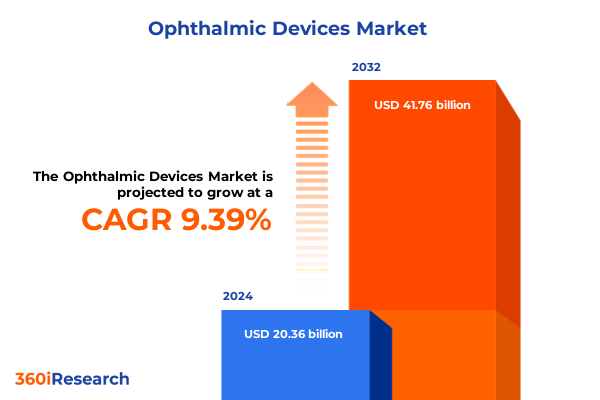

The Ophthalmic Devices Market size was estimated at USD 22.07 billion in 2025 and expected to reach USD 23.92 billion in 2026, at a CAGR of 9.53% to reach USD 41.76 billion by 2032.

Setting the Stage for Future Growth in Ophthalmic Devices with Market Evolution Technological Innovation and Emerging Patient Needs

The ophthalmic devices industry stands at a pivotal juncture where rapid technological advances and shifting patient demographics converge to create both challenges and opportunities for manufacturers, clinicians, and policy makers. Innovations in diagnostics and minimally invasive surgery have expanded the therapeutic scope for conditions ranging from cataracts to diabetic retinopathy, while evolving reimbursement frameworks and regulatory landscapes demand greater agility from stakeholders. Amid these dynamics, the necessity of a comprehensive understanding of market drivers, competitive pressures, and emerging threats has never been more critical.

Against this backdrop, industry leaders are seeking consolidated perspectives that blend clinical evidence, supply chain analytics, and end-user behavior to inform strategic decision making. By synthesizing insights from primary interviews with key opinion leaders and secondary data from authoritative sources, this report offers a robust foundation for executives tasked with navigating complex market forces. It provides a clear line of sight into how demographic shifts, such as rising incidence of age-related eye diseases and expanding access to care in underserved regions, are reshaping demand patterns across the globe.

Ultimately, this introduction lays the groundwork for a deep dive into the transformative shifts, tariff implications, segmentation nuances, regional variations, and competitive movements that are defining the future of ophthalmic devices. With a professional and authoritative lens, readers will gain confidence in leveraging these findings to drive innovation, optimize operations, and capture emerging growth opportunities in a rapidly evolving landscape.

Revolutionary Advances Reshaping the Ophthalmic Landscape through Digital Diagnostics AI Integration and Minimally Invasive Surgical Techniques

Innovations in digital imaging and artificial intelligence are rewriting the rules of ophthalmic diagnostics, ushering in an era of precision medicine and automated disease screening. Optical coherence tomography devices now deliver unprecedented resolution and depth penetration, while machine learning algorithms sift through millions of retinal scans to identify early markers of glaucoma and diabetic retinopathy. As a result, clinical workflows are becoming more efficient and patient outcomes more consistent, driving a shift toward centralized data platforms and integrated electronic health records.

Furthermore, minimally invasive surgical techniques are gaining momentum, propelled by advances in femtosecond lasers and micro-incisional instruments. These technologies reduce operative risks and accelerate postoperative recovery, making procedures like cataract extraction and corneal refractive correction safer and more patient-friendly. Concurrently, robotic-assisted platforms are finding footholds in complex retinal surgeries, enhancing manual precision and enabling novel approaches to tissue manipulation. As surgeons embrace these capabilities, hospitals and specialty clinics alike are investing in training programs and infrastructure upgrades to support the next generation of ophthalmic care.

Teleophthalmology and wearable monitoring devices are likewise transforming access to eye care, particularly in rural and underserved regions. From handheld fundus cameras deployed in community clinics to smart contact lenses that continuously measure intraocular pressure, remote diagnostics are reducing appointment backlogs and enabling earlier intervention. Combined with mobile health applications that guide patients through treatment regimens for conditions like dry eye disease, these digital solutions are fostering more proactive and personalized models of care. As the industry accelerates toward a data-driven future, interoperability standards and cybersecurity measures will emerge as essential enablers for sustained innovation.

Assessing the Cumulative Effects of New United States Tariff Measures on Ophthalmic Device Supply Chains and Cost Structures

In recent months, new United States tariff measures have introduced incremental costs on imports that are integral to ophthalmic device production, significantly altering supply chain economics and procurement strategies. A baseline 10 percent duty on goods originating from mainland China has raised input expenses for manufacturers reliant on semiconductors, precision optics, and specialized polymers. At the same time, a concurrent 25 percent levy on steel and aluminum derivatives has amplified the cost burden on instrument casings, surgical blades, and supporting hardware components, placing additional pressure on contract manufacturers to renegotiate supplier agreements and optimize material usage.

Further complicating the landscape, Section 301 tariffs originally imposed on medical devices have seen phased increases effective January of this year, with certain consumables facing rates of up to 50 percent. These adjustments directly affect categories such as surgical masks, irrigation sets, and single-use instruments frequently utilized in ophthalmic surgeries. As a result, device makers have reported a surge in landed costs, prompting many to explore near-shoring alternatives and dual-sourcing strategies to maintain margins and secure uninterrupted supply.

In response, a growing number of industry groups are petitioning for tariff exemptions or targeted carve-outs, arguing that preserving access to critical ophthalmic technologies is paramount for patient care continuity. Manufacturers are actively engaging with policy advocates and trade representatives to highlight the public health implications of cost‐driven shortages, while simultaneously accelerating R&D programs aimed at developing domestically-sourced substitutes for tariff-impacted components. Through these efforts, stakeholders seek to balance national economic objectives with the imperative to uphold quality and affordability in eye care.

Unveiling In-Depth Segmentation Insights across Product Types Applications and End Users Driving Ophthalmic Device Demand Dynamics

A nuanced understanding of product type segmentation reveals how diagnostic and monitoring instruments coexist with surgical platforms to drive varied demand streams. On the diagnostic side, fundus cameras, ophthalmoscopes, optical coherence tomography scanners, pachymeters, perimeters and visual field analyzers, retinoscopes, and wavefront aberrometers each address distinct clinical needs from retinal examinations to corneal mapping and visual field assessments. By contrast, surgical device portfolios center on cataract surgery systems, glaucoma surgery implants, advanced laser platforms, phacoemulsification units, and refractive surgery apparatus, reflecting both the procedural complexity and capital investment required by operating rooms.

Equally important, application segmentation underscores where clinical demand is concentrated across cataract interventions, dry eye management solutions, glaucoma filtration and micro-stent procedures, refractive vision correction treatments, and vitreoretinal repair strategies. Each application sphere presents its own regulatory pathways, reimbursement policies, and surgeon adoption curves, necessitating tailored product development and market access plans to align with evolving clinical guidelines and payer frameworks.

Finally, end-user insights clarify that ambulatory surgery centers, hospitals, ophthalmic clinics, optical retail stores, research and academic institutes, and specialty eye centers function as primary distribution channels and care delivery venues. These venues exhibit distinct procurement cycles, volume discounts, and service expectations, influencing how companies position their value propositions-from bundled service agreements for high-volume surgical suites to subscription-based diagnostic platforms for academic research programs. Recognizing the interplay among these segmentation dimensions enables more precise go-to-market strategies and resource allocation decisions.

This comprehensive research report categorizes the Ophthalmic Devices market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End-User

Understanding Regional Market Dynamics across the Americas EMEA and Asia-Pacific and Their Influence on Ophthalmic Device Adoption

The Americas region is characterized by well-established healthcare infrastructures, high per-capita spending, and a robust reimbursement environment that encourages early adoption of advanced ophthalmic technologies. Market entry strategies here often involve collaborating with leading hospital systems and national eye care chains to demonstrate clinical efficacy and secure favorable insurance coverage terms. Meanwhile, regulatory bodies maintain stringent approval pathways, prompting device makers to invest in comprehensive clinical trials to achieve market clearance and build physician trust.

In Europe, Middle East & Africa, fragmented healthcare systems coexist with pockets of rapid modernization in major economies and emerging markets alike. While the European Union enforces harmonized device regulations under a unified framework, individual nations retain distinct tender processes and pricing pressures. Concurrently, Gulf countries and select African hubs are prioritizing investments in specialized eye institutes to address high prevalence of cataracts and glaucoma. As digital health initiatives gain traction, cross-border telemedicine programs are emerging to bridge physician shortages and enhance remote diagnostics.

The Asia-Pacific region presents a diverse landscape, from advanced medical centers in Japan and Australia to high-growth opportunities in China, India, and Southeast Asia. Rapid demographic aging, rising urbanization, and expanding health insurance coverage are fueling demand for both diagnostic and therapeutic ophthalmic devices. Local manufacturing hubs are expanding capacity to meet regional needs, while partnerships with multinational corporations facilitate technology transfer and regulatory know-how. As governments prioritize vision health as part of broader public health campaigns, device makers are finding scope for public-private collaborations and volume-driven access programs.

This comprehensive research report examines key regions that drive the evolution of the Ophthalmic Devices market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Ophthalmic Device Manufacturers Highlighting Strategic Initiatives Collaborations and Competitive Differentiators

Leading companies are differentiating through robust product pipelines, strategic acquisitions, and targeted collaborations. Alcon continues to expand its cataract and refractive surgery portfolio by integrating next-generation intraocular lenses with digital guidance systems, while also investing in AI-driven diagnostics to complement its portfolio. Bausch + Lomb leverages its heritage in corneal care and dry eye therapeutics to deliver comprehensive device platforms that combine diagnostic sensors with therapeutic delivery systems, aligning with broader ocular surface disease management trends.

Meanwhile, Carl Zeiss Meditec capitalizes on its expertise in imaging technologies, offering multimodal systems that fuse high-resolution OCT with fundus photography and angiography. These integrated platforms cater to both clinical practices and research centers seeking advanced diagnostic workflows. Johnson & Johnson Vision has intensified its focus on laser-based vision correction and premium lens implants, bolstered by partnerships with leading surgical centers to conduct real-world evidence studies and refine procedural techniques.

Regional specialists such as Topcon and Nidek are reinforcing their positions through agile product updates and local manufacturing expansions, particularly in Asia-Pacific markets. Haag-Streit has carved out a niche in perimetry and visual field analysis with its innovative virtual reality-based systems, while Hoya Surgical Optics addresses surgeon demands for enhanced intraoperative visualization and precision optics. Collectively, these companies exemplify diverse approaches to balancing clinical innovation, operational scale, and market responsiveness in the competitive ophthalmic device landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ophthalmic Devices market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- Bausch & Lomb Incorporated

- Canon Medical Systems Corporation

- Carl Zeiss AG

- ClearSight

- Diamatrix Ltd.

- Essilor International S.A.

- Eyenovia, Inc.

- F. Hoffmann-La Roche AG

- GWS Surgicals LLP

- Haag-Streit Group by Metall Zug

- Halma PLC

- HEINE Optotechnik

- Luneau Technology Operations SAS

- Nidek Co. Ltd.

- Ophtec B.V.

- Ophtechnics Unlimited

- Paramount Surgimed Ltd.

- Quantel Medical

- Topcon Corporation

- Ziemer Ophthalmic Systems AG

Actionable Recommendations for Industry Leaders to Navigate Regulatory Challenges and Capitalize on Emerging Ophthalmic Technology Trends

Industry leaders should prioritize supply chain resilience by diversifying sourcing strategies and establishing near-shore manufacturing partnerships to insulate against tariff volatility and global disruptions. This approach will not only safeguard continuity of supply but also reduce lead times and improve cost control. In parallel, allocating resources toward advanced data analytics and AI-enhanced platforms will unlock deeper clinical insights, bolster product differentiation, and foster stronger engagements with payers seeking evidence-based value propositions.

Moreover, forging strategic alliances with hospital networks, academic institutes, and digital health innovators will accelerate market access for novel solutions, particularly in teleophthalmology and remote monitoring. Such collaborations can create integrated ecosystems that streamline patient pathways and demonstrate real-world outcomes to key stakeholders. Concurrently, companies must navigate evolving regulatory requirements by embedding compliance expertise early in the product development cycle, ensuring faster approvals and avoiding post-market surprises.

Finally, to capture emerging opportunities in high-growth regions, organizations should design flexible commercialization models that align with local healthcare financing structures and unmet clinical needs. Tailoring service agreements, training programs, and reimbursement support to each market’s nuances will enhance adoption rates and optimize resource allocation. By executing these targeted recommendations, industry leaders can confidently adapt to the changing landscape and maintain sustainable growth trajectories.

Outlining a Rigorous Research Methodology Combining Primary Validation Secondary Data Analysis and Robust Data Triangulation

This research employs a hybrid methodology that begins with extensive secondary data collection from regulatory filings, peer-reviewed journals, and official healthcare databases to construct foundational market frameworks. Subsequently, primary validation is undertaken through structured interviews with surgeons, procurement specialists, and key opinion leaders across diverse geographies to corroborate quantitative findings and capture nuanced clinical preferences.

Quantitative analysis leverages statistical techniques to ensure data integrity and uncover correlations among variables such as adoption rates, reimbursement levels, and demographic shifts. Data triangulation is performed by cross-referencing triangulated inputs from supplier price lists, company financial disclosures, and aggregated hospital purchasing records, thereby minimizing biases and enhancing result reliability.

Furthermore, qualitative insights are synthesized through thematic coding of interview transcripts, enabling the identification of emerging pain points and innovation drivers. The combined approach provides a multidimensional view of the ophthalmic devices market, balancing empirical rigor with practitioner perspectives to inform robust strategic guidance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ophthalmic Devices market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ophthalmic Devices Market, by Product Type

- Ophthalmic Devices Market, by Technology

- Ophthalmic Devices Market, by Application

- Ophthalmic Devices Market, by End-User

- Ophthalmic Devices Market, by Region

- Ophthalmic Devices Market, by Group

- Ophthalmic Devices Market, by Country

- United States Ophthalmic Devices Market

- China Ophthalmic Devices Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Drawing Strategic Conclusions to Synthesize Key Insights and Chart a Path Forward in the Rapidly Evolving Ophthalmic Devices Sector

In synthesizing these insights, it becomes clear that the future of ophthalmic devices will be shaped by a confluence of technological innovation, regulatory adaptation, and supply chain optimization. Decision makers must remain vigilant in tracking policy developments, particularly trade measures that influence cost structures, while simultaneously embracing digital transformation to enhance clinical outcomes and operational efficiency. As diagnostic platforms evolve toward greater automation and interoperability, opportunities will emerge to deliver more personalized and proactive eye care solutions.

Regional market dynamics underscore the importance of tailoring strategies to local healthcare ecosystems-from sophisticated reimbursement models in mature economies to access programs in developing regions. Competitive positioning will hinge on the ability to execute targeted go-to-market plans that resonate with both institutional and consumer-centric purchasing behaviors. By integrating segmentation intelligence, tariff impact assessments, and trend analyses, executives can make informed decisions to allocate resources optimally and pursue high-value initiatives.

Ultimately, agility, partnership, and a relentless focus on patient-centric innovation will define industry winners. Those who can leverage data-driven evidence, strengthen their global supply chains, and forge strategic collaborations will be best positioned to capitalize on the evolving needs of eye care providers and patients worldwide.

Contact the Associate Director for Exclusive Market Research Insights and Unlock Tailored Ophthalmic Device Industry Intelligence today

To gain full access to the comprehensive analysis and strategic insights detailed within this market research report, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation. By engaging with Ketan, you will unlock tailored intelligence on technology trends, regulatory updates, and competitive dynamics driving the ophthalmic devices sector. He will guide you through the report’s methodology, highlight the most relevant findings for your business objectives, and discuss bespoke opportunities for collaboration or deeper analysis. Don’t miss the chance to leverage expert guidance and actionable data to steer your growth strategies in this rapidly evolving industry-connect with Ketan Rohom today to secure your copy of the report and start capitalizing on future market opportunities.

- How big is the Ophthalmic Devices Market?

- What is the Ophthalmic Devices Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?