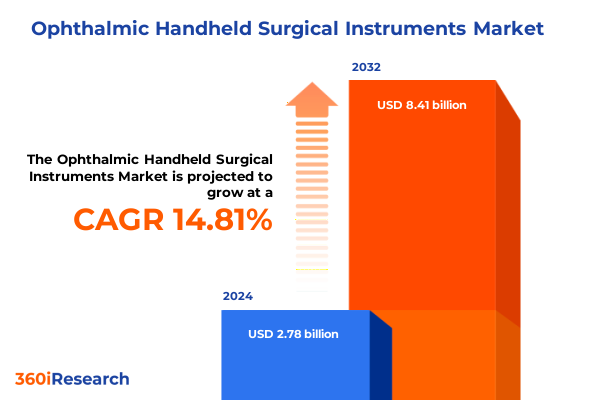

The Ophthalmic Handheld Surgical Instruments Market size was estimated at USD 3.15 billion in 2025 and expected to reach USD 3.58 billion in 2026, at a CAGR of 15.02% to reach USD 8.41 billion by 2032.

Exploring the Critical Importance of High Precision Handheld Instruments in Addressing the Growing Global Burden of Ophthalmic Diseases

Handheld surgical instruments have emerged as indispensable tools in the fight against vision impairment, particularly at a time when the global prevalence of cataracts is on the rise. Age-related cataracts remain the leading cause of global blindness, affecting an estimated 51 percent of cases worldwide and imposing a significant burden on healthcare systems and economies alike. As populations age, with prevalence rates climbing from 3.9 percent among those aged 55–64 to more than 92 percent by age 80, the demand for precise, reliable instruments continues to grow. This trend underscores the critical need for high-precision handheld tools capable of facilitating efficient, minimally invasive procedures while ensuring patient safety and optimal outcomes.

In response to these demographic shifts, surgeons worldwide have increased their reliance on specialized forceps, micro-cannulas, keratomes, and other handheld devices designed to meet the exacting demands of modern ophthalmic surgery. Phacoemulsification alone accounted for more than 82 percent of the over 28 million cataract operations performed globally in 2024, illustrating the dominance of minimally invasive techniques and the subsequent requirement for state-of-the-art instrumentation. Moreover, evolving practice patterns in emerging markets continue to fuel greater procedure volumes, heightening the imperative for robust supply chains and uninterrupted instrument availability. Consequently, healthcare providers and device manufacturers are collaborating more closely than ever to optimize product design, streamline sterilization protocols, and address the specialized needs of both high-volume ambulatory settings and advanced surgical centers.

Unveiling the Transformational Technological and Clinical Evolution Shaping the Future of Ophthalmic Handheld Surgical Instrumentation

A confluence of technological breakthroughs and clinical innovations has dramatically reshaped the landscape of ophthalmic handheld devices. Recent advancements in micro-machining and biocompatible materials have given rise to forceps and scissors with unprecedented tip fidelity and corrosion resistance, enabling surgeons to perform intricate maneuvers within micron-scale tolerances. At the same time, the integration of modular handle-tip architectures permits rapid intraoperative customization, reducing setup times and minimizing instrument inventory requirements. This modularity has become particularly valuable in high-throughput cataract lists, where efficiency gains directly translate into increased case volume and improved patient access.

Concurrently, the aftermath of the COVID-19 pandemic has accelerated adoption of disposable instrument components in ambulatory surgical centers as infection control and operational continuity emerged as top priorities. Sustainability concerns have prompted a parallel focus on environmentally conscious manufacturing, with leading suppliers exploring polymer composites, QR-coded packaging to curb paper waste, and reusable-disposable hybrid models. Ultimately, these trends are converging to create a dynamic environment where robust sterilization protocols coexist alongside single-use innovations, affording practitioners greater flexibility while safeguarding patient outcomes in an era of heightened clinical vigilance.

Analyzing the Layered Impact of United States Reciprocal Tariffs and Trade Policy Duties on Ophthalmic Handheld Surgical Instrument Supply Chains in 2025

In 2025, ophthalmic device manufacturers continue to navigate a complex tariff environment in which multiple layers of U.S. duties affect import costs and supply chain strategies. After the completion of the four-year statutory review, the Office of the United States Trade Representative announced targeted increases in Section 301 tariffs for select medical categories, including certain surgical instruments, effective January 1, 2025. While some exclusions were maintained for specific subheadings within HTSUS 9018, a three-month extension of key exclusions through August 31, 2025 underscores the transient relief for critical ophthalmic tool imports. Importers must therefore remain vigilant regarding the ongoing eligibility of their products for these exemptions, as any lapse in coverage could trigger additional 25 percent duty assessments.

Moreover, proposed reciprocal tariffs announced in mid-2025 threaten to introduce uniform ad valorem duties on goods from major trading partners, potentially reshaping sourcing decisions and cost structures. With regional manufacturing hubs in Asia and Europe adjusting capacity in response to these policy shifts, industry participants are reassessing supplier portfolios, evaluating nearshoring options, and intensifying collaboration with customs experts. Consequently, the cumulative impact of U.S. tariffs has emerged as a critical factor influencing instrument pricing, strategic inventory allocations, and long-term investment in domestic production capabilities.

Unlocking Comprehensive Segmentation Insights into Product Types, Applications, Materials, End Users, and Distribution Channels for Ophthalmic Handheld Instruments

Examining market segmentation reveals distinct patterns in product usage and purchasing behavior for handheld ophthalmic tools. Among instrument categories, cannulas-comprising anterior segment and vitreoretinal designs-have seen frequent redesigns aimed at reducing incision sizes and enhancing fluidics control during intravitreal injections. Similarly, forceps sub-segments such as capsule, micro, and vitreoretinal variants are evolving to accommodate gene therapy and membrane-peeling techniques, with titanium models gaining traction for their lightweight profiles and MRI-compatibility. Keratome and blade knife developments have focused on precision depth guards and laser-assisted docking features, while iris and vitreoretinal scissors incorporate nanocoatings to reduce tissue adhesion.

By application, cataract surgery remains the largest driver of instrument demand, with procedure volumes rising in both mature and emerging markets. Corneal, glaucoma, and retinal surgeries each contribute to the diversification of product portfolios, prompting companies to invest in specialized instrument kits tailored to subspecialty workflows. The disposability axis continues to polarize preferences: reusable sets predominate in hospitals with established sterilization capacity, while ambulatory surgical centers increasingly favor ready-to-use disposable configurations to streamline throughput and mitigate cross-contamination risks. Furthermore, distribution channels oscillate between direct sales models-enabling deeper customer engagement-and distributor partnerships that ensure rapid regional coverage. Stainless steel remains the baseline material for most instruments, but titanium’s premium positioning reflects both its mechanical advantages and manufacturers’ strategies for product differentiation. Collectively, these segmentation insights provide a granular view of how design innovations, application demands, and procurement models intersect to shape the ophthalmic handheld instrument market.

This comprehensive research report categorizes the Ophthalmic Handheld Surgical Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Instrument Type

- Material

- Application

- End User

- Distribution Channel

Unraveling Regional Dynamics Highlighting Growth Drivers and Challenges across Americas, Europe, Middle East, Africa, and Asia-Pacific Ophthalmic Markets

Regional market dynamics are defined by a confluence of healthcare infrastructure maturity, reimbursement frameworks, and demographic trends. In the Americas, the United States and Canada leverage advanced phacoemulsification platforms, high-volume ambulatory surgical centers, and favorable reimbursement codes to sustain robust demand for premium handheld instruments. Growth in Latin America is buoyed by public health initiatives targeting cataract backlogs, with government tenders often favoring domestic assembly partnerships to lower total procurement costs.

Across Europe, Middle East, and Africa, heterogeneous regulatory environments and tender-based purchasing govern instrument adoption. Western European nations exhibit stable demand for innovation-driven tools, while price pressures in Southern Europe and the procurement climates in the Gulf Cooperation Council countries reflect a balance between quality standards and budgetary constraints. Sub-Saharan Africa continues to address significant cataract burdens, catalyzing non-profit and donor-funded programs that incentivize durable, reusable instrument solutions suited for intermittent sterilization facilities.

Asia-Pacific stands out as the fastest-growing region, driven by aging populations in Japan, China, and India alongside expanding eye-care access in Southeast Asia. Infrastructure investments in ambulatory surgical centers and government subsidies for rural eye camps have accelerated procedure volumes. In particular, China’s push to develop localized medical device ecosystems has encouraged joint ventures and technology transfers, positioning the region as both a key production hub and a leading demand center.

This comprehensive research report examines key regions that drive the evolution of the Ophthalmic Handheld Surgical Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Collaborators Shaping the Competitive Landscape of Ophthalmic Handheld Surgical Instruments Worldwide

Leading companies in the ophthalmic handheld instrument space are distinguishing themselves through diversified portfolios, strategic collaborations, and a focus on tailored clinician support. Global incumbents with legacy expertise in stainless steel blade and scissor technologies continue to invest in next-generation materials such as cobalt-chrome and polymer composites, aiming to deliver ergonomic benefits and enhanced edge retention. At the same time, niche specialists in microforceps and vitreoretinal tools leverage modular tip-swap systems to cater to subspecialty surgeons seeking streamlined instrument turnover.

Strategic partnerships between device OEMs and sterilization service providers have emerged as a differentiator, especially in markets where reusable sets dominate. These collaborations encompass remote instrument tracking, predictive maintenance analytics, and turnkey sterilization contracts designed to minimize downtime and lower total cost of ownership for large hospital systems. In parallel, leading firms are piloting digital integration initiatives-incorporating QR-enabled packaging and cloud-based inventory management-to enhance traceability and regulatory compliance. By aligning product innovation with clinical education programs and robust customer service, these companies are reinforcing their competitive positions and fostering long-term loyalty among surgical teams.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ophthalmic Handheld Surgical Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alcon Inc.

- ASICO LLC

- Bausch + Lomb Incorporated

- Carl Zeiss Meditec AG

- D.O.R.C. International B.V.

- Geuder AG

- Johnson & Johnson Vision Care, Inc.

- Katalyst Surgical, LLC

- MicroSurgical Technology, Inc.

- NIDEK Co., Ltd.

- RUMEX International Co.

- STERIS plc

- Surgical Holdings Ltd

- Topcon Corporation

Formulating Strategic Roadmaps to Guide Leaders through Regulatory Pressures, Sustainability Priorities, and Innovation Adoption in Ophthalmic Surgery

Industry leaders can capitalize on emerging opportunities by implementing strategic initiatives that balance innovation, sustainability, and regulatory compliance. To mitigate tariff-driven cost pressures, companies should pursue diversified manufacturing footprints and explore nearshoring in regions with preferential trade agreements. At the product level, investing in modular, upgradable instrument platforms allows for incremental enhancements without the expense of full device redesigns.

Sustainability imperatives call for greater collaboration with materials scientists to advance bioresorbable coatings and take-back programs, reducing environmental impact while meeting surgeon demand for single-use safety. Engaging with professional societies and regulatory bodies to clarify reusable reuse guidelines can unlock new pathways for cost savings and waste reduction. Concurrently, establishing joint training and proctoring programs in key markets ensures rapid adoption of novel instrument features, reinforcing brand differentiation and clinical trust.

Finally, embracing digital solutions-from QR-linked usage analytics to AI-driven predictive maintenance-can elevate instrument lifecycle management, optimize order fulfillment, and strengthen customer relationships. By adhering to these recommendations, stakeholders will be well positioned to navigate the evolving landscape of ophthalmic surgery and secure sustainable growth.

Detailing Comprehensive Research Methodologies Integrating Primary Interviews, Quantitative Analysis, and Expert Validation for Ophthalmic Instrument Insights

Our research methodology combines primary qualitative interviews with ophthalmic surgeons, device procurement managers, and regulatory experts, alongside a rigorous quantitative analysis of import-export data, tariff schedules, and clinical utilization metrics. Interviews were conducted across North America, Europe, and Asia-Pacific to capture regional nuances in instrument preferences and purchasing drivers. Import data from U.S. Customs and Border Protection was triangulated with public duty schedules issued by the Office of the U.S. Trade Representative, providing a clear view of tariff exposure and exemption timelines.

Secondary research encompassed peer-reviewed journals, device registries, professional association publications, and industry conference proceedings to validate clinical trends and emerging technologies. We employed statistical modeling techniques to analyze usage volumes across applications-cataract, corneal, glaucoma, and retinal surgery-ensuring that segmentation insights are grounded in robust empirical evidence. Finally, an expert advisory panel reviewed all findings to ensure accuracy, relevance, and strategic applicability for stakeholders seeking to deepen their insights into the ophthalmic handheld surgical instrument market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ophthalmic Handheld Surgical Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ophthalmic Handheld Surgical Instruments Market, by Product Type

- Ophthalmic Handheld Surgical Instruments Market, by Instrument Type

- Ophthalmic Handheld Surgical Instruments Market, by Material

- Ophthalmic Handheld Surgical Instruments Market, by Application

- Ophthalmic Handheld Surgical Instruments Market, by End User

- Ophthalmic Handheld Surgical Instruments Market, by Distribution Channel

- Ophthalmic Handheld Surgical Instruments Market, by Region

- Ophthalmic Handheld Surgical Instruments Market, by Group

- Ophthalmic Handheld Surgical Instruments Market, by Country

- United States Ophthalmic Handheld Surgical Instruments Market

- China Ophthalmic Handheld Surgical Instruments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing Strategic Takeaways, Market Dynamics, and the Imperative for Continuous Innovation in Ophthalmic Handheld Instruments

In conclusion, the ophthalmic handheld surgical instrument sector stands at the intersection of demographic headwinds, clinical innovation, and evolving trade policies. The sustained rise in cataract and other ophthalmic surgery volumes underscores the critical role of precision-engineered tools in delivering safe, effective patient care. Technological advances-from modular tip architectures to novel materials-are reshaping instrument design, while sustainability and operational efficiency continue to drive the balance between disposable and reusable solutions.

Navigating the complex landscape of U.S. reciprocal tariffs and duty extensions requires proactive supply chain strategies and close collaboration with trade specialists. At the same time, regional variations in reimbursement models and procurement frameworks highlight the importance of tailored market approaches. By leveraging granular segmentation insights, engaging leading innovators, and adhering to strategic recommendations, industry participants can secure a competitive edge and contribute to improved surgical outcomes worldwide.

Looking forward, continuous innovation and close alignment with clinical needs will determine which organizations thrive in this dynamic environment. Stakeholders who invest in flexible platforms, sustainable practices, and deep customer partnerships will be best positioned to meet the demands of tomorrow’s ophthalmic surgeries and ensure enduring patient impact.

Driving Action with Ketan Rohom to Secure In-Depth Ophthalmic Handheld Instruments Market Intelligence and Stay Ahead of Evolving Surgical Trends

Engaging with Ketan Rohom opens the door to procuring a comprehensive market research report packed with actionable insights on ophthalmic handheld surgical instruments. By partnering with his expertise in sales and marketing strategy, stakeholders can gain an in-depth understanding of industry trends, competitive dynamics, and regulatory considerations shaping this critical medical device segment. Learning from the meticulously curated data and professional analysis ensures that decision-makers are equipped to anticipate market shifts, prioritize research and development investments, and align product portfolios with evolving surgical requirements.

Reach out to Ketan Rohom today to explore tailored solutions and secure the detailed research intelligence necessary to drive growth. Through direct collaboration, clients will receive personalized guidance on leveraging market data to optimize supply chains, refine pricing strategies, and bolster market access across regional landscapes. Taking this step now empowers organizations to stay at the forefront of innovation, mitigate risks associated with trade policy changes, and capitalize on emerging opportunities within ophthalmic surgery.

- How big is the Ophthalmic Handheld Surgical Instruments Market?

- What is the Ophthalmic Handheld Surgical Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?