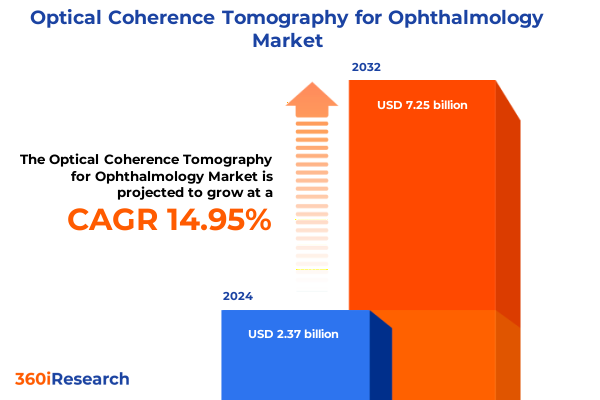

The Optical Coherence Tomography for Ophthalmology Market size was estimated at USD 2.71 billion in 2025 and expected to reach USD 3.10 billion in 2026, at a CAGR of 15.05% to reach USD 7.25 billion by 2032.

Exploring Cutting-Edge Optical Coherence Tomography Innovations that Are Shaping the Next Generation of Ophthalmic Imaging and Diagnostic Excellence

Optical coherence tomography (OCT) has emerged as a cornerstone of modern ophthalmic diagnosis, offering high-resolution, non-invasive imaging that transforms how eye care professionals visualize and manage a broad spectrum of ocular conditions. Initially developed in the early 1990s, OCT technology has evolved from time-domain platforms to state-of-the-art spectral domain and swept source systems, enabling clinicians to capture microscopic cross-sectional views of retinal and anterior segment structures with unprecedented clarity.

As demographic shifts accelerate and the global burden of vision-threatening diseases such as age-related macular degeneration and diabetic retinopathy continues to rise, demand for OCT solutions is intensifying. Advancements in image processing, instrument miniaturization, and clinical workflow integration are further fueling adoption across hospitals, outpatient clinics, and specialized diagnostic centers. Within this context, next-generation OCT platforms are poised to redefine diagnostic accuracy, streamline surgical planning, and enhance patient outcomes.

Embracing Revolutionary Technological and Clinical Paradigm Shifts Redefining Ophthalmology through Next-Generation OCT Integration and Care Pathway Optimization

In recent years, the OCT landscape has undergone a profound transformation driven by technological convergence and evolving clinical imperatives. The migration from time-domain to spectral domain OCT unlocked dramatic gains in image acquisition speed and axial resolution, while the advent of swept source platforms introduced deeper tissue penetration and wider scan widths. These shifts have enabled ophthalmologists to detect subtle pathologies earlier and to monitor disease progression with greater precision.

Concurrently, the integration of artificial intelligence and machine learning algorithms into OCT image analysis is redefining diagnostic workflows. Automated segmentation and pattern recognition tools are accelerating decision making, reducing inter-observer variability, and facilitating large-scale screening initiatives. At the same time, miniaturized handheld OCT devices are expanding access to point-of-care imaging in ambulatory surgery centers and remote clinics, bridging gaps in underserved regions and enabling tele-ophthalmology services.

Regulatory developments and reimbursement reforms are also influencing the trajectory of OCT adoption. Agencies worldwide are recognizing the clinical and economic value of OCT, incorporating image-guided diagnostics into reimbursement frameworks and issuing clear guidance on safety and performance standards. As stakeholders collaborate to optimize clinical pathways, OCT is emerging not only as a diagnostic instrument but also as a critical component of comprehensive eye care ecosystems.

Assessing the Comprehensive Effects of Recent United States Trade Tariffs on Ophthalmic Imaging Devices and Associated Supply Chain Dynamics in 2025

The United States’ latest trade measures introduced in early 2025 have had far-reaching consequences for the OCT market and its supply chain. In April 2025, policymakers implemented a baseline 10% tariff on most imported goods, with higher levies targeting key trading partners and specialized equipment categories, including medical imaging devices such as OCT systems. Industry observers warn that these duties will elevate production costs, strain supplier contracts, and potentially slow procurement cycles for hospitals and clinics seeking to upgrade or expand their OCT capabilities.

Major OCT manufacturers have already begun recalibrating their strategies in response to these trade dynamics. GE Healthcare, for example, projected a $500 million tariff impact in 2025, driven largely by bilateral duties on medical device components sourced from China and other markets. The company’s mitigation plans include accelerated localization of manufacturing, diversification of component suppliers, and strategic inventory positioning-measures expected to temper tariff liabilities beginning in 2026.

Beyond specialized imaging equipment, ancillary components reliant on steel and aluminum faces have seen derivative tariffs rise to 25%, further amplifying cost pressures for OCT device assembly lines. Additionally, proposed 20% tariffs on European equipment threaten high-margin product lines and could compel suppliers to adjust pricing structures or defer new product launches. Together, these cumulative duties underscore the urgency for stakeholders to pursue supply chain resilience and to anticipate near-term margin compressions in the OCT arena.

Unveiling Critical Market Segmentation Dynamics Highlighting Technology, Product Type, Applications, End User, and Channel Variations Shaping the OCT Landscape

Examining the OCT market through the lens of technology reveals three distinct platform tiers: spectral domain, swept source, and time domain systems. Spectral domain devices, with their balance of speed and resolution, maintain a dominant presence in established practices, yet swept source instruments are rapidly gaining ground due to their deeper tissue imaging capabilities and faster scan times. Time domain platforms, though largely superseded, remain in service in select emerging markets where cost constraints persist.

Differentiation by product form factor underscores the emergence of handheld and portable OCT solutions alongside traditional tabletop units. Compact, mobile devices facilitate in-office and remote screening, enabling ambulatory surgery centers and diagnostic clinics to incorporate OCT without the footprint of a fixed imaging suite. Conversely, tabletop configurations continue to serve as the workhorses of high-throughput hospital imaging departments, offering advanced features and integrated software suites for comprehensive assessment.

Applications in the OCT domain span anterior segment imaging, corneal topography, optic nerve head evaluation, and detailed retinal scans. Retinal imaging holds a pivotal role, driven by screening programs for diabetic retinopathy and macular pathologies, whereas anterior segment modalities are increasingly leveraged for refractive surgery planning and keratoconus monitoring. As practices seek to optimize patient throughput and diagnostic yield, modular OCT platforms that support multiple application modules have emerged as preferred solutions.

End users across the continuum of care-from ambulatory surgery centers and clinics to diagnostic centers and hospitals-adopt OCT to enhance workflow efficiency and diagnostic accuracy. Private and public hospitals invest in integrated imaging networks, while specialized ophthalmology clinics rely on compact units to serve high-volume patient streams. Distribution channels, spanning direct sales, distributor partnerships, and burgeoning online procurement platforms, shape access to OCT devices, with OEMs balancing personalized service models against scalable digital ordering experiences.

This comprehensive research report categorizes the Optical Coherence Tomography for Ophthalmology market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Product Type

- Application

- End User

- Distribution Channel

Analyzing Regional Market Divergences and Growth Trajectories across the Americas, Europe Middle East and Africa, and the Asia-Pacific Optical Imaging Sectors

In the Americas, robust healthcare infrastructures and expansive reimbursement policies have accelerated OCT adoption in both urban centers and rural outreach programs. The United States remains a leading purchaser of high-end OCT instrumentation, supported by advanced clinical trials and a dense network of diagnostic centers. Latin American markets, despite budgetary constraints, are witnessing growing interest in portable OCT solutions that align with initiatives to expand access to eye care in underserved regions.

Europe, the Middle East, and Africa present a heterogeneous market landscape shaped by divergent regulatory frameworks and economic conditions. Western European nations benefit from consolidated purchasing agreements and strong research consortiums that drive technology uptake, while emerging economies prioritize cost-effective solutions and leveraged distributor networks. In the Middle East, government-led infrastructure investments are fueling demand for premium OCT platforms, even as political dynamics and import tariffs intermittently influence procurement timelines.

The Asia-Pacific region stands out for its dynamic growth trajectory, fueled by expanding private hospital chains, tele-ophthalmology initiatives, and rising incidence of diabetes-related eye diseases. China and India lead national screening programs, while Southeast Asian markets demonstrate rapid adoption of handheld OCT units in primary care settings. Regional OEMs and international vendors alike are forging local partnerships to navigate regulatory requirements and to tailor solutions to localized clinical workflows.

This comprehensive research report examines key regions that drive the evolution of the Optical Coherence Tomography for Ophthalmology market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Evaluating Major Industry Players’ Strategic Positioning, Technology Investments and Collaborative Initiatives Driving Leadership in Ophthalmic OCT Solutions

Key industry players are fortifying their portfolios through strategic collaborations and product innovations. Heidelberg Engineering has introduced multi-modal platforms that combine OCT with fundus photography and angiography, capitalizing on integrated diagnostics. Zeiss continues to expand its OCT angiography offerings, targeting vascular retinal disorders and leveraging proprietary software to enhance lesion detection algorithms.

Meanwhile, Canon and Topcon have intensified efforts in handheld and ultra-widefield OCT development, catering to the growing need for flexible imaging solutions in outpatient settings. These OEMs are forging partnerships with telemedicine providers to extend sight-saving diagnostics to remote communities. Concurrently, NIDEK is focusing on cost-competitive spectral domain systems, aiming to capture market share in regions where budgetary considerations drive equipment selection.

Emerging players and niche innovators are supplementing established lineups with AI-enabled image analysis suites and subscription-based service models. These entrants often emphasize agile development cycles and cloud-native software infrastructures, compelling legacy manufacturers to accelerate digital transformation initiatives. As competitive intensity escalates, alliances between clinical device makers, software vendors, and academic research centers are becoming increasingly pivotal to maintain differentiation and to foster technology validation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Coherence Tomography for Ophthalmology market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Appasamy Associates

- Canon Inc.

- Carl Zeiss AG

- Chongqing Bio Newvision Medical Equipment Ltd.

- Chongqing Vision Star Optical Co., ltd

- Enhanced Medical Services

- G&H Group

- Guangzhou MeCan Medical Limited

- Heidelberg Engineering GmbH

- Huvitz Corp.

- Lab Medica Systems Pvt. Ltd.

- NIDEK Co., Ltd.

- Novacam Technologies, Inc.

- OPTOPOL Technology Sp. z o.o.

- Optos PLC

- Perimeter Medical Imaging AI, Inc.

- Physik Instrumente (PI) SE & Co. KG

- Santec Holdings Corporation

- Shenzhen Certainn Technology Co., Ltd.

- Thorlabs, Inc.

- TOMEY GmbH

- Topcon Corporation

- ZD Medical Inc.

- Ziemer Group

Strategic Roadmap and Priority Actions for Stakeholders to Capitalize on Emerging OCT Opportunities and Mitigate Market Challenges in Ophthalmology

Manufacturers should prioritize supply chain resilience by establishing regional assembly hubs and diversifying component sourcing to mitigate tariff volatility and logistical disruptions. Investing in modular product architectures will enable rapid adaptation to evolving clinical requirements, while offering scalable upgrade pathways to existing customers. In parallel, developing cloud-based service platforms can create new revenue streams through software subscriptions and data analytics offerings.

Clinics and hospitals can harness the full potential of OCT by integrating imaging outputs with electronic health record systems and leveraging AI-powered decision support tools. Training programs for clinicians and technicians should emphasize standardized scanning protocols and interpretation guidelines to reduce variability in diagnostic outcomes. Additionally, partnerships with tele-ophthalmology providers can extend specialist expertise to underserved areas, driving earlier detection of vision-threatening conditions and optimizing patient referral pathways.

Collaborative efforts between industry stakeholders and regulatory bodies are essential to streamline product approvals and to align reimbursement policies with technological capabilities. Manufacturers and professional societies should furnish evidence demonstrating the clinical and economic value of OCT interventions. By fostering an ecosystem of transparency and information sharing, stakeholders can accelerate policy decisions that support sustainable adoption and reimbursement frameworks.

Comprehensive Research Framework Employing Rigorous Primary and Secondary Methods, Data Triangulation, and Robust Validation for OCT Market Analysis

This study employed a rigorous two-phase research methodology, commencing with an exhaustive secondary research campaign. Authoritative public records, peer-reviewed publications, regulatory filings, and respected healthcare databases were systematically reviewed to establish industry benchmarks and technology adoption trends. Trade journals, white papers, and annual reports served to enrich the understanding of market dynamics and competitive landscapes.

In the primary research phase, in-depth interviews were conducted with ophthalmologists, clinical directors, procurement managers, and manufacturing executives across North America, EMEA, and Asia-Pacific. Responses were triangulated with quantitative shipment data and device registry information to ensure consistency and reliability. Advanced analytics techniques, including sensitivity analysis and scenario planning, were applied to interpret the data and to identify key inflection points influencing OCT market evolution.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Coherence Tomography for Ophthalmology market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Coherence Tomography for Ophthalmology Market, by Technology

- Optical Coherence Tomography for Ophthalmology Market, by Product Type

- Optical Coherence Tomography for Ophthalmology Market, by Application

- Optical Coherence Tomography for Ophthalmology Market, by End User

- Optical Coherence Tomography for Ophthalmology Market, by Distribution Channel

- Optical Coherence Tomography for Ophthalmology Market, by Region

- Optical Coherence Tomography for Ophthalmology Market, by Group

- Optical Coherence Tomography for Ophthalmology Market, by Country

- United States Optical Coherence Tomography for Ophthalmology Market

- China Optical Coherence Tomography for Ophthalmology Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Distilling Critical Insights and Strategic Takeaways Emphasizing the Transformative Impact of OCT on Future Ophthalmic Diagnostic and Therapeutic Landscapes

Across this report, optical coherence tomography has been shown to transcend its role as a diagnostic novelty, emerging as an indispensable instrument in contemporary ophthalmic care. Technological enhancements, regulatory endorsements, and clinical synergies with artificial intelligence are aligning to broaden OCT’s impact, from routine screenings to advanced surgical planning.

Stakeholders that embrace strategic agility-by fortifying supply chains, fostering collaborative ecosystems, and harnessing data-driven insights-will be best positioned to thrive in an environment marked by both unprecedented opportunity and evolving trade considerations. As OCT technology continues to mature, its potential to elevate patient outcomes and to redefine care pathways remains both profound and imminent.

Connect Directly with Ketan Rohom to Access the Complete In-Depth OCT Market Research Report and Unlock Actionable Intelligence Today

Engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to discover how this in-depth market intelligence can empower your strategic decisions and technology investments. Reach out today to secure your comprehensive report and unlock actionable insights that will guide your organization toward innovation leadership in the rapidly evolving OCT landscape.

- How big is the Optical Coherence Tomography for Ophthalmology Market?

- What is the Optical Coherence Tomography for Ophthalmology Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?