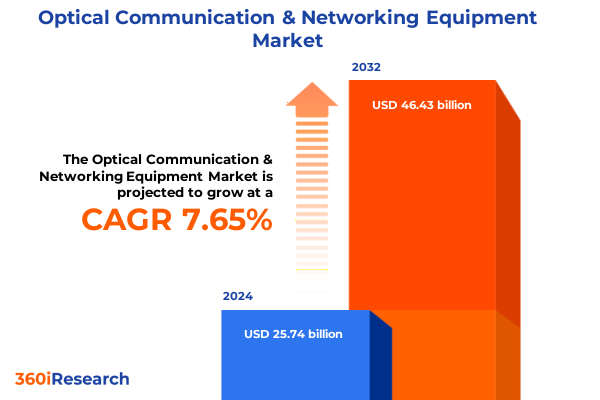

The Optical Communication & Networking Equipment Market size was estimated at USD 27.43 billion in 2025 and expected to reach USD 29.24 billion in 2026, at a CAGR of 7.80% to reach USD 46.43 billion by 2032.

Unveiling the critical role and evolution of optical communication infrastructure in accelerating global connectivity and digital transformation

The landscape of digital connectivity is underpinned by optical communication infrastructure, which carries the bulk of global data traffic over vast fiber networks. This report begins by framing why optical networking equipment forms the backbone of modern telecommunications, data centers, and enterprise interconnects. As the world’s appetite for bandwidth escalates, driven by cloud services, 5G rollouts, and AI-powered applications, optical solutions have become indispensable for supporting ultra-high data rates and low latency requirements.

In this context, the introduction explores how advances in photonic integration, coherent optical modules, and pluggable transceivers are redefining network architectures across metro, regional, and long-haul segments. It underscores the shift from traditional transport gear to compact, software-defined optical platforms that offer greater flexibility and cost efficiency. By setting the stage with an overview of industry drivers, technological enablers, and evolving user demands, this opening section situates the subsequent analysis in a clear strategic framework for both technical and business decision-makers.

Identifying pivotal technological and market forces reshaping optical networking solutions across global ecosystems

Recent years have witnessed transformative shifts in optical networking precipitated by converging technological innovations and business imperatives. The rapid adoption of 800G coherent pluggable transceivers, such as the 800G ZR/ZR+ QSFP-DD module now commercially available, is enabling hyperscale operators to extend high-capacity links across data center interconnects without standalone transport equipment, thereby reducing both capital and operating expenses. Complementing this trend, emerging co-packaged optics architectures are poised to tightly integrate photonics with switching silicon, potentially reshaping switch design and driving down power consumption while boosting bandwidth density.

Moreover, the body of network traffic has become increasingly dominated by AI workloads and cloud services, which demand highly scalable, low-latency optical interconnects. According to the latest Optical Components Report, shipments of coherent modules like 400ZR and 800ZR are set to eclipse 600,000 units in 2025, reflecting a 60% year-on-year surge driven by both intra-data-center and metro applications. Parallel to these hardware advancements, service providers and enterprises are embracing open line systems and disaggregated transport to decouple software control from proprietary hardware, fostering greater agility and cost transparency. Together, these shifts are forging a new era in which optical networks evolve from static, siloed transport layers into dynamic, programmable infrastructures that underpin digital transformation initiatives.

Assessing broad and longstanding effects of 2025 U.S. tariff measures on optical networking supply chains and profitability

The cumulative impact of U.S. tariff measures implemented in early 2025 has reverberated across optical networking supply chains, exerting pressure on costs, procurement strategies, and profit margins. Several leading vendors have reported tangible hits to their bottom lines as duties on imported fiber optic modules, cables, and key subcomponents rose sharply. For instance, Nokia recently revised its 2025 profit guidance downward, citing that tariffs are anticipated to shave €50–80 million from its operating profit, underscoring how even established players face significant headwinds from trade policy shifts.

Beyond direct financial impacts, the elevated tariffs have accelerated supply chain diversification and reshoring initiatives. Companies are exploring alternative manufacturing locales in Southeast Asia and Latin America to mitigate exposure to punitive duty rates, which for Chinese-origin components reached levels as high as 145% in reciprocal tariff reclassifications earlier in the year. In parallel, industry analysis indicates that blended tariff rates for optical modules imported into the U.S. could average 40%, prompting reconfiguration of sourcing agreements and inventory buffers. While short-term cost pass-through to end customers has been a coping mechanism, sustained duty burdens risk slowing infrastructure deployments, particularly in price-sensitive rural and developing markets where financing and margins are already constrained. Consequently, the tariffs are reshaping capital allocation decisions and driving closer collaboration between equipment suppliers and service operators to navigate the evolving trade landscape.

Diving deep into segmentation dynamics to reveal offering, protocol, application, component, network, data rate, technology, and form factor insights

A granular examination of market segments reveals distinct opportunity landscapes shaped by product offerings and end-market requirements. On the basis of hardware, services, and software, the hardware domain continues to command dominant expenditure, fueled by investments in cutting-edge routers, switches, and transceiver modules, while consulting, deployment, and maintenance services underpin the ongoing operationalization of optical networks. Within protocol segments, Ethernet remains the workhorse for both data center and enterprise applications, whereas Fibre Channel retains its stronghold in storage area networks, and emerging coherent OTU solutions like OTN (Optical Transport Network) cater to high-performance metro and long-haul links.

Looking at applications, data centers are the fastest-growing demand center for coherent optics, while enterprise LAN deployments benefit from passive optical networking for campus connectivity. Industrial networks leverage deterministic SONET/SDH architectures for mission-critical operations, and telecom operators deploy SONET/SDH alongside DWDM for backbone capacity. A component-type lens highlights that transceiver modules-spanning CFP, QSFP, SFP, and XFP form factors-lead unit shipments, with routers and multiplexers playing crucial roles in service aggregation. Meanwhile, LAN and MAN network segments drive metro fiber investment, while WAN architectures underpin global connectivity. High data-rate segments are dominated by 100G to 400G solutions today, with 800G and emerging 1.6T technologies representing the next frontier for hyperscalers. On the technology front, DWDM and coherent WDM remain core to maximizing fiber capacity, while PON and SDM innovations are expanding access and scaling potential. Form factor proliferation ensures flexible deployment models-from compact SFP pluggables to high-density QSFP modules-supporting both greenfield builds and brownfield upgrades.

This comprehensive research report categorizes the Optical Communication & Networking Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Protocol

- Component Type

- Network Type

- Data Rate

- Technology

- Form Factor

- Application

Mapping regional growth patterns and strategic drivers in the Americas, EMEA, and Asia-Pacific optical networking markets

Regional dynamics in optical networking equipment exhibit pronounced variations in investment patterns and growth trajectories. In the Americas, policy incentives and infrastructure funding drives-embodied by the Broadband Equity, Access, and Deployment (BEAD) program-have mobilized over $42 billion toward expanding high-speed connectivity, though recent executive actions have paused certain disbursements, introducing implementation uncertainty and fueling debate over technology-neutral versus fiber-preferred solutions. As a result, carriers and equipment vendors in North America are reassessing project timelines and engaging more deeply with federal and state stakeholders to align on sustainable rollouts.

Across Europe, the Middle East, and Africa, strategic initiatives such as the EU’s Digital Compass seek to deliver gigabit connectivity to all households and blanket populated areas with 5G by 2030. Despite progress-69% of EU premises had fiber-to-the-building access as of late 2024-scaling beyond urban centers remains a challenge, especially where rural FTTP economics are strained. Concurrently, the remarkable 2Africa submarine cable project promises to transform connectivity for Africa and the Middle East by 2025, adding 180 Tbps of capacity and enabling broader access in under-served markets through novel spatial division multiplexing designs.

In the Asia-Pacific region, surging demand from hyperscale cloud operators and government broadband initiatives has propelled APAC to account for nearly 39% of global GPON growth, while high-speed datacom optical shipments, particularly 400G and 800G modules, are projected to drive optics revenue toward $16 billion in 2025, underscoring APAC’s position as both a manufacturing powerhouse and a leading end-market for advanced optical solutions.

This comprehensive research report examines key regions that drive the evolution of the Optical Communication & Networking Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting key strategic movements and innovation drivers among leading optical networking and communication equipment vendors

Leading players in the optical communication equipment landscape are deploying varied strategies to secure technological leadership and market share. Ciena has intensified its focus on coherent pluggable optics coupled with open line system architectures, partnering with hyperscale cloud operators to co-develop integrated ROADMs and tunable transceivers. Cisco continues to embed optics into its high-capacity routers and switches while advancing silicon photonics research through strategic acquisitions and in-house labs. Coherent leverages its photonics expertise to deliver high-performance modules like the 800G ZR/ZR+ QSFP-DD transceiver, enabling customers to simplify network stacks and reduce TCO.

Meanwhile, Nokia and Ericsson balance optical transport with service-aware software suites, targeting telecom operators with end-to-end solutions spanning IP routing, optical WDM, and OSS integration. STMicroelectronics has entered the photonics space with AWS-backed silicon photonics chips designed to accelerate AI data-center interconnects and lower power consumption. And Fujitsu Optical Components is commercially shipping 800 Gbps CFP2-DCO coherent transceivers for metro and submarine segments, highlighting the role of proprietary modulators in extending reach and capacity. Collectively, these companies are driving the evolution of optical networks through differentiated product portfolios, software-centric value propositions, and collaborative ecosystem engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Optical Communication & Networking Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADVA Optical Networking SE

- Broadcom Inc.

- Ciena Corporation

- Cisco Systems, Inc.

- Corning Incorporated

- Ericsson

- Fujitsu Limited

- Huawei Investment & Holding Co., Ltd.

- Infinera Corporation

- Juniper Networks, Inc.

- Nokia Corporation

- Sumitomo Electric Industries

- ZTE Corporation

Providing actionable strategies for industry leaders to navigate supply chain complexity, regulatory shifts, and technological disruptions

To thrive amid shifting trade policies, technological disruptions, and evolving service demands, industry leaders should adopt a proactive approach that balances agility with strategic investments. First, diversifying supply chains beyond single-source geographies is essential to mitigate tariff and geopolitical risks; this entails qualifying manufacturers in alternative regions and exploring onshore assembly partnerships. Second, accelerating R&D in high-performance photonic integration and software-defined capabilities can unlock new revenue streams and reduce reliance on traditional hardware lifecycle models.

Third, forging deeper collaborations with hyperscale cloud operators and large service providers-whether through co-development of custom optics or pilot trials of open disaggregated networks-can yield valuable insights into next-generation requirements and ensure early access to volume deployments. Fourth, engaging constructively with policymakers and standards bodies to shape favorable regulatory frameworks, trade agreements, and interoperability protocols will be critical as governments increasingly influence broadband infrastructure priorities. Finally, investing in modular, scalable platforms that support a range of data-rates from 100G to 1.6T will position companies to address diverse end-markets, from rural broadband to high-density AI interconnects, thereby future-proofing product roadmaps.

Explaining the rigorous research approach employed to ensure validity, reliability, and comprehensive coverage of optical networking market insights

This research leverages a rigorous methodology combining comprehensive secondary research with primary interviews and expert validation to ensure the accuracy and relevance of insights. Industry publications, regulatory filings, financial disclosures, and reputable market reports were reviewed to establish baseline data and identify emerging trends. These sources were meticulously cross-referenced to maintain data integrity and to capture the latest developments in trade policy, technology launches, and company strategies.

In parallel, in-depth interviews were conducted with senior executives from equipment vendors, service providers, and component manufacturers to obtain firsthand perspectives on competitive positioning, product innovation, and go-to-market approaches. Knowledge gleaned from these interactions was triangulated against quantitative shipment and revenue metrics to confirm market dynamics. Finally, key findings were benchmarked against global benchmarks and regional projections, integrating macro-economic indicators and infrastructure investment programs to contextualize the optical networking landscape comprehensively.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Optical Communication & Networking Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Optical Communication & Networking Equipment Market, by Offering

- Optical Communication & Networking Equipment Market, by Protocol

- Optical Communication & Networking Equipment Market, by Component Type

- Optical Communication & Networking Equipment Market, by Network Type

- Optical Communication & Networking Equipment Market, by Data Rate

- Optical Communication & Networking Equipment Market, by Technology

- Optical Communication & Networking Equipment Market, by Form Factor

- Optical Communication & Networking Equipment Market, by Application

- Optical Communication & Networking Equipment Market, by Region

- Optical Communication & Networking Equipment Market, by Group

- Optical Communication & Networking Equipment Market, by Country

- United States Optical Communication & Networking Equipment Market

- China Optical Communication & Networking Equipment Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1590 ]

Synthesizing core findings to emphasize critical developments and strategic imperatives in optical communication and networking equipment

In summary, optical communication and networking equipment is undergoing a profound transformation driven by digitalization, AI-led data growth, and evolving regulatory landscapes. The ascendancy of pluggable coherent optics, co-packaged photonics, and open line systems is redefining network architectures, offering new pathways to enhance capacity and flexibility. Simultaneously, the ripple effects of 2025 U.S. tariff measures have underscored the importance of resilient supply chains and spurred shifts toward supply diversification and domestic sourcing.

Regional variations reveal robust demand in Asia-Pacific for high-speed data center optics, sustained government-driven broadband expansion in the Americas despite funding pauses, and ambitious European objectives to achieve ubiquitous gigabit connectivity by 2030, bolstered by transformative submarine cable projects in EMEA. Against this backdrop, leading vendors are differentiating through integrated hardware-software portfolios, strategic partnerships, and targeted R&D investments. Ultimately, by embracing modular architectures, software-centric models, and collaborative ecosystem strategies, stakeholders can capitalize on emerging opportunities and navigate the converging forces shaping the future of global optical networks.

Empowering decision-makers with expert guidance and direct engagement opportunities to secure in-depth optical network market intelligence

Ready to equip your team with the in-depth insights, data-backed analysis, and strategic guidance delivered in this comprehensive market research report on Optical Communication and Networking Equipment? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, at 360iResearch to learn how this report can empower your organization to make informed decisions, seize emerging opportunities, and stay ahead in a rapidly evolving industry landscape. Secure your copy today and partner with an expert who can tailor the findings to your unique strategic objectives, ensuring maximum value from this critical market intelligence resource.

- How big is the Optical Communication & Networking Equipment Market?

- What is the Optical Communication & Networking Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?