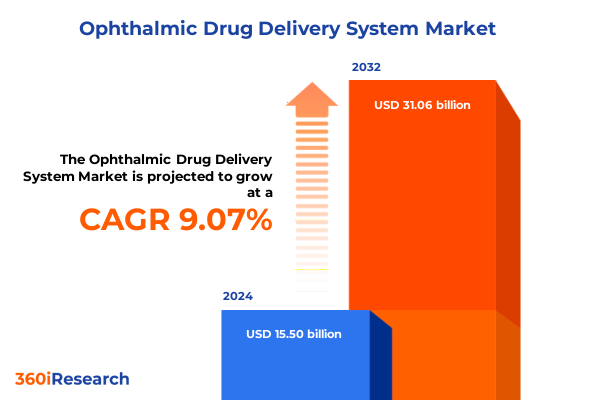

The Ophthalmic Drug Delivery System Market size was estimated at USD 16.84 billion in 2025 and expected to reach USD 18.31 billion in 2026, at a CAGR of 9.14% to reach USD 31.06 billion by 2032.

Unveiling the Converging Forces Shaping the Future of Ophthalmic Drug Delivery Systems in a Rapidly Evolving Healthcare Ecosystem

In recent years, the landscape of ophthalmic drug delivery has experienced a remarkable convergence of clinical necessity and technological ingenuity. The growing prevalence of ocular disorders-driven largely by demographic shifts such as aging populations and increased digital screen exposure-has magnified the urgency for more effective, patient-friendly treatment modalities. Traditional topical drops, while foundational, often struggle with limited bioavailability and patient adherence, underscoring the importance of the next generation of delivery platforms. This evolving environment has spurred activity across academic research, regulatory agencies, and private industry, all seeking solutions that can overcome anatomical barriers, optimize therapeutic concentrations, and enhance patient quality of life.

Against this backdrop, this executive summary offers a concise yet comprehensive overview of the key drivers reshaping ophthalmic drug delivery. It synthesizes the most consequential technological shifts, assesses the economic ripple effects of recent tariff policies, and distills critical segmentation, regional, and competitive insights. Designed for leaders at pharmaceutical companies, device manufacturers, and healthcare institutions, this overview sets the stage for actionable strategies that embrace innovation, navigate emerging headwinds, and position organizations to capitalize on the next wave of market opportunities.

Navigating the Paradigm Shifts Revolutionizing Ophthalmic Drug Delivery Through Technological Innovation and Regulatory Evolution

Over the past decade, technological breakthroughs have redefined what is possible in ocular therapeutics. Advances in microfabrication have enabled the development of minimally invasive microneedle arrays that painlessly deliver agents directly across the corneal barrier, while next–generation contact lenses release drugs in a controlled manner over extended periods. At the same time, biodegradable intraocular implants have gained regulatory approvals to maintain sustained therapeutic levels within the vitreous chamber, eliminating the need for frequent injections. These innovations are complemented by an expanding repertoire of combination products that integrate sensors and drug reservoirs, allowing real–time monitoring of intraocular pressure or drug release kinetics.

Meanwhile, the regulatory landscape has evolved to keep pace with these hybrid technologies. Guidance documents issued by global health authorities now clarify requirements for combination ophthalmic products, and accelerated pathways such as breakthrough designations enable faster development of therapies for unmet medical needs, including rare retinal diseases. This evolving framework is promoting earlier engagement between sponsors and regulators, resulting in more streamlined clinical protocols and reduced time to market. Together, these technological and regulatory shifts are fundamentally transforming the innovation pipeline and opening new frontiers for therapeutic delivery.

Assessing the Compound Consequences of 2025 United States Tariff Measures on Ophthalmic Drug Delivery Supply Chains and Cost Structures

In 2025, new tariff measures enacted by the United States government extended duties of up to 25 percent on certain components critical to advanced ophthalmic drug delivery systems, including high–precision polymers, specialty packaging materials, and electronic sensors. These levies, initially instituted under Section 301 trade actions, have compounded existing cost pressures, prompting manufacturers to reassess supplier relationships and logistics strategies. As a direct consequence, some companies have experienced raw material costs rising by double digits, necessitating price negotiations with payers and contract manufacturers to preserve margins and ensure uninterrupted supply.

The cumulative impact of these tariffs extends beyond immediate cost inflation. To mitigate exposure, several leading firms have relocated portions of their component manufacturing to duty–exempt free trade zones and accelerated investments in domestic production facilities. However, onshoring introduces new complexities such as capital expenditure burdens and workforce training requirements, which may offset some anticipated savings. In addition, procurement teams are increasingly leveraging duty drawback programs and exploring alternative sourcing hubs in regions unaffected by U.S. tariffs. Such strategic adjustments are reshaping global supply chains and driving a broader industry trend toward diversified supplier networks.

Looking ahead, companies that proactively model tariff scenarios, integrate trade compliance into product development plans, and negotiate flexible supply agreements will be better positioned to absorb future trade policy fluctuations. The interplay between tariff-driven cost dynamics and regulatory incentives for local manufacturing suggests that agility in supply chain design will remain a critical competitive differentiator in the ophthalmic drug delivery space.

Revealing Critical Segmentation Insights Illuminating Diverse Drug Types Delivery Methods Formulations and Clinical Applications

Insight into drug type segmentation reveals that treatments targeting angiogenic retinal disorders using anti–VEGF molecules command robust clinical and commercial attention, driven by escalating cases of age–related macular degeneration. Meanwhile, anti–glaucoma therapies continue to sustain stable utilization, reflecting the chronic nature of intraocular pressure management. Anti–inflammatory and anti–allergy formulations are benefiting from growing awareness of ocular surface diseases and a transition toward self–administered therapies. These drug classes are complemented by anti–infective options that remain indispensable in surgical recovery settings and emergency ocular infection treatments.

When evaluating delivery device technologies, the field is witnessing a strategic shift from conventional ointments and sprays to high–precision ophthalmic inserts and controlled microneedle platforms. Intraocular implants are increasingly viewed as the gold standard for sustained release, particularly in chronic retinal conditions, whereas contact lens drug delivery is gaining interest for its ability to combine vision correction with therapeutic release. Topical gels are also undergoing reformulation to enhance corneal retention, thereby improving patient adherence and therapeutic outcomes.

Product type considerations indicate a delineation between over–the–counter formats, which capitalize on ease of access for common ailments such as dry eye syndrome, and prescription formulations designed for complex pathologies. Within prescription offerings, controlled–release designs are emerging as preferred choices for reducing dosing frequency and enhancing bioavailability, while standard formulations remain integral to established treatment regimens.

The interplay of formulation and mode of delivery underscores a progression from liquid solutions toward semi–solid gels that offer superior ocular retention without the greasiness of traditional ointments, and solid capsules that facilitate targeted periocular injection. While topical administration continues to dominate in terms of convenience and patient preference, intravitreal and periocular routes are indispensable for delivering high molecular weight biologics directly to posterior segment tissues. This diversity of drug delivery modalities is aligned with evolving applications, from allergy relief and surgical recovery to advanced interventions in glaucoma and retinal disorders.

End users across hospitals, specialized ophthalmic clinics, and research organizations are actively driving demand for these differentiated platforms. Hospitals leverage integrated procurement channels for high–value implantable devices, whereas ophthalmic clinics focus on outpatient–friendly delivery systems. Research entities, for their part, fuel the innovation engine by validating new platforms through preclinical and early clinical studies. Collectively, this segmentation matrix highlights where therapeutic need intersects with technological capability, guiding targeted investment and development strategies.

This comprehensive research report categorizes the Ophthalmic Drug Delivery System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drug Type

- Delivery Device Type

- Product Type

- Formulation Type

- Mode Of Delivery

- Application

- End User

Mapping Regional Dynamics Uncovering Unique Ophthalmic Drug Delivery Trends Across Americas EMEA and Asia Pacific Markets

In the Americas, the United States serves as the epicenter of innovation, supported by well–established regulatory frameworks and abundant venture capital funding. Collaborations between academic medical centers and private companies have yielded a stream of cutting–edge clinical trials, particularly in biologic injections and sustained–release devices. Canada, while smaller in scale, has demonstrated leadership in GMP manufacturing of drug–device combination products and benefits from streamlined regulatory pathways under Health Canada. Together, the region’s robust healthcare infrastructure and reimbursement mechanisms create an environment conducive to early adoption of premium delivery technologies.

Across Europe, the Middle East, and Africa, the regulatory landscape varies significantly. Western Europe’s harmonized CE marking process has facilitated market entry of novel implants and diagnostic sensors, while Eastern European markets are gaining traction through localized production partnerships. In the Middle East, government–led healthcare modernization initiatives are beginning to prioritize ophthalmic care, driving demand for premium therapeutic platforms. Conversely, parts of Africa face infrastructure challenges and limited reimbursement, which slow adoption despite high unmet clinical need. Despite these discrepancies, regional collaborations and pan–continental consortia are laying the groundwork for broader technology dissemination.

Asia Pacific is marked by rapid adoption curves in key markets such as China, India, Japan, and South Korea. Government policies favoring domestic innovation and self–sufficiency have spurred local manufacturing of advanced polymers and biodegradable implants. In addition, the rising prevalence of diabetes in the region is accelerating demand for treatments targeting diabetic retinopathy and glaucoma. Teleophthalmology services are gaining momentum as a means to extend specialist access to rural populations, further boosting adoption of user–friendly delivery formats. These dynamics together underscore the region’s critical role in shaping global ophthalmic drug delivery trends.

This comprehensive research report examines key regions that drive the evolution of the Ophthalmic Drug Delivery System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Industry Pioneers Shaping the Ophthalmic Drug Delivery Market Through Innovation Partnerships and Strategic Expansion

Leading global firms have employed a multi–pronged approach to secure their positions in the ophthalmic delivery arena. Established medical device and pharmaceutical conglomerates have pursued acquisitions of specialized biotech startups focused on microneedle platforms and ocular gene therapies, ensuring immediate access to breakthrough technologies. Others have entered licensing agreements with academic spin–outs to co–develop combination products, blending advanced materials science with proprietary drug formulations. Concurrently, these incumbents are expanding their footprints in emerging markets by forging joint ventures with local manufacturers and leveraging regional distribution networks.

At the same time, nimble innovators and early–stage ventures are capturing attention by concentrating on niche segments such as ultra–thin biodegradable implants for posterior segment diseases and smart contact lens systems equipped with biosensors. These players often collaborate with contract research organizations and medical universities to validate proof of concept, subsequently attracting strategic investment from industry giants. This synergy between smaller pioneers and established corporations is accelerating the translation of novel delivery modalities from laboratory to clinic.

Moreover, strategic alliances extend beyond the traditional pharma–device paradigm to encompass partnerships with digital health companies. By integrating drug delivery platforms with remote monitoring and telemedicine applications, leading organizations are constructing comprehensive care ecosystems that enhance patient engagement and adherence. These collaborations are generating shared intellectual property, reinforcing competitive moats, and enabling unified commercial launches that span both therapeutic and diagnostic spheres.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ophthalmic Drug Delivery System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- AbbVie Inc.

- Alcon Vision LLC

- Apotex Inc.

- AptarGroup, Inc.

- Bausch Health Companies Inc.

- Bayer AG

- Carl Zeiss AG

- DifGen Pharmaceuticals LLC

- EyePoint Pharmaceuticals, Inc.

- F. Hoffmann-La Roche AG

- Genentech, Inc.

- Gerresheimer AG

- Iskon Remedies

- Johnson & Johnson Service, Inc.

- Mati Therapeutics, Inc.

- Merck KGaA

- MgShell S.R.L.

- Nicox SA

- Novartis AG

- Ocular Therapeutix Inc.

- Oculis SA

- Pfizer Inc.

- Recipharm AB

- Regeneron Pharmaceuticals, Inc.

- Santen Pharmaceutical Co., Ltd.

- Sun Pharmaceutical Industries, Inc.

- Terumo Corporation

- Teva Pharmaceutical Industries Ltd.

Strategic Imperatives for Industry Leaders to Drive Growth and Resilience in the Evolving Ophthalmic Drug Delivery Landscape

To navigate this highly dynamic landscape, industry leaders should prioritize investment in integrated delivery platforms that combine controlled release with real–time feedback mechanisms. Allocating resources toward the development and validation of microneedle arrays and smart implants will establish competitive differentiators and address unmet clinical needs. Simultaneously, companies must accelerate efforts to localize key manufacturing processes, thereby mitigating the impact of fluctuating tariff policies and strengthening supply chain resilience.

Early and proactive engagement with regulatory bodies is equally critical. By leveraging adaptive trial designs and breakthrough designation pathways, sponsors can secure accelerated reviews and reduce development timelines for high–value therapies. Establishing cross–functional teams that include regulatory experts, clinical scientists, and commercial strategists will facilitate alignment on product requirements from inception to launch. At the same time, pursuing strategic partnerships with digital health firms can unlock new channels for patient monitoring and adherence support, transforming one–time interventions into longitudinal care solutions.

Operationally, organizations should adopt flexible procurement strategies that combine diversified supplier networks with real–time tariff modeling. Embracing advanced analytics for demand forecasting and inventory optimization will minimize stockouts and cost overruns. In parallel, investing in workforce development programs focused on advanced drug delivery technologies and digital competencies will ensure that teams possess the technical acumen needed to execute complex combination product launches. Finally, cultivating non–dilutive funding sources-such as grants and innovation awards-can accelerate R&D initiatives without sacrificing financial agility.

Comprehensive Research Methodology Detailing Integrated Primary and Secondary Approaches to Uncover Ophthalmic Drug Delivery Insights

This analysis is founded on a rigorously structured research methodology that blends both primary and secondary approaches. Primary research included structured interviews with key opinion leaders spanning ophthalmologists, clinical trial investigators, procurement directors, and regulatory affairs specialists. These conversations provided firsthand insights into the real–world challenges associated with drug delivery efficacy, patient adherence, and supply chain constraints.

Secondary research encompassed comprehensive reviews of peer–reviewed literature, conference proceedings from leading ophthalmology symposia, patent filings, and public regulatory databases. Data points were triangulated across multiple sources to ensure validity, and emerging trends were cross–checked against real–time patent analyses to capture novel material and device innovations. Quantitative data was supported by qualitative assessments, facilitating a balanced perspective on both technological feasibility and market adoption.

A dedicated panel of internal experts conducted iterative validation sessions, scrutinizing assumptions, refining categorizations, and calibrating insights to reflect diverse regional and therapeutic contexts. Ethical standards were upheld through transparent sourcing and adherence to research best practices. The outcome is a data–driven, stakeholder–vetted report that equips decision–makers with a holistic understanding of the ophthalmic drug delivery ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ophthalmic Drug Delivery System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ophthalmic Drug Delivery System Market, by Drug Type

- Ophthalmic Drug Delivery System Market, by Delivery Device Type

- Ophthalmic Drug Delivery System Market, by Product Type

- Ophthalmic Drug Delivery System Market, by Formulation Type

- Ophthalmic Drug Delivery System Market, by Mode Of Delivery

- Ophthalmic Drug Delivery System Market, by Application

- Ophthalmic Drug Delivery System Market, by End User

- Ophthalmic Drug Delivery System Market, by Region

- Ophthalmic Drug Delivery System Market, by Group

- Ophthalmic Drug Delivery System Market, by Country

- United States Ophthalmic Drug Delivery System Market

- China Ophthalmic Drug Delivery System Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

Synthesis of Critical Findings and Forward Looking Perspectives on the Evolution of Ophthalmic Drug Delivery Innovation and Market Dynamics

The confluence of advanced device engineering, targeted drug formulations, and evolving regulatory pathways is reshaping the future of ophthalmic drug delivery. Technological breakthroughs such as microneedles, sustained–release implants, and sensor–enabled platforms are converging with patient–centric design principles to overcome longstanding barriers in ocular therapy. At the same time, the compounding effects of recent tariff measures underscore the importance of supply chain agility and strategic onshoring. Together, these forces define a complex yet opportunity–rich environment.

Segmentation insights reveal clear pockets of high growth potential, particularly in anti–VEGF therapies for retinal disorders and in novel contact lens delivery systems. Regional dynamics highlight the Americas’ leadership in innovation, EMEA’s regulatory sophistication, and Asia Pacific’s manufacturing ascendancy. Leading companies are forging alliances that bridge traditional pharma, device, and digital health domains, setting the stage for integrated care models. By synthesizing these findings, stakeholders can craft strategies that are both forward–looking and resilient, ensuring sustained competitive advantage in this transformative market.

Engage with Ketan Rohom to Gain Exclusive Access to Comprehensive Ophthalmic Drug Delivery Market Research and Insights Today

To secure an in-depth exploration of ophthalmic drug delivery innovations and to harness the strategic intelligence outlined in this executive summary, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can guide you to the most relevant sections of the full report, demonstrate tailored insights that align with your organizational goals, and facilitate a seamless purchasing process. Engage today to capitalize on these critical perspectives and position your organization at the forefront of this dynamic market.

- How big is the Ophthalmic Drug Delivery System Market?

- What is the Ophthalmic Drug Delivery System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?