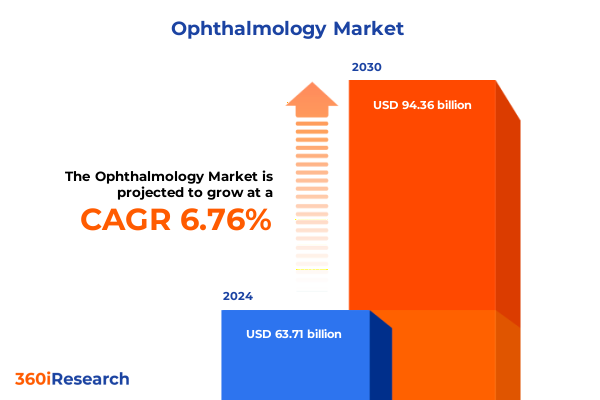

The Ophthalmology Market size was estimated at USD 63.71 billion in 2024 and expected to reach USD 67.85 billion in 2025, at a CAGR of 6.76% to reach USD 94.36 billion by 2030.

Setting the Stage for Ophthalmology’s Next Era with Comprehensive Insight into Market Dynamics and Emerging Clinical Opportunities

As the global population continues to age and the prevalence of vision impairment rises, the ophthalmology landscape is experiencing an unprecedented transformation. Advances in medical science combined with accelerated technological innovation are redefining how eye care is delivered, from early-stage diagnostics to advanced surgical interventions. In parallel, patient expectations are evolving toward personalized treatment regimens and seamless care experiences, creating new imperatives for stakeholders across the value chain.

Against this backdrop, a confluence of regulatory changes, reimbursement reforms, and digital health initiatives is reshaping competitive strategies and investment priorities. Market actors must navigate shifting policy frameworks while capitalizing on breakthroughs in areas such as retinal therapies, minimally invasive surgery, and artificial intelligence-powered diagnostics. Moreover, the integration of data-driven decision support tools and remote care models is enabling deeper patient engagement and operational efficiencies.

This executive summary provides a cohesive overview of the current ophthalmology market dynamics, highlighting the key drivers, challenges, and strategic opportunities that are defining the next era of eye care. Through an in-depth examination of technological trends, market segmentation, regional nuances, and leading company activities, decision-makers will gain the insights needed to chart a course for sustainable growth and competitive advantage.

Identifying Transformative Technological and Therapeutic Shifts Reshaping Ophthalmology Practice Patterns and Patient Outcomes Worldwide

The ophthalmology sector is undergoing transformative shifts powered by both technological breakthroughs and evolving therapeutic approaches. Foremost among these is the rise of artificial intelligence in diagnostic imaging, which is enhancing the precision of retinal scans and enabling early detection of conditions such as diabetic retinopathy and age-related macular degeneration. Concurrently, gene and cell therapies are progressing through the clinical pipeline, promising durable solutions for inherited retinal disorders and other previously intractable diseases.

In parallel, minimally invasive surgical techniques, including femtosecond lasers and micro-incisional procedures, are gaining traction by reducing patient recovery times and improving procedural outcomes. These innovations are complemented by the proliferation of teleophthalmology platforms, which extend specialist expertise to remote and underserved regions, thereby democratizing access to quality eye care. The convergence of wearable technologies and mobile health applications further empowers patients to monitor ocular metrics in real time, fostering proactive disease management.

Taken together, these advancements are not isolated developments but interconnected forces that are redefining standard of care protocols and supply chain models. As stakeholders adapt to this dynamic environment, they are challenged to balance rapid adoption of novel solutions with robust validation processes and regulatory compliance. Consequently, success will be measured not only by technological prowess but also by the ability to integrate emerging therapies and digital tools into cohesive, patient-centric care pathways.

Assessing the Cumulative Effects of 2025 United States Tariff Adjustments on Ophthalmic Trade Flows and Clinical Equipment Accessibility

In 2025, adjustments to United States tariff policies have exerted notable influence on the import and distribution of ophthalmic products. Diagnostic devices, including advanced fundus cameras and slit lamps, have become subject to higher duty rates, prompting many suppliers to reevaluate global supply chains and consider strategic localization of manufacturing. Similarly, surgical equipment such as ophthalmic lasers and viscosurgical devices faces escalated costs, which in turn can translate into higher operational expenses for clinics and hospitals.

These tariff-induced cost increments have initiated a ripple effect across the ecosystem. Equipment providers are exploring partnerships with domestic manufacturers to mitigate tariff exposure and maintain competitive pricing. At the same time, distributors are negotiating volume-based agreements and exploring alternative sourcing arrangements. Clinical practices, meanwhile, are reassessing capital expenditure plans and extending equipment lifecycles to offset budgetary pressures.

Despite these challenges, tariffs have also catalyzed innovation in procurement strategies. Stakeholders are increasingly leveraging comprehensive total cost of ownership analyses and engaging in consortium purchasing models to distribute risk. Furthermore, the policy environment has heightened interest in locally developed solutions, spurring investment in U.S.-based R&D and fostering closer collaboration between regulatory bodies and technology developers. As the market adapts, the net effect of tariff adjustments will be determined by the industry’s agility in optimizing supply chains, managing cost structures, and ensuring uninterrupted patient care.

Unveiling Strategic Market Insights Through Detailed Segmentation Across Products Software Modalities Diseases End Users and Distribution Channels

A granular examination of ophthalmology market segmentation reveals critical insights for strategic decision-making across multiple dimensions. Based on product type, the domain encompasses Drugs, Equipment, and Prescription Glasses & Lens. Within the Drugs category, there is a clear delineation among Allergic Conjunctivitis & Inflammation Drugs, Dry Eye Drugs, Glaucoma Drugs, and Retinal Disorder Drugs, each exhibiting distinct therapeutic profiles and market maturity. The Equipment segment bifurcates into Diagnostic Devices and Surgical Devices; diagnostic modalities are powered by innovations in Fundus Cameras, Slit Lamps, and Ultrasound Imaging Systems, whereas surgical technologies leverage Ophthalmic Lasers and Ophthalmic Viscosurgical Devices to achieve superior clinical precision.

Beyond hardware and pharmaceuticals, the ophthalmology ecosystem is increasingly driven by Software solutions. Data Management Software is facilitating secure patient record integration, Medical Imaging Software is enhancing image analysis accuracy, and Practice Management Software is streamlining operational workflows. Disease type segmentation underscores the heterogeneity of treatment landscapes, spanning Age-Related Macular Degeneration, Cataract, Glaucoma, Inflammatory Diseases, and Refractive Disorders-each presenting unique epidemiological and reimbursement challenges.

End users, including Healthcare Service Providers, Hospitals, Medical Institutes, and Research Organizations, drive product adoption and clinical protocol development, while distribution channels such as Hospital Pharmacy, Online Retail via E-commerce Platforms and Manufacturer Websites, and Retail Pharmacy define the pathways through which patients access therapies and devices. By weaving these segmentation dimensions together, stakeholders can pinpoint high-value opportunities, align product development with unmet needs, and optimize channel strategies for maximum market penetration.

This comprehensive research report categorizes the Ophthalmology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Opthalmology Softwares

- Disease Type

- End User

- Distribution Channel

Highlighting Region-Specific Ophthalmology Market Trends and Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Landscapes

Regional dynamics play a pivotal role in shaping ophthalmology market trajectories, as each geography reflects unique demographic, economic, and regulatory influences. In the Americas, advanced healthcare infrastructure and a growing focus on value-based care are accelerating the adoption of cutting-edge therapies and diagnostic equipment, with the United States leading the way in reimbursement reforms and clinical trial activity. Canada and select Latin American nations are following suit, albeit with variable pace influenced by public policy and healthcare funding models.

Shifting to Europe, Middle East & Africa, regulatory harmonization efforts across the European Union are streamlining market entry for novel ophthalmic products, while national health services continue to emphasize cost containment and centralized procurement. In the Middle East, high-investment health initiatives are driving demand for premium surgical devices, whereas parts of Africa remain challenged by limited access to basic eye care, underscoring the need for low-cost, scalable diagnostic solutions.

Asia-Pacific exemplifies a market of contrasts, with developed economies like Japan and Australia advancing precision medicine and AI integration, while emerging markets in Southeast Asia and India are experiencing rapid infrastructure expansion and digital health adoption. This regional tapestry highlights the importance of tailored strategies that address local reimbursement frameworks, disease prevalence patterns, and technology readiness levels, enabling companies to maximize impact across diverse ophthalmology landscapes.

This comprehensive research report examines key regions that drive the evolution of the Ophthalmology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Performance and Strategic Initiatives of Leading Ophthalmology Stakeholders Driving Innovation and Market Leadership

Leading ophthalmology companies are deploying a range of strategic initiatives to consolidate market leadership and stimulate innovation. Established multinationals are leveraging core competencies in pharmaceutical development and device manufacturing to expand therapeutic portfolios and streamline production processes. Concurrently, technology-focused entrants are gaining traction by introducing AI-enabled imaging solutions and cloud-based data management platforms, challenging traditional boundaries between equipment providers and software vendors.

Strategic collaborations, joint ventures, and targeted acquisitions have intensified as companies seek to integrate complementary assets and accelerate time to market. Research alliances with academic institutions and contract research organizations are becoming instrumental in advancing gene and cell therapy programs, while partnerships with digital health firms enable rapid deployment of teleophthalmology services. Many stakeholders are also prioritizing sustainability and supply-chain resilience, introducing eco-friendly packaging, and diversifying supplier networks to mitigate geopolitical risks.

Competitive differentiation increasingly hinges on service offerings that extend beyond product delivery. Companies are deploying remote monitoring platforms, value-based contracting models, and clinician training academies, thereby embedding themselves within the care continuum. This holistic approach not only strengthens customer relationships but also generates real-world evidence to support product efficacy and reimbursement negotiations. As the competitive landscape evolves, success will favor organizations that blend scientific excellence with agile go-to-market strategies and patient-centric service innovations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ophthalmology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AbbVie Inc.

- Alcon Inc.

- Alkeus Pharmaceuticals, Inc.

- Apotex Inc.

- Bausch + Lomb Corporation

- C.H. Boehringer Sohn AG & Co. KG

- Carl Zeiss AG

- ClearSight LLC by Riskonnect

- Duopharma Biotech Berhad

- Essex Bio-Technology Limited

- EssilorLuxottica S.A.

- Eyenovia, Inc.

- F. Hoffmann-La Roche AG

- GenSight Biologics S.A.

- Glaukos Corporation

- Halma PLC

- Harrow Health, Inc.

- Hoya Corporation

- Johnson & Johnson Services Inc.

- Kubota Pharmaceutical Holdings Co., Ltd.

- Lumenis Be Ltd.

- McKesson Corporation

- Nidek Co., Ltd.

- Novartis AG

- OCuSOFT, Inc.

- Oxurion NV

- Pfizer, Inc.

- Reichert by AMETEK, Inc.

- Santen Pharmaceutical Co., Ltd.

- SEED Co., Ltd.

- Sun Pharmaceutical Industries Limited

- Teva Pharmaceutical Industries Ltd.

- The Cooper Companies, Inc.

- TME Pharma N.V.

- Topcon Corporation

- Unimed Pharma, Spols r.o.

- Ziemer Ophthalmic Systems AG

Empowering Industry Leadership with Actionable Strategies to Navigate Ophthalmology Market Challenges Accelerate Growth and Enhance Patient Care Outcomes

Industry leaders must adopt a proactive stance to harness emerging opportunities and safeguard against market disruptions. First, investments in digital health capabilities-particularly AI-driven diagnostics and teleophthalmology platforms-will be critical for extending reach and enhancing patient outcomes. Leaders should prioritize partnerships with technology innovators to expedite integration and ensure compliance with evolving data privacy regulations.

Second, supply-chain diversification is paramount in light of ongoing tariff volatility and global logistical challenges. By cultivating relationships with regional contract manufacturers and leveraging nearshoring strategies, organizations can maintain cost competitiveness while minimizing supply interruptions. Concurrently, adopting advanced analytics for demand forecasting will optimize inventory management and resource allocation.

Third, embracing patient-centric care models and value-based contracting can differentiate offerings in an increasingly cost-conscious environment. Companies should explore outcome-linked reimbursement arrangements and support programs that improve adherence and satisfaction. Additionally, aligning product development roadmaps with unmet clinical needs-such as novel gene therapies for retinal diseases-will unlock high-growth niches.

Finally, fostering a culture of continuous innovation through cross-functional collaboration and iterative feedback loops will accelerate product refinement and market responsiveness. By integrating real-world evidence into decision making and investing in clinician education initiatives, leaders can reinforce their competitive edge and deliver sustainable value across the ophthalmology ecosystem.

Outlining Rigorous Research Methodology and Analytical Frameworks Employed to Validate Ophthalmology Market Insights with Data Integrity and Transparency

This analysis is grounded in a robust, multi-stage research methodology combining primary and secondary data sources to ensure comprehensive insight and data integrity. Primary research consisted of in-depth interviews with key opinion leaders, ophthalmologists, technology developers, and payers to capture qualitative perspectives on clinical trends and market drivers. Additionally, proprietary surveys were conducted across a diverse cross section of end users, including hospitals, specialty clinics, and research institutions, to validate adoption patterns and purchasing behaviors.

Secondary research encompassed a thorough review of peer-reviewed journals, clinical trial registries, patent filings, regulatory documentation, and financial disclosures. Government databases and trade association reports provided macroeconomic context, while company publications and white papers illuminated competitive strategies. Data triangulation techniques were employed to reconcile discrepancies between sources and bolster the reliability of insights.

Analytical frameworks such as SWOT, Porter’s Five Forces, and PESTLE were utilized to evaluate market attractiveness, competitive intensity, and external influences. Segmentation analyses were performed to identify opportunities within product categories, software solutions, disease types, end-user groups, and distribution channels. Rigorous validation protocols, including stakeholder feedback loops and consistency checks, underpin the credibility of this research, ensuring that findings offer actionable guidance for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ophthalmology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ophthalmology Market, by Product Type

- Ophthalmology Market, by Opthalmology Softwares

- Ophthalmology Market, by Disease Type

- Ophthalmology Market, by End User

- Ophthalmology Market, by Distribution Channel

- Ophthalmology Market, by Region

- Ophthalmology Market, by Group

- Ophthalmology Market, by Country

- United States Ophthalmology Market

- China Ophthalmology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Insights Reflecting Key Findings Synthesis and Implications for Stakeholders Engaged in Advancing Ophthalmology Care Standards

In summary, the ophthalmology market stands at a pivotal juncture characterized by rapid technological advancement, evolving therapeutic paradigms, and complex policy landscapes. Stakeholders who proactively embrace digital transformation, diversify supply chains, and prioritize patient-centric care will be best positioned to seize emerging growth opportunities. Regional nuances-from advanced economies to developing markets-underscore the need for tailored approaches that address local regulatory, reimbursement, and infrastructure considerations.

The integration of novel diagnostics, gene therapies, and AI-driven solutions is redefining clinical pathways and creating new value propositions. At the same time, competitive dynamics are intensifying, with both established players and agile entrants vying for market share through strategic alliances and service innovations. As the industry adapts to shifting tariff environments and reimbursement shifts, the ability to align strategic investments with unmet needs will be the hallmark of market leaders.

Ultimately, this executive summary offers a strategic compass for decision-makers seeking to navigate the complexities of the modern ophthalmology ecosystem. By leveraging the insights herein, executives can formulate robust strategies that drive sustainable growth, enhance patient outcomes, and solidify long-term competitive advantage.

Connect with Associate Director Ketan Rohom to Secure the Definitive Ophthalmology Market Research Report and Drive Strategic Decision-Making

To explore how this comprehensive ophthalmology market research report can inform your strategic initiatives and operational planning, connect directly with Associate Director Ketan Rohom to secure exclusive access. By engaging with Ketan, you will receive tailored guidance on aligning the report’s insights with your organization’s unique objectives, whether you are evaluating new product development, assessing distribution strategies, or refining competitive positioning. This call will also include an overview of complimentary advisory support, ensuring that you can implement findings seamlessly and drive meaningful impact. Reach out today to take the next step in optimizing your ophthalmology portfolio and sustaining long-term growth in a rapidly evolving healthcare environment

- How big is the Ophthalmology Market?

- What is the Ophthalmology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?