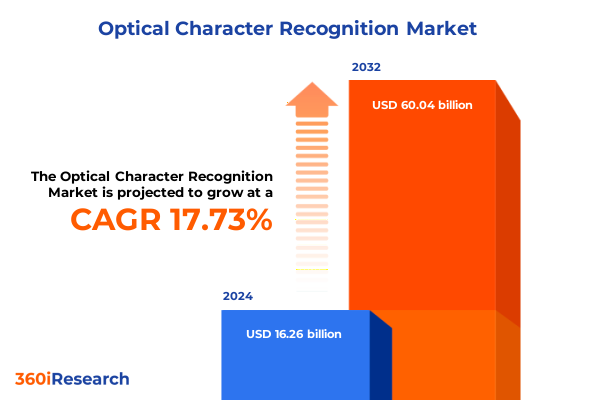

The Optical Character Recognition Market size was estimated at USD 19.15 billion in 2025 and expected to reach USD 22.21 billion in 2026, at a CAGR of 17.72% to reach USD 60.04 billion by 2032.

Setting the Foundation for Optical Character Recognition Market Insights by Exploring Core Innovations and Strategic Business Imperatives

Optical Character Recognition has evolved from a niche automation tool into a cornerstone technology for enterprises seeking to streamline document processing, enhance accuracy, and accelerate decision-making. In this digital age, the volume of unstructured data continues to surge across industries, and organizations are compelled to adopt intelligent solutions that can transform image-based information into actionable digital content. As part of a broader digital transformation strategy, OCR not only reduces manual data entry errors but also enables deeper data analysis by integrating captured text into enterprise resource planning and customer relationship management systems.

Rapid advancements in artificial intelligence and machine learning have significantly elevated OCR capabilities, offering organizations the ability to handle complex scripts, variable fonts, and cursive handwriting with unprecedented precision. This introduction sets the stage for a comprehensive exploration of how OCR is reshaping business processes, driving operational efficiencies, and opening new avenues for innovation. By combining traditional pattern recognition with neural network–based techniques, modern OCR solutions deliver contextual understanding, further empowering decision-makers with reliable data extraction across multiple document types.

Unveiling Next-Generation OCR Disruptions Fueled by AI, Cloud Convergence, and Mobile Capture Paradigms

Over the past few years, the OCR landscape has experienced transformative shifts driven by the convergence of artificial intelligence, cloud computing, and edge processing. Deep learning algorithms now enable real-time character recognition with adaptive learning capabilities, allowing systems to improve accuracy dynamically as they process diverse document formats. This shift has elevated OCR from a back-office utility to a mission-critical element of enterprise artificial intelligence strategies. Simultaneously, the proliferation of mobile capture technologies has democratized access to OCR, enabling field workers to digitize forms and invoices directly from smartphones and tablets, thus extending OCR’s reach beyond traditional office environments.

Another pivotal change has been the migration from on-premise deployments to cloud-native OCR platforms, offering scalable infrastructure, seamless updates, and integration with broader cloud ecosystems. This transition has catalyzed innovation, leading to tightly integrated workflows where OCR outputs feed directly into robotic process automation, natural language processing, and intelligent analytics suites. As a result, organizations can achieve end-to-end automation of complex document-centric processes, unlocking new efficiencies and reducing cycle times. These transformative shifts underscore how OCR has matured from a standalone solution to a foundational technology enabling intelligent document processing at scale.

Examining the Ripple Effects of 2025 United States Technology Tariffs on OCR Hardware Sourcing and Strategic Deployment Choices

In 2025, the implementation of tariffs by the United States on select technology imports has introduced new considerations for organizations deploying OCR hardware and peripheral devices. Increased duties on imaging equipment and specialized scanners have driven some enterprises to reevaluate their supply chains, exploring options such as sourcing from domestic manufacturers or transitioning to software-centric and cloud-based OCR services to mitigate capital expenditure. These adjustments have not only reshaped procurement strategies but have also prompted a renewed focus on operational agility and total cost of ownership analysis.

Beyond equipment costs, tariffs have indirectly influenced partnerships and alliances across the OCR ecosystem. Service providers and original equipment manufacturers have accelerated investments in software innovation to offset hardware pricing pressures, further blurring the lines between hardware, software, and services. As companies navigate this tariff environment, strategic decisions around deployment models-whether maintaining on-premise systems or embracing hybrid cloud architectures-are increasingly informed by geopolitical and trade dynamics. This cumulative impact highlights the need for resilient strategies that balance cost management with performance and compliance requirements.

Decoding Comprehensive Insights from Component, Deployment, Application, Industry, and Enterprise Size Dimensions in OCR

Analyzing the OCR market through the lens of component segmentation reveals that software solutions, encompassing intelligent character recognition, word recognition, and traditional OCR modules, remain the primary growth engine, driven by continuous improvements in algorithmic accuracy and language support. Hardware continues to play a vital role in specialized high-throughput environments, such as bulk scanning operations, while professional services have gained prominence as organizations seek expert deployment, customization, and maintenance support. The interplay among these segments underscores a broad trend toward software-centric offerings, with embedded AI capabilities that reduce reliance on dedicated scanning hardware.

Deployment type segmentation shows a pronounced shift toward cloud-based OCR platforms, as enterprises prioritize flexibility, scalability, and seamless integration with existing cloud ecosystems. Nonetheless, on-premise deployments continue to serve industries with stringent data sovereignty and security requirements, including banking and government sectors. The application segmentation further delineates market dynamics, as document management and form processing use cases sustain foundational demand, identity verification solutions grow in tandem with digital onboarding initiatives, and invoice processing emerges as a critical driver of accounts payable automation.

End-user industry analysis indicates that banking, financial services, and insurance organizations remain core adopters of OCR technology, reflecting their need for secure, high-accuracy data extraction. Government agencies and healthcare providers follow closely, leveraging OCR to digitize records and ensure regulatory compliance. The manufacturing sector benefits from OCR-enabled quality control, while IT and telecommunications companies integrate character recognition into service assurance workflows. Retail and e-commerce enterprises increasingly utilize OCR for order processing and customer service automation. Finally, organization size segmentation highlights that large enterprises often implement end-to-end OCR suites across multiple departments, whereas small and medium enterprises selectively adopt modular OCR services to address specific operational bottlenecks.

This comprehensive research report categorizes the Optical Character Recognition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment Type

- Application

- Organization Size

- End User Industry

Revealing Contrasting OCR Adoption Patterns Across Americas, EMEA, and Asia-Pacific Driven by Regulatory and Infrastructure Dynamics

Regional analysis underscores the Americas as a leading market for OCR technology, propelled by advanced digital infrastructure, high adoption in financial services, and innovation hubs in North America. Many enterprise customers in the region pursue cloud-based OCR to accelerate their digital transformation journeys, while specialized vertical use cases in government and healthcare continue to reinforce foundational demand. Conversely, strong R&D investments and supportive regulatory frameworks in Europe, the Middle East, and Africa have fostered extensive adoption of OCR in fields such as legal documentation, multilingual public services, and industrial automation.

The Asia-Pacific region stands out for its rapid adoption rate, fueled by large-scale government digitization initiatives, the proliferation of manufacturing facilities requiring automated quality inspections, and a burgeoning e-commerce sector. Nations across this region are investing heavily in AI and machine learning, establishing local innovation centers and public–private partnerships that drive OCR advancement. This dynamic environment is encouraging global and regional vendors to tailor their offerings for diverse language requirements and to develop cost-effective solutions catering to small and mid-sized enterprises in emerging markets.

Looking ahead, cross-regional collaborations and strategic alliances are expected to further blur the lines between geographies. As data privacy regulations evolve in Europe and North America, and as digital infrastructure matures in emerging economies, the global OCR landscape will continue to be shaped by a complex interplay of regulatory, technological, and economic factors.

This comprehensive research report examines key regions that drive the evolution of the Optical Character Recognition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping the Dynamic Competitive Environment Shaping OCR Solutions with Strategic Alliances, Acquisitions, and Niche Innovators

The competitive landscape of the OCR market is characterized by a mix of established technology incumbents and agile specialized vendors. Leading software providers have solidified their positions through strategic acquisitions and partnerships, expanding their portfolios with advanced AI modules and cloud-native services. Some hardware manufacturers have diversified into managed service offerings, addressing the full spectrum of OCR deployment needs from hardware provisioning to continuous performance optimization. Additionally, partnerships between OCR specialists and enterprise software vendors have created integrated solutions that seamlessly embed character recognition within broader digital workflow platforms.

Mid-market and emerging players have also made inroads by focusing on niche applications and underserved segments, offering tailored vertical solutions for industries such as logistics, education, and legal services. These companies differentiate themselves with domain-specific templates, rapid deployment models, and subscription-based pricing that lower barriers to entry for small and mid-sized organizations. As the market matures, competition is expected to intensify along dimensions of accuracy, language coverage, ease of integration, and the ability to deliver end-to-end automation through prebuilt connectors to ERP and CRM systems.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Character Recognition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABBYY Production LLC

- Adobe Inc.

- Anyline GmbH

- Captricity Inc.

- CVISION Technologies, Inc.

- Google LLC

- Google LLC

- IBM Corporation

- International Business Machines Corporation

- IRIS S.A.

- Kofax Inc.

- Microsoft Corporation

- Nuance Communications, Inc.

- Open Text Corporation

- Oracle Corporation

- Rossum Ltd.

- SAP SE

- Smart Engines Service LLC

- Tesseract

Outlining Strategic Paths for Leaders to Architect Agile, AI-Driven OCR Ecosystems That Align with Enterprise Transformation Objectives

Industry leaders looking to maximize their OCR investments should begin by aligning their deployment strategy with long-term digital transformation goals, prioritizing cloud-native platforms that offer scalability and continuous updates. Emphasizing modular architectures will enable organizations to tailor OCR capabilities to diverse use cases without incurring unnecessary complexity or cost. It is critical to invest in advanced AI and machine learning models to maintain high accuracy across multiple languages and to handle unstructured data effectively, thereby reducing manual intervention and operational risk.

Collaboration between IT and business units is essential to drive user adoption and to ensure OCR solutions deliver tangible ROI. Establishing clear governance frameworks for data security and compliance will mitigate risks associated with sensitive information handling. Moreover, forming strategic partnerships with service providers can accelerate implementation timelines and provide access to specialized expertise for customization. By continuously monitoring emerging technologies such as real-time mobile capture, edge-based OCR, and integrated analytics, enterprises can stay ahead of competitive pressures and harness the full potential of intelligent document processing.

Describing a Robust Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Validation to Ensure Insight Reliability

The research methodology underpinning this analysis integrates both primary and secondary research approaches. Primary research involved in-depth interviews with industry stakeholders, including technology providers, systems integrators, and end users across major verticals. These interviews provided qualitative insights into deployment challenges, adoption drivers, and emerging use cases. Secondary research comprised a systematic review of company reports, white papers, regulatory filings, and reputable publications to validate and enrich findings related to technology trends, market dynamics, and competitive strategies.

Data triangulation played a pivotal role in ensuring the reliability of insights. Quantitative data from public financial disclosures, patent databases, and technology adoption surveys were cross-examined against qualitative feedback obtained from subject matter experts. Market validation workshops were conducted with select participants to refine segmentation criteria, validate forecast assumptions, and identify high-impact growth opportunities. This rigorous approach ensures a comprehensive view of the OCR market that balances empirical data with real-world practitioner perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Character Recognition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Character Recognition Market, by Component

- Optical Character Recognition Market, by Deployment Type

- Optical Character Recognition Market, by Application

- Optical Character Recognition Market, by Organization Size

- Optical Character Recognition Market, by End User Industry

- Optical Character Recognition Market, by Region

- Optical Character Recognition Market, by Group

- Optical Character Recognition Market, by Country

- United States Optical Character Recognition Market

- China Optical Character Recognition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesizing Key Findings on Technological, Regulatory, and Market Trends to Highlight Unstructured Data as a Strategic Enterprise Asset

This executive summary has outlined the critical forces shaping the Optical Character Recognition landscape, from AI-driven innovations and cloud migration trends to regional dynamics and tariff-related supply chain considerations. The intricate interplay between software, hardware, and services underscores the importance of a holistic approach to OCR deployment, where accuracy, scalability, and integration capabilities are paramount. Market segmentation insights highlight that no single strategy fits all, requiring tailored solutions that address specific applications, industries, and organizational scales.

Looking forward, the OCR market is poised for further expansion, driven by real-time processing demands, the integration of cognitive services, and evolving regulatory requirements around data privacy and compliance. Organizations that adopt a forward-looking strategy-prioritizing agility, innovation, and strategic partnerships-will be best positioned to capitalize on this growth. By leveraging the insights and recommendations presented, decision-makers can chart a clear path to transform unstructured content into strategic assets, powering efficiency, and unlocking new business opportunities.

Empowering Strategic OCR Adoption with Personalized Guidance to Unlock Business Opportunities Through Direct Engagement with Industry Experts

If your organization is poised to harness the transformative power of Optical Character Recognition and secure a competitive edge in an increasingly digitized landscape, connect with Ketan Rohom, Associate Director of Sales & Marketing to acquire the full market research report. His expertise and guidance will ensure you gain unparalleled visibility into market dynamics and strategic intelligence to drive impactful decisions. Reach out today to empower your enterprise with actionable insights that accelerate growth and innovation in OCR technologies

- How big is the Optical Character Recognition Market?

- What is the Optical Character Recognition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?