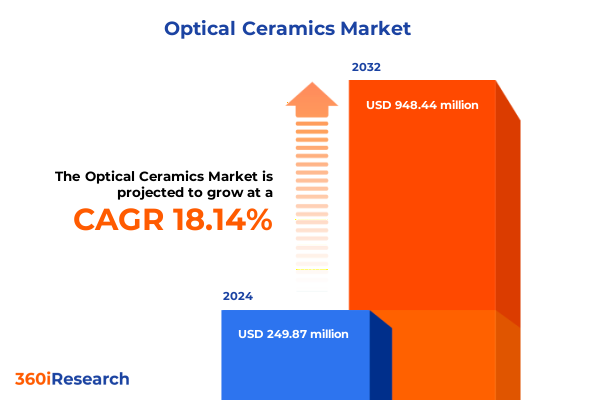

The Optical Ceramics Market size was estimated at USD 296.19 million in 2025 and expected to reach USD 354.36 million in 2026, at a CAGR of 18.08% to reach USD 948.44 million by 2032.

Exploring the Foundational Role of Optical Ceramics Within High-Performance Applications Driven by Technological Innovation and Material Excellence

Optical ceramics have emerged as critical enablers across high-performance applications where precision, durability, and transparency converge. Composed of advanced materials such as alumina, silicon nitride, silicon carbide, and zirconia, these engineered ceramics deliver exceptional optical clarity under extreme thermal and mechanical stress. Their ability to maintain structural integrity and optical properties at elevated temperatures positions them at the forefront of industries ranging from defense systems to medical imaging equipment. As applications continue to evolve, the emphasis on material purity, microstructural control, and advanced manufacturing techniques has intensified, driving rapid innovation across the value chain.

Moreover, the rise of additive manufacturing, hybrid machining, and thin-film deposition has expanded the breadth of ceramic components that can be produced with micron-level precision. These technological advances have reduced fabrication times and lowered barriers to complex geometries, enabling designers to integrate ceramic optical elements into novel system architectures. Coupled with a growing focus on environmental regulations and sustainable practices, the industry is under pressure to optimize energy consumption, minimize waste, and adopt green supply chains. Consequently, the next generation of optical ceramics not only meets stringent optical specifications but also aligns with broader corporate sustainability agendas.

Unveiling Key Transformative Shifts Redefining the Optical Ceramics Landscape Across Technological Advancements and Emerging Industry Demands

Over the past decade, the optical ceramics sector has undergone transformative shifts driven by breakthroughs in material science and processing methodologies. Transparency in ceramics, once limited by pore size and grain boundary scattering, has been substantially improved through innovative sintering protocols and high-pressure hot isostatic pressing. These advances have expanded the practical thickness and optical uniformity achievable in components used for laser windows and high-power optics. In parallel, the integration of nano-scale dopants has unlocked tailored refractive indices, enabling precise control of light propagation for specialized applications such as infrared imaging and ultraviolet sterilization.

In addition to microstructural enhancements, digital design tools and in situ monitoring technologies have revolutionized quality assurance and process optimization. Real-time feedback systems embedded within sintering furnaces and coating chambers allow engineers to adjust parameters on the fly, reducing scrap rates and improving yield consistency. Meanwhile, collaborations between material suppliers and end-use manufacturers have fostered co-development models that accelerate product qualification cycles. As a result, optical ceramics are transitioning from niche specialty parts to mainstream architectural elements in emerging fields like photonics, autonomous vehicle sensors, and next-generation telecommunications infrastructure.

Assessing the Cumulative Effects of 2025 United States Tariffs on Supply Chains, Pricing Dynamics, and Competitive Strategies in Optical Ceramics

The implementation of new tariffs on ceramic raw materials and finished components imposed by the United States in early 2025 has introduced significant adjustments throughout the optical ceramics supply chain. Manufacturer margins have been compressed as additional duties elevate input costs, prompting a re-evaluation of offshore procurement strategies. Many original equipment manufacturers have responded by seeking local sourcing alternatives, spurring capital expenditure in domestic production capacity. This shift has, in turn, led to a surge in equipment orders for hot-press and isostatic pressing systems within North America.

Furthermore, price volatility driven by trade policy has intensified negotiations between suppliers and buyers, catalyzing long-term contracts and joint venture formations. To maintain competitiveness, some global ceramic producers have established satellite facilities within the United States to mitigate the impact of duties and streamline logistics. Concurrently, research and development investments are increasingly focused on alternative feedstocks and innovative coatings that reduce reliance on originating regions subject to tariffs. Although these adjustments introduce short-term complexity, they also create opportunities for technology licensing, strategic partnerships, and reshoring initiatives that could fortify the industry’s resilience against future trade fluctuations.

Delving into Product, Form, Coating Type, and End-Use Industry Segmentation to Reveal Nuanced Trends and Growth Drivers in Optical Ceramics

Examining segmentation by product type reveals distinct performance and cost characteristics that guide application decisions. Alumina stands out for its affordability and high hardness, making it suitable for abrasion-resistant windows and protective enclosures. Conversely, silicon carbide offers superior thermal conductivity and fracture toughness, catering to high-power laser systems and advanced sensor housings. Silicon nitride’s low thermal expansion and chemical stability underpin its use in precision optical mounts and high-temperature lenses, while zirconia’s exceptional toughness and translucency at select wavelengths position it for innovative biomedical imaging interfaces.

Meanwhile, variations in form factor influence manufacturing flexibility and end-use adaptability. Coated ceramic substrates enable multifunctional surfaces that combine optical clarity with abrasion or chemical resistance, whereas powder precursors form the backbone of additive manufacturing processes or slip castings. Transparent ceramic blanks, produced through rigorous densification, facilitate direct machining of complex lens geometries with minimal post-processing. At the coating level, abrasion resistant layers extend component lifetimes in harsh operational environments, while anti-reflection treatments maximize throughput in optical chains. Protective coatings guard against corrosive exposure, and thermal barrier films insulate sensitive optics from temperature extremes.

Lastly, the diversity of end-use industries underscores the market’s multidimensional growth paths. The automotive sector leverages ceramics in LiDAR systems and head-up displays, while defense and aerospace demand high-performance windows for targeting and surveillance. Electronics applications incorporate transparent substrates for ultraviolet sterilization modules and optical sensors, and the energy industry embraces ceramic elements in high-temperature solar receivers. Industrial processes utilize ceramics for precision measurement optics, and medical imaging continues to adopt translucent ceramic devices for diagnostic and therapeutic tools.

This comprehensive research report categorizes the Optical Ceramics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Coating Type

- End Use Industry

Mapping Regional Dynamics Across the Americas, Europe, Middle East & Africa, and Asia-Pacific to Illuminate Divergent Market Opportunities

Regional dynamics in the optical ceramics market vary considerably, shaped by industrial concentration and policy environments. In the Americas, a mature ecosystem of material suppliers, equipment manufacturers, and end-use integrators fosters continuous innovation. Research hubs in the United States and Canada drive breakthroughs in transparent ceramics and advanced coating chemistries, bolstered by government funding for defense and clean energy technologies. Consequently, regional demand is characterized by high specifications and stringent certification processes that set global benchmarks.

Transitioning eastward, Europe, Middle East & Africa exhibit a diverse mosaic of market drivers. Western Europe emphasizes sustainability and circular economy principles, prompting manufacturers to adopt recyclable ceramic waste strategies and closed-loop processing. At the same time, defense budgets in select European nations support the development of next-generation sensor windows and ruggedized optical assemblies. In the Middle East, sovereign wealth investments accelerate infrastructure modernization, including optical systems for renewable energy and water treatment. Africa’s growing electronics sector is gradually integrating optical ceramics for industrial instrumentation and emerging medical applications.

Further south and east, the Asia-Pacific region manifests rapid adoption and capacity expansion. China’s aggressive pursuit of technological self-reliance has resulted in substantial investments across the optical ceramics value chain, from raw feedstock refinement to high-volume component production. Japan and South Korea leverage decades of ceramic expertise to refine manufacturing quality and precision, focusing on transparent ceramics for high-resolution displays and compact LiDAR modules. Meanwhile, Southeast Asian nations serve as key assembly hubs, integrating ceramic optical elements into consumer electronics and automotive safety systems.

This comprehensive research report examines key regions that drive the evolution of the Optical Ceramics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading Industry Players’ Strategic Initiatives Unveiling Competitive Positioning and Innovation Trajectories in Optical Ceramics

The competitive landscape in optical ceramics is defined by strategic initiatives aimed at differentiation through innovation, capacity investment, and collaboration. A leading German specialty glass and ceramics firm has expanded its portfolio with advanced transparent oxide ceramics, targeting high-power photonic and defense applications. A Japanese multinational has prioritized acquisitions of niche ceramic coating specialists to enhance its surface treatment capabilities and broaden its endpoint performance range. Meanwhile, an established North American ceramics manufacturer has invested in modular production lines to enable rapid scaling of customization, leveraging close partnerships with major aerospace and electronics integrators.

Emerging enterprise collaborations are also reshaping industry dynamics. Joint research centers between material developers and end users are fast-tracking qualification protocols for next-generation ceramic composites, while strategic alliances with equipment vendors optimize process control via digital twin simulations. In addition, several companies have announced sustainability roadmaps aimed at reducing carbon footprints within ceramic sintering operations and coating processes. These concerted efforts underscore a shift from commodity supply models toward value-added services, with firms offering integrated solutions encompassing materials, coatings, and design support to secure long-term customer engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Ceramics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Ceramic Manufacturing LLC

- American Elements

- CeramTec GmbH

- CeraNova Corporation

- CoorsTek, Inc.

- Denka Company Limited

- Heraeus Materials Technology GmbH

- II‑VI Incorporated

- Konoshima Chemical Co., Ltd.

- Kyocera Corporation

- Kyocera Fineceramics Europe GmbH

- Morgan Advanced Materials plc

- Murata Manufacturing Co., Ltd.

- Noritake Co., Limited

- OptiPro Systems

- Saint-Gobain S.A.

- SCHOTT AG

- Surmet Corp.

- Toshima Manufacturing Co., Ltd.

- Wacker Chemie AG

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Advancing Optical Ceramics Opportunities

Industry leaders should prioritize investment in additive manufacturing and digital process controls to capitalize on the demand for complex optical geometries and rapid prototyping. By integrating in situ monitoring systems within sintering and coating workflows, organizations can reduce defect rates and accelerate time to market. Furthermore, establishing dual-sourcing agreements for critical raw materials will mitigate exposure to future trade policy fluctuations and supply disruptions, reinforcing operational resilience.

Moreover, expanding the coatings portfolio to include multifunctional layers-such as combined thermal barrier and abrasion resistant films-will address the growing need for integrated performance in harsh environments. Collaborative partnerships with end-use customers can yield co-development opportunities, enabling tailored solutions that differentiate offerings and deepen client relationships. Finally, embedding sustainability goals within process optimization, such as adopting low-temperature sintering aids and recycling ceramic waste, will align manufacturers with evolving ESG criteria and appeal to eco-conscious stakeholders.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data, and Triangulation to Ensure Rigorous Optical Ceramics Insights

The research framework underpinning this analysis integrates both primary and secondary data sources to ensure comprehensive and rigorous insights. Initially, secondary research encompassed a thorough review of academic literature, patent filings, regulatory documents, and industry white papers, capturing the latest advancements in ceramic materials and optical coatings. Corporate disclosures from leading material suppliers and end-use manufacturers provided financial and operational context, while trade association reports illuminated supply chain structures and capacity trends.

Primary research involved in-depth interviews with key stakeholders, including materials scientists, process engineers, procurement directors, and strategic planners across multiple geographies. These discussions offered qualitative perspectives on technology adoption challenges, cost drivers, and partnership models. To validate findings, data triangulation was conducted through cross-referencing interview insights with quantitative trade statistics, production capacity databases, and patent landscape analyses. The iterative review process, guided by an expert advisory panel, ensured that conclusions were both current and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Ceramics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Ceramics Market, by Product Type

- Optical Ceramics Market, by Form

- Optical Ceramics Market, by Coating Type

- Optical Ceramics Market, by End Use Industry

- Optical Ceramics Market, by Region

- Optical Ceramics Market, by Group

- Optical Ceramics Market, by Country

- United States Optical Ceramics Market

- China Optical Ceramics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesizing Core Findings and Strategic Implications to Provide a Coherent Conclusion on the Evolving Optical Ceramics Market Landscape

In summary, the optical ceramics sector is experiencing dynamic evolution driven by material innovation, process digitization, and shifting trade policies. Advances in sintering technologies and nano-engineered dopants have enhanced transparency and mechanical performance, while digital in situ monitoring is streamlining quality assurance. Trade interventions in 2025 have prompted a strategic realignment of supply chains and accelerated domestic capacity investments, underscoring the importance of agility in procurement and manufacturing.

Segmentation analysis reveals that product type, form, coating type, and end-use industry each present distinct growth pathways and performance requirements. Regional dynamics further influence strategic priorities, with the Americas leading in defense and clean energy, EMEA emphasizing sustainability and modernization, and Asia-Pacific driving volume production and process refinement. Leading companies are differentiating through targeted M&A, co-development models, and sustainability initiatives, signaling a shift toward integrated offerings and long-term partnerships. Collectively, these developments highlight the need for proactive strategies that combine innovation, collaboration, and resilience to thrive in this competitive landscape.

Engage with Ketan Rohom to Secure Your In-Depth Optical Ceramics Market Research Report and Empower Data-Driven Decision Making Today

To gain a deeper understanding of the evolving optical ceramics landscape and harness actionable insights for strategic decision-making, connect with Ketan Rohom, the Associate Director of Sales & Marketing. His in-depth knowledge of material innovations, market dynamics, and supply chain implications will guide your exploration of the comprehensive market research report tailored to your organization’s needs and growth objectives. Whether you are evaluating new investments, optimizing manufacturing processes, or planning market entry strategies, securing the full report will equip your team with the robust analysis and data essential for informed, confident decisions. Reach out to Ketan to customize your report package and explore volume licensing options or executive briefing sessions designed to accelerate time to market and competitive advantage.

- How big is the Optical Ceramics Market?

- What is the Optical Ceramics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?