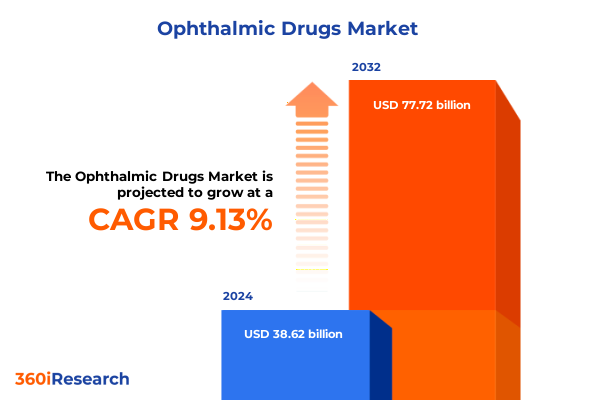

The Ophthalmic Drugs Market size was estimated at USD 42.06 billion in 2025 and expected to reach USD 45.86 billion in 2026, at a CAGR of 9.16% to reach USD 77.72 billion by 2032.

A practical orientation framing the ophthalmic drugs marketplace, policy intersections, and strategic decision priorities for commercial and clinical leaders

This executive summary opens with a concise orientation to the ophthalmic drugs landscape, highlighting the technical, regulatory, and commercial vectors that are shaping near‑term strategy for manufacturers, distributors, and clinical service providers. The market now sits at the intersection of accelerated product innovation, heightened supply‑chain scrutiny, and evolving trade policy, which together demand an integrated response from leaders who must balance access, cost, and resilience. The opening analysis frames the report’s core scope: a systematic review of product and therapeutic segmentation, distribution channels, patient demographics, and the policy levers that materially affect procurement and manufacturing choices.

Readers should expect an evidence‑driven assessment that prioritizes operational levers and decision points over raw forecasting. The narrative traces how clinical demand drivers-such as aging populations and rising incidence of chronic retinal disorders-interact with dosage form preferences and regulatory pathways to influence product development strategies. In parallel, the summary synthesizes how channel dynamics, from hospital formularies to online pharmacies, change the mechanics of adoption and reimbursement. This introduction therefore establishes a practical baseline for executives: understand the segments where technology and policy converge, prioritize supply chain visibility, and align commercial models to the nuanced needs of adult, geriatric, and pediatric patient cohorts.

How scientific advances, supply reshoring, and regulatory modernization are reshaping product development, distribution strategies, and competitive advantage in ophthalmology

The landscape for ophthalmic therapeutics is undergoing transformative shifts driven by science, supply architecture, and regulatory pressure. Biologics and advanced modalities continue to migrate into ophthalmology, prompting manufacturers to rethink formulation science and cold‑chain logistics to support intravitreal biologics and sustained‑release platforms. At the same time, the maturation of digital health tools-ranging from remote monitoring for dry eye and retinal disorders to diagnostic adjuncts used in clinics-reshapes patient pathways and creates new opportunities for value‑based contracting. These clinical and technological inflections are prompting commercial leaders to reassess go‑to‑market models and partner ecosystems.

Concurrently, supply‑chain reconfiguration is accelerating. Strategic reshoring and regionalization trends are prompting investments in domestic capacity for active pharmaceutical ingredient production and sterile fill/finish capabilities. This movement is in part a response to trade and national security policy signals that have elevated the cost of reliance on concentrated overseas supply. On the regulatory front, authorities are streamlining approval pathways for certain ophthalmic generics and biosimilars while also increasing scrutiny on quality and traceability. Together these shifts require firms to deploy agile manufacturing, to engage payers earlier in product design, and to design distribution strategies that account for both traditional end users such as hospitals and clinics and growth channels like online pharmacies.

Understanding the cumulative commercial and operational effects from recent United States tariff measures and policy signals that reshaped supply‑chain decisions in 2025

Trade policy developments in 2024–2025 have introduced a new dimension of commercial risk for firms that rely on global supply chains for APIs, packaging, and finished ophthalmic products. The Office of the United States Trade Representative completed a statutory review that led to targeted tariff increases on selected product lines effective from January 1, 2025, and concurrently implemented scope changes that explicitly included certain medical‑related items; those policy actions have prompted companies to reassess sourcing geographies and cost allocations. The same administrative process has seen periodic extensions and adjustments to exclusions that temporarily mitigate near‑term impacts; these extensions and modifications create a dynamic policy environment that requires continuous monitoring and scenario planning.

In addition to administrative tariff changes, public discourse and executive signals around pharmaceutical‑specific tariffs have materially influenced corporate investment choices. Senior government commentary in 2025 signaled the potential for very steep levies on imported pharmaceuticals, including public statements indicating that tariffs could increase substantially over time, a development that has catalyzed capital redeployment into domestic manufacturing projects. High‑profile corporate commitments to expand U.S. production capacity have followed those policy signals, reflecting an industry preference to de‑risk exposure to import levies and to demonstrate supply‑chain resilience. These developments have sharpened the calculus for commercial teams evaluating the trade‑offs between the near‑term cost of re‑shoring and the longer‑term exposure to tariff volatility.

Market analysts and financial commentators have underscored that while tactical mitigation is possible, the structural effect of broad tariffs depends on final rates and on whether exemptions for critical medicine classes are maintained. Several analyses in 2025 suggested that initial tariff phases could be moderate but that higher escalations were contemplated, prompting many manufacturers to adopt a layered mitigation strategy that includes dual sourcing, domestic capacity expansion, and price‑protection provisions in supplier contracts. These approaches aim to protect patient access while preserving margins under multiple policy scenarios.

Segmentation insights revealing clinical, commercial, and distribution priorities across product types, drug classes, dosage forms, routes, therapeutic areas, demographics, and end users

Segmentation analysis reveals where value pools and clinical need converge, and it indicates the areas that warrant prioritized investment. When viewed through the lens of product type, the distinction between over‑the‑counter and prescription drugs informs route‑to‑market, regulatory burden, and margin expectations; over‑the‑counter ocular lubricants and allergy formulations tend to be volume‑driven and distribution‑sensitive, whereas prescription anti‑glaucoma agents and advanced antivirals demand tighter clinical engagement and payer negotiation. Within drug class, therapeutic distinctions matter: anti‑allergics and anti‑inflammatories are affected by seasonal demand and formulary placement, anti‑glaucoma agents require chronic adherence strategies, and antibiotics for ocular infections bring formulation and spectrum considerations that influence clinical preference. The antibiotic category itself breaks down into aminoglycosides, fluoroquinolones, macrolides, and tetracyclines, each with unique resistance, safety, and administration implications that affect stewardship programs and hospital purchasing practices.

Dosage form and route of administration are powerful determinants of commercial strategy. Eye drops remain the primary access point for many outpatient regimens, while gels and ointments serve niche indications where residence time and tolerability drive clinician choice. Tablets and capsules support systemic treatments for ocular infection or inflammation, and injectable routes are pivotal for advanced retinal therapies where intravitreal delivery requires specialized logistics and administration capabilities. Therapeutic area segmentation-spanning age‑related macular degeneration, cataracts, conjunctivitis, dry eye syndrome, glaucoma, ocular infections, and broader retinal disorders-shapes development priorities; for example, wet and dry subtypes of age‑related macular degeneration have divergent clinical trial endpoints and commercial models. Patient demographics and end‑user segmentation further refine opportunity maps: adult, geriatric, and pediatric populations demand differentiated safety profiles, adherence strategies, and dosing regimens, while hospitals, ophthalmic clinics, online pharmacies, and retail pharmacies & drug stores each present distinct procurement cycles, margin structures, and promotional levers. Synthesizing these segmentation layers reveals where targeted clinical evidence, distribution partnerships, and formulation innovation will most rapidly convert into commercial traction.

This comprehensive research report categorizes the Ophthalmic Drugs market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Drug Class

- Route of Administration

- Therapeutic Area

- Patient Demographics

- End User

- Distribution Channel

Regional imperatives for ophthalmic drug strategies that prioritize regulatory agility, supply continuity, and tailored commercial models across Americas, EMEA, and Asia‑Pacific

Regional dynamics are pivotal to understanding where regulatory, manufacturing, and distribution choices will prevail. In the Americas, the United States market continues to be characterized by a high dependence on specialty distribution channels and a payer environment that places a premium on evidence of cost‑effectiveness; these incentives influence product positioning especially for biologics and advanced retinal therapies. Latin American markets show fragmentary reimbursement regimes and variable procurement capacity; as a result, manufacturers often pursue tiered pricing or partnership models to facilitate access while managing commercial risk.

Europe, Middle East & Africa presents a heterogeneous regulatory landscape where centralized and national approval pathways coexist alongside differing payer expectations. In parts of Europe, strong biosimilar uptake and tendering processes favor cost‑competitive entries, while regions within the Middle East and Africa prioritize supply reliability and cold‑chain resilience. Manufacturers that can demonstrate both clinical value and supply continuity will gain leverage in tenders and national formulary negotiations. Asia‑Pacific features a wide spread of demand drivers: advanced economies in the region are adopting the latest retinal and glaucoma innovations rapidly, requiring manufacturers to maintain robust regulatory dossiers and local partnerships; emerging markets prioritize affordability and distribution breadth, driving demand for generics, stable formulations that tolerate variable cold‑chain environments, and oral or topical dosage forms that fit primary‑care models. Across all regions, supply‑chain localization and regulatory agility are recurring themes for companies seeking to capture growth while managing political and tariff‑related uncertainty.

This comprehensive research report examines key regions that drive the evolution of the Ophthalmic Drugs market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive architecture and partnership playbook for ophthalmic drug developers, generics manufacturers, and contract providers focusing on differentiation and operational resilience

Competitive dynamics in the ophthalmic drugs space are defined by a mix of large integrated pharmaceutical firms, specialized ophthalmology companies, and agile generics and contract manufacturing organizations. Large multinational manufacturers bring scale in development and global distribution, enabling comprehensive clinical programs and negotiated access with major payers. Specialized ophthalmic companies typically lead on formulation innovation, clinician engagement, and niche indications where deep therapeutic expertise yields differentiated value propositions. Generics providers and contract manufacturers exert influence through cost leadership, rapid scale‑up of commoditized dosage forms, and flexible manufacturing that supports tender wins and private label supply.

Strategic alliances, licensing deals, and M&A activity are common mechanisms to accelerate pipeline breadth and to secure manufacturing footings in target regions. Partnerships between innovative drug developers and regional distributors or contract manufacturers allow portfolio owners to manage capital intensity while ensuring market access. In parallel, firms that invest in cold‑chain logistics, sterile fill capabilities, and quality assurance systems create durable barriers to entry for competitors, especially in injectable and biologic ophthalmic therapies. Across competitive archetypes, clear differentiation comes from the ability to pair clinical evidence with operational reliability and channel‑specific go‑to‑market execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ophthalmic Drugs market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Ajanta Pharma Ltd.

- Alcon Vision LLC

- Apotex Inc.

- Bausch Health Companies Inc.

- Bayer AG

- Chengdu Kanghong Pharmaceutical Group Co., Ltd.

- Cipla Limited

- EyePoint Pharmaceuticals, Inc.

- F. Hoffmann-La Roche Ltd

- Intas Pharmaceuticals Ltd.

- Johnson & Johnson Service, Inc.

- KODIAK SCIENCES INC.

- Lotus Pharmaceuticals

- Lupin Limited

- Merck & Co., Inc.

- Nicox SA

- Novartis AG

- Ocular Therapeutix, Inc.

- OCuSOFT Inc.

- Otsuka Pharmaceutical Co., Ltd.

- Outlook Therapeutics, Inc.

- Pfizer Inc.

- Regeneron Pharmaceuticals Inc.

- Santen Pharmaceutical Co., Ltd.

- Senju Pharmaceutical Co.,Ltd.

- Somerset Pharma, LLC.

- Sun Pharmaceutical Industries Ltd.

- Viatris Inc.

- Viatris Inc.

Actionable recommendations for industry leaders to strengthen supply resilience, align evidence strategies with payers, and adapt commercial models to tariff and channel shifts

Industry leaders should adopt a pragmatic, multi‑track response that balances immediate risk mitigation with long‑term strategic repositioning. First, companies should implement near‑term supply‑chain resilience measures such as qualifying alternative API suppliers, negotiating dual‑source contracts, and incorporating tariff contingency clauses in procurement agreements. These tactical steps reduce exposure to sudden policy shifts while preserving production continuity. Second, prioritize investments that enhance domestic or near‑shore manufacturing capabilities for critical sterile and biologic processes; capital commitments targeted at fill/finish and API capacity can be positioned as strategic risk mitigation against tariff escalation and as competitive advantage in markets that value local production.

At the commercial and clinical interface, align evidence generation with payer priorities by strengthening real‑world outcome tracking, particularly for chronic indications like glaucoma and for high‑cost retinal interventions. This approach increases reimbursement leverage and accelerates adoption by hospital systems and specialty clinics. Additionally, adapt distribution strategies to reflect channel evolution: deepen relationships with online pharmacies and digital channels for maintenance therapies while maintaining supply assurance to hospitals and ophthalmic clinics for acute and specialized products. Finally, establish a cross‑functional tariff and trade monitoring capability that translates policy developments into actionable scenarios for procurement, pricing, and capital planning. This governance ensures timely decisions on capacity deployment and contract renegotiation under changing trade regimes.

Methodology detailing primary interviews, secondary source triangulation, segmentation mapping, and scenario planning used to derive actionable insights for ophthalmic drugs

This research uses a mixed‑methods approach combining primary interviews with key stakeholders, secondary desk research, regulatory filings, trade notices, and supply‑chain trace data to produce an integrated view of the ophthalmic drugs environment. Primary inputs included structured interviews with senior executives in manufacturing, procurement, and clinical affairs, as well as survey data from hospital pharmacy directors and specialty clinic administrators to understand real‑world prescribing and purchasing behaviours. Secondary sources encompassed regulatory guidance documents, official tariff announcements, industry statements, and recent news reporting to contextualize policy and investment developments.

Analytical methods included segmentation mapping across product type, drug class, dosage form, route of administration, therapeutic area, patient demographics, and end‑user channels to surface actionable opportunity zones. Scenario planning was employed to test the operational and financial sensitivity of different sourcing and manufacturing choices under a range of tariff outcomes. Quality control measures comprised cross‑validation of primary responses with public filings and triangulation against multiple independent news and government sources. Where available, country‑level regulatory documents and trade notices were used to confirm policy timing and scope. Any limitations arising from confidential commercial data or rapidly evolving policy were addressed by presenting clear ranges of plausible strategic responses rather than deterministic forecasts.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ophthalmic Drugs market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ophthalmic Drugs Market, by Product Type

- Ophthalmic Drugs Market, by Drug Class

- Ophthalmic Drugs Market, by Route of Administration

- Ophthalmic Drugs Market, by Therapeutic Area

- Ophthalmic Drugs Market, by Patient Demographics

- Ophthalmic Drugs Market, by End User

- Ophthalmic Drugs Market, by Distribution Channel

- Ophthalmic Drugs Market, by Region

- Ophthalmic Drugs Market, by Group

- Ophthalmic Drugs Market, by Country

- United States Ophthalmic Drugs Market

- China Ophthalmic Drugs Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2862 ]

Concluding synthesis emphasizing the need for integrated operational, clinical, and commercial strategies to navigate policy uncertainty and maintain patient access

In conclusion, the ophthalmic drugs ecosystem is at an inflection point where clinical innovation and policy volatility intersect. Strategic winners will be those that invest selectively in supply‑chain resilience, align clinical evidence development to payer and clinician needs, and adapt distribution strategies to a multi‑channel reality that includes hospitals, ophthalmic clinics, retail pharmacies, and online platforms. The intensified focus on domestic production capacity and flexible sourcing is a rational response to recent tariff actions and public policy signals; however, these moves should be executed in tandem with commercial strategies that protect patient access and maintain affordability.

The research underscores a persistent truth: operational excellence and clinical differentiation are complementary levers. Firms that combine robust quality systems and manufacturing reliability with clear clinical value propositions will be best positioned to navigate policy uncertainty and to capture demand across diverse regional markets. Continuous monitoring of trade policy developments and the agility to execute multi‑scenario supply adjustments will be decisive capabilities for sustaining competitive advantage.

Immediate commercial engagement with Associate Director Ketan Rohom to secure the ophthalmic drugs market research report and tailored enterprise licensing options

The ophthalmic drugs market intelligence report is available for purchase through a tailored commercial engagement process led by Ketan Rohom, Associate Director, Sales & Marketing. Prospective buyers will receive a compact briefing that summarizes the report's scope, methodology, and the most critical findings to determine fit, followed by a customized proposal that outlines licensing, enterprise access, and bespoke analytic add-ons. For teams that require deep due‑diligence, an accelerated option provides a short virtual walkthrough of key datasets and segmentation matrices ahead of purchase to accelerate decision timelines.

To request a commercial briefing and receive the tailored proposal for report acquisition, readers should contact the sales office and request an engagement with Ketan Rohom. This approach ensures procurement teams, strategy leads, and commercial operations stakeholders receive immediate answers on deliverables, data access, and any necessary non‑disclosure arrangements. Early engagement also opens opportunities for scope extension, such as custom regional deep dives or competitor landscape maps, so that the final deliverable aligns precisely with internal intelligence needs.

Purchasing the report enables direct access to appendices containing raw segmentation tables, methodology documentation, and a prioritized action checklist derived from the research. It also provides options for scheduled update sessions so that corporate subscribers remain current as regulatory and trade developments evolve. For executive teams seeking an expedited path from insight to implementation, coordinating a briefing with Ketan Rohom will clarify delivery timelines and licensing options and fast‑track access to the full analytical package.

- How big is the Ophthalmic Drugs Market?

- What is the Ophthalmic Drugs Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?