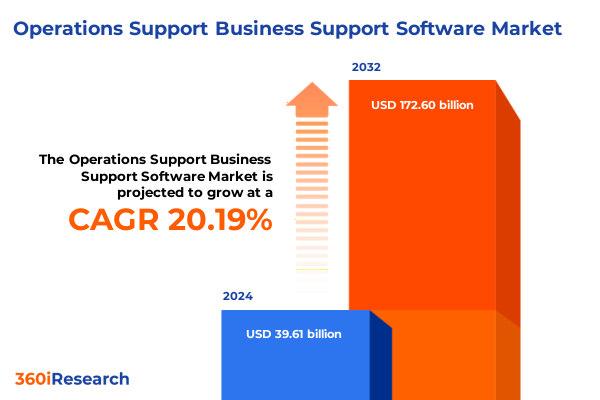

The Operations Support Business Support Software Market size was estimated at USD 47.78 billion in 2025 and expected to reach USD 56.35 billion in 2026, at a CAGR of 20.13% to reach USD 172.60 billion by 2032.

Understanding the Evolving Operations Support Software Ecosystem and Its Critical Role in Streamlining Enterprise Business Support Functions

The landscape of enterprise operations support software has transformed dramatically in recent years, driven by an increasing imperative for organizations to streamline complex processes and deliver seamless service experiences. As businesses navigate the demands of digital transformation, the adoption of advanced service desk management, workflow automation, and analytics-driven performance monitoring has become indispensable. Enterprises are no longer satisfied with standalone point solutions but seek integrated platforms that offer end-to-end visibility and contextual intelligence. This shift reflects a broader recognition that operational efficiency and business continuity are inextricably linked to customer satisfaction and competitive differentiation.

Against this backdrop, the introduction of sophisticated asset and configuration management capabilities has empowered IT and telecom companies to maintain high availability and rapid issue resolution, while sectors such as BFSI and healthcare leverage these systems to ensure regulatory compliance and protect sensitive data. Moreover, the emergence of usage-based pricing models has encouraged organizations to align software consumption with actual business outcomes, fostering cost transparency and agility. In this context, the operations support software ecosystem has evolved from a productive cost center into a strategic enabler of growth, enabling enterprises to anticipate challenges, optimize resource allocation, and deliver proactive support across distributed environments.

Exploring the Major Disruptive Technological Advancements and Digital Transformation Trends Reshaping Operations Support Software Landscape Worldwide

Technological advancements in artificial intelligence, machine learning, and cloud computing have driven profound shifts in the operations support software landscape. Artificial intelligence algorithms now underpin predictive maintenance frameworks, enabling organizations to identify potential disruptions before they escalate into service outages. Concurrently, machine learning-powered analytics platforms have redefined network performance management by offering dynamic insights into traffic patterns and anomaly detection. These innovations have catalyzed a move away from reactive troubleshooting toward a more proactive, data-driven approach.

Similarly, the widespread adoption of cloud and hybrid deployment models has unlocked unprecedented flexibility, allowing businesses to scale their support infrastructure in line with fluctuating demands. This transition has been accentuated by the growth of subscription licensing, which reduces upfront capital expenditure and simplifies software lifecycle management. Additionally, the integration of service desk management solutions with collaboration and communication platforms has accelerated incident resolution, fostering a more cohesive service delivery framework. Collectively, these transformative trends are reshaping how enterprises architect their operations support strategies, driving efficiencies that extend far beyond traditional boundaries.

Analyzing the Comprehensive Effects of Newly Implemented United States Tariffs in 2025 on the Operations Support Software Market and Supply Chains

The imposition of new tariffs by the United States in 2025 has had a multifaceted impact on the operations support software industry. Heightened import duties on hardware components and related infrastructure have contributed to an increase in total cost of ownership for on-premises deployments, prompting many organizations to reevaluate their deployment strategy. As a result, there has been a noticeable shift toward cloud and hybrid solutions, which offer reduced reliance on geopolitical supply chains and lower capital expenditure requirements.

Moreover, tariff-induced supply chain delays have underscored the importance of integrated asset and configuration management capabilities that provide real-time visibility into both software and hardware assets. These systems have enabled IT managers to mitigate the risk of part shortages and to reallocate resources more effectively when traditional procurement channels face disruption. Importantly, the tariffs have also amplified the appeal of usage-based pricing models, as organizations seek to align expenditure with service consumption and avoid long-term licensing commitments that may be subject to future trade policy volatility.

Uncovering Critical Market Segmentation Dimensions That Drive Tailored Solutions and Strategic Focus in the Operations Support Software Arena

A nuanced understanding of market segmentation proves critical to developing targeted operations support software solutions. When considering pricing model strategies, software vendors have calibrated offerings across perpetual licensing, subscription, and usage-based structures to cater to diverse customer requirements for budget predictability and consumption flexibility. In terms of deployment type, enterprises weigh the trade-off between cloud, hybrid, and on-premises installations, balancing considerations of scalability, security, and compliance. Organizational size further refines this picture, with large enterprises leveraging extensive in-house resources for bespoke integrations, while small and medium enterprises prioritize simplicity and rapid time to value. Component-level segmentation reveals demand for robust asset and configuration management, sophisticated network performance management, advanced reporting and analytics, streamlined service desk management, and intelligent workflow automation in varying proportions across industry verticals. The vertical landscape itself spans banking, capital markets, and insurance within BFSI; energy and utilities; government agencies and public utilities; hospitals and pharmaceuticals in healthcare; IT services and telecommunications; discrete and process manufacturing; and e-commerce alongside retail. Each of these segments exhibits unique priorities for compliance, uptime, or customer experience, underscoring the importance of adaptable operations support frameworks.

This comprehensive research report categorizes the Operations Support Business Support Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Organization Size

- Deployment Type

- End User

Examining Regional Dynamics and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific in Operations Support Software Deployment

Regional dynamics play a significant role in shaping the adoption and evolution of operations support software. In the Americas, enterprises are at the forefront of incorporating advanced automation and analytics to enhance service agility, supported by a mature ecosystem of cloud data centers and managed service providers. Transitioning to Europe, Middle East and Africa, diverse regulatory landscapes and data sovereignty requirements have made hybrid deployment models particularly attractive, while local providers emphasize compliance and localized support services. Conversely, in the Asia-Pacific region, rapid digitalization and the proliferation of telecommunications infrastructures have accelerated demand for network performance management and workflow automation solutions, fueled by government-led smart city initiatives and the expansion of e-commerce platforms. Despite these regional distinctions, a common thread emerges: organizations across all territories are prioritizing solutions that deliver real-time operational insights, bolster resilience, and support continuous improvement initiatives.

This comprehensive research report examines key regions that drive the evolution of the Operations Support Business Support Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Prominent Industry Players and Their Strategic Initiatives Shaping the Future of Operations Support Software Solutions Globally

A cadre of forward-thinking companies is driving innovation in the operations support software domain through strategic partnerships, targeted acquisitions, and continuous product enhancements. Long-standing incumbents have expanded their analytics and AI capabilities by integrating third-party modules, while emerging vendors are disrupting the market with minimalist interfaces and low-code customization options. Several firms have focused on deepening vertical expertise, embedding compliance frameworks for sectors such as healthcare and finance directly into their platforms. Others are forging alliances with cloud hyperscalers to optimize performance and extend global reach. These collective efforts have elevated the competitive bar, compelling every player to pursue a blend of functional depth and user-centric design to captivate a discerning enterprise clientele.

This comprehensive research report delivers an in-depth overview of the principal market players in the Operations Support Business Support Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amdocs Inc.

- ASG Technologies Group, Inc.

- Axios Systems PLC

- BMC Software, Inc.

- CA, Inc.

- Cherwell Software, LLC

- EasyVista Inc.

- Freshworks Inc.

- HEAT Software

- IBM Corporation

- Ivanti, Inc.

- ManageEngine

- Micro Focus International plc

- OpenText Corporation

- Oracle Corporation

- ServiceNow, Inc.

- Software AG

- SolarWinds Worldwide, LLC

- SysAid Technologies Ltd.

- Zendesk, Inc.

Delivering Pragmatic and Impactful Strategic Recommendations to Empower Industry Leaders in Optimizing Business Support Through Advanced Operations Software

To capitalize on the trends and insights presented, industry leaders should initiate a phased modernization program that prioritizes core process automation and expands incrementally to more advanced analytics capabilities. Early mobilization of artificial intelligence-powered predictive maintenance tools will yield rapid operational gains, while subsequent layering of workflow orchestration engines can enhance cross-departmental collaboration. It is also advisable to reevaluate existing licensing agreements in light of recent tariff changes, transitioning to subscription or usage-based models where appropriate to safeguard budget flexibility. Engagement with cross-functional stakeholders will be essential to ensure that implementation roadmaps address both IT governance and business objectives. Finally, establishing continuous feedback loops through integrated reporting dashboards will enable leaders to refine their strategies based on live operational data and user-experience metrics.

Detailing the Comprehensive Research Methodology Employed to Ensure Rigor Validity and Reliability in the Operations Support Software Market Analysis

The research underpinning this analysis was conducted through a multi-stage methodology designed to ensure comprehensiveness and rigor. Initially, primary interviews were carried out with senior IT executives, operations managers, and subject-matter experts to uncover real-world challenges and priorities. These qualitative inputs were complemented by secondary research, involving the review of industry publications, regulatory filings, and vendor technical briefs to validate emerging trends and solution capabilities. Quantitative data was then synthesized from proprietary databases tracking software deployments, configuration changes, and usage patterns across various verticals. An iterative validation process, including expert panel reviews and scenario testing, reinforced the accuracy of the findings. This combination of methodologies has yielded a robust, sector-agnostic perspective that captures both strategic imperatives and tactical considerations for operations support software adoption.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Operations Support Business Support Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Operations Support Business Support Software Market, by Offering

- Operations Support Business Support Software Market, by Organization Size

- Operations Support Business Support Software Market, by Deployment Type

- Operations Support Business Support Software Market, by End User

- Operations Support Business Support Software Market, by Region

- Operations Support Business Support Software Market, by Group

- Operations Support Business Support Software Market, by Country

- United States Operations Support Business Support Software Market

- China Operations Support Business Support Software Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Reflections on Strategic Imperatives and Evolving Opportunities in Operations Support Software for Future Business Excellence

In conclusion, operations support software has emerged as a cornerstone for enterprises aiming to bolster operational efficiency and deliver superior service experiences. The convergence of AI-driven analytics, flexible deployment architectures, and customer-centric licensing models has created a fertile ground for innovation. Organizations that embrace these technologies while remaining agile in their strategic approach will be best positioned to navigate ongoing tariff fluctuations and evolving regulatory demands. The segmentation and regional insights provided highlight the necessity of tailoring solutions to specific organizational profiles and local market conditions. By following the recommendations outlined and leveraging the comprehensive research methodology described, decision-makers can confidently steer their operations support initiatives toward sustained business excellence.

Engage with Associate Director of Sales and Marketing to Secure Your Comprehensive Report and Drive Strategic Advantage with Expert Insights

The comprehensive exploration we have presented underscores the pivotal role that operations support software plays in fortifying enterprise resilience and driving sustainable performance. By delving into market dynamics, segmentation insights, regional variances, and competitive strategies, this report has illuminated the critical levers that organizations must engage to remain agile in an ever-evolving technological environment. Leaders are now equipped with a clear understanding of which components, pricing approaches, and deployment models can yield the greatest return on investment while minimizing operational friction. As global economic policies continue to shift, the ability to adapt swiftly to tariff changes and supply chain disruptions will distinguish market frontrunners from followers. The actionable recommendations offered emanate from rigorous analysis and industry best practices, ensuring that decision-makers are empowered to chart a course toward optimized service delivery and enhanced customer satisfaction.

To translate these insights into tangible outcomes, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His expertise and deep understanding of current market conditions will facilitate a bespoke discussion around your organization’s unique challenges and objectives. Engaging with this report through direct dialogue will enable you to unlock strategic advantages, tailor solutions to your operational priorities, and accelerate your path to excellence in business support.

- How big is the Operations Support Business Support Software Market?

- What is the Operations Support Business Support Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?